Business

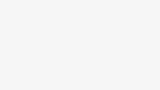

Government borrowing hits highest August level for five years

Charlotte EdwardsBusiness reporter

Getty Images

Getty ImagesUK government borrowing in August hit the highest level for the month in five years, latest figures show, adding to the pressure on the chancellor ahead of the Budget.

Borrowing – the difference between public spending and tax income – was £18bn in August, the Office for National Statistics (ONS) said, which was higher than analysts had expected.

Despite tax and National Insurance receipts increasing, they were outstripped by higher spending on public services, benefits and debt interest, the UK statistics body said.

One analyst said Rachel Reeves faced “tough choices” in the Budget to meet her tax and spending rules, with speculation building that taxes will rise.

The latest borrowing figure for August is the highest for the month since the height of the Covid pandemic, when government spending was ramped up to support the economy.

Borrowing over the first five months of the financial year has now reached £83.8bn, which is £16.2bn higher than the same period last year.

It is also above the prediction of £72.4bn that the government’s official forecaster, the Office for Budget Responsibility, had made in March.

Paul Dales, chief UK economist at Capital Economics, said the latest figures, “highlight the deteriorating nature of the public finances even though the economy hasn’t been terribly weak”.

He added that this would contribute to the chancellor having to find money in November’s Budget, “mostly through higher taxes”.

Nabil Taleb, an economist at PwC UK, said Reeves now faced “tough choices, and the test will be whether she can make them palatable to voters and markets”.

The expectation is Reeves will need to raise extra money or cut spending to meet her self-imposed rules for government finances.

Reeves has two main rules, which she has said are “non-negotiable”:

- Not to borrow to fund day-to-day public spending by the end of this parliament

- To get government debt falling as a share of national income by the end of this parliament in 2029/30.

There has been a wide range of forecasts for how much money Reeves might raise in the Budget to meet her rules.

One factor that will influence this is the latest growth forecast from the Office for Budget Responsibility (OBR). Small changes to the forecaster’s outlook can make a big difference to its projections for tax income over the years ahead.

The cost to the government through its U-turns on benefit cuts – which had aimed to save billions of pounds – will also be a factor, as will the interest rates on government borrowing.

Mr Dales at Capital Economics said the chancellor would have “to raise £28bn, mostly through higher taxes, if she wants to keep her buffer against her rule of £10bn”.

Elliott Jordan-Doak, senior UK economist at Pantheon Macroeconomics, said the latest figures suggested “the chancellor will need to raise taxes by more than the £20bn we had previously estimated”.

“We still expect the chancellor to fill the fiscal hole with a smorgasbord of stealth and sin tax increases, along with some smaller spending cuts.”

On the financial markets, the value of the pound fell 0.5% against the dollar to $1.349, while government bond yields – which indicate government borrowing costs – rose on Friday.

The latest ONS figures showed interest payments on government debt rose by £1.9bn to £8.4bn, partly due to inflation pushing up costs.

Welfare spending increased by £1.1bn to £27.3bn, largely driven by inflation-linked benefit rises and higher state pension payments.

James Murray, Chief Secretary to the Treasury, said the government had “a plan to bring down borrowing because taxpayer money should be spent on the country’s priorities, not on debt interest”.

“Our focus is on economic stability, fiscal responsibility, ripping up needless red tape, tearing out waste from our public services, driving forward reforms, and putting more money in working people’s pockets,” he added.

But shadow chancellor Sir Mel Stride, wrote on X: “Keir Starmer and Rachel Reeves are too weak and distracted to take the action needed to reduce the deficit.

“The chancellor has lost control of the public finances, and Labour’s weakness means much needed welfare reforms have been abandoned.”

Warm weather boosts stores

Separate data from the ONS showed that good weather brought a boost to the High Street in August.

Retail sales rose by 0.5% during the month, slightly higher than analysts had expected, with butchers, bakers, clothing stores and online shopping all reporting growth.

