Business

Ben & Jerry’s brand could be destroyed under Magnum – co-founder

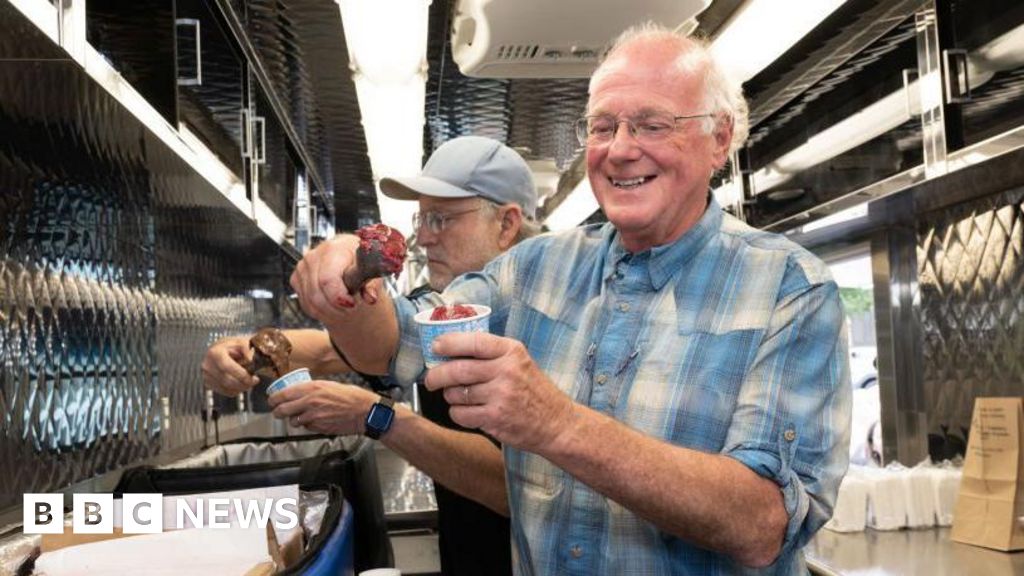

Ben & Jerry’s will be destroyed as a brand if it remains with parent company Magnum, the company’s co-founder Ben Cohen has told the BBC.

His remarks are the latest in a long-running spat between the ice cream brand and its parent company over its ability to express its social activism and the continued independence of its board.

The comments came on the day that the Magnum Ice Cream Company (TMICC) started trading on the European stock market – spinning off from owner Unilever.

A spokesperson for Magnum said the firm wanted to build and strengthen Ben & Jerry’s “powerful, non-partisan values-based position in the world”.

Ben & Jerry’s was sold to Unilever in 2000 in a deal which allowed it to retain an independent board and the right to make decisions about its social mission.

Since the sale there have been deepening clashes between the Vermont-based brand and Unilever, with this conflict now inherited by Magnum.

In 2021, Ben & Jerry’s refused to sell its products in areas occupied by Israel, resulting in its Israeli operation being sold by Unilever to a local licensee, and in October, Ben Cohen said it was prevented from launching an ice cream which expressed “solidarity with Palestine”.

Last month, ahead of its spin off from Unilever, Magnum said the chair of Ben & Jerry’s board Anuradha Mittal, who has held the position since 2018, “no longer meets the criteria to serve” – saying this was the result of an internal audit.

A spokesperson for Magnum said it had found “a series of material deficiencies in financial controls, governance and other compliance policies, including conflicts of interest”.

“So far, the trustees have not fully addressed the deficiencies identified,” they said.

In a statement to Reuters, Ms Mittal said: “The so-called audit of the foundation was a manufactured inquiry – engineered to attempt to discredit me.

“It is important to understand that this is not simply an attack on me as chair. It is Unilever’s attempt to undermine the authority of the Board itself.”

The BBC has contacted Ben & Jerry’s to request this statement.

Mr Cohen said Magnum “has no standing to determine who the chair of the independent board should be”.

“Therefore, by trying to [change the chair of the board], I would say that Magnum is not fit to own Ben & Jerry’s,” he added.

Mr Cohen called for either the business to be “owned by a group of investors that support the brand and want to encourage the values” or for Magnum to make a “180 degree turn around and say they support the chairman of the independent board”.

Ahead of the spin off on Monday, news agency Reuters reported that Ms Mittal said she had no plans to step down from the board.

Ben Cohen remains an employee of Ben & Jerry’s and the brand’s most high-profile spokesperson.

