Business

Southwest’s profits are down 42% this year but it’s the top U.S. airline stock

A Southwest Airlines Boeing 737 airplane arrives at Los Angeles International Airport from San Francisco on March 28, 2025 in Los Angeles, California.

Kevin Carter | Getty Images News | Getty Images

Southwest Airlines‘ profit fell 42% in the first nine months of the year compared with the same period in 2024. But its stock has been on a tear.

Shares of Southwest are up nearly 24% so far in 2025, more than any other U.S. passenger carrier. Industry profit leaders Delta Air Lines and United Airlines have risen about 17% each this year.

Southwest stock this week hit a 2½ year high. Analysts and investors have high hopes for the carrier next year, when it completes its planned transformation from a one-size-all-fits airline to one that looks more like its larger rivals.

“What’s helping Southwest’s stock is clearly the initiatives, not the [demand] environment, because if it was you’d see it in all the other stocks as well,” said Savanthi Syth, airline analyst at Raymond James.

Southwest Airlines stock compared with the NYSE Arca Airline index

Starting Jan. 27, Southwest is ditching open seating and moving to assigned seats on its all-Boeing 737 fleet. The first rows of seats have extra legroom — for a fee. Seat prices vary, but, for example, a Baltimore to Las Vegas flight in early February showed the seats going for about $80 each way.

Southwest in October forecast that assigned seating and extra legroom seats could drive $1 billion in pretax earnings next year and $1.5 billion in pretax earnings in 2027.

“Because the assigned seating, the extra legroom, kicks in and there’s a lot of value in that, of course, [results are] going to be better year over year,” Southwest CEO Bob Jordan told CNBC on Dec. 10. “The bookings that we’re seeing reflect the business case for assigned seating and extra legroom.”

Barclays upgraded Southwest’s stock earlier this month, with transportation analyst Brandon Oglenski forecasting Southwest’s adjusted earnings will be above $4 per share next year and surpass $6 per share in 2027.

The end of the cattle call boarding lineup comes months after the Dallas carrier got rid of another decades-old policy: two free checked bags for customers. It also started selling its first-ever no-frills basic economy fares.

Southwest, like other airlines, cut its profit forecast for 2025 after demand dipped early this year as President Donald Trump‘s tariffs and cost cutting in Washington weighed on bookings. More recently, the government shutdown that ended last month hurt demand prompting Southwest to again lower its earnings outlook for the year.

Southwest typically provides its yearly outlook alongside the previous year’s earnings in late January.

Business

How the new order of the Murdoch dynasty is playing out

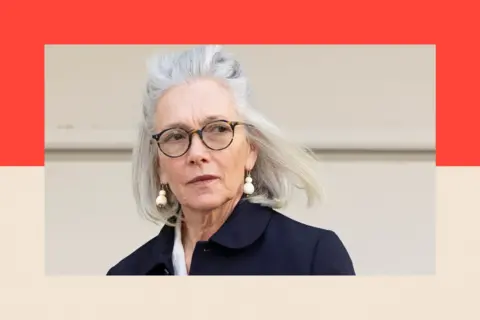

Katie RazzallCulture and Media Editor

BBC

BBCChristmas is a time when families get together if they can – and, until this year, the Murdochs were no different. With members of the media dynasty spread across the globe, full family gatherings were rare, although in 2008, according to biographer Michael Wolff, the Murdochs spent the festive season together on a flotilla of private yachts.

But more often in recent years it was Rupert – for many decades the most influential media titan in the world – and his daughter Elisabeth who would make time for each other.

She would certainly have room this year to host her father at the luxurious home she has renovated on the edge of the Cotswolds. But after a bruising closed-court battle in Nevada that became public and an eventual agreement that shut Elisabeth and two of her siblings out of the family firm for good, relations are likely still too strained for even the Murdoch family peacemaker to suggest communal tree-decorating.

WireImage

WireImageRupert’s eldest child by his second wife, Elisabeth is the co-founder and executive chairman of the production company, Sister, which is behind hit television series, including Black Doves, The Split and This is Going To Hurt. In my experience, she is generous, intelligent and hard-working.

Friends are fiercely loyal and protective of her privacy. Nobody I have spoken to has a bad word to say about her. Many acknowledge, though, that it has been an incredibly testing year on the family front – even if Elisabeth, her younger brother, James, and elder half-sister, Prudence, are each around a billion dollars richer.

