Business

Why has inflation fallen and what does it mean for me?

UK inflation fell to an eight-month low in November as Black Friday sales and a dip in food prices helped ease the cost of living.

The rate of Consumer Prices Index (CPI) inflation fell to 3.2% in November, from 3.6% in October, the Office for National Statistics (ONS) said.

Here, the Press Association looks at what is behind the drop and what it means for households and the economy.

– What is inflation?

Inflation is the term used to describe the rising price of goods and services.

The inflation rate refers to how quickly prices are going up.

November’s inflation rate of 3.2% means if an item cost £100 a year ago, it would now cost £103.20.

It is below the 3.6% rate recorded in October, meaning that prices are rising at a slower rate than they were before.

– What made inflation go down?

The ONS said the biggest factor driving inflation down last month was lower food prices.

Items such as bread, cereals and cakes, butter, cheese and pasta got cheaper between October and November, while alcoholic drinks including beer and wine also decreased.

However, food prices are still higher than they were last year, with the annual inflation rate coming in at 4.2% in November – albeit lower than the 4.9% October rate.

The price of some food and drinks has spiked over the past year, with annual rises including beef up 27.7%, chocolate rising by 17.3% and coffee up 14.5%.

Sarah Coles, head of personal finance for Hargreaves Lansdown, said this means that people’s “experiences at the supermarket will still depend enormously on what you buy”.

– Did Black Friday make a difference?

The ONS said its data pointed to there being bigger Black Friday sales this year than in 2024, which helped lower the price of clothes and shoes.

Black Friday has become a key time for retailers to attract shoppers with discounts that last well beyond the specific November shopping date.

The ONS said women’s clothing fell the most, with falls for items such as trousers and skirts.

Ms Coles said that sluggish sales through the year may have “persuaded retailers that they have to work harder to get people through the doors – so discounts were heavier”.

– Will inflation keep falling?

While November’s inflation rate fell sharply, some economists have cautioned that it is likely to be a one-off, with factors such as Black Friday sales potentially skewing the data.

Rob Wood, chief UK economist for Pantheon Macroeconomics, said that prices fell by more than expected for items including clothes, furniture and games, toys and hobbies, warning that this will “likely reverse” in the coming months.

James Smith, an economist for ING, said he was expecting inflation to edge higher in December, particularly due to a seasonal spike in air fares.

However, he said the “latest drop in inflation fits into a broader body of evidence suggesting that price pressures are cooling”, adding: “We expect headline inflation to fall pretty close to 2% by May.”

– What does it mean for interest rates?

Most economists think that the latest set of inflation data will be enough to convince policymakers to cut interest rates when they next meet on Thursday.

The Bank of England is widely expected to reduce rates to 3.75% from 4%.

Charlotte Kennedy, chartered financial planner for Rathbones, said the inflation reading “paves the way for a possible pre-Christmas rate cut, particularly given the need to stimulate the economy and address the ongoing malaise in employment and job opportunities”.

“Measures announced at the Budget – such as freezing rail fares until 2027, cutting fuel duty, and reducing energy bill costs – are expected to shave around 0.5 percentage points off headline inflation by the middle of next year,” she said.

She added that this raises the prospect of the Bank of England reaching its 2% target rate for CPI inflation “in the not-too-distant future”.

Business

$2 trillion wiped off crypto markets! Bitcoin halves since October; investor company shares sink to multiyear lows – The Times of India

