Business

Car headlights to be reviewed after drivers complain of being ‘blinded’ at night

Katy Austin,Transport correspondent and

Lucy Hooker,Business Reporter

EPA

EPACriticism from drivers over the dazzle from oncoming headlights has prompted the government to take a closer look at the design of cars and headlamps on UK roads.

Drivers say LED headlamps, which are increasingly common in new vehicles, are causing them problems and making it harder to drive at night

Research into the issue on behalf of the Department for Transport (DfT) has still not been published, but the BBC has learned that the government now plans to launch a new assessment of the causes and remedies.

New measures will be included in the government’s upcoming Road Safety Strategy, reflecting what is becoming an increasingly fraught issue for road users.

Both Ruth Goldsworthy and Sally Burt say bright headlights make it harder for them to get to their weekly SO Sound choir meetings in Totton, in Hampshire.

“Some of the lights are so bright you are blinded by them, for seconds,” says Ruth.

The beam from LED headlights is whiter, more focused and brighter than the more diffuse light from halogen lamps fitted in older cars.

“I’m not sure where to look, I look into the gutter,” says Sally. They are both relieved if someone else offers to drive.

Evening driving becomes a bigger problem as the winter evenings draw in, and especially after the clocks change, which means more people are driving in the dark.

The problem is worse for older people, whose eyes take around nine seconds to recover from glare, compared to one second for a 16-year-old, according to road safety consultant, Rob Heard.

“In severe cases, we might need to stop until our sight can recuperate,” he said.

A survey from the RAC motoring organisation found that more than a third of drivers were nervous about getting behind the wheel as the evenings get darker. Three quarters of respondents said driving was getting more difficult due to brighter lights.

The RAC’s senior policy officer, Rod Dennis, said so far little progress has been made on tackling glare, with regulations governing headlights dating back to 1989.

A Department for Transport spokesperson said: “We know headlight glare is frustrating for many drivers, especially as the evenings get darker.”

What to do in the face of brighter headlamps:

- Ensure your windscreen is clean

- Wear glasses and keep them clean

- Avoid looking straight ahead, instead focus on the edge of the road

- Do not wear night sunglasses sold for night-driving, as they reduce overall light and won’t reduce glare.

Source: College of Optometrists

New research

The results of last winter’s government commissioned research into the “causes and impact of glare” have been delayed since the summer but are now expected in the next few weeks, the DfT said.

They will inform the upcoming Road Safety Strategy, which is also expected to tighten rules on drink-driving and eye-sight tests for older drivers.

The BBC understands the government is commissioning new research into the role of vehicle design in causing glare, and possible solutions, which will feed into international discussion of the issue.

Getty Images

Getty ImagesOne already well-understood source of glare is drivers retrofitting their vehicles, replacing old halogen bulbs with LEDs.

The housing for halogen bulbs is not compatible with LED bulbs, and a retrofitted car will not pass its annual MOT check-up.

As part of the government’s new approach the Driver and Vehicle Standards Agency has “stepped up surveillance” to stop the sale of illegal retrofit headlamp bulbs, the DfT said.

Seeing better

Cars sold with LED lights can improve road safety, Thomas Broberg, senior adviser for safety at Volvo told the BBC.

“Headlights have become brighter over the years to help drivers see better,” he said.

However, avoiding dazzle was “equally important”, he said.

“I would say poor aiming of the headlights and also the road shape are the major factors for glare,” he said.

For larger vehicles, such as SUVs, where lamps are higher off the ground, there is a requirement for the beam to point more sharply downwards, to protect oncoming drivers. But the angle can be affected by how many passengers it is carrying.

Some new cars with “adaptive features” adjust the lamps automatically if there is a change in load, but cars without that will need manual adjusting, Mr Broberg said.

Some new cars also have automatic headlamp dipping, which lowers the lights when an oncoming vehicle is detected.

Getty Images/Stephen Robinson Pictures

Getty Images/Stephen Robinson PicturesHowever, Daniel Harriman-McCartney, clinical advisor at the College of Optometrists, said automatic dimming features can be “slow to kick in”.

“If it only works when the car is closer than it needs to be, or doesn’t work for cyclists, that can be a problem,” he said.

He is seeing an increasing number of patients concerned about headlamp glare, he added.

Dazzling headlights are cited as a factor in around 250 accidents a year, but there is no evidence that brighter lights are causing more collisions than previously, the RAC concedes.

Instead, worried drivers may simply be “taking the risk off the road” by not driving at night, with a big social impact, the RAC’s Mr Dennis warned.

He would like to see action that “strikes a balance”.

“We don’t want to go back to worse headlights. It is about what is bright enough.”

Business

How inflation rebound is set to affect UK interest rates

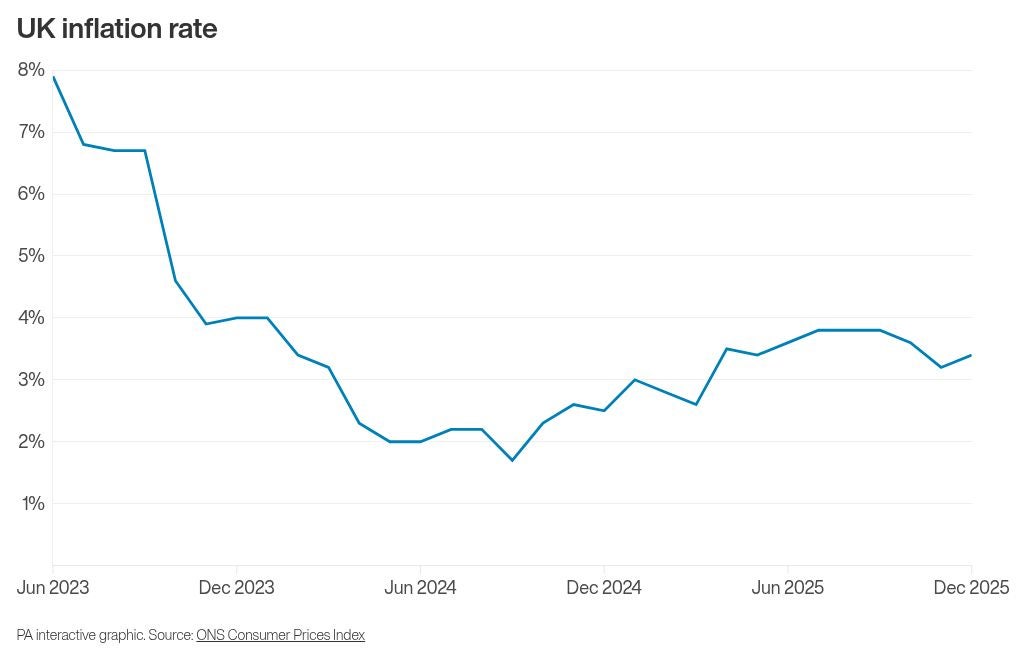

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’

-

Entertainment5 days ago

Entertainment5 days agoClaire Danes reveals how she reacted to pregnancy at 44