Money doesn’t compensate for a father who, in his mid-90s, decided to rip his family apart because he believed it was in the interests of his business. The Murdochs have never been a traditional family – one reason why their story is said to have inspired the power struggles and backstabbing in the acclaimed TV drama, Succession. But this time, the schism feels more permanent. And as one person put it to me, the TV show concluded too early by killing off Logan Roy: there was more drama to come.

‘James and Rupert will never patch up differences’

James Murdoch’s relationship with his father and older brother Lachlan appears irreconcilable. Earlier this year, he described his dad as a “misogynist” in an interview in US magazine The Atlantic, and referred to some of Rupert’s behaviour in the courtroom fight as “twisted”.

He is known to feel betrayed and angered by Rupert’s decision to force him, Elisabeth and Prudence formally to cut ties with Fox Corp and News Corp. Driven by fears over the more liberal direction they might want the companies to take after his death, the media mogul tried to change the terms of a trust that gave his four oldest children equal control when he dies.

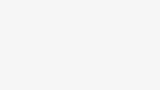

Ron Galella Collection via Getty Images

Ron Galella Collection via Getty ImagesLachlan, who Rupert had already chosen to run the business, is now – definitively – the only one who will take the reins after his father’s demise.

Lachlan and Rupert Murdoch actually lost the first round of their court fight. The trust had been set up in 1999, when Rupert divorced Anna, the mother of Lachlan, Elisabeth and James.

The judge ruled that changing it was in bad faith. But behind the scenes, the warring sides eventually came to an agreement. James, Elisabeth and Prudence agreed to sell their shares. They have accepted terms that include not being allowed to buy any equity in the family company in future.

“It’s a sad ending,” Claire Atkinson, whose biography of Rupert Murdoch will come out next year, told us on The Media Show.

“These kids worked in the business, they grew up in the business, and the press release said, ‘You can’t buy shares in this company,’ and effectively said, ‘Don’t let the door hit you on the way out.'”

She also told me: “This break is extremely permanent. It feels like James and Rupert will never patch up their differences.”

Lachlan Murdoch has been quoted as saying that the resolution is “good news for investors” and “gives us clarity about our strategy going forward”.

Ironically, his successful leadership of Fox Corp, where he’s been CEO since 2019 (he became chairman of Fox and also News Corp in 2023 when his father became chairman emeritus), made the deal more costly.

Getty Images

Getty ImagesFox Corp has seen its share price double under Lachlan and the Trump presidency has brought a ratings bonanza. It raised the amount he had to pay his siblings to get them out – a presumably unwelcome side effect.

Despite the payout, Atkinson says, “There is a fracture in the company and a fracture in the family.”

So where do the Murdochs go from here, privately and corporately?

Court battles, rifts and an ageing patriarch

Elisabeth and her half-sister Prudence are said to be concentrating on moving on.

Their father turned 94 in March, with the court battle in full swing. The sisters are mindful that he won’t be around forever and I am told they are hoping at some point to repair the rift.

Reuters

ReutersHowever much they have felt betrayed by him (and there is no doubt, they have felt it, very painfully), there’s an understanding of the dwindling number of years he has left.

But Christmas may still be too soon for reconciliation. Lachlan hosted his annual party for the Australian elite at his harbour-side Sydney home earlier this month. Fox Corp may operate out of the US, but he is said to prefer the laid-back nature of Australian life, even if the trade-off is business calls in the middle of the night because of the time difference, as well as a lot of flights.

Atkinson says he is popular and well-liked within the business. “The difficulty that Lachlan has is that he’s been in charge for years, but everybody is always going to project that every decision is Rupert’s. He’s never going to want to say, ‘Hey, that’s me,’ and so I think it’s a little hard to come out from Dad’s shadow.”

At the same time, Rodney Benson, professor of media, culture, and communication at New York University, says that while Rupert remains a presence in the company “what’s really unique about Lachlan’s approach, or what will be unique about his approach, won’t fully emerge”.

Lachlan’s ‘business over politics’ strategy

Fox News is the financial cash cow, which may explain Rupert Murdoch’s concerns that his children might have wanted to change its political affiliations.

Under Lachlan, there’s been a successful strategy to expand into digital and streaming, most notably the ad-supported video-on-demand service, Tubi.

In September, US President Donald Trump said Rupert and Lachlan Murdoch were expected to be part of a group of investors trying to buy TikTok in the US. On Thursday, TikTok parent company ByteDance announced to staff that it had signed an agreement to sell a portion of TikTok to a group of mostly US based investors. Lachlan and Rupert were not named as part of the deal.