He told the BBC he feared under the current ownership the ice cream maker’s “loyal” followers would be lost for good.

“If the company continues to be owned by Magnum, not only will the values be lost, but the essence of the brand will be lost,” he said.

On Sunday, Magnum’s chief executive Peter ter Kulve told the Financial Times the Ben & Jerry’s founders were in their seventies and “at a certain moment they need to hand over to a new generation”.

Jerry Greenfield, Mr Cohen’s co-founder, left the ice cream maker in September after almost half a century at the firm – citing concerns about the stifling of its social mission.

“It’s absurd,” said Mr Cohen.

“This is about values and abiding by a legally binding agreement.”

Mr Cohen added investors in Magnum were being asked to pay a premium for the Ben & Jerry’s brand “because it has such a loyal following”.

“As they destroy Ben and Jerry’s values, they will destroy that following and they will destroy that brand,” he said.

“It’ll become just another piece of frozen mush that just going to lose a lot of market share.”

A spokesperson for Magnum said Ben & Jerry’s was “not for sale” and it had “always respected” the brand’s commitment to continue its “social mission”.

The demerger of Unilever’s ice cream business saw primary shares in Magnum open at €12.20 (£10.66) – down on the expected €12.80 (£11.18) reference price set by the EuroNext exchange in Amsterdam. But it bounced back up by 1.3% at close of trading.

The spin off means Magnum is now the world’s biggest standalone ice cream business.

Business

Harry Styles and Anthony Joshua among UK’s top tax payers

The former One Direction member-turned-solo artist appears on the Sunday Times list for the first time.

Source link

Business

From Manufacturing To Infra And AI: Capex Boost Flags Off Budget 2026 ‘Reforms Express’

Last Updated:

Budget 2026: FM Nirmala Sitharaman gives a strong push to manufacturing, infrastructure and job creation, while proposing a simpler tax and customs system.

Finance Minister Nirmala Sitharaman presents the Union Budget 2026-27.

Budget 2026 Takeaways: Finance Minister Nirmala Sitharaman on Sunday presented the Union Budget 2026-27, giving a strong push to manufacturing, infrastructure and job creation, proposing a simpler tax and customs regime, and hailing the government’s modernisation drive as a “reforms express”.

The Budget 2026 is anchored around three ‘kartavyas’ — driving growth by enhancing productivity and competitiveness, building people’s capacity, and ensuring inclusive development under the vision of Sabka Saath, Sabka Vikaas.

In her ninth consecutive Budget in Parliament, Sitharaman laid out a multi-pronged strategy to sustain growth amid global uncertainty, including expanding domestic electronics and semiconductor capabilities, de-risking infrastructure projects, skilling India’s youth for emerging technologies, and easing compliance for taxpayers and importers.

Here are the key takeaways from Budget 2026 across manufacturing, infrastructure, skills, AI, taxation and customs duty.

Manufacturing Gets A Boost

Budget 2026 put a special emphasis on the manufacturing landscape in India. The outlay for electronics components manufacturing was raised sharply to Rs 40,000 crore, while new schemes for rare earth magnets, chemical parks, container manufacturing and capital goods seek to reduce import dependency, and strengthen domestic supply chains. Textiles got an integrated, employment-oriented package covering fibres, clusters, skilling and sustainability.

Infrastructure-Led Growth

Infrastructure got a boost with a higher capex allocation and initiatives like a risk guarantee fund to de-risk projects for private developers, new dedicated freight corridors and national waterways, dedicated REITs (real estate investment trusts) for recycling of significant real estate assets of central public sector enterprises (CPSEs), and a seaplane VGF (viability gap funding) scheme.

The Centre’s capital expenditure (capex) target has been increased to Rs 12.2 lakh crore for FY27, up from Rs 11.2 lakh crore earmarked for the current financial year. Moreover, maintaining the fiscal discipline, Sitharaman said the government expects the fiscal deficit to be at 4.3 per cent of the GDP in 2026-27, lower than 4.4 per cent projected for the current financial year.

Tier-II and Tier-III cities were placed at the centre of urban growth via City Economic Regions, backed by reform-linked funding.

“We shall continue to focus on developing infrastructure in cities with over 5 lakh population (Tier II and Tier III), which have expanded to become growth centres,” Sitharaman said in her Budget Speech.

Greater Emphasis On Skilling

The Budget placed renewed emphasis on the services economy as a jobs engine. A high-powered Education-to-Employment and Enterprise Committee will realign skilling with market needs, including the impact of emerging technologies.

