Business

Petrol, Diesel Fresh Prices Announced: Check Rates In Your City On November 7

Last Updated:

Petrol, Diesel Price On November 7: Check City-Wise Rates Across India Including In Delhi, Mumbai and Chennai.

Petrol, Diesel Prices On November 7

Petrol and Diesel Prices on November 7, 2025: OMCs update petrol and diesel prices daily at 6 AM, aligning them with fluctuations in global crude oil prices and currency exchange rates. This daily revision promotes transparency and ensures consumers have access to the most up-to-date and accurate fuel prices.

Petrol Diesel Price Today In India

Check city-wise petrol and diesel prices on November 7:

| City | Petrol (₹/L) | Diesel (₹/L) |

|---|---|---|

| New Delhi | 94.72 | 87.62 |

| Mumbai | 104.21 | 92.15 |

| Kolkata | 103.94 | 90.76 |

| Chennai | 100.75 | 92.34 |

| Ahmedabad | 94.49 | 90.17 |

| Bengaluru | 102.92 | 89.02 |

| Hyderabad | 107.46 | 95.70 |

| Jaipur | 104.72 | 90.21 |

| Lucknow | 94.69 | 87.80 |

| Pune | 104.04 | 90.57 |

| Chandigarh | 94.30 | 82.45 |

| Indore | 106.48 | 91.88 |

| Patna | 105.58 | 93.80 |

| Surat | 95.00 | 89.00 |

| Nashik | 95.50 | 89.50 |

Key Factors Behind Petrol and Diesel Rates

Petrol and diesel prices in India have remained unchanged since May 2022, following tax reductions by the central and several state governments.

Oil Marketing Companies (OMCs) update fuel prices daily at 6 am, adjusting for fluctuations in global crude oil markets. While these rates are technically market-linked, they are also influenced by regulatory measures such as excise duties, base pricing frameworks, and informal price caps.

Key Factors Influencing Fuel Prices in India

-

Crude Oil Prices: Global crude oil prices are a primary driver of fuel prices, as crude is the main input in petrol and diesel production.

-

Exchange Rate: Since India relies heavily on crude oil imports, the value of the Indian rupee against the US dollar significantly affects fuel costs. A weaker rupee typically translates to higher prices.

-

Taxes: Central and state-level taxes constitute a major portion of retail fuel prices. Tax rates vary across states, leading to regional price differences.

-

Refining Costs: The cost of processing crude oil into usable fuel impacts retail prices. These costs can fluctuate depending on crude quality and refinery efficiency.

-

Demand-Supply Dynamics: Market demand also influences fuel pricing. Higher demand can push prices up as supply adjusts to consumption trends.

How to Check Petrol and Diesel Prices via SMS

You can easily check the latest petrol and diesel prices in your city through SMS. For Indian Oil customers, text the city code followed by “RSP” to 9224992249. BPCL customers can send “RSP” to 9223112222, and HPCL customers can text “HP Price” to 9222201122 to receive the current fuel prices.

Aparna Deb is a Subeditor and writes for the business vertical of News18.com. She has a nose for news that matters. She is inquisitive and curious about things. Among other things, financial markets, economy, a…Read More

Aparna Deb is a Subeditor and writes for the business vertical of News18.com. She has a nose for news that matters. She is inquisitive and curious about things. Among other things, financial markets, economy, a… Read More

November 07, 2025, 07:13 IST

Read More

Business

Craft beer brewer BrewDog could be broken up as sale process begins

Beermaker BrewDog could be broken up after consultants were called in to help look for new investors.

The Scotland-based brewer, which makes craft beer such as Punk IPA and Elvis Juice, has appointed consultants AlixPartners to oversee a sale process.

Last month, BrewDog announced it was closing its distilling brands, sparking concerns for jobs at its facility in Ellon, Aberdeenshire.

The company, which was founded in 2007, said it made the decision to focus on its beer products.

No decision has been made in respect of the sale process.

A spokesperson for BrewDog said: “As with many businesses operating in a challenging economic climate and facing sustained macro headwinds, we regularly review our options with a focus on the long-term strength and sustainability of the company.

“Following a year of decisive action in 2025, which saw a focus on costs and operating efficiencies, we have appointed AlixPartners to support a structured and competitive process to evaluate the next phase of investment for the business.

“This is a deliberate and disciplined step with a focus on strengthening the long-term future of the BrewDog brand and its operations.

