Business

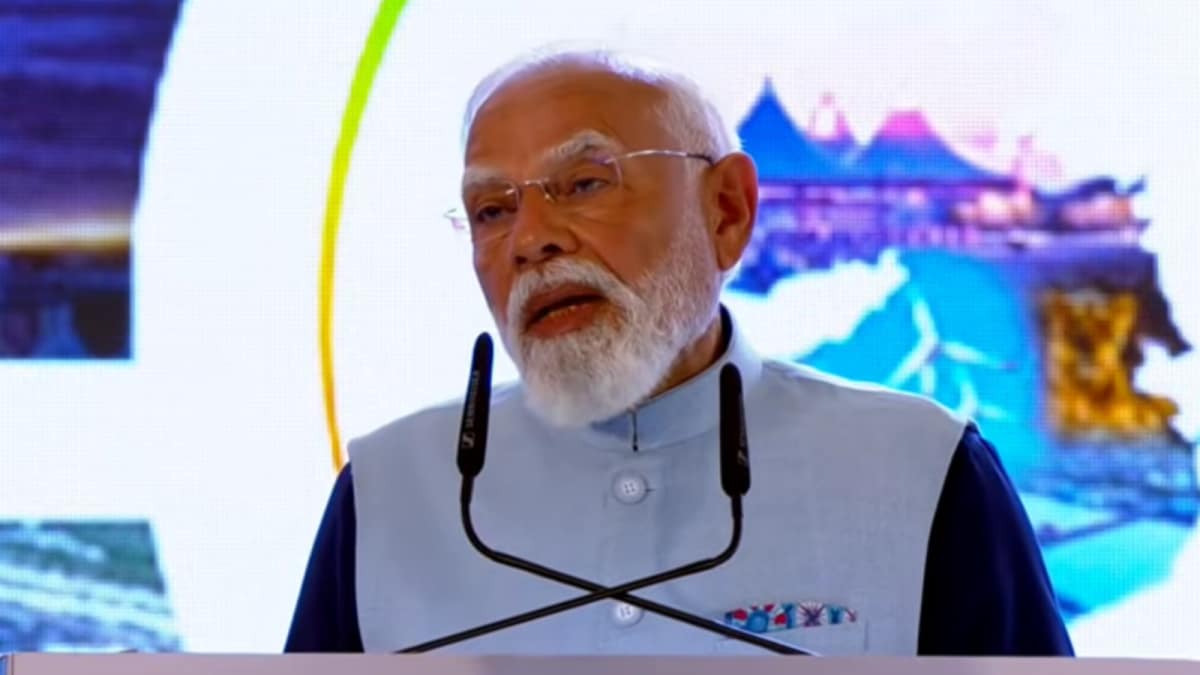

India’s Growth Momentum To Stay Strong At 6.5% Till 2027: Moody’s Ratings

Last Updated:

India’s GDP is expected to sustain a 6.5% growth rate through 2027, compared with a projected 6.4% in 2026 and 7% in 2025

GDP Growth

Strong domestic demand, export diversification in response to US tariffs, and continued infrastructure spending will help India maintain its position as the world’s fastest-growing major economy over the next few years.

India’s GDP is expected to sustain a 6.5% growth rate through 2027, compared with a projected 6.4% in 2026 and 7% in 2025, Moody’s Ratings said in its Global Macro Outlook 2026–27 released on Thursday.

According to Moody’s, government-led capital expenditure and resilient household consumption will remain key growth drivers, even as private sector investment stays subdued.

“We expect Brazil and India — the fastest-growing G-20 economies — to grow at 2.0% and 6.5%, respectively, through 2027, supported by domestic and export diversification. India’s economic performance is underpinned by strong infrastructure spending and solid consumption, although business capex remains cautious,” the agency noted.

The report highlights how Indian exporters have adapted to evolving trade dynamics amid steep US tariffs.

“Despite 50% tariffs on select Indian goods, exporters have managed to redirect shipments — overall exports rose 6.75% in September even as exports to the US fell 11.9%,” Moody’s said.

The agency expects India to grow around 6.5% in 2026 and 2027, supported by a neutral-to-easy monetary policy stance and low inflation. Strong global investor sentiment has also cushioned external risks.

Moody’s outlook comes against a volatile global backdrop marked by diverging monetary policies, tariff tensions, and shifting trade alliances intensified by US President Donald Trump’s trade war.

Global GDP growth is forecast to slow to 2.5%–2.6% in 2026 and 2027 from 2.9% in 2024, with emerging markets continuing to outpace advanced economies.

The RBI projects India’s growth at 6.8% in FY26, while the finance ministry has estimated a 6.3%–6.8% range.

The US has imposed tariffs of up to 50% — including a 25% levy linked to India’s purchase of Russian oil — on certain steel, aluminium, and manufactured products. India has avoided retaliation, focusing instead on market diversification and trade negotiations with the EU and other partners.

The Moody’s report also noted that the RBI’s policy stance remains neutral-to-easy as inflation moderates. Retail inflation dropped to a record 0.25% in October from 1.54% in September amid broad easing in food and fuel prices.

The central bank has gradually shifted from tightening to easing over the past two years, delivering three rate cuts in 2025 — 25 bps each in February and April, followed by a 50 bps cut in June.

“Bond yields in major emerging economies have remained stable, supported by stronger inflation-targeting frameworks and deeper domestic markets,” Moody’s said. However, it warned that global bond markets remain fragile and highly sensitive to fiscal risks and geopolitical shifts.