Cryptogiant Bitcoin has suffered sharp losses since the beginning of 2026, tumbling over 20%. The digital currency has given up almost half of its value since October’s record peak of over $124,000, sliding to $67,000, now worth less than it was at the start of President Donald Trump’s second term. Bitcoin is often pitched as “digital gold” as its returns are just like gold, offering no dividends or profits and price driven by what investors are willing to pay. The world’s largest cryptocurrency was last trading 1.64% higher at $64,153.24 after a volatile session that saw prices swing between gains and losses, having earlier touched a low of $60,008.52. The global crypto market has lost $2 trillion in value since peaking at $4.379 trillion in early October, with $800 billion wiped out in the last month alone, Reuters reported. Bitcoin has declined 28% so far this year, while ether has lost nearly 38% over the same period.As the asset slid, shares of companies holding bitcoin and other digital assets also came under heavy pressure amid ongoing turbulence in the cryptocurrency market, fuelling concerns about stress across the sector. Publicly listed firms that piled into crypto last year, encouraged by US President Donald Trump’s supportive stance, are now grappling with intensifying market challenges.The decline comes as uncertainty over Federal Reserve rate cuts and concerns over AI company valuations weigh on risk assets, pushing bitcoin to its lowest level since November 2024.Strategy shares plunge to multi-year lowsMicroStrategy’s bitcoin-focused arm, Strategy, has seen shares tumble from $457 in July to $111.27 on Thursday, marking their lowest level since August 2024. The stock was last down more than 11%, according to Reuters.In December, Strategy cut its 2025 earnings forecast, citing weak bitcoin performance, and announced plans to create a reserve to support dividend payments. The company now expects full-year earnings between a $6.3 billion profit and a $5.5 billion loss, down from its earlier forecast of $24 billion.Other notable bitcoin buyers have also been hit. UK-based Smarter Web Company (SWC.L) fell nearly 18%, Nakamoto Inc (NAKA.O) lost almost 9%, and Japan’s Metaplanet (3350.T) dropped over 7%.Bitcoin wipes out gains since Trump’s electionBitcoin itself is down nearly 28% since the start of the year, with recent selling accelerating after Trump nominated Kevin Warsh as the next Federal Reserve chair. Analysts cited by Reuters say that Warsh’s appointment could lead to a smaller Fed balance sheet, a negative for speculative assets like crypto.Bitcoin has erased all gains made since Trump’s election, when he pledged to overhaul policies toward digital assets. The cryptocurrency last traded at $67,651.“As Bitcoin continues its slide below the psychological barrier of $70,000, it’s clear the crypto market is now in full capitulation mode,” said Nic Puckrin, investment analyst and co-founder of Coin Bureau. “If previous cycles are anything to go by, this is no longer a short-term correction, but rather a transition… and these typically take months, not weeks,” Reuters cited the expert.Broader digital asset holdings also hitCompanies holding other tokens have been affected as well. Alt5 Sigma, which stocks the Trump family’s WLFI token, fell 8.4%. SharpLink Gaming, holding ether, dropped 8%, while Forward Industries, which holds solana, fell nearly 6%.Bitcoin fell to a low of $63,295.74 on Thursday, its weakest since October 2024, before rebounding slightly to $63,525, marking its largest one-day drop since November 2022. Approximately $1 billion in bitcoin positions were liquidated over 24 hours, according to CoinGlass data.Fed concerns and investor outflowsTrump’s Fed pick, Kevin Warsh, has added to market fears. Analysts say investors worry that a smaller balance sheet will remove liquidity support for speculative assets.“The market fears a hawk with him,” Manuel Villegas Franceschi from Julius Baer told Reuters. “A smaller balance sheet is not going to provide any tailwinds for crypto.”Deutsche Bank analysts highlighted massive outflows from institutional ETFs as a key driver of the decline. US spot bitcoin ETFs saw over $3 billion withdrawn in January, following $2 billion and $7 billion outflows in December and November, respectively. “This steady selling in our view signals that traditional investors are losing interest, and overall pessimism about crypto is growing,” they said.Tech sector weakness piles pressure on crypto segmentThe slide in cryptocurrencies has been compounded by a broader downturn in tech stocks, particularly software companies linked to AI. Bitcoin and other tokens have historically tracked risk appetite in technology markets, and the current weakness has intensified losses.“Concerns are being raised around the crypto miners and whether we could be looking at forced liquidations if prices continue to fall, which could lead to a vicious cycle,” said Jefferies strategist Mohit Kumar, as cited by Reuters. The analyst further added that crypto “should never be more than a very small portion of a portfolio, but its heavy retail ownership adds to overall market risk.”

Business

RBI MPC Meeting 2026 Live Updates: Gov Sanjay Malhotra To Announce Decision On Repo Rate Today

RBI MPC Meeting February 2026 Live Updates: All eyes are on the Reserve Bank of India (RBI) governor, Sanjay Malhotra, today as he is going to announce the decision of the Monetary Policy Committee (MPC) February policy meeting, which started on February 04. The outcome, due shortly, will set the tone for interest rates, liquidity conditions, and market sentiment at a time when growth is steady but inflation risks haven’t fully disappeared.

