Business

Tech billionaires seem to be doom prepping. Should we be worried?

Zoe KleinmanTechnology editor

Zoe KleinmanTechnology editor BBC

BBCMark Zuckerberg is said to have started work on Koolau Ranch, his sprawling 1,400-acre compound on the Hawaiian island of Kauai, as far back as 2014.

It is set to include a shelter, complete with its own energy and food supplies, though the carpenters and electricians working on the site were banned from talking about it by non-disclosure agreements, according to a report by Wired magazine.

A six-foot wall blocked the project from view of a nearby road.

Asked last year if he was creating a doomsday bunker, the Facebook founder gave a flat “no”. The underground space spanning some 5,000 square feet is, he explained, “just like a little shelter, it’s like a basement”.

That hasn’t stopped the speculation – likewise about his decision to buy 11 properties in the Crescent Park neighbourhood of Palo Alto in California, apparently adding a 7,000 square feet underground space beneath.

Bloomberg via Getty Images

Bloomberg via Getty ImagesThough his building permits refer to basements, according to the New York Times, some of his neighbours call it a bunker. Or a billionaire’s bat cave.

Then there is the speculation around other tech leaders, some of whom appear to have been busy buying up chunks of land with underground spaces, ripe for conversion into multi-million pound luxury bunkers.

Reid Hoffman, the co-founder of LinkedIn, has talked about “apocalypse insurance”. This is something about half of the super-wealthy have, he has previously claimed, with New Zealand a popular destination for homes.

So, could they really be preparing for war, the effects of climate change, or some other catastrophic event the rest of us have yet to know about?

Getty Images News

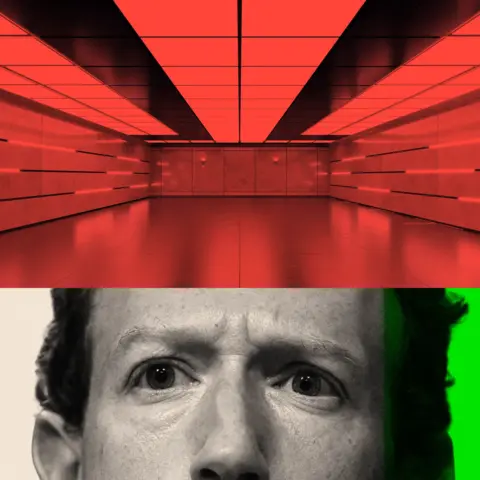

Getty Images NewsIn the last few years, the advancement of artificial intelligence (AI) has only added to that list of potential existential woes. Many are deeply worried at the sheer speed of the progression.

Ilya Sutskever, chief scientist and a co-founder of Open AI, is reported to be one of them.

By mid-2023, the San Francisco-based firm had released ChatGPT – the chatbot now used by hundreds of millions of people across the world – and they were working fast on updates.

But by that summer, Mr Sutskever was becoming increasingly convinced that computer scientists were on the brink of developing artificial general intelligence (AGI) – the point at which machines match human intelligence – according to a book by journalist Karen Hao.

In a meeting, Mr Sutskever suggested to colleagues that they should dig an underground shelter for the company’s top scientists before such a powerful technology was released on the world, Ms Hao reports.

AFP via Getty Images

AFP via Getty Images“We’re definitely going to build a bunker before we release AGI,” he’s widely reported to have said, though it’s unclear who he meant by “we”.

It sheds light on a strange fact: many leading computer scientists and tech leaders, some of whom are working hard to develop a hugely intelligent form of AI, also seem deeply afraid of what it could one day do.

So when exactly – if ever – will AGI arrive? And could it really prove transformational enough to make ordinary people afraid?

An arrival ‘sooner than we think’

Tech leaders have claimed that AGI is imminent. OpenAI boss Sam Altman said in December 2024 that it will come “sooner than most people in the world think”.

Sir Demis Hassabis, the co-founder of DeepMind, has predicted in the next five to ten years, while Anthropic founder Dario Amodei wrote last year that his preferred term – “powerful AI” – could be with us as early as 2026.

Others are dubious. “They move the goalposts all the time,” says Dame Wendy Hall, professor of computer science at Southampton University. “It depends who you talk to.” We are on the phone but I can almost hear the eye-roll.

“The scientific community says AI technology is amazing,” she adds, “but it’s nowhere near human intelligence.”

There would need to be a number of “fundamental breakthroughs” first, agrees Babak Hodjat, chief technology officer of the tech firm Cognizant.

What’s more, it’s unlikely to arrive as a single moment. Rather, AI is a rapidly advancing technology, it’s on a journey and there are many companies around the world racing to develop their own versions of it.

But one reason the idea excites some in Silicon Valley is that it’s thought to be a pre-cursor to something even more advanced: ASI, or artificial super intelligence – tech that surpasses human intelligence.

