Business

GST revamp: What are the latest tax rates on cars, gold, mobile phones, EVs, cigarettes? Check details – The Times of India

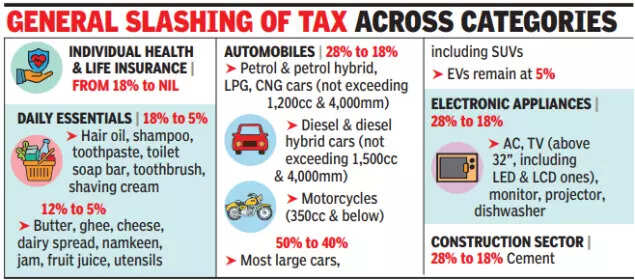

The Goods and Services Tax (GST) Council, chaired by Union finance minister Nirmala Sitharaman, on Wednesday announced the most extensive revamp of the indirect tax system since its rollout in 2017.The reform introduces a simplified two-slab structure of 5% and 18%, alongside a new 40% slab for luxury and sin goods.The new rates, except for tobacco where cess continues, take effect from September 22, the first day of Navratri.

Revenue secretary Arvind Shrivastava estimated the net fiscal implication of the changes at Rs 48,000 crore. He added the measures are designed to spur consumption and improve compliance.

Sitharaman underlined that the reforms were aimed at the common man, stating, “Every tax levied on common man’s daily use items have undergone a rigorous look, and in most cases, the rates have come down drastically”.

Cars

Buyers of small cars stand to benefit the most. Small cars will now attract 18% GST, reduced from the earlier 29% (28% plus 1% cess).For GST purposes, small cars are defined as petrol, LPG or CNG vehicles with an engine capacity of up to 1200 cc and length up to 4000 mm. In the case of diesel cars, the definition covers vehicles with engine capacity up to 1500 cc and length not exceeding 4000 mm.Large vehicles exceeding 1500 cc or longer than 4000 mm will fall into the new 40% GST slab.The same rate will also apply to all utility vehicles, including SUVs, MUVs, MPVs and cross-over vehicles, provided they have an engine capacity above 1500 cc, a length over 4000 mm, and a ground clearance of 170 mm or more.Unlike the earlier regime that combined 28% GST with a 17–22% cess, the new framework consolidates this into a single 40% rate without cess.

Bikes

Two-wheelers have also seen a rationalisation. Motorcycles up to 350 cc engine capacity will attract 18% GST, reduced from 28%. The 18% rate also applies to 350 cc models.Motorcycles exceeding 350 cc engine capacity have been placed in the 40% bracket, aligning them with the treatment of luxury and high-powered vehicles.This change is expected to encourage mass-market two-wheeler sales, especially in rural and urban middle-class markets, while continuing to tax premium motorcycles at a higher rate.

Electric Vehicles

Electric cars remain unchanged, continuing to be taxed at 5%.

Health Insurance

A major relief comes for individuals purchasing life and health insurance. These policies will now be exempt from GST. Earlier, these services attracted 18%, adding to premium costs.Exemption is expected to make policies more affordable, widening insurance coverage in a country where penetration levels remain low.

Cigarettes and tobacco

The GST Council has shifted cigarettes, cigars, pan masala, and chewing tobacco into the 40% slab. However, until compensation cess loans are fully repaid, the existing 28% GST plus cess regime will continue.Analysts noted that revenue neutrality is a priority for the government, as cigarette taxation contributes significantly to exchequer inflows. The move balances public health concerns with the need to curb illicit trade.

Alcohol

Alcohol remains outside the purview of GST altogether. It continues to be taxed separately through state excise duties, meaning the GST overhaul has no bearing on alcohol pricing.States will retain autonomy in setting alcohol taxes, a key revenue source for their budgets.

Gold

There has been no change in the taxation of precious metals. Gold and silver jewellery remain taxed at 3%, with an additional 5% GST on making charges. Gold bars and coins also continue to face 3% GST.With no direct impact from GST 2.0, demand in the bullion market is expected to remain steady, especially during the festive season when purchases peak.

Mobile Phones

Despite repeated industry requests, mobile phones remain taxed at 18%. ET reported that the India Cellular and Electronics Association (ICEA) had sought a 5% slab, calling the current levy “regressive” and reminding that pre-GST state VAT on mobiles was mostly capped at 5%.Despite the wider rate cuts across consumer goods, mobile phones remain at 18% GST, unchanged under the new regime. As per ET, the India Cellular and Electronics Association (ICEA) had urged for a 5% slab, calling the current levy “regressive.”The industry argued that mobile phones are a basic digital necessity, not a luxury.ICEA highlighted that pre-GST, most states had capped VAT at 5%. With domestic production rising to Rs 5.45 lakh crore in FY25 and exports crossing Rs 2 lakh crore, industry bodies stressed that lower GST would have boosted affordability and domestic demand.