“BrewDog remains a global pioneer in craft beer: a world-class consumer brand, the number one independent brewer in the UK and with a highly engaged global community.

“We believe that this combination will attract substantial interest, though no final decisions have been made.

“Our breweries, bars, and venues continue to operate as normal. We will not comment on any further speculation.”

Brewdog operates 72 bars around the world as well as four breweries.

Business

‘Better to abolish RERA’: Supreme court says law helping defaulting builders

New Delhi: The Supreme Court has raised serious concerns over how real estate regulatory authorities are functioning across the country. Taking a sharp view, the top court said it may be “better to abolish” these bodies, suggesting they have failed to protect homebuyers and instead appear to benefit defaulting builders. The court added that states should reconsider the very need for such authorities if they are not serving their intended purpose.

A Bench led by Chief Justice of India Surya Kant and Justice Joymalya Bagchi said states should rethink the original purpose behind introducing RERA. The court observed that instead of protecting homebuyers, the law appears to be helping defaulting builders and not serving its intended role.

Expressing strong concern, CJI Surya Kant said states should reflect on the purpose for which RERA was created. He suggested the institution is failing to serve homebuyers and instead appears to benefit defaulting builders. “All states should now think of the people for whom the institution of RERA was created. Except facilitating builders in default, it is not doing anything else. Better to just abolish this institution,” CJI Kant said, quoted by Bar and Bench.

Last year, the High Court had stayed the state government’s decision to shift the RERA office, pointing out that the move was taken “without even identifying an alternative office location”. The court also noted that transferring 18 outsourced employees to other boards and corporations, as requested, “would render the functioning of Rera defunct”.

The Supreme Court, however, set aside the High Court’s order and allowed the state government to shift the RERA office to Dharamshala. It also permitted the relocation of the appellate tribunal to the same location. “With a view to ensure that persons affected by Rera orders are not inconvenienced, the principal appellate is also moved to Dharamshala,” the apex court said.

What Is RERA And Why It Matters

RERA, introduced in 2016, was aimed at addressing project delays, improving transparency and safeguarding homebuyers’ interests. Earlier, each state and union territory operated its own RERA website. However, in September 2025, the Ministry of Housing and Urban Affairs launched a unified RERA portal that brings together data from across states and UTs on a single platform.