The six-member MPC, headed by RBI Governor, has deliberated on domestic inflation trends, global uncertainty, crude oil prices, and the evolving growth outlook.

The decision will be announced by RBI Governor Sanjay Malhotra amid a supportive domestic backdrop of a growth-oriented Union Budget, easing inflation pressures and a major easing of external uncertainty following the long-awaited India-US trade deal.

RBI Governor will begin his speech at 10:00 AM. The Central bank had cut the repo rate by 25 bps to 5.25 per cent from 5.50 per cent with a ‘neutral stance’ in its December monetary policy.

This time, expectations are mixed. While retail inflation has shown signs of cooling, it remains close to the RBI’s comfort zone. At the same time, global central banks are turning more cautious on rate cuts, which could influence RBI’s tone and forward guidance.

Markets will closely track not just the rate decision but also the RBI’s commentary on inflation risks, growth projections, liquidity management, and its stance going forward.

Stay tuned with us to watch the live coverage of RBI MPC February Meeting 2026

Business

The White House is launching direct-to-consumer drug site Trump Rx. Here’s what to know

President Donald Trump makes an announcement from the Oval Office at the White House in Washington, Nov. 6, 2025.

Jonathan Ernst | Reuters

President Donald Trump on Thursday is slated to announce the launch of TrumpRx — a direct-to-consumer website that is key to his administration’s efforts to lower prescription drug costs in the U.S.

In a post on X, White House press secretary Karoline Leavitt said Trump and other administration officials will debut the website at 7 p.m. ET on Thursday.

She said millions of Americans would save money through TrumpRx, but it’s still unclear if all patients — particularly those with insurance coverage — will see more cost savings from using that site to buy their medicines. TrumpRx targets people who are willing to pay with cash and forgo insurance, which suggests that people without or with limited coverage may benefit the most.

The site is not expected to sell drugs directly to American patients, but will act as a central hub that points them to drugmakers that are offering discounts on certain products on their own direct-to-consumer sites. For example, Eli Lilly and Novo Nordisk have offered their blockbuster obesity drugs at hefty discounts to cash-paying patients.

In recent months, both companies and at least 14 other drugmakers have negotiated agreements with the Trump administration to participate on the platform and voluntarily sell certain medicines at a discount to Medicaid patients. Those landmark deals are part of Trump’s broader “most favored nation” policy, which pushes to link U.S. drug prices to the lowest ones abroad.

It is the government’s latest effort to try to rein in U.S. prescription drug prices, which are two to three times higher on average than those in other developed nations — and up to 10 times more than in certain countries, according to the Rand Corp., a public policy think tank.

But TrumpRx “doesn’t seem like it is the only solution” to that issue for most Americans, said Juliette Cubanski, deputy director of the program on Medicare Policy at KFF, a health policy research organization. The cash-pay offerings could be better deals for patients without insurance, but it’s difficult to assess exactly how many people stand to benefit from TrumpRx, she added.

“If they’re able to get a drug covered by their insurance at a relatively affordable copay, then there’s not a great upside to using the TrumpRx website,” Cubanski said.

She said people with insurance coverage who buy through direct-to-consumer platforms may also not have their purchases count toward their benefits, which means it doesn’t help them meet their deductible or out-of-pocket maximum.

But Cubanski said there’s potential for TrumpRx to be helpful in expanding access to certain drugs at more affordable prices, particularly medicines not covered widely by insurance in the U.S., such as obesity drugs. Medicare will start covering weight loss treatments for the first time later this year as part of the deals Lilly and Novo struck with Trump, but many employers are still hesitant to cover those drugs.

Still, many of the other products expected to be listed on TrumpRx are already widely covered through insurance, and some are available as cheaper generics from competing drugmakers.

Questions about savings

Questions remain about how much savings people can expect if they buy their medicines at direct-to-consumer prices.

The announced price reductions for certain drugs are framed as steep cuts from their so-called retail list prices. For example, under Novo Nordisk’s agreement with the administration, its diabetes drug Ozempic will be priced at $350 per month on TrumpRx, which is less than half of its roughly $1,000 monthly list price.