Reuters

ReutersPresenting the Fox Corporation’s results for July to September, Lachlan said Tubi had achieved rapid revenue growth and growth in view time, confirming its position as the top premium advertising-based video-on-demand platform in the US.

“And I’m happy to say Tubi reached profitability this past quarter,” he added. “It’s a great milestone.”

He also said Fox News had maintained strong ratings throughout the quarter, cementing its status as the most-watched cable network in prime time, and leading to the highest advertising revenue for July-September quarter in Fox’s history.

Rupert Murdoch’s 70-year career saw him as “both an interventionist editor-in-chief figure and a political kingmaker”, according to Paddy Manning, an investigative journalist who wrote The Successor: The High-Stakes Life of Lachlan Murdoch. But he adds, “Lachlan is less of the journalist and powerbroker than his father, and more of a businessman.

Getty Images

Getty Images“If you look at the signature deals that Lachlan has made over his career, they have not been designed to increase his political influence. From digital real estate to sports betting to commercial radio to Tubi, Lachlan’s investment decisions are focused on the bottom line, not burnishing his political credentials.”

But Prof Benson suggests the significant debt the Murdoch businesses have taken on as part of the settlement with Lachlan’s siblings increases pressure to make profit, and therefore to pursue “politically sensationalistic… outrage journalism”.

“The proven way to be profitable in cable/streaming news is not by becoming more centrist and civil, it’s by becoming more extreme, more polarising, and more willing to stir outrage,” he says.

Rupert has had a hotline to major political figures for decades. In September he was on President Trump’s guestlist for the state banquet at Windsor Castle. I’m told he spent nearly two weeks in London and was in the News UK office most days.

While Lachlan now runs the company, his father is still very much involved. Rupert’s been described to me, at 94, as still “the sharpest person in the room” and a “phenomenon who loves papers and has ink in his veins”. His voice may be a little softer, but he is mentally as strong and influential as ever, I’m told.

AFP via Getty Images

AFP via Getty ImagesAt one point the editor of the Times introduced Rupert to a slightly startled young journalist on the newsdesk and asked him to show the boss the paper’s recently launched Live app and what it showed around reader engagement on specific stories.

Rupert also spoke to Fraser Nelson, the former Spectator editor now Times columnist, who usually sits at the open plan table in the office. They discussed the company’s pivot to video and the work Nelson had been trialling around short form video. Rupert also wanted to talk to his paper’s new star about whether Nigel Farage would end up in government.

A family ‘deeply divided’

Three months on from the family trust dispute settlement, Mr Manning claims that the Murdochs are “deeply divided”.

“While Lachlan works closely with his father, I understand he remains estranged from his elder siblings,” he alleges.

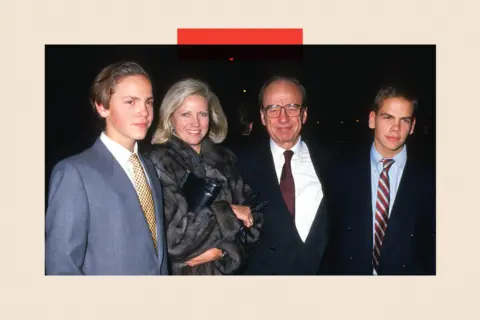

Rupert Murdoch and his children Lachlan, James, Elisabeth and Prudence were all approached for comment.

Presciently, Anna Murdoch – Lachlan, James and Elisabeth’s mother – predicted much of the fallout back in the 1980s.

In her novel Family Business, Anna, a journalist and author, wrote about the rise of a fictional newspaper dynasty and explored sibling rivalry, jealousy and how parental power can negatively impact family relationships. The plot of the book, published while her children were in their teens, follows how a newspaper owner’s children are shaped by a parent who turns them into competitors in a power struggle.

Getty Images

Getty ImagesA decade after it was published – by which time the pair had divorced and Rupert had married third wife Wendi Deng – Anna gave an interview to an Australian women’s magazine, during which she was asked which of her children would be best suited to take over from her ex-husband.

“Actually I’d like none of them to,” she said. “I think they’re all so good that they could do whatever they wanted really. But I think there’s going to be a lot of heartbreak and hardship with this [succession]. There’s been such a lot of pressure that they needn’t have had at their age.”

The family trust, agreed between Rupert and Anna as part of their divorce settlement, was her way of safeguarding her children’s futures, by ensuring they had equality after Rupert’s death. But that blew up – through a court fight in Nevada and a settlement.

And with that, relations with three of his six children may have blown up too – perhaps for good.