Business

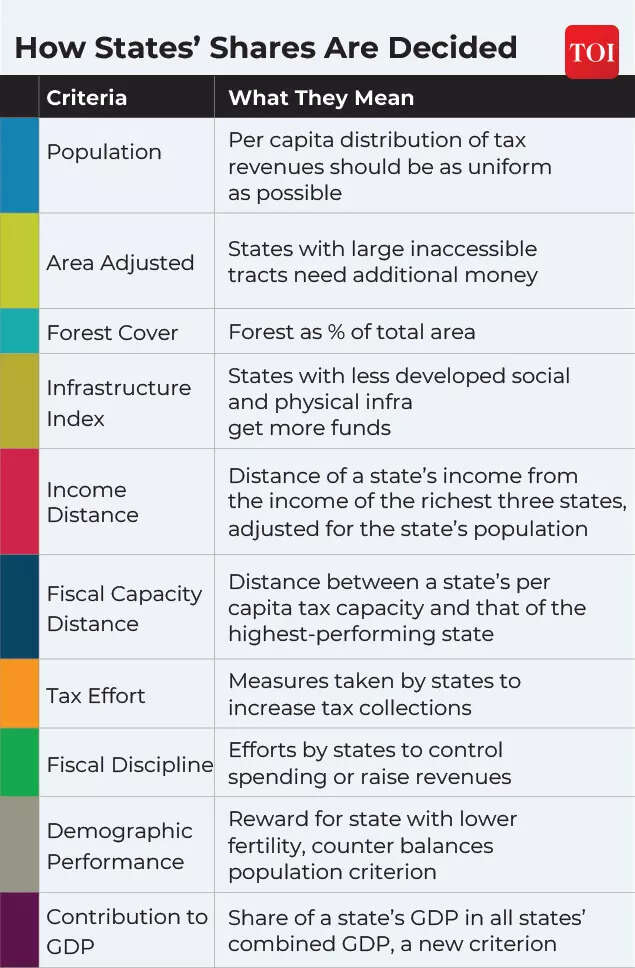

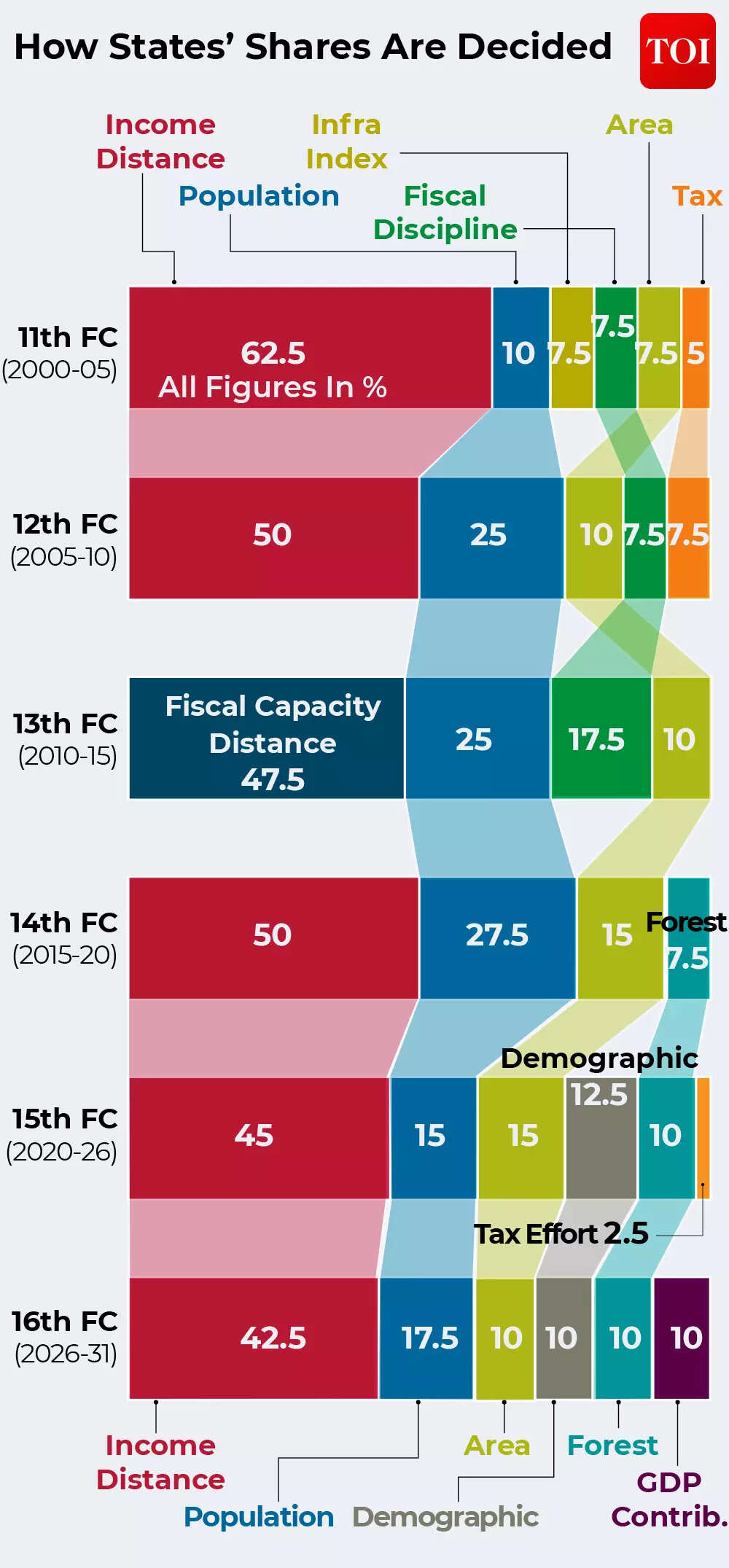

16th Finance Commission: Are federal transfers moving from support to performance? – The Times of India

NEW DELHI: For decades, India’s fiscal federal system has had one core element that stood out: poorer states would be supported so that growth could be shared.The 16th Finance Commission has not broken that promise on paper. States will still receive 41 percent of the divisible pool of central taxes. But beneath that headline number, the logic of how money moves across the Union is beginning to change.For the first time, economic output shapes transfers. Long-running revenue deficit grants — once a fiscal buffer for states — have been eliminated. Parts of local government funding are now tied to performance benchmarks. Disaster funding is moving towards risk-indexed allocation rather than discretionary relief.The shift is subtle in design but important in consequence. Transfers are no longer only about closing gaps. They are increasingly about shaping behaviour — rewarding growth, nudging fiscal discipline, and linking public money to administrative capacity.“Considering India’s growth imperative, there is a need for at least a small shift in the devolution criteria towards efficiency,” the Commission said, capturing the direction of travel.