Business

Forget Budget Homes! Luxury Housing Sales Reach 4-Year High As Indians Opt For High-End Flats

Last Updated:

Luxury homes made up 27% of Indian residential sales in 2025, with high demand in Mumbai, Delhi-NCR, Bengaluru, and Hyderabad

The report noted that around 62,500 homes were sold during the October–December 2025 quarter

The residential real estate market is undergoing a decisive shift, with luxury housing emerging as the dominant growth driver and redefining buyer preferences across the country. Once led by demand for compact and affordable homes, the market has now firmly entered what industry observers describe as a “luxury era”, where larger homes, premium locations and lifestyle-driven amenities have become central to purchasing decisions.

The year 2025 has proved to be a watershed moment for this transformation. According to the India Market Monitor Q4 2025 report, luxury homes accounted for nearly 27% of total residential sales during the year, bringing the segment within striking distance of one-third of all housing transactions. For the first time, sales of premium and luxury homes outpaced those in the mid-income and affordable categories.

The scale of the shift is striking. In 2022, premium and luxury homes made up just about 12% of total residential sales. In a span of four years, that share has more than doubled, signalling a rapid change in the aspirations and spending power of Indian homebuyers.

Industry experts attribute this surge to a combination of economic and demographic factors. Sustained salary growth in the corporate sector, the expansion of the startup ecosystem, rising entrepreneurial incomes and strong participation from non-resident Indian (NRI) investors have significantly boosted purchasing capacity at the top end of the market.

“Today’s crore-plus homebuyers are looking well beyond basic shelter,” said Yash Miglani, Managing Director of Migson Group, “They want larger homes in prime locations, global-standard amenities and a sense of exclusivity. Features such as clubhouses, swimming pools, landscaped green spaces, smart home technology and sustainable design are no longer add-ons, they are expectations.”

Developers, too, are recalibrating their strategies in response. Many are increasingly prioritising high-end and super luxury projects, particularly in markets where demand has shown resilience even during periods of economic uncertainty.

The definition of luxury, however, continues to vary across cities. In Mumbai and the Delhi-NCR region, homes priced between Rs 1.5 crore-Rs 3 crore are typically classified as premium. In Bengaluru and Hyderabad, the range is narrower, between Rs 1.5 crore-Rs 2.5 crore. At the same time, cities such as Pune, Chennai and Kolkata are witnessing rising demand for homes priced above Rs 1.25 crore, underscoring that luxury housing is no longer confined to a handful of metros.

Harvinder, Chairman of Sikka Group, said strong demand in NCR, Mumbai and Bengaluru reflects the underlying strength of the housing market. “Infrastructure upgrades, improved connectivity and sustained corporate expansion have pushed high-end residential projects to a new level,” he said, adding that the premium and luxury segment is likely to maintain steady growth over the next five to seven years.

The momentum is even more pronounced at the very top of the market. The super luxury segment recorded a sharp rise in 2025, with demand increasing by nearly 70% over the year. Growth during the October–December quarter alone exceeded 60 per cent, pointing to heightened interest from ultra-high-net-worth individuals, who increasingly view real estate as a stable and secure asset class.

“Buyer attitudes have changed fundamentally,” said Amit Modi, Director of County Group, “There is a clear preference for larger, better-planned homes with superior amenities, especially in metro and tier-1 cities. Real estate is no longer seen merely as a necessity, it has become a status symbol and a long-term investment.”

The report noted that around 62,500 homes were sold during the October–December 2025 quarter, while approximately 60,000 new units were launched in the same period. Mumbai, Pune, Delhi-NCR and Hyderabad accounted for the bulk of the transactions, indicating a healthy equilibrium between demand and supply.

For developers, the shift marks a critical inflection point. Success today depends on far more than pricing, said Kushagra Ansal, Director of Ansal Housing, adding, “Design excellence, location, sustainability and reliability of delivery are now decisive factors. The growing appetite for luxury and super luxury homes shows that the market has matured and become quality-driven.”

January 21, 2026, 18:44 IST

Read More

Business

Next buys shoe brand Russell & Bromley but 400 jobs still at risk

High street fashion giant Next has bought shoe retailer Russell & Bromley which had collapsed in to administration.