Aparna Deb is a Subeditor and writes for the business vertical of News18.com. She has a nose for news that matters. She is inquisitive and curious about things. Among other things, financial markets, economy, a…Read More

Aparna Deb is a Subeditor and writes for the business vertical of News18.com. She has a nose for news that matters. She is inquisitive and curious about things. Among other things, financial markets, economy, a… Read More

November 14, 2025, 13:23 IST

Read More

Business

Video: How ICE Is Pushing Tech Companies to Identify Protesters

new video loaded: How ICE Is Pushing Tech Companies to Identify Protesters

By Sheera Frenkel, Christina Thornell, Valentina Caval, Thomas Vollkommer, Jon Hazell and June Kim

February 14, 2026

Business

52 reforms in 52 weeks: Ashwini Vaishnaw outlines massive railway overhaul for 2026

Indian Railways has reached a global milestone in freight operations, securing its position as a premier international logistics hub. Union Minister for Railways, Ashwini Vaishnaw, announced today that the national carrier has achieved an unprecedented scale in its logistics division. Highlighting this achievement, the Minister stated, “Indian Railways has become the second-largest cargo carrier in the world.”

Building on this momentum, the Ministry has prepared a rigorous roadmap for the upcoming year aimed at systemic transformation. The government plans to roll out a series of weekly initiatives to modernise every facet of rail travel and transport. Vaishnaw explained the structured timeline, saying, “For 2026, Railways has resolved to implement 52 reforms in 52 weeks.”

The initial phase of this plan will prioritise the passenger experience, with a focus on improving the quality of onboard facilities. The Minister identified the primary starting point for this year-long agenda, noting, “The first reform is better onboard services in Railways.”

In addition to passenger amenities, the government is placing strong emphasis on the “Gati Shakti” initiative to streamline the nationwide movement of goods. This strategic focus is designed to strengthen the country’s supply chain. Vaishnaw confirmed the freight sector’s priority, adding, “The second concerns ‘Gati Shakti Cargo.’”

A cornerstone of the 2026 agenda is a comprehensive overhaul of sanitation and hygiene standards. The Ministry has developed a new blueprint to ensure that the rail network’s cleanliness meets global benchmarks. Detailing the specifics of the first major initiative, the Minister remarked, “Reform number one for 2026 will ensure proper end-to-end cleaning of the Railways… The concept of a clean rail station has been established.”

This cleanliness drive is not a short-term measure but a multi-year commitment to cover the entire Indian Railways fleet. The implementation will be phased to ensure thoroughness and consistency. Vaishnaw clarified the timeline, stating, “Over three years, this reform will be implemented across all trains.”

To ensure the success of these reforms, the Ministry is introducing a robust accountability framework. These measures will include performance-based contracts and the integration of modern digital tools to monitor progress in real time. Emphasising the shift towards professional and technology-driven management, the Minister concluded, “There will be clearly defined service-level agreements… There will be extensive use of technology.”

Business

BrewDog owners say craft beer company could be sold off

Craft beer brand BrewDog could be sold off after the company started the process to find new investors.

The Scottish beer brand recently announced plans to close all of its distilling brands, meaning it would no longer produce any of its spirits, including Duo Rum, Abstrakt Vodka, and Lonewolf Gin, at its distillery in Ellon, Aberdeenshire.

The company, which was founded in 2007, said it made the decision to focus on its beer brands, including the highly-popular Punk IPA, Elvis Juice, and Hazy Jane.

Now, in a statement, a spokesperson for BrewDog said the company had appointed Alix Partners to “support a structured and competitive process to evaluate the next phase of investment for the business.”

The statement said: “As with many businesses operating in a challenging economic climate and facing sustained macro headwinds, we regularly review our options with a focus on the long-term strength and sustainability of the company.

“Following a year of decisive action in 2025, which saw a focus on costs and operating efficiencies, we have appointed AlixPartners to support a structured and competitive process to evaluate the next phase of investment for the business. This is a deliberate and disciplined step with a focus on strengthening the long-term future of the BrewDog brand and its operations.”

Although no decisions have been made, a sale is under consideration.

In a statment BrewDog added: “BrewDog remains a global pioneer in craft beer: a world-class consumer brand, the No.1 independent brewer in the UK, and with a highly engaged global community. We believe that this combination will attract substantial interest, though no final decisions have been made.”

According to reports by Sky News, AlixPartners had begun sounding out prospective buyers in the last few days.

The company, which has 72 bars worldwide and four breweries in Scotland, the US, Australia, and Germany, said its breweries, bars, and venues will continue to operate as normal. It employs 1400 people across the organisation.

BrewDog’s founders James Watt and Martin Dickie are the company’s major shareholders alongside private equity company TSG, which invested £213 million in 2017, making it a 21 per cent shareholder.

In 2024, the beer brand grossed £357 million in sales, and it is a major independent brewer with 4 per cent market share in the UK grocery market.

-

Entertainment1 week ago

Entertainment1 week agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Business4 days ago

Business4 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Tech1 week ago

Tech1 week agoNew York Is the Latest State to Consider a Data Center Pause

-

Tech1 week ago

Tech1 week agoNordProtect Makes ID Theft Protection a Little Easier—if You Trust That It Works

-

Tech1 week ago

Tech1 week agoPrivate LTE/5G networks reached 6,500 deployments in 2025 | Computer Weekly

-

Fashion4 days ago

Fashion4 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Business1 week ago

Business1 week agoStock market today: Here are the top gainers and losers on NSE, BSE on February 6 – check list – The Times of India

-

Business1 week ago

Business1 week agoMandelson’s lobbying firm cuts all ties with disgraced peer amid Epstein fallout