Business

Want To Know Your EPF Balance? Here’s How To Check It With Or Without UAN

New Delhi: The Employees’ Provident Fund (EPF) serves as an important retirement savings plan for salaried individuals, helping them build a financial cushion for the future. Both employees and employers contribute 12 per cent of the employee’s salary to this fund every month. To keep track of your growing savings, it’s important to regularly check your EPF balance. For this, you’ll need an active Universal Account Number (UAN) a unique ID mentioned on your salary slip that links all your PF accounts under one number.

You can easily check your EPF balance online through the official EPFO portal. Here’s how to do it:

Step 1: Visit the official EPFO website – https://www.epfindia.gov.in.

Step 2: Go to the “Our Services” section and click on “For Employees.”

Step 3: Select “Member Passbook” and log in with your Universal Account Number (UAN) and password.

Step 4: Once logged in, you’ll be able to view your updated PF balance and transaction details.

If you prefer not to use the EPFO website, there are several other quick ways to check your PF balance:

1. Via SMS

Send an SMS to 7738299899.

Type “EPFOHO UAN ENG”, where “ENG” stands for English (you can also use “HIN” for Hindi or the first three letters of your preferred language).

You’ll receive an SMS with your latest PF balance and account details.

2. Via Missed Call

Give a missed call to 011-22901406 from your registered mobile number.

You’ll get an SMS with your current PF balance.

3. Through the UMANG App

Download the UMANG app from the Google Play Store or Apple App Store.

Go to the “EPFO” section and log in using your UAN and OTP sent to your registered mobile.

Open your passbook to view the balance and contribution details.

4. Without a UAN

If you don’t have a UAN, you can still check your PF balance by contacting your employer’s HR department or visiting the nearest EPFO office with your PF account number and ID proof.

Another simple way to check your PF balance is by contacting your employer’s HR or finance department.

Most companies provide employees with regular access to their PF statements or can generate them on request. Employers have access to the EPFO portal, which allows them to download and share your latest PF balance details directly.

This method is especially useful if you’re facing issues with your UAN activation or online access.

Business

Aviva flags potential for Iran conflict to send claims costs rising

The boss of insurer Aviva has cautioned that a lengthy conflict in the Middle East could send the cost of vehicle parts and repairs surging in an echo of the aftermath seen after Russia’s invasion of Ukraine.

Chief executive Amanda Blanc said the group has seen limited claims so far relating to the US-Israel war with Iran, but flagged the potential for claims costs to jump if supply chains are badly disrupted for a long time.

She said: “We have a good case study on this in terms of the Ukraine situation back in 2022 and the impact on the supply chain, which had an inflationary impact on vehicle parts and replacement vehicles.

“Obviously, if this goes on for a prolonged period of time, we would expect that this could have some impact, but to speak about this from an Aviva perspective, we are very well placed to manage that with our supply chain and our owned garage network.”

Ms Blanc added: “We will take action as necessary to make sure we look after our customers and price accordingly for any new inflationary impact.”

She said there had been “very limited” travel claims so far.

Ms Blanc added: “We have had calls from customers asking about whether they should travel and those sorts of things, and we are pointing them to the Foreign Office guidance on that.”

Full-year results from Aviva on Thursday showed annual earnings leaped 25% higher, while the firm also announced it was resuming share buybacks as it continues to benefit from its £3.7 billion takeover of Direct Line.

The group unveiled an earnings haul of £2.2 billion for 2025, up from £1.8 billion in 2024, including a £174 million contribution from Direct Line, helping the group hit its financial targets a year early.

Aviva unveiled a £350 million share buyback after putting these on hold due to the Direct Line deal, which completed last year.

Ms Blanc cheered an “outstanding performance”.

She said: “We have transformed Aviva over the last five years and whilst we have made significant progress, there is so much more to come.”

Artificial intelligence (AI) is also a big area of focus for the firm, according to Ms Blanc.

“We have clear strengths in artificial intelligence which are creating major opportunities to transform claims, underwriting and customer experience,” she said.

Business

South East Water faces £22m fine for supply failures

The firm was unable to cope during high demand, Ofwat says, leading to “immense stress” for customers.

Source link

Business

Middle East heat may ripple across India’s energy supply chain, flags Goldman Sachs – The Times of India