What a Finance Commission decides

Under Article 280 of the Constitution, a Finance Commission is appointed roughly every five years to recommend how Union tax revenues are shared with states and how that share is distributed among them.The 16th Commission covers the period from 2026-27 to 2030-31. Its recommendations come at a time when India is expected to remain one of the fastest-growing major economies and set to become world’s third largest economy in the recommendation period.

The core decisions are twofold. Vertical devolution determines what share of central taxes goes to states. Horizontal devolution determines how that pool is divided among them. The vertical share remained unchanged. The horizontal framework has changed.

GDP contribution enters the formula

For the first time, contribution to national GDP has been included as a horizontal devolution criterion with a 10 percent weight. Karnataka gains 0.48 percentage points. Kerala gains 0.45 percentage point. Madhya Pradesh loses 0.50 percentage point. Bihar loses 0.11 percentage points . The formula now combines income distance, population, demographic performance, area, forest, GDP contribution. Income distance continues to drive equalisation. GDP contribution introduces an efficiency signal.In response to TOI queries, DK Srivastava, Chief Policy Advisor at EY India, questioned the conceptual basis.“Linking devolution to production efficiency does not appear to be justified,” he said.He said variation in state GDP contribution reflects structural economic factors rather than fiscal management.“It is important to distinguish between efficiency of a production system and efficiency of a fiscal system. GSDPs and GDP are the outcome of the production system in a country which is largely driven by market forces. Inter-state variation in the contribution of the GSDP of an individual state to the overall GDP depends largely on the inter-state concentration of capital stock, inter-state movement of financial and human resources and state level availability of infrastructure,” Srivastava said.He said fiscal rules themselves reinforce divergence.“The differences in inter-state infrastructure depends largely on the limit of fiscal deficit of 3% of GSDP which is by definition higher for higher GSDP states,” he said. “Lowering of the weight attached to the income distance criterion and giving a relatively high weight to the contribution criterion would reduce the degree of equalization.”Ranen Banerjee, Partner and Leader, Economic Advisory, PwC India, said the change sends a policy signal rather than creating an immediate redistribution shock.“The introduction of contribution to GDP as a parameter is a bold step as it clearly puts growth and consequent improvement in the per capita incomes of citizens as an important imperative,” he told TOI.

He said states are already competing on growth and investment metrics.“The states have been competing in attracting investments and improving their ease of doing business as well as articulating ambitious growth targets,” Banerjee said. “The signalling through this indicator could possibly work towards restraining populist expenditures and encouraging capital output enhancing expenditures that lead to economic growth.”He added the numerical impact remains modest.“While this may not be counted as a structural shift given the highest negative impact of just 50 basis points in the share of a state with all the changes in the weights and introduction of this parameter, it is a big incentive for states to perform well and provide growth to its population,” he said.Rumki Majumdar, Economist at Deloitte India, said the shift formally introduces performance into federal fiscal thinking.“The introduction of GDP contribution marks an important evolution: for the first time, economic performance finds measured recognition in horizontal devolution,” she said.

Revenue deficit grants end

The Commission has eliminated revenue deficit grants entirely, ending a mechanism historically used to support fiscally weaker states.The Commission’s reasoning is behavioural. It argues that persistent revenue support created ‘adverse incentive structures’ and weakened fiscal reform pressure.Srivastava said stronger design could still have been built around subsidy discipline.“One possible approach could have been to more explicitly exclude excessive or unjustified subsidies in the assessment of states’ expenditure needs during the award period,” he said. “Designing calibrated fiscal incentives or disincentives linked to subsidy discipline may enhance accountability.”

Local body transfers: performance now matters

Local bodies will receive Rs 7.91 lakh crore between 2026 and 2031, with 60 percent going to rural bodies and 40 percent to urban bodies.

Within this, 80 percent is basic grants and 20 percent is performance-linked.Performance conditions include audited accounts publication, property tax system strengthening, and own revenue growth targets.Majumdar said transparency reform is foundational.“Uniform on-budget reporting becomes the first step toward discipline,” she said.She said transparency alone is insufficient without incentive design.“A shift to uniform, on-budget accounting will ensure states remain committed to the path of fiscal prudence. That said, transparency will have to paired with targeted incentives for efficiency and progressive designs,” she said.

