Business

Aurangzeb highlights Pakistan’s strategic shift to restore economic confidence – SUCH TV

Finance Minister Muhammad Aurangzeb underscored Pakistan’s strategic shift from seeking aid-based support towards trade- and investment-led engagement to ensure long-term economic sustainability and mutually beneficial partnerships, particularly with the Gulf Cooperation Council (GCC) countries.

In an interview with CNN Business Arabia, Aurangzeb highlighted the vision of Prime Minister Shehbaz Sharif, which reflected Pakistan’s renewed economic confidence and reform momentum.

He said that Pakistan has followed a comprehensive macroeconomic stabilisation program for the past 18 months, which has delivered tangible and measurable results, while inflation has declined to single-digit levels from an unprecedented 38%.

On the fiscal front, Pakistan has achieved primary surpluses, while the current account deficit remains well within targeted limits. According to the finance czar, the exchange rate has also stabilised, and foreign exchange reserves have improved to approximately 2.5 months of import cover, reflecting strengthening external buffers.

He maintained that the country has two major external validations, which indicate Pakistan’s improving economic outlook.

Firstly, he said, all three international credit rating agencies have aligned their assessments this year by upgrading Pakistan’s ratings and outlook. On the other hand, the country has completed the second review under the IMF Extended Fund Facility, with the IMF Executive Board granting its approval earlier this week.

He stated that such developments demonstrate growing international confidence in Pakistan’s economic management and reform trajectory.

The finance minister further emphasised that macroeconomic stabilisation has been achieved through a coordinated approach combining disciplined monetary and fiscal policies with an ambitious structural reform agenda.

“Reforms are being implemented across key areas, including taxation, energy, state-owned enterprises, public financial management, and privatisation, aimed at consolidating stability and laying the foundation for sustainable growth,” Aurangzeb said.

The finance minister also highlighted the significant progress in Pakistan’s improvement of the tax-to-GDP ratio.

“During the last fiscal year, it increased to 10.3 per cent, with a clear path towards 11 per cent,” the finance minister said.

He further explained the government’s objective to reach a level of tax collection that ensures fiscal sustainability over the medium to long term.

“This is being pursued through widening the tax base by bringing previously undertaxed but economically significant sectors such as real estate, agriculture, and wholesale and retail trade into the formal net, alongside deepening compliance by reducing leakages through production monitoring systems and AI-enabled technologies. Simultaneously, the tax administration is being transformed through reforms in people, processes, and technology,” he said.

The minister further highlighted efforts to improve governance in [power] distribution companies, involve private sector expertise, advance privatisation, and reduce circular debt, which has long constrained the power sector.

“Rationalising the tariff regime is essential to making energy more competitive for industry, thereby enabling industrial revival and economic growth,” he stressed.

Senator Aurangzeb acknowledged the longstanding support of GCC countries, including Saudi Arabia, the United Arab Emirates, and Qatar, for their critical role in critical role supporting Pakistan through financing, funding, and cooperation at international financial institutions such as the International Monetary Fund.

“This relationship is now evolving towards a new phase centred on trade expansion and investment flows. Remittances continue to play a vital role in supporting the current account, with inflows reaching approximately $38 billion last year and projected to rise to $41-42 billion this year, over half of which originates from GCC countries,” he added.

He further said, “Pakistan is actively engaging with GCC partners to attract investment in priority sectors including energy, oil and gas, minerals and mining, artificial intelligence, digital infrastructure, pharmaceuticals, and agriculture.”

Expressing optimism regarding progress on a Free Trade Agreement (FTA) with the GCC, he termed the discussions at an “advanced stage”.

Senator Aurangzeb reiterated the government’s strategic direction in shifting the collective focus on trade rather than relying on aid.

“Pakistan’s future lies in fostering trade and investment partnerships rather than reliance on aid,” said the finance minister.

He also emphasised the role of foreign direct investment in supporting the higher GDP growth, generating employment opportunities, and delivering shared economic benefits for Pakistan and its partners.

“The government is fully mobilised to translate this vision into reality.” He concluded.

Business

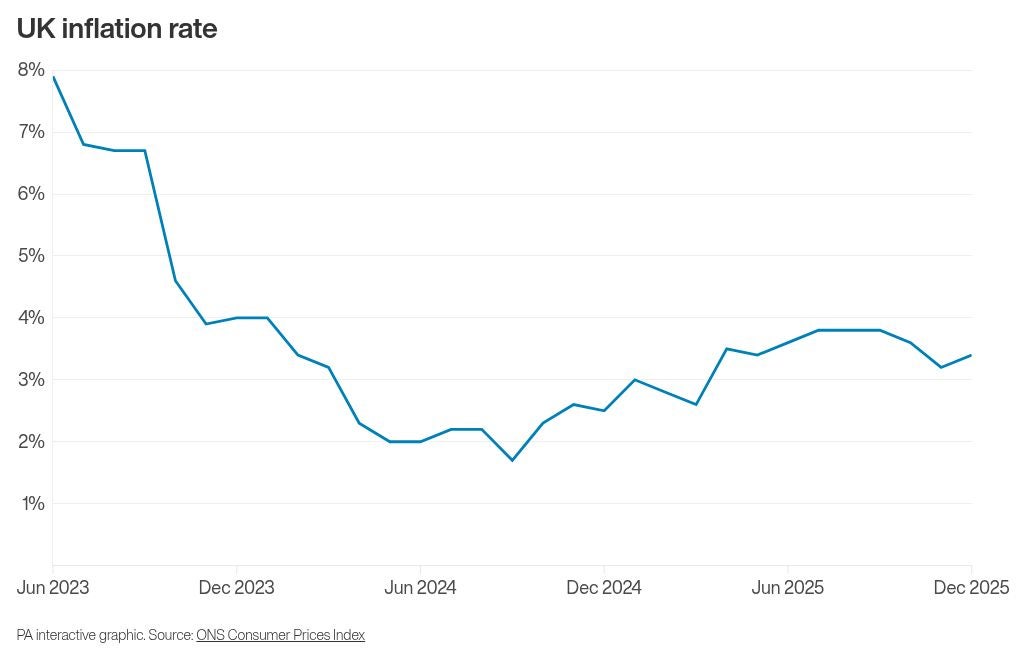

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’