Top picture credits: Getty Images and Reuters

BBC InDepth is the home on the website and app for the best analysis, with fresh perspectives that challenge assumptions and deep reporting on the biggest issues of the day. You can now sign up for notifications that will alert you whenever an InDepth story is published – click here to find out how.

Business

Deal approvals: CCI clears Blackstone’s Federal Bank entry; Tata Steel gets nod for BlueScope buyout – The Times of India

The Competition Commission of India on Tuesday approved US-based private equity firm Blackstone’s proposal to acquire up to 9.99 per cent stake in Federal Bank through warrants, clearing the way for the global investor’s entry into the private sector lender.In a release, the fair trade regulator said the proposed transaction involves Asia II Topco XIII Pte Ltd, an arm of Blackstone, acquiring warrants that carry the right to subscribe to equity shares of Federal Bank, PTI reported.“The proposed combination envisages acquisition of certain warrants by Asia II Topco XIII Pte Ltd (acquirer), each carrying a right to subscribe to one fully paid-up equity share of Federal Bank Ltd (target),” the regulator said.Upon full exercise of the warrants, the acquirer will hold 9.99 per cent of the paid-up share capital of Federal Bank on a fully diluted basis, according to the CCI. Blackstone will also have the right to nominate a director on the bank’s board as long as it holds at least a 5 per cent stake.Federal Bank is a private sector commercial lender offering a range of banking products and services, including deposits, loans and payment solutions.In a separate approval, the CCI also cleared Tata Steel Ltd’s proposal to acquire sole control of Tata BlueScope Steel by purchasing the remaining 50 per cent equity stake held by BlueScope Steel Asia Holdings Pty Ltd.“Commission approves Tata Steel Limited’s proposed acquisition of sole control in Tata BlueScope Steel Pvt. Ltd. by purchasing the remaining 50 per cent equity shareholding currently held by BlueScope Steel Asia Holdings Pty Ltd,” the watchdog said in a post on X.Tata BlueScope Steel is currently a 50:50 joint venture between BlueScope Steel Ltd of Australia and Tata Steel Downstream Products Ltd. Tata Steel is engaged in iron ore mining and steel production, while Tata Steel Downstream Products operates in the coated steel segment, offering surface-coated steel products and related solutions.Transactions crossing specified thresholds require clearance from the competition regulator, which is mandated to prevent unfair business practices and ensure fair competition in the market.

Business

FTSE 100 moves ahead amid surprise US growth jump

The FTSE 100 was in festive mood on Tuesday, closing higher after a report showed improved UK business confidence and the US economy grew more than forecast in the third quarter.

The FTSE 100 index closed up 23.25 points, 0.2%, at 9,889.22. The FTSE 250 ended up just 6.83 points at 22,349.55, while the AIM All-Share closed down 1.67 points, 0.2%, at 758.81.

UK business confidence increased to 47% in December, rising five points from last month and standing 10 points higher than the start of 2025, according to the latest Lloyds Business Barometer.

In addition, optimism towards the wider economy reached a four-month high, up 11 points to 42%. The renewed economic optimism offset a slight dip in firms’ expectations for their own trading prospects, which decreased by one point to 52%.

“It is great to see business confidence ending the year on a higher note,” said Hann-Ju Ho, senior economist at Lloyds Commercial Banking.

Construction saw the sharpest improvement, up 22 points to 61%, its highest level seen this year.

Manufacturing also was up five points to 49%, while retail firms edged higher to 47%, likely reflecting seasonal demand.

In European equities, the CAC 40 in Paris closed down 0.2%, while the DAX 40 ended up 0.2%.

In Copenhagen, Novo Nordisk jumped 9.2% after the US Food and Drug Administration approved its once‑daily Wegovy pill, the first oral glucagon‑like peptide‑1 therapy cleared for weight management.

“As the first oral GLP-1 treatment for people living with overweight or obesity, the Wegovy pill provides patients with a new, convenient treatment option that can help patients start or continue their weight loss journey,” said Novo chief executive Mike Doustdar in a statement late on Monday.

The company expects to launch the Wegovy pill in the US in early January 2026.

Stocks in New York were higher at the time of the London equity market close. The Dow Jones Industrial Average was up 0.2%, while the S&P 500 and the Nasdaq Composite were both 0.3% higher.

The yield on the US 10-year Treasury was quoted at 4.18%, widened from 4.17%. The yield on the US 30-year Treasury was quoted at 4.84%, stretched from 4.83%.

