Business

Trump sanctions fail to dent flow? India’s oil imports from Russia top cross 1 million barrels a day; show resilience – The Times of India

Donald Trump’s sanctions on Russian oil majors don’t seem to have deterred Indian refiners from procuring crude – though non-sanctioned – from Russia. India’s crude oil imports from Russia are showing resilience in December, days after Trump’s sanctions on Russian firms Lukoil and Rosneft kicked in. The bilateral relationship has remained robust despite Western sanctions pressure.India’s imports of Russian oil are expected to cross 1 million barrels per day this December, according to trade and refining sources quoted in a Reuters report. This is against expectations of a significant reduction, as refiners continue purchasing from non-sanctioned entities that provide deep discounts.

India-Russia Crude Oil Trade Intact

* Data from trade sources quoted in the report indicates that India, the world’s third-largest crude importer, received 1.77 million bpd of Russian oil in November, showing a 3.4% increase from October. * Despite expectations of a significant decrease due to Trump’s sanctions on two major Russian producers, December deliveries are anticipated to surpass 1.2 million bpd, based on initial LSEG trade flow data.

Russia continues to be top oil supplier to India

* This figure could reach an average of 1.5 million bpd by month-end, according to a trade source quoted in the report. It is important to note that the surge in India’s December imports from Russia is attributed to buyers rushing to complete transactions before Washington’s November 21 deadline for deals with Rosneft and Lukoil. LSEG data confirms recent arrivals of such shipments at Indian ports.* However, in January, trade sources indicate that import levels might maintain December volumes as new entities not affected by sanctions begin supplying Russian oil cargoes.* Indian refiners find January prices attractive, with discounts of approximately $6 per barrel to dated Brent, which is two to three times larger than in August, according to sources.According to refining sources, January volumes are expected to be below 1 million bpd since Reliance Industries has stopped purchases. LSEG data shows Reliance is receiving at least 10 Russian oil cargoes this month.

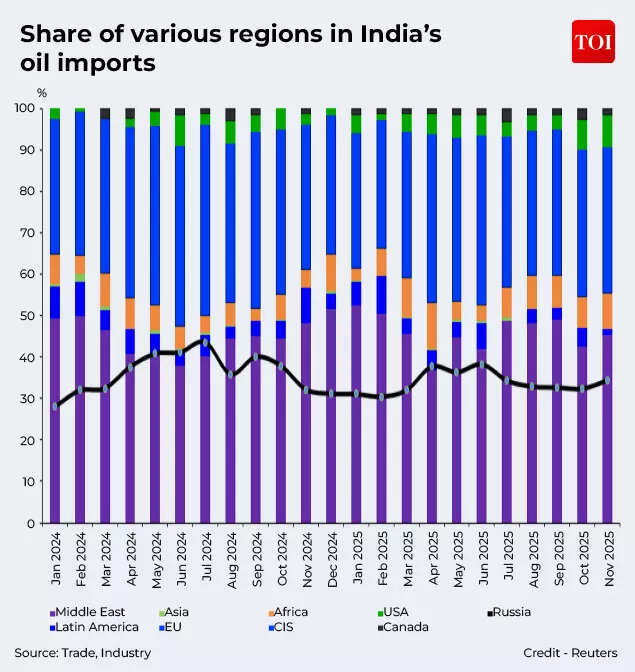

Share of various regions in India’s oil imports

Regarding state refiners, Indian Oil Corp maintains Russian oil purchases at pre-sanctions levels, sources told Reuters. Bharat Petroleum has increased its January acquisitions to at least six cargoes, up from two in December, whilst Hindustan Petroleum is negotiating January loadings, sources were quoted as saying.Private refiner Nayara Energy, with majority Russian ownership including Rosneft, exclusively purchases Russian oil after other suppliers withdrew following EU and British sanctions.Reliance and HPCL Mittal Energy have announced that they will not procure Russian oil. Additionally, Mangalore Refinery and Petrochemicals are not procuring Russian oil for January, the report said.India emerged as Russia’s primary seaborne crude purchaser following Western sanctions imposed on Moscow over the Ukraine invasion. However, these purchases became problematic during trade negotiations with the US, as President Donald Trump raised import tariffs on Indian products to 50%.“Thanks to President Trump’s leadership, Russia has been forced to accept deep discounts and fewer buyers for its oil,” a US official said. “These pressures are limiting the Kremlin’s revenues and increasing the financial strain of sustaining its war.”Russian producers are utilising domestic market swaps to maintain oil flows to India whilst adhering to sanctions. This involves exchanging oil intended for local refineries with export volumes handled by non-sanctioned companies, Reuters said.These swaps are a standard practice in Russia for managing domestic supply constraints whilst maintaining export obligations.“There is a possibility that non-sanctioned entities can increase their crude output and shift supplies to export markets and sanctioned barrels can meet Russia’s local demand,” said Prashant Vashisth, vice president at Moody’s affiliate ICRA.

Business

Budget 2026 Live Updates: TCS On Overseas Tour Packages Slashed To 2%; TDS On Education LRS Eased

Union Budget 2026 Live Updates: Union Budget 2026 Live Updates: Finance Minister Nirmala Sitharaman is presenting the Union Budget 2026-27 in Parliament, her record ninth budget speech. During her Budget Speech, the FM will detail budgetary allocations and revenue projections for the upcoming financial year 2026-27. Sitharaman is notably dressed in a Kanjeevaram Silk saree, a nod to the traditional weaving sector in poll-bound Tamil Nadu.