Next paid £2.5m in a rescue deal for the upmarket British footwear and accessories seller — but the future for most of the chain’s current staff and shops remains uncertain

Next will own the brand and three of Russell & Bromley’s 36 stores, as well as some existing stock for which it is paying an additional £1.3m.

Administrators Interpath said it was considering the future of the remaining stores, which for the moment remain open, as well as nine concession stores which all employ around 400 people.

Russell & Bromley’s chief executive Andrew Bromley said it was a “difficult decision” but the sale of the brand was the best way to secure its future.

The company is around 150 years old but has become the latest to struggle in a tough retail environment.

It joins other brands in a familiar path to largely disappearing off the high street via a process of administration, which means companies are often broken up and the highest value assets sold off to the highest bidder.

The Original Factory Shop and accessories retailer Claire’s are both currently going through a process of administration, with site closures and jobs at risk. Around 1,000 people lost their jobs after Bodycare collapsed in September, while River Island will close some stores to avoid a total collapse. The woes all come after a tranche of high profile closures such as Debenhams and Wilko.

In a statement, Next said it secured “the future of a much loved British footwear brand.”

“Next intends to build on this legacy and provide the operational stability and expertise to support Russell & Bromley’s next chapter, allowing it to return to its core mission: the design and curation of world-class, premium footwear and accessories for many years to come.”

The three stores Next will acquire are in high-end shopping destinations in or around London: Chelsea, Mayfair and Kent.

Next has seen relatively solid performance in the current turbulent retail landscape – unlike Russell & Bromley which has been loss-making in recent years.

Its saviour has experience in failing circumstances: last year, Next bought out of administration fashion maternity label Seraphine, and began rolling out its FatFace concessions a few years after snapping it up.

Business

Over 80% of below 40 entrepreneurs self-made – The Times of India

MUMBAI: Nearly four out of five of India’s leading young entrepreneurs are self-made, underscoring a shift in the country’s business landscape from inheritance to merit, according to the Avendus Wealth – Hurun India Uth Series 2025. The report shows that about 80% of business leaders under 40 featured in the ranking are first-generation founders.The study tracks entrepreneurs aged up to 40 whose companies meet minimum valuation thresholds ranging from $25 million to $200 million, based on age cohort and whether the founder is first- or next-generation. Of the 436 entrepreneurs shortlisted, 349 are self-made, pointing to a growing ecosystem driven by new ideas and technology rather than legacy ownership.Among first-generation founders, Ritesh Agarwal, founder of OYO, leads the list. At 31, Agarwal has built one of the most capitalised startups in the country, raising $3.7 billion. He is followed by Aadit Palicha and Kaivalya Vohra, both 22, whose quick-commerce firm Zepto has raised $1.95 billion.Other prominent first-generation entrepreneurs include Nikhil Kamath of Zerodha, now among India’s most-followed entrepreneurs on LinkedIn; Alakh Pandey of Physics Wallah, who disrupted the ed-tech space; and Ghazal Alagh, the most-followed woman entrepreneur on the list.Next-generation leaders account for about 20% of the ranking and continue to shape large family-run businesses. Key names include Isha Ambani of Reliance Retail, which employs more than 2.47 lakh people; Abhyuday Jindal, who is driving sustainability initiatives at Jindal Stainless; and Vidhi Shanghvi, who recently led Sun Pharmaceutical’s $355 million acquisition of US-based Checkpoint Therapeutics.The report categorises entrepreneurs across three age groups—under 30, under 35 and under 40. Together, the companies led by these 436 entrepreneurs are valued at more than $950 billion, higher than Switzerland’s GDP. Bengaluru tops the list with 109 entrants, followed by Mumbai with 87 and New Delhi with 45. Software products and services dominate with 77 entrepreneurs, ahead of financial services and healthcare, highlighting the tilt toward digital and technology-led businesses.

-

Tech1 week ago

Tech1 week agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Entertainment1 week ago

Entertainment1 week agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Sports6 days ago

Sports6 days agoPak-Australia T20 series tickets sale to begin tomorrow – SUCH TV

-

Politics4 days ago

Politics4 days agoSaudi King Salman leaves hospital after medical tests

-

Business5 days ago

Business5 days agoTrump’s proposed ban on buying single-family homes introduces uncertainty for family offices

-

Tech7 days ago

Tech7 days agoTwo Thinking Machines Lab Cofounders Are Leaving to Rejoin OpenAI

-

Tech6 days ago

Tech6 days agoMeta’s Layoffs Leave Supernatural Fitness Users in Mourning

-

Fashion4 days ago

Fashion4 days agoBangladesh, Nepal agree to fast-track proposed PTA