Content creation and creative industries get a boost through AVGC labs in schools and colleges, support for animation, gaming and comics, and new institutional capacity for design and hospitality. Tourism-linked skilling, from guides to digital heritage documentation, signals a clear intent to convert culture and content into employment and exports.

“I propose to support the Indian Institute of Creative Technologies, Mumbai in setting up AVGC Content Creator Labs in 15,000 secondary schools and 500 colleges,” FM Sitharaman said. AVGC stands for animation, visual effects, gaming and comics.

AI & Semiconductors Push

Artificial intelligence (AI) was positioned as a cross-sector force multiplier rather than a standalone theme. The Budget provided a push to artificial intelligence (AI) by promoting adoption with governance, agriculture, education and skilling, including proposals for AI-enabled advisory tools for farmers and AI integration in education curricula.

On hardware, the semiconductor strategy expanded decisively under ISM 2.0 (India Semiconductor Mission 2.0), with focus on domestic equipment manufacturing, materials, research centres and workforce development, signalling a long-term commitment to building a resilient chip ecosystem in India.

Taxation, ITR, TDS, TCS

A major structural reform comes with the Income Tax Act, 2025, effective April 1, 2026, containing simpler rules and redesigned forms.

Budget 2026 provided compliance relief for individuals, including extended timelines for revising returns to March 31 from December 31 earlier, staggered ITR due dates, and easier filing of Form 15G/15H through depositories.

Individuals with ITR-1 and ITR-2 returns will continue to file till July 31, and non-audit business cases or trusts are proposed to be allowed time till August 31, according to the Budget Speech 2026-27.

“I propose to extend time available for revising returns from 31st December to up to 31st March with the payment of a nominal fee. I also propose to stagger the timeline for filing of tax returns. Individuals with ITR 1 and ITR 2 returns will continue to file till 31st July and non-audit business cases or trusts are proposed to be allowed time till 31st August,” Sitharaman said.

TDS (Tax deducted at source) rules were clarified for manpower services, while a rule-based system for lower or nil TDS certificates is proposed. TCS rates were cut to 2% for overseas tour packages, education and medical expenses under liberalised remittance scheme (LRS). Litigation is targeted through integrated assessment and penalty orders, lower pre-deposit requirements, and wider immunity provisions.

TDS on the sale of immovable property by a non-resident will be deducted and deposited through resident buyer’s PAN (Permanent Account Number)-based challan instead of requiring TAN (Tax Deduction and Collection Account Number), Sitharaman said.

Customs Duty Tweaks

Customs duty rationalisation continued with a clear focus on domestic manufacturing, energy transition and ease of living. Exemptions have been extended or introduced for capital goods used in lithium-ion batteries, critical minerals processing, nuclear power projects and aircraft manufacturing.

Personal imports will become cheaper with a reduction in duty on goods for personal use from 20% to 10%. Seventeen cancer drugs and additional rare-disease treatments were exempted from customs duty. Process reforms aimed at trust-based, tech-driven clearances, faster cargo movement and lower compliance costs, especially for exporters and MSMEs (micro, small, medium and enterprises).

STT On F&O Hiked

The Budget increased securities transaction tax (STT) on futures trading from 0.02% to 0.05% and on options trading from 0.10% to 0.15%, a move that upset the capital markets with the BSE Sensex crashing more than 2,300 points from the day’s high and the NSE Nifty dropping to 24,571.75.

Securities Transaction Tax (STT) is a direct tax imposed on the buying and selling of securities in India.

Commenting on the Budget, Prime Minister Narendra Modi said, “The Union Budget reflects the aspirations of 140 crore Indians. It strengthens the reform journey and charts a clear roadmap for Viksit Bharat.”

February 01, 2026, 14:43 IST

Read More

Business

French tech giant Capgemini to sell US subsidiary working for ICE

The firm’s move comes amid global scrutiny of the methods used by the US immigration enforcement agency.

Source link

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Entertainment5 days ago

Entertainment5 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Tech1 week ago

Tech1 week ago‘Uncanny Valley’: Donald Trump’s Davos Drama, AI Midterms, and ChatGPT’s Last Resort

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Tech1 week ago

Tech1 week agoICE Asks Companies About ‘Ad Tech and Big Data’ Tools It Could Use in Investigations

-

Sports5 days ago

Sports5 days agoCollege football’s top 100 games of the 2025 season

-

Fashion1 week ago

Fashion1 week agoTurkiye cuts benchmark rate to 37%, flags confidence on inflation