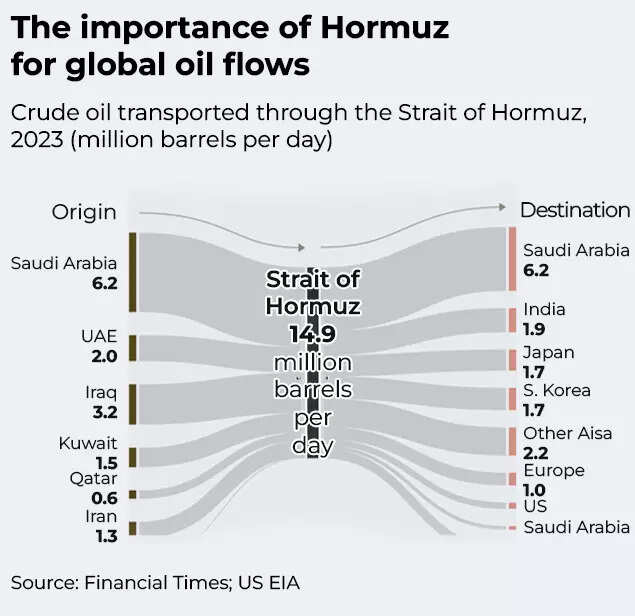

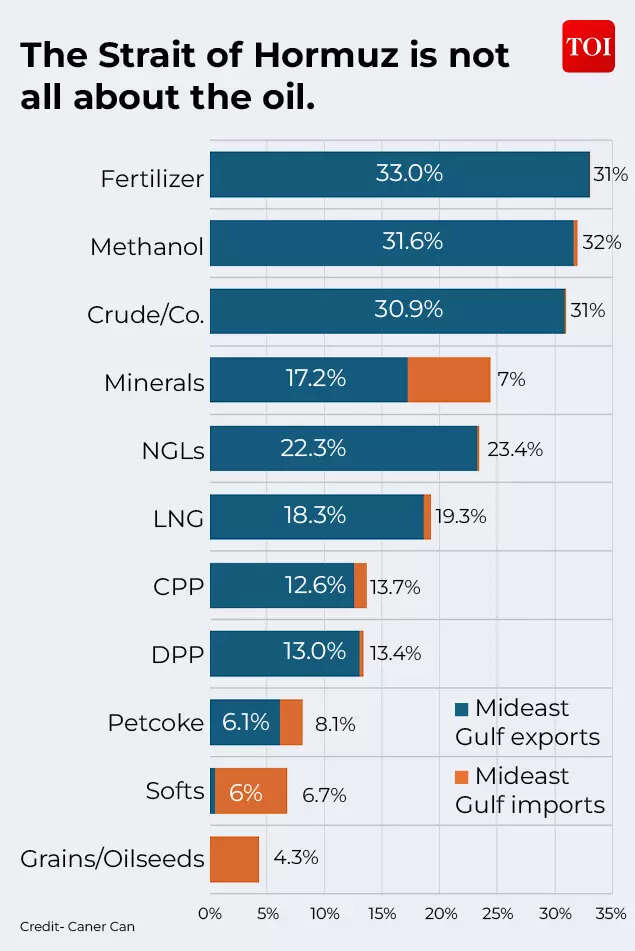

As tensions continue to heat up in the Middle East, concerns are raising about disruptions to one of the world’s most critical energy shipping routes, the Strait of Hormuz. Any disruption could significantly affect major oil-importing countries such as India, as the narrow Strait of Hormuz is central to global energy trade. The strait sees almost 20 million barrels of oil passing through each day, or about a fifth of the world’s consumption, pass through the route. The waterway also carries roughly 19% of global liquefied natural gas (LNG) shipments, making it a crucial corridor for energy-importing economies.A recent report by Goldman Sachs has flagged early signs of stress in the region. The report warned that tanker traffic through the Strait of Hormuz has already begun showing signs of disruption, with shipping firms, oil producers and insurers adopting a cautious approach following reports of damaged vessels in nearby waters.According to the firm, financial markets have already begun factoring in the geopolitical risk. Oil prices currently carry an estimated risk premium of $18-per-barrel, reflecting the potential market impact if energy flows through the Strait of Hormuz were disrupted for about a month.

Even is the oil facilities are not directly damaged, a shutdown of the shipping route could expose a significant portion of global supply. The report estimates that in an event of full closure, about 16 million barrels per day of oil flows could be affected, despite the availability of some pipeline routes designed to bypass the strait.And the risks are not limited to crude oil shipments with almost 80 million tonnes of LNG exports annually, much of it from Qatar, moving through the passage. Any prolonged disruption could tighten gas supply globally and potentially drive European benchmark gas prices back to levels seen during the 2022 energy crisis.

Asian economies stand among the most exposed to such disruptions. Major importers such as China, India, Japan and South Korea depend heavily on oil and LNG shipments that transit through the strategic corridor.While global oil inventories and spare production capacity could help cushion short-term shocks, the report warned that sustained disruption to Gulf shipping routes could trigger sharp volatility in global energy markets and push prices higher across oil, gas and refined fuel products.Market participants and governments are closely watching tanker traffic in the Strait of Hormuz, along with diplomatic and military developments involving the United States, Iran and Gulf nations, to assess whether the current disruptions remain temporary or escalate into a broader energy supply shock.

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business6 days ago

Business6 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Business7 days ago

Business7 days agoAttock Cement’s acquisition approved | The Express Tribune

-

Business1 week ago

Business1 week agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Fashion7 days ago

Fashion7 days agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports6 days ago

Sports6 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Fashion6 days ago

Fashion6 days agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026