It was back in 1958 that the concept of “the singularity” was attributed posthumously to Hungarian-born mathematician John von Neumann. It refers to the moment when computer intelligence advances beyond human understanding.

Getty Images

Getty ImagesMore recently, the 2024 book Genesis, written by Eric Schmidt, Craig Mundy and the late Henry Kissinger, explores the idea of a super-powerful technology that becomes so efficient at decision-making and leadership we end up handing control to it completely.

It’s a matter of when, not if, they argue.

Money for all, without needing a job?

Those in favour of AGI and ASI are almost evangelical about its benefits. It will find new cures for deadly diseases, solve climate change and invent an inexhaustible supply of clean energy, they argue.

Elon Musk has even claimed that super-intelligent AI could usher in an era of “universal high income”.

He recently endorsed the idea that AI will become so cheap and widespread that virtually anyone will want their “own personal R2-D2 and C-3PO” (referencing the droids from Star Wars).

“Everyone will have the best medical care, food, home transport and everything else. Sustainable abundance,” he enthused.

There is a scary side, of course. Could the tech be hijacked by terrorists and used as an enormous weapon, or what if it decides for itself that humanity is the cause of the world’s problems and destroys us?

AFP via Getty Images

AFP via Getty Images“If it’s smarter than you, then we have to keep it contained,” warned Tim Berners Lee, creator of the World Wide Web, talking to the BBC earlier this month.

“We have to be able to switch it off.”

Governments are taking some protective steps. In the US, where many leading AI companies are based, President Biden passed an executive order in 2023 that required some firms to share safety test results with the federal government – though President Trump has since revoked some of the order, calling it a “barrier” to innovation.

Meanwhile in the UK, the AI Safety Institute – a government-funded research body – was set up two years ago to better understand the risks posed by advanced AI.

And then there are those super-rich with their own apocalypse insurance plans.

Getty Images

Getty Images“Saying you’re ‘buying a house in New Zealand’ is kind of a wink, wink, say no more,” Reid Hoffman previously said. The same presumably goes for bunkers.

But there’s a distinctly human flaw.

I once met a former bodyguard of one billionaire with his own “bunker”, who told me his security team’s first priority, if this really did happen, would be to eliminate said boss and get in the bunker themselves. And he didn’t seem to be joking.

Is it all alarmist nonsense?

Neil Lawrence is a professor of machine learning at Cambridge University. To him, this whole debate in itself is nonsense.

“The notion of Artificial General Intelligence is as absurd as the notion of an ‘Artificial General Vehicle’,” he argues.

“The right vehicle is dependent on the context. I used an Airbus A350 to fly to Kenya, I use a car to get to the university each day, I walk to the cafeteria… There’s no vehicle that could ever do all of this.”

For him, talk about AGI is a distraction.

“The technology we have [already] built allows, for the first time, normal people to directly talk to a machine and potentially have it do what they intend. That is absolutely extraordinary… and utterly transformational.

“The big worry is that we’re so drawn in to big tech’s narratives about AGI that we’re missing the ways in which we need to make things better for people.”

Getty Images

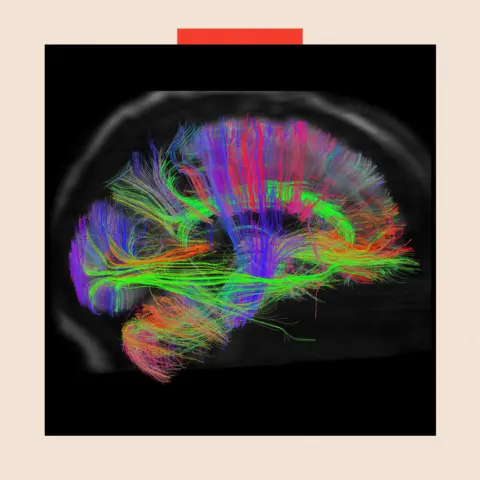

Getty ImagesCurrent AI tools are trained on mountains of data and are good at spotting patterns: whether tumour signs in scans or the word most likely to come after another in a particular sequence. But they do not “feel”, however convincing their responses may appear.

“There are some ‘cheaty’ ways to make a Large Language Model (the foundation of AI chatbots) act as if it has memory and learns, but these are unsatisfying and quite inferior to humans,” says Mr Hodjat.

Vince Lynch, CEO of the California-based IV.AI, is also wary of overblown declarations about AGI.

“It’s great marketing,” he says “If you are the company that’s building the smartest thing that’s ever existed, people are going to want to give you money.”

He adds, “It’s not a two-years-away thing. It requires so much compute, so much human creativity, so much trial and error.”

Getty Images

Getty ImagesAsked whether he believes AGI will ever materialise, there’s a long pause.

“I really don’t know.”

Intelligence without consciousness

In some ways, AI has already taken the edge over human brains. A generative AI tool can be an expert in medieval history one minute and solve complex mathematical equations the next.