But those list prices are often far higher than what private insurers and government programs ultimately pay for medicines after rebates, discounts and other concessions, according to researchers at Georgetown’s Medicare Policy Initiative. That suggests some payers may already be securing prices comparable to — or lower than — the newly announced discounts on medications under the Trump deals.

The Georgetown researchers cited one study that found that average discounts on brand-name drugs in Medicare Part D run around 40% of list prices. Meanwhile, discounts in Medicaid exceed 75%, according to a Congressional Budget Office study.

In the private sector, “we’ve got insurers and pharmacy benefit managers negotiating lower prices and designing an insurance benefit that enables people to benefit from those price negotiations,” said KFF’s Cubanski.

“My guess is that for most drugs, at least most brand-name medications, people are likely to get a better deal using their insurance rather than purchasing a drug through a direct-to-consumer website,” she said.

Drugs on TrumpRx

The administration has not provided a full list of drugs that will be listed on TrumpRx.

But available information from recent drug pricing deals indicates many widely used drugs will have discounted prices listed on the site:

- Ozempic injection for diabetes, made by Novo Nordisk: $350 per month, down from around $1,000

- Wegovy injection for obesity, made by Novo Nordisk: $350 per month, down from around $1,350

- Wegovy pill for obesity, made by Novo Nordisk: $150 per month for the starting doses

- Zepbound injection for obesity, made by Eli Lilly: $350 per month, down from $1,086

- Trulicity for diabetes, made by Eli Lilly: $389 per month, down from about $1,000

- Emgality for migraines, made by Eli Lilly: $299, down from around $764

- Repatha for lowering cholesterol, made by Amgen: $239, down from $573

- Reyataz for HIV, made by Bristol Myers Squibb: $217, down from $1,449

- Januvia for diabetes, made by Merck: $100, down from $330

- Epclusa for hepatitis C, made by Gilead: $2,425, down from $24,920

- Jentadueto for diabetes, made by Boehringer Ingelheim: $55, down from $525

- Xofluza for flu, made by Genentech: $50, down from $168

- Advair Diskus inhaler 500/50, made by GSK: $89, down from $265

- Mayzent for multiple sclerosis, made by Novartis: $1,137, down from $9,987

- Plavix, made by Sanofi: $16, down from $756

In an interview with CNBC at a conference in January, Bristol Myers Squibb CEO Chris Boerner said the company has multiple products on its existing direct-to-consumer platform, which first offered a cash-pay discount on its blood thinner Eliquis. That platform will link to TrumpRx, he said.

The company is going to examine ways to put additional products in its portfolio on its own platform, “where it makes sense,” Boerner added. He said Bristol Myers is “aligned with the administration” on the issue of the U.S. health care system being too complex, and said several middlemen can increase costs.

“What we like about these [direct-to-consumer models], where they make sense from a business standpoint, is you’re able to circumvent some of that,” Boerner said.

Meanwhile, in an exclusive interview with CNBC last week, Eli Lilly CEO Dave Ricks said the company was the first drugmaker to sell obesity treatments directly to patients, and that TrumpRx is “taking that and expanding it across the industry” to other medicines.

“We’re all for that,” Ricks said.

-

Business1 week ago

Business1 week agoPSX witnesses 6,000-point on Middle East tensions | The Express Tribune

-

Tech1 week ago

Tech1 week agoThe Surface Laptop Is $400 Off

-

Tech1 week ago

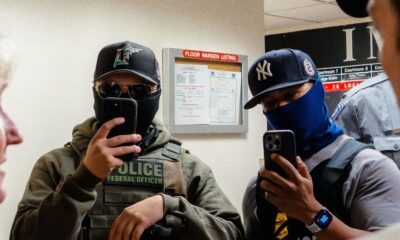

Tech1 week agoHere’s the Company That Sold DHS ICE’s Notorious Face Recognition App

-

Business1 week ago

Business1 week agoBudget 2026: Defence, critical minerals and infra may get major boost

-

Tech4 days ago

Tech4 days agoHow to Watch the 2026 Winter Olympics

-

Tech6 days ago

Tech6 days agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Fashion7 days ago

Fashion7 days agoItaly’s Brunello Cucinelli debuts Callimacus AI e-commerce experience

-

Business6 days ago

Business6 days agoVideo: Who Is Trump’s New Fed Chair Pick?