The figures come despite warnings from some retailers in recent days of cost pressures and price rises.

However, the monthly shop sales data from the ONS can be volatile.

Over the three months to August sales declined by 0.1%, the ONS said, compared with the three months to May.

“Overall, August caps off a better-than-expected summer, particularly for non-food retailers, with sales of seasonal lines boosted by the hottest summer temperatures on record,” said Jacqueline Windsor, head of retail at PwC.

“However, overall sales volumes remain below pre-pandemic levels, so the high street is far from being out of the woods.”

Alice Cowley, managing director in Accenture’s retail practice, said retailers were “facing fresh headwinds as we head into the autumn”.

She said factors such as uncertainty over possible Budget measures, and ongoing energy and labour cost pressures, would continue to put profit margins “under greater strain”.

Business

Petrol and diesel prices likely to rise – SUCH TV

Oil and Gas Regulatory Authority (OGRA) forwarded a summary to the federal government suggesting an increase of Rs4.39 per liter in petrol price for the next fortnight.

After approval from the federal government, one liter of petrol will be sold at Rs257.56 instead of Rs253.17 per liter.

The price of high-speed diesel (HSD) will be increased by Rs5.40 per liter.

After approval, the price of one liter of high-speed diesel will increase by Rs268.38 to Rs273.78.

The proposal to increase the price of kerosene by Rs4 per liter is also on the cards.

The OGRA also recommended increasing the price of one liter of light diesel by Rs6.55.

The new prices of petroleum products will be effective from February 16, 2026.

Due to tension between the USA and Iran, petroleum prices are likely to increase further.

Business

RBI Proposes 4 Major Changes In Kisan Credit Card Scheme: What Beneficiaries Must Know

Last Updated:

RBI releases draft to revise Kisan Credit Card Scheme, standardizing crop cycles, extending loan tenure to six years, and aligning credit limits with cultivation costs.

From Crop Cycles To Loan Tenure: 4 Key Changes In RBI’s KCC Proposal

Kisan Credit Card Scheme: The Reserve Bank of India (RBI) has released draft directions to revise the Kisan Credit Card (KCC) Scheme, aiming to expand coverage, streamline operations, and align credit norms with evolving agricultural needs.

Standardized Crop Cycles And Extended Loan Tenure

As outlined in the draft, crop seasons have been standardized to introduce uniformity in loan sanctioning and repayment schedules. Short-duration crops will now be treated under a 12-month cycle, while long-duration crops will follow an 18-month cycle.

Example:

A farmer growing paddy or wheat (harvested in a few months) will follow a 12-month loan cycle.

A farmer growing sugarcane (which takes 12–18 months) will get an 18-month cycle.

To better align loan tenure with these crop cycles, especially for longer-duration crops, the overall tenure of the KCC facility has been extended to six years. The move is expected to provide farmers with greater flexibility in repayment and reduce rollover pressures.

Example:

If a farmer growing sugarcane faces a bad monsoon in Year 2, he doesn’t have to rush repayment immediately. The 6-year window gives more breathing space and reduces pressure to take fresh loans to repay old ones.

The draft directions apply to Commercial Banks, Small Finance Banks, Regional Rural Banks, and Rural Co-operative Banks, indicating a system-wide implementation once finalized.

Drawing Limits Linked To Cost Of Cultivation

The RBI has proposed aligning drawing limits under the KCC scheme with the scale of finance for each crop season . This adjustment aims to ensure that farmers receive credit in line with the actual cost of cultivation, addressing concerns around under-financing.

Example:

If growing cotton in a district costs Rs 60,000 per acre (as per agriculture department data), banks will align KCC limits accordingly — instead of giving a lower, outdated amount like Rs 40,000.

In addition, the draft expands eligible components under the KCC framework. Expenses related to technological interventions—such as soil testing, real-time weather forecasts, and certification for organic or good agricultural practices—have been included within the existing 20% additional component earmarked for repairs and maintenance of farm assets .