Figures showed US economic growth accelerated in the third quarter of the year, markedly outperforming expectations.

According to Bureau of Economic Analysis data, US gross domestic product expanded 4.3% on an annualised basis quarter-on-quarter in the three months to September 30, easily beating the 3.3% growth predicted by consensus cited by FXStreet, and accelerating from a 3.8% expansion in the second quarter.

ING said the figure was “eye-popping”, primarily due to a strong performance from net trade with exports rising 8.8% and imports falling 4.7%, while consumer spending grew a robust 3.5% versus the 2.7% rate expected.

But while it was a “fantastic outcome”, ING noted fourth-quarter GDP is likely to record growth that is considerably slower, thanks in part to the effects of the month-long government shutdown.

“We also can’t see the net trade component continuing to make such a strong contribution while consumer spending is also set to slow,” ING added.

Other US data was mixed, with industrial production beating expectations, but consumer confidence and durable goods orders falling short of hopes.

The pound was quoted at 1.3481 US dollars at the time of the London equities close on Tuesday, up from 1.3452 on Monday.

The euro stood at 1.1777 dollars, higher against 1.1759 dollars. Against the yen, the dollar was trading lower at 156.37 yen compared to 156.95.

Back in London, Metlen Energy & Metals was the best FTSE 100 performer, rising 6.8%.

It said it has completed the sale of a portfolio of solar farms and co-located battery energy storage systems in Chile to a subsidiary of Glenfarne Group at enhanced terms.

Metlen is an Athens-based aluminium producer and electricity generator. Glenfarne is a New York and Houston-based developer, owner, operator, and industrial manager of energy and infrastructure assets.

In April, Metlen had said Glenfarne unit GAC RS Chile II Spa would pay 815 million dollars (£606 million) for the assets.

On Tuesday, Metlen said the final price to be paid is 865 million dollars (£643 million), reflecting the “value creation opportunities emerging in the Chilean market”.

Videndum plunged 56% as the provider of broadcasting hardware and software said a planned refinancing will, if successful, see current shareholdings “very significantly diluted”, while completion is also not guaranteed.

The firm said the main components of a refinancing proposal have now been agreed in principle with the revolving credit facility lenders and its two largest shareholders.

But the firm warned any share issue would be “very significantly below” their current nominal value of 20p per share.

Gut Gulf Marine Services fared better, climbing 11% after reporting a new contract award that covers two of its large-class vessels in Europe.

Neither the name of the client nor the financial terms of the contract were disclosed, but Gulf Marine Services said the award increases its contracted backlog to 540 million dollars.

Brent oil was quoted at 62.09 dollars a barrel at the time of the London equities close on Tuesday, up from 61.87 dollars late on Monday.

Gold traded at 4,462.05 dollars an ounce, up from 4,440.54 on Monday.

The biggest risers on the FTSE 100 were Metlen Energy & Metals, up 2.80 euro cents at 44.00 euro, Anglo American, up 88.00 pence at 2,993.00p, Antofagasta, up 67.00p at 3,235.00p, BT, up 2.80p at 185.05p and Airtel Africa, up 4.80p at 337.80p.

The biggest fallers on the FTSE 100 were Diageo, down 29.00p at 1,588.00p, Ashtead Group, down 78.00p at 5,192.00p, Convatec, down 3.20p at 238.60p, Burberry, down 16.00p at 1,261.50p and easyJet, down 6.29p at 506.80p.

Wednesday’s economic calendar includes US weekly jobless claims data.

There are no significant events scheduled in Wednesday’s UK corporate calendar.

– Contributed by Alliance News

-

Business1 week ago

Business1 week agoStudying Abroad Is Costly, But Not Impossible: Experts On Smarter Financial Planning

-

Fashion6 days ago

Fashion6 days agoIndonesia’s thrift surge fuels waste and textile industry woes

-

Business1 week ago

Business1 week agoKSE-100 index gains 876 points amid cut in policy rate | The Express Tribune

-

Sports1 week ago

Sports1 week agoJets defensive lineman rips NFL officials after ejection vs Jaguars

-

Tech6 days ago

Tech6 days agoT-Mobile Business Internet and Phone Deals

-

Business6 days ago

Business6 days agoBP names new boss as current CEO leaves after less than two years

-

Entertainment1 week ago

Entertainment1 week agoPrince Harry, Meghan Markle’s 2025 Christmas card: A shift in strategy

-

Sports6 days ago

Sports6 days agoPKF summons meeting after Pakistani player represents India in kabaddi tournament