Some tech companies say they don’t always know why their products respond the way they do. Meta says there are some signs of its AI systems improving themselves.

Ultimately, though, no matter how intelligent machines become, biologically the human brain still wins. It has about 86 billion neurons and 600 trillion synapses, many more than the artificial equivalents.

The brain doesn’t need to pause between interactions either, and it is constantly adapting to new information.

“If you tell a human that life has been found on an exoplanet, they will immediately learn that, and it will affect their world view going forward. For an LLM [Large Language Model], they will only know that as long as you keep repeating this to them as a fact,” says Mr Hodjat.

“LLMs also do not have meta-cognition, which means they don’t quite know what they know. Humans seem to have an introspective capacity, sometimes referred to as consciousness, that allows them to know what they know.”

It is a fundamental part of human intelligence – and one that is yet to be replicated in a lab.

Top picture credits: The Washington Post via Getty Images/ Getty Images MASTER. Lead image shows Mark Zuckerberg and a stock image of a bunker in an unknown location

BBC InDepth is the home on the website and app for the best analysis, with fresh perspectives that challenge assumptions and deep reporting on the biggest issues of the day. And we showcase thought-provoking content from across BBC Sounds and iPlayer too. You can sign up for notifications that will alert you when a BBC InDepth story is published – find out how to sign up here.

Business

Anthropic officially designated a supply chain risk by Pentagon

The supply chain risk designation of the artificial intelligence firm is a first for a US company.

Source link

Business

FDA official calls UniQure’s gene therapy a ‘failed’ treatment for Huntington’s disease

Thomas Fuller | SOPA Images | Lightrocket | Getty Images

UniQure needs to run another study to prove that its gene therapy “actually helps people with Huntington’s disease,” a senior U.S. Food and Drug Administration official said on a call with reporters Thursday.

The official, who requested anonymity before discussing sensitive information, confirmed the agency has asked the company to run a placebo controlled trial of its treatment, which is administered directly into the brain. UniQure has said that type of study isn’t ethical because it would require putting people under general anesthesia for hours, a characterization the official disputed.

“So what is really going on? UniQure is the latest company to make a failed therapy for Huntington’s patients,” the official said. “They likely acknowledge or understand at some deep level that their trial failed years ago, and instead of doing the right thing and running the correct clinical study, UniQure is performing a distorted or manipulated comparison in the mind of FDA.”

The comments mark the latest development in a messy public spat between UniQure and the FDA, and as the agency comes under fire for a number of recent drug approval application rejections, including some where companies have accused it of going back on previous guidance. FDA Commissioner Marty Makary in an interview with CNBC’s Becky Quick last week seemingly criticized UniQure’s gene therapy for Huntington’s disease. Makary didn’t name UniQure but described its treatment.

UniQure then accused the FDA of reversing its stance that the company’s clinical trial data would be sufficient to seek approval. UniQure’s study used an outside database to measure how patients with Huntington’s disease might decline without treatment, known as an external control. UniQure has said it wouldn’t be feasible to run a true randomized, double-blind placebo-controlled study, considered the gold standard, because it wouldn’t be ethical to make people undergo a sham hours-long brain surgery.

The FDA official said the agency “never agreed to accept this distorted comparison” and the FDA “never makes such assurances.” Instead, the “FDA will always say, ‘Well, we have to see the data when we get it.'”

UniQure didn’t immediately comment.

The company’s stock rose more than 10% on Thursday and has fallen 58% this year as of Thursday afternoon.

Business

US mortgage rates rise to 6% after three-week slide as oil-driven bond yields climb – The Times of India

The average long-term US mortgage rate edged higher this week, ending a three-week decline as bond yields rose amid oil-price pressures linked to the war with Iran.The benchmark 30-year fixed mortgage rate increased to 6% from 5.98% last week, mortgage buyer Freddie Mac said on Thursday. A year ago, the average rate stood at 6.63%, AP reported.The modest uptick breaks a three-week slide in borrowing costs, with mortgage rates having hovered close to the 6% mark for most of this year. Last week’s average had marked the first time the rate dipped below 6% since September 2022, reaching its lowest level in nearly three and a half years.Mortgage rates are influenced by several factors, including the Federal Reserve’s interest-rate policy, investor expectations about inflation and economic growth, and movements in the bond market.They typically track the direction of the 10-year US Treasury yield, which lenders use as a benchmark for pricing home loans.The 10-year Treasury yield rose to 4.14% at midday Thursday, up from around 4% a week earlier.Treasury yields have moved higher in recent days as rising oil prices added fresh inflation concerns, potentially complicating the Federal Reserve’s plans to cut interest rates.

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business7 days ago

Business7 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Business6 days ago

Business6 days agoGreggs to reveal trading amid pressure from cost of living and weight loss drugs

-

Sports1 week ago

Sports1 week agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Sports6 days ago

Sports6 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’