Example:

If a farmer wants to:

- Test soil before sowing

- Subscribe to real-time weather alerts

- Get organic farming certification

These costs can now be covered under KCC instead of paying from pocket.

What Is Kisan Credit Card Scheme?

The Kisan Credit Card scheme aims at providing adequate and timely credit support from the banking system under a single window with flexible and simplified procedures to the farmers for their cultivation and other needs.

The KCC scheme was introduced in 1998 for the issue of Kisan Credit Cards to farmers on the basis of their holdings for uniform adoption by the banks so that farmers may use them to readily purchase agriculture inputs such as seeds, fertilizers, pesticides etc. and draw cash for their production needs.

KCC covers post-harvest expenses, produce marketing loan, consumption requirements of farmer households, working capital for maintenance of farm assets and activities allied to agriculture, investment credit requirement for agriculture and allied activities.

February 14, 2026, 12:49 IST

Read More

Business

Four ports under construction in Andhra Pradesh, Centre tells Lok Sabha – The Times of India

The Centre is pushing port-led infrastructure expansion in Andhra Pradesh, with four ports currently under construction, even as it steps up nationwide port modernisation and efficiency measures.As per information shared on Friday in Parliament, the ports under construction in Andhra Pradesh are Mulapeta Port (formerly Bhavanapadu Port) in Srikakulam district, Machilipatnam Port in Krishna district, Ramayapatnam Port in SPSR Nellore district, and Kakinada SEZ Port in Kakinada district.The government said it is undertaking measures such as mechanisation of berths and terminals, digitalisation and logistics integration, new berth construction, capital dredging for larger vessels, and connectivity upgrades across road, rail and waterways.It has also rolled out initiatives including elimination of manual forms, direct port delivery and entry, container scanners, e-delivery of documents and payments, RFID-based gate automation and Maritime Single Window platform SagarSetu 2.0 to cut vessel turnaround time.Two new ports — Vadhavan Port in Maharashtra and Galathea Bay Port in Andaman and Nicobar Islands — have been notified as major ports. At present, 12 major ports operate under the central government, while 68 other-than-major ports are under state governments.Under the Sagarmala scheme, financial assistance is provided across five pillars including port modernisation, connectivity, port-led industrialisation, coastal community development and inland water transport.The government has also launched HaritSagar green port guidelines, the Green Tug Transition Programme (GTTP), and the Cruise Bharat Mission to promote sustainability and cruise tourism.The information was given by Union Minister of Ports, Shipping and Waterways Sarbananda Sonowal in a written reply to the Lok Sabha.At present, 12 major ports operate under the administrative control of the central government, while 68 operational other-than-major ports are under state governments.The government said it has launched multiple national programmes for port development, expansion and upgradation. Under the Sagarmala scheme, financial assistance is provided under five pillars — port modernisation, port connectivity, port-led industrialisation, coastal community development, and coastal shipping and inland water transport.Green and sustainability-linked initiatives have also been introduced. The government has launched HaritSagar green port guidelines to promote environment-friendly port ecosystems and initiated the Green Tug Transition Programme (GTTP) to shift harbour tugs towards greener fuel alternatives.Further, the Cruise Bharat Mission has been launched to prioritise cruise tourism development across the country.

-

Entertainment1 week ago

Entertainment1 week agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Tech1 week ago

Tech1 week agoNew York Is the Latest State to Consider a Data Center Pause

-

Business4 days ago

Business4 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Tech1 week ago

Tech1 week agoNordProtect Makes ID Theft Protection a Little Easier—if You Trust That It Works

-

Tech1 week ago

Tech1 week agoPrivate LTE/5G networks reached 6,500 deployments in 2025 | Computer Weekly

-

Fashion4 days ago

Fashion4 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Business1 week ago

Business1 week agoStock market today: Here are the top gainers and losers on NSE, BSE on February 6 – check list – The Times of India

-

Business1 week ago

Business1 week agoMandelson’s lobbying firm cuts all ties with disgraced peer amid Epstein fallout