Disaster funding

The Commission has expanded formula-based disaster allocations using a disaster risk index based on hazard, exposure and vulnerability.Banerjee said the framework attempts to balance predictability with flexibility.“The sixteenth finance commission’s disaster relief and mitigation fund related recommendations have built in fiscal flexibility,” he said.He said extreme disaster funding scales with the size of the event.“The risk to extreme tail end disaster events that essentially entails relief has been adequately provided for with a graded contribution from states and centre based on the size of relief,” he said.He said fund stockpiling is controlled while allowing emergency replenishment.“The commission has also recommended capping of accumulation in the SDRF to the extent of past 3 years allocation,” he said.“In the event the fund gets depleted on account of a disaster, it has given provision for its replenishment,” he said.He said mitigation spending remains underused.“The challenge has been utilisation of the State Disaster Mitigation Funds,” he said.“Work on mitigation measures utilising the mitigation funds will be the best way to bring down the risks to be within modelled risk scenarios,” he said.Srivastava said tail-risk disasters remain a central government stabilisation responsibility.“Tail-risk disasters refer to high impact, low probability events such as natural disasters and pandemics,” he said.

(Credit -Sandeep Adhwaryu)

“In the macro-fiscal stabilization framework, dealing with these disasters is largely the responsibility of the central government,” he said.He said fiscal rule flexibility may be necessary in extreme events.“This calls for some flexibility in the fiscal deficit to GDP targets provided in the Centre’s FRBM Act,” he said.He cited pandemic precedent.“For events such as Covid-19 also, it was the central government that increased its fiscal deficit to an inordinately high level of 9.2% of GDP in 2020-21 to cope with the Covid led economic contraction,” he said.He said long-term catastrophic planning remains incomplete.“There is also a case to plan for dealing with disasters like pandemics, nuclear and biological holocausts in advance,” he said.Majumdar framed the shift as systemic resilience building.“When the next black swan arrives, the question is not whether models predicted it, but whether financing can move at the speed of need,” she said.“By modernising risk indices, widening eligibility and introducing market-based risk transfer, the framework somewhat ensures that public finances retain the agility required for a new era of tail-risk volatility,” she said.

Subsidy discipline

The Commission has recommended subsidy rationalisation, improved targeting, sunset clauses and stronger disclosure.Banerjee said fiscal deficit limits already create indirect discipline.“The fiscal federalism structure has an in-built mechanism that penalises fiscal profligacy by states,” he said.“This is through capping of the fiscal deficit that means limiting the borrowing that a state can undertake,” he said.He said adjustment pressures fall on capital spending.“When states are faced with serious fiscal constraints on account of excessive subsidy, the borrowing limit forces it to rationalise expenses,” he said.“Given the rigidity of expenditure for salaries, pension and interest payments, the casualty of such rationalisation is the capital expenditure,” he said.

Representative image

He said transparency can create market pressure.“More transparency on the fiscal condition of a state should upward pressure on the yields of the state development loans raised by the states making borrowing more expensive,” he said.Srivastava said stronger incentive architecture could have been considered.“One possible approach could have been to more explicitly exclude excessive or unjustified subsidies in the assessment of states’ expenditure needs,” he said.“Designing calibrated fiscal incentives or disincentives linked to subsidy discipline may enhance accountability,” he said.

A quieter federal shift

The Commission does not abandon equalisation. Income distance remains the dominant driver.But incentive-linked federalism now sits alongside support-based transfers.Growth versus redistribution, performance versus protection and fiscal discipline versus political economy pressures now operate within the same transfer structure.Over the next five years, states will adjust spending, borrowing and welfare design around this framework.

-

Entertainment1 week ago

Entertainment1 week agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Business4 days ago

Business4 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Tech1 week ago

Tech1 week agoNew York Is the Latest State to Consider a Data Center Pause

-

Tech1 week ago

Tech1 week agoNordProtect Makes ID Theft Protection a Little Easier—if You Trust That It Works

-

Tech1 week ago

Tech1 week agoPrivate LTE/5G networks reached 6,500 deployments in 2025 | Computer Weekly

-

Fashion4 days ago

Fashion4 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Business1 week ago

Business1 week agoStock market today: Here are the top gainers and losers on NSE, BSE on February 6 – check list – The Times of India

-

Business1 week ago

Business1 week agoMandelson’s lobbying firm cuts all ties with disgraced peer amid Epstein fallout