The budget comes at a time when there is geopolitical turmoil, economic volatility and trade war. Different sectors are looking to get some support with new measures and relaxations ahead of the budget, especially export-oriented industries, which have borne the brunt of the higher US tariffs being imposed last year by the Trump administration.

On January 29, 2026, Sitharaman tabled the Economic Survey 2025-26, a comprehensive snapshot of the country’s macro-economic situation, in Parliament, setting the stage for the budget and showing the government’s roadmap. The survey projected that India’s economy is expected to grow 6.8%-7.2% in FY27, underscoring resilience even as global economic uncertainty persists.

Budget 2026 Expectations

Expectations across key sectors are taking shape as stakeholders look to the Budget for support that sustains growth, strengthens jobs and eases financial pressures:

Taxpayers & Households: Many taxpayers want practical improvements to the income tax structure that preserve simplicity while supporting long-term financial planning — including broader deductions for home loan interest and diversified retirement savings options.

New Tax Regime vs Old Tax Regime | New Income Tax Rules | Income Tax 2026

Businesses & Industry: With industrial output and investment showing resilience, firms are looking for policies that bolster capital formation, ease compliance, and expand infrastructure spending — especially in manufacturing and technology-driven sectors that promise jobs and exports.

Startups & Innovation: The startup ecosystem expects incentives around employee stock options and capital access, along with regulatory tweaks that encourage risk capital and talent retention without increasing compliance burdens.

Also See: Stock Market Updates Today

The Budget speech will be broadcast live here and on all other news channels. You can also catch all the updates about Budget 2026 on News18.com. News18 will provide detailed live blog updates on the Budget speech, and political, industry, and market reactions.

We are providing a full, detailed coverage of the union budget 2026 here, with a lot of insights, experts’ views and analyses. Stay tuned with us to get latest updates.

Also Read: Budget 2026 Live Streaming

Here are the Live Updates of Union Budget 2026:

Business

Budget 2026: Cabinet gives green signal to Union Budget 2026–27

New Delhi: The Cabinet on Sunday approved the Union Budget 2026-27 during a meeting in Parliament chaired by Prime Minister Narendra Modi. A meeting of the Union Cabinet was held at Sansad Bhawan at 10 a.m., and after the Cabinet’s approval, Finance Minister Nirmala Sitharaman proceeded to Parliament to present the Budget.

Earlier, FM Sitharaman met President Droupadi Murmu and offered her a copy of the digital budget. The President also offered ‘dahi-cheeni’ (curd and sugar) to Sitharaman when she arrived at the Rashtrapati Bhavan. The Finance Minister was seen carrying her trademark ‘bahi-khata’, a tablet wrapped in a red-coloured cloth bearing a golden-coloured national emblem on it.

Minister of State for Finance Pankaj Chaudhary, Chief Economic Advisor Dr V. Anantha Nageswaran, Central Board of Direct Taxes (CBDT) Chairman Ravi Agrawal and other officials were seen accompanying the Finance Minister. Sitharaman was set to present her ninth consecutive Union Budget in the Lok Sabha. In 2021, she switched to using a digital tablet to carry the Budget papers, further promoting a modern and eco-friendly approach.

The ‘bahi-khata’ is a red pouch that holds the digital tablet containing the Budget documents. This year, Sitharaman opted for a deep maroon Kanjeevaram saree from Tamil Nadu. The saree featured a deep maroon base with a contrasting border and subtle gold detailing, paired with a yellow blouse.

The Budget is likely to strike a deft balance of sustaining growth momentum and maintaining fiscal consolidation. It also needs to address near-term challenges emanating from unprecedented geopolitical flux, said economists. According to economists, the budget is likely to focus more on capital expenditure, especially in sectors deemed to be strategically important owing to prevailing geopolitical compulsions.

While the FY26 Budget was more tilted towards stimulating middle-class consumption with tax reliefs, the FY27 Budget’s approach to stimulating consumption will be selective, they added.

Business

Education Budget 2026 Live Updates: What Will The Education Sector Get From FM Nirmala Sitharaman?

Union Education Budget 2026 Live Updates: Union Finance Minister Nirmala Sitharaman will present the Union Budget 2026–27 on February 1, with a strong focus expected on the Education Budget 2026, a key area of interest for students, teachers, and institutions across the country.

In the previous budget, the Bharatiya Janata Party government announced plans to add 75,000 medical seats over five years and strengthen infrastructure at IITs established after 2014. For 2025, the Centre had earmarked Rs 1,28,650.05 crore for education, a 6.65 percent rise compared to the previous year.

Meanwhile, the Economic Survey 2025–26, tabled in the Parliament of India, points to persistent challenges in school education. While enrolment at the school level is close to universal, this has not translated into consistent learning outcomes, especially beyond elementary classes. The net enrolment rate drops sharply at the secondary level, standing at just over 52 per cent.

The survey also flags concerns over student retention after Class 8, particularly in rural areas. It notes an uneven spread of schools, with a majority offering only foundational and preparatory education, while far fewer institutions provide secondary-level schooling. This gap, the survey suggests, is a key reason behind low enrolment in higher classes.

Stay tuned to this LIVE blog for all the latest updates on the Education Budget 2026 LIVE.

-

Business1 week ago

Business1 week agoSuccess Story: This IITian Failed 17 Times Before Building A ₹40,000 Crore Giant

-

Fashion1 week ago

Fashion1 week agoSouth Korea tilts sourcing towards China as apparel imports shift

-

Sports1 week ago

Sports1 week agoTransfer rumors, news: Saudi league eyes Salah, Vinícius Jr. plus 50 more

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain