Business

The electric question | The Express Tribune

PUBLISHED

September 21, 2025

KARACHI:

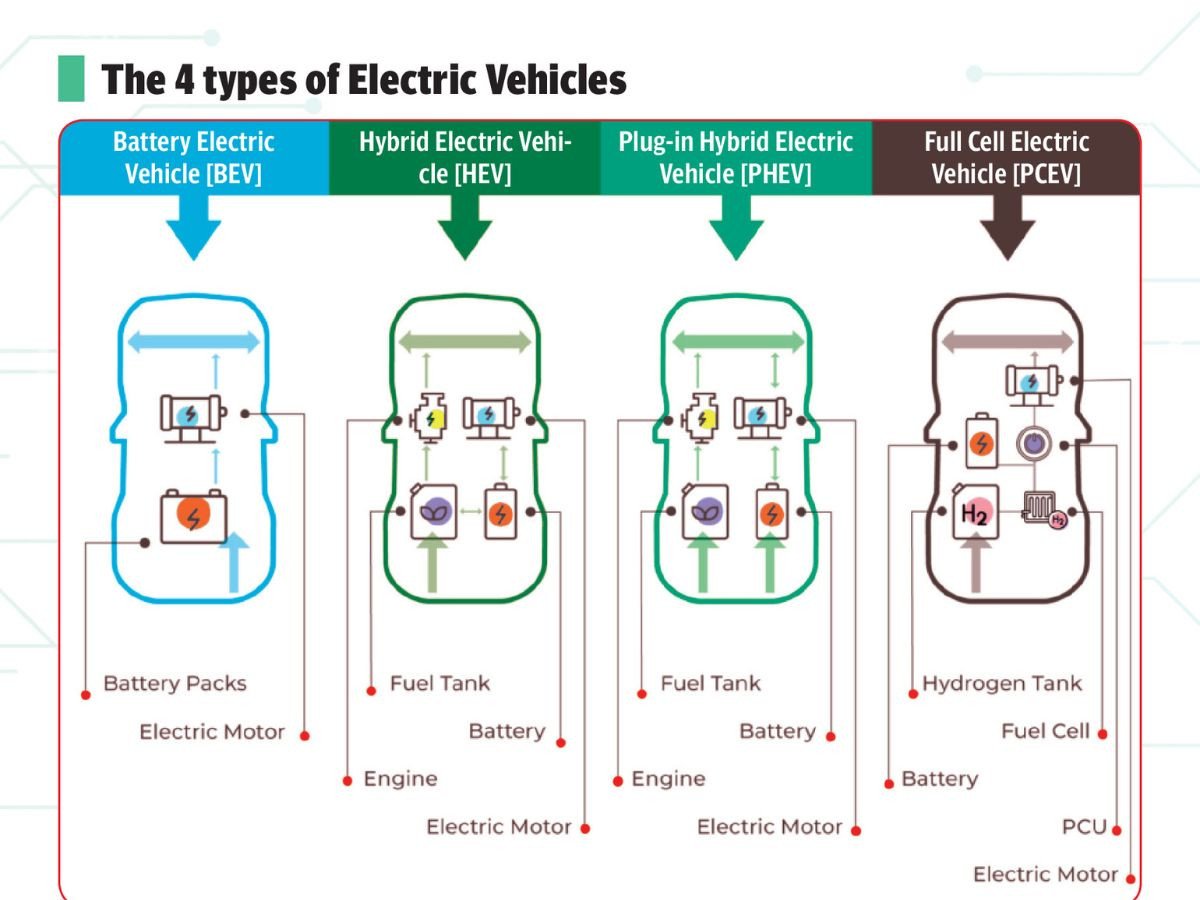

The afternoon sun beats down on Karachi’s Shahrah-e-Faisal as traffic locks into yet another jam. In an old sedan, a driver taps the steering wheel, eyes fixed on the blinking fuel gauge. At more than Rs. 270 a litre, every refill feels heavier than the last. A few lanes over, a plug-in hybrid electric vehicle (PHEV) glides forward almost noiselessly, its driver unbothered by the stop-and-go grind, knowing most of the ride will cost only a fraction in electricity.

This quiet contrast says a lot about where Pakistan finds itself. In cities like Karachi and Lahore, congestion is a way of life and the rising price of petrol has become a private calculation in every household. The fumes from endless traffic only add to skies already thick with smog. It is here that New Energy Vehicles (NEVs), a category that includes both plug-in hybrids (PHEVs) and fully electric cars (EVs), are being looked at as more than just cars. They promise relief for wallets as well as for the air people breathe.

Elsewhere, this shift has been years in the making. In the beginning, electric cars were more of a novelty. They were costly, clunky, and could not go very far on a single charge. It was only after battery technology improved that the shift began. By the mid-2000s, companies like Tesla in the US and BYD in China started to change perceptions.

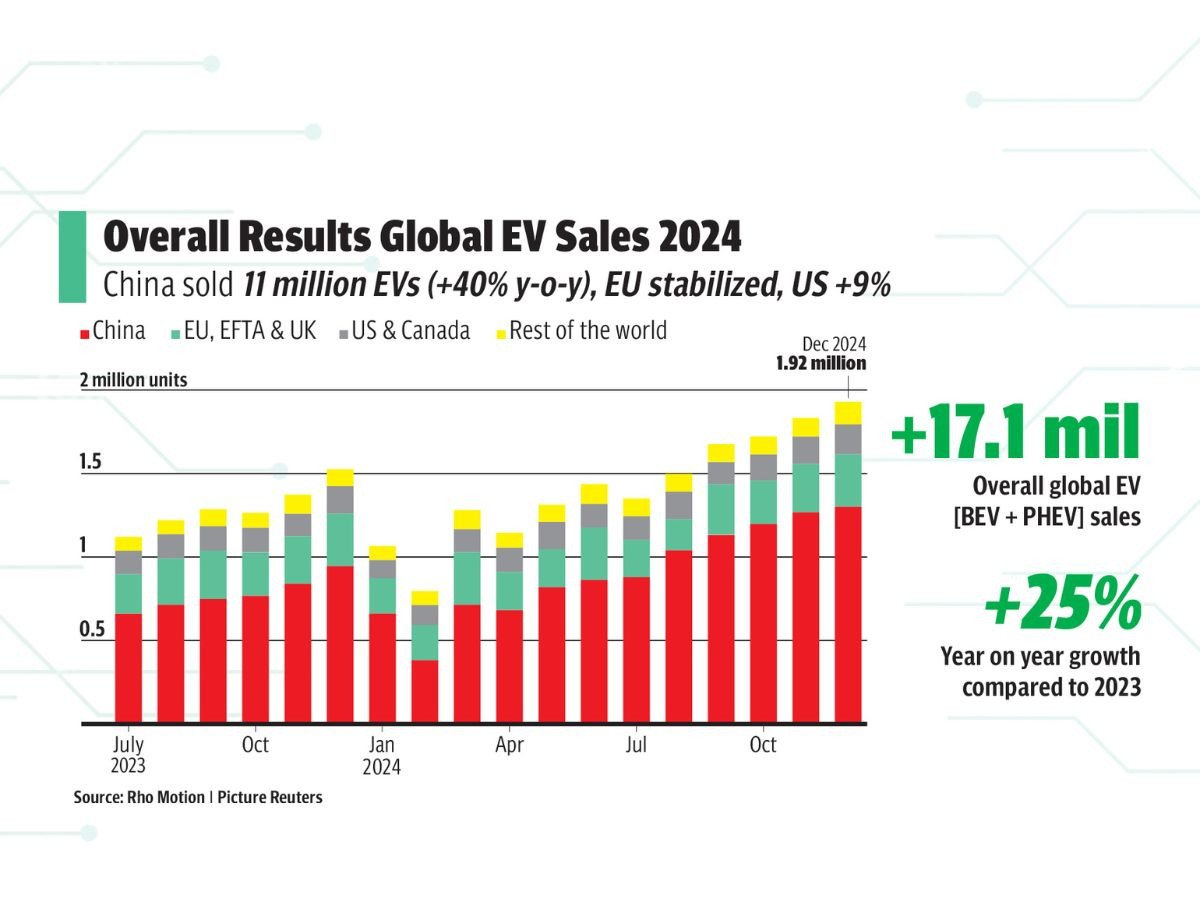

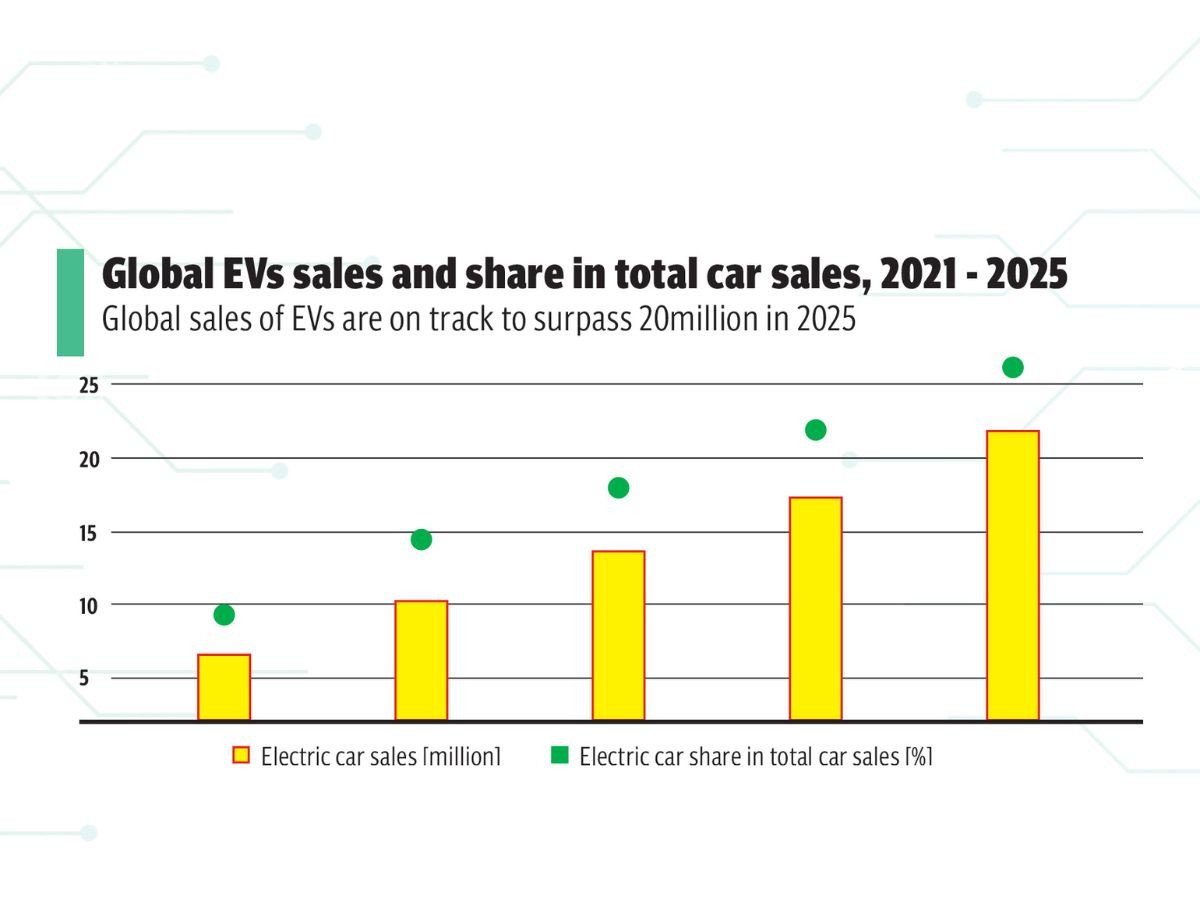

Governments in Europe and Asia added fuel to the push by offering incentives and building charging networks. The result was a global surge. In 2024 alone, more than 17 million electric and plug-in hybrids were sold, and in places like China, Norway and Germany, electric cars now account for a significant share of the market.

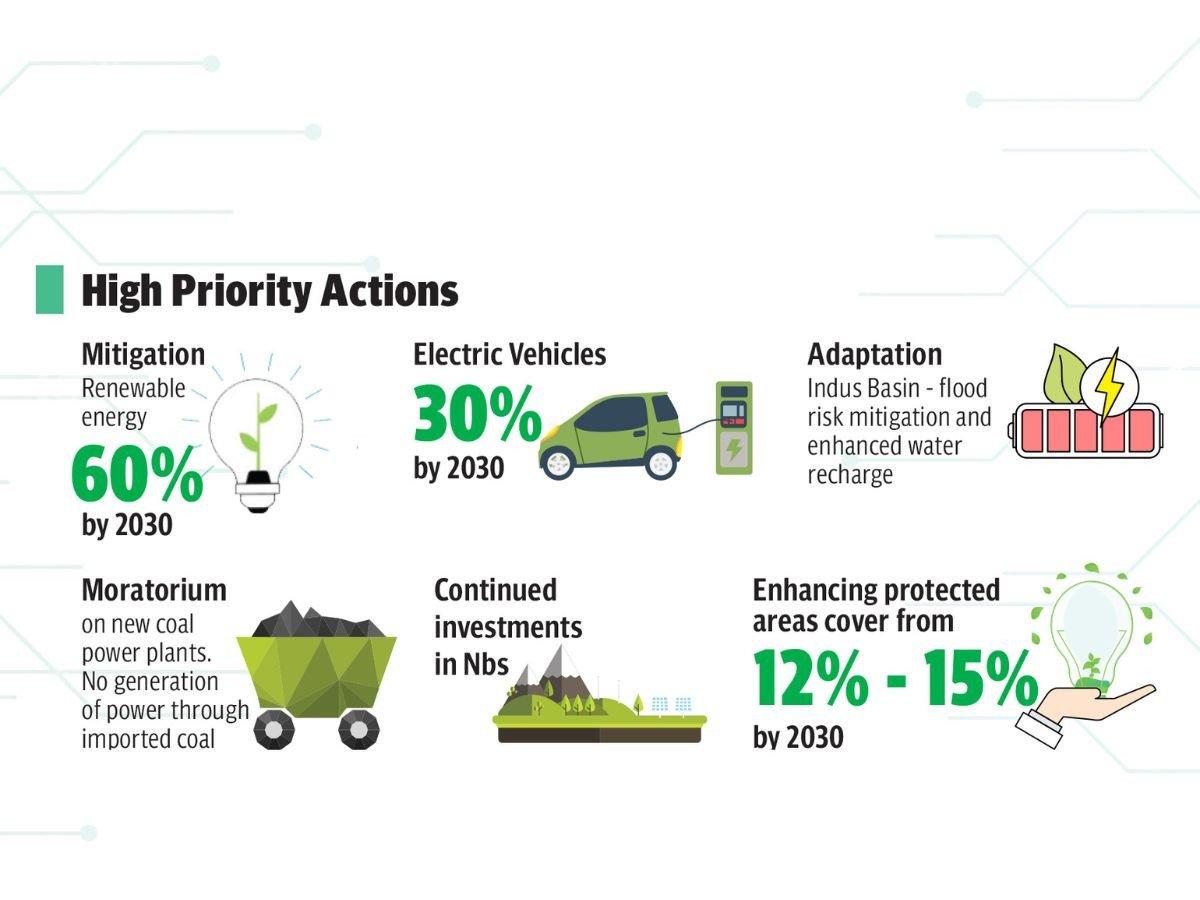

Pakistan is late to the curve. Policy papers now talk of 30 per cent of new cars being electric by 2030, yet on the streets petrol still rules. Charging stations remain rare, and EVs are mostly limited to wealthier buyers. Even so, the entry of global players and the slow trickle of PHEVs onto Pakistani roads suggest the story of the country’s auto market may be about to change.

The global promise of NEVs

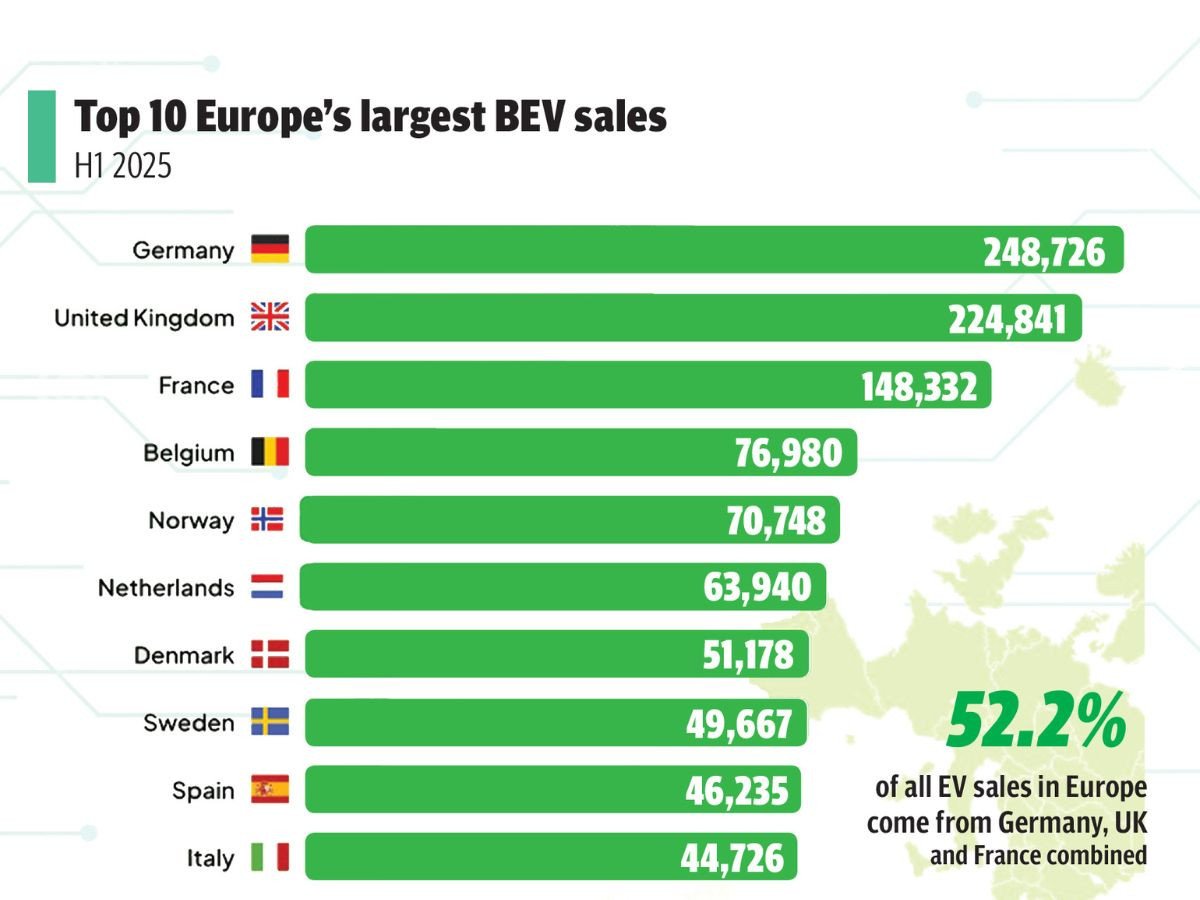

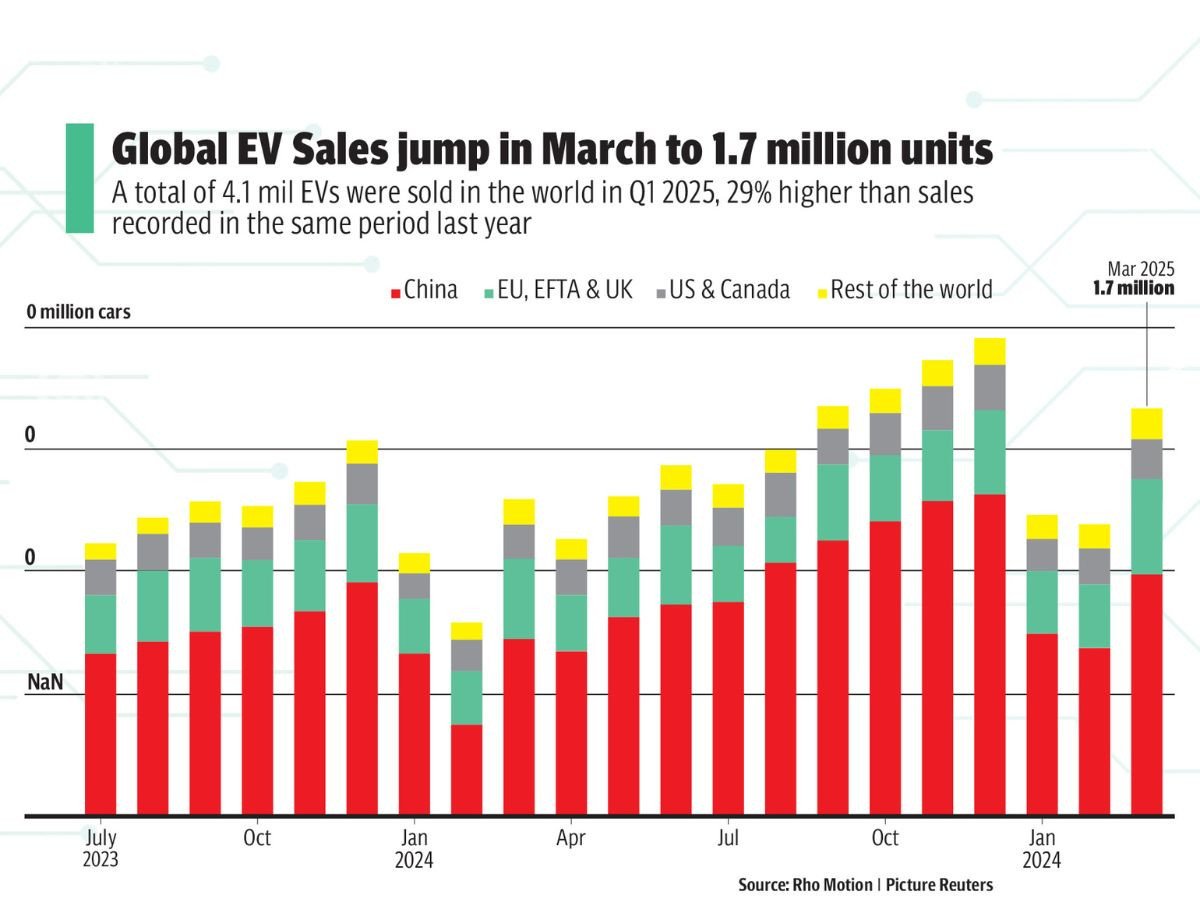

Around the world, the case for New Energy Vehicles has moved well beyond symbolism. In 2024, more than 17 million EVs and PHEVs were sold globally, a 25 percent increase from the year before, with forecasts suggesting sales will surpass 20 million in 2025. China alone now sells more EVs in a single month than most countries sell in a year. Europe, too, has embraced the transition; in the first half of 2025, over half of all new car registrations carried some form of electrification. In Norway, nearly four out of every five new cars are fully electric, an achievement that once seemed unthinkable but is now routine, powered by years of incentives and consistent infrastructure investment.

Governments have discovered that NEVs are more than just a consumer upgrade; they are a tool of national strategy. Transport is one of the largest contributors to carbon emissions, and urban pollution has become a political issue in many countries. By replacing internal combustion engines with electric or hybrid powertrains, nations cut dependence on imported oil, save billions in foreign exchange, and reduce the smog that chokes their cities. For countries that import much of their energy, the appeal is obvious: cleaner air at home and greater resilience abroad.

The rise of NEVs has also spurred new industrial ecosystems. Thailand, for example, has positioned itself as Southeast Asia’s EV hub by offering automakers tax breaks and duty reductions in exchange for commitments to local assembly. Indonesia has moved aggressively into the electric supply chain by promoting domestic nickel reserves for battery production. Even small markets have shown what is possible with the right approach.

These global examples show that the shift to new energy vehicles is no longer limited to rich nations. From Europe’s motorways to the crowded streets of Southeast Asia, electric mobility is spreading on the back of climate concerns and economic logic. Pakistan, by contrast, is only just beginning. Policies have been announced and a few showrooms have opened, but adoption remains slow, infrastructure is thin, and prices are still out of reach for most buyers. The success of NEVs elsewhere shows what is possible, but also underlines how far Pakistan has to travel.

On the ground, the gap between ambition and reality is hard to miss. Other countries move quickly with clear policies and expanding networks, while Pakistan is still sketching the outlines of a plan. The government has set targets, big players have entered with big promises, and early adopters are experimenting in cities such as Karachi and Lahore. But under the optimism linger real questions about charging, affordability and whether policy can keep pace with technology.

Pakistan’s NEV landscape

On paper, Pakistan has not ignored the rise of new energy vehicles. Targets have been set, committees formed, and policies announced with the promise of a greener transport future. The government has spoken of seeing thirty percent of all new vehicles as NEVs by 2030, and officials have laid out frameworks that appear designed to encourage investment. But on the roads of Karachi, Lahore, and Islamabad, progress is far less visible.

When asked about the policy environment, Danish Khaliq, the Vice President Sales and Strategy at Mega Motor Company (Private Limited), BYD’s local partner in Pakistan, acknowledged that conditions had improved compared to just a few years ago. “Two key policy frameworks exist. One is the Electric Vehicle Charging Policy, which streamlines NOCs and reduction in tariffs for charging stations. The other is the National Electric Vehicle Policy 2025-2030, which incentivizes NEV adoption. It gives subsidies on two- and three-wheelers (Up to Rs65,000 on 2 wheelers and up to PKR 400,000 on 3 wheelers.) and talks of extending this to four-wheelers in the future. Consistency and long-term implementation remain important,” he explained. In addition to this the NEV policy aims to achieve 3,000 public charging stations by 2030.

The optimism, however, is tempered by market realities. In September 2025, Pakistan’s Tariff Policy Board formally approved the commercial import of used vehicles up to five years old. According to the Federal Board of Revenue (FBR), these imports are subject to an additional 40% percent duty and the decision is still to be placed before the Economic Coordination Committee (ECC) for final authorization. While framed as a step toward broadening consumer choice, industry leaders see it very differently.

As Khaliq put it, “Practically, this favors Internal Combustion Engine (ICE) vehicles, not EVs. Importers will mostly bring in old petrol and diesel cars because they’re cheaper. That’s counterproductive, it worsens emissions, wastes limited foreign exchange, and we don’t even have mandatory emissions testing. Used EVs are rare, so the benefit is minimal for EV adoption.”

From the perspective of car reviewers and consumers, the gap between what is promised and what is delivered is even starker. Sunil Munj, co-founder of PakWheels, had a different perspective. “The truth is, despite the talk, our charging network is almost non-existent. Policies are ambitious, but the implementation is missing. Without consistent support, the market will struggle,” he said.

The contradiction is clear. On one side, policy documents speak of streamlined approvals, subsidies, and a network of charging stations that would transform the country’s mobility landscape by the end of the decade. At the same time, drivers can still count on one hand the number of working chargers in the country’s biggest cities, while dealers continue to bring in second-hand petrol cars by the shipload. For now, Pakistan’s journey with new energy vehicles sits in an uneasy middle ground, ambitious on paper, uncertain in practice, and waiting to see whether promises can turn into action.

For policymakers and automakers, the debate revolves around targets, tariffs and incentives. For ordinary drivers, the question is far simpler: will these cars make life easier, cheaper and more reliable? In cities where daily commutes stretch well past an hour and long intercity trips are routine, the real test will not be in policy documents or press conferences, but in how these vehicles fit into everyday habits and worries.

Consumer insights

For many buyers in Pakistan, the debate over new energy vehicles is not about policy frameworks or technical jargon. It is about whether these cars can realistically replace the habits formed over decades of driving petrol engines. That is why voices from within the car community carry weight, reflecting what ordinary commuters see as practical solutions.

Sunil, described PHEVs as the natural middle ground for a market like Pakistan. “I think this machine is an ideal shift from a petrol or gasoline engine towards an EV, because PHEV is right in the center. So, when you’re changing the habit of people that were used to driving gasoline cars, going 100 percent electric is a big step. PHEV gives you the long-range of petrol plus the ability to drive electric on city commutes. First step towards full electric.”

He pointed to commuting patterns as one of the strongest reasons why hybrids with electric range may fit better than pure EVs at this stage. “If I look at Karachi, a one-way, 40–50-minute drive is normal. In Lahore, inter-city drives to Faisalabad, Multan, Islamabad, even Peshawar are common. For a 100 percent EV, range anxiety is real with our weak charging network. PHEV solves that problem because you get electric range and the liberty to cover long distances on fuel.”

For Sunil, the hesitation surrounding charging is part of a natural adjustment process. He compared it to the early days of mobile phones, when users were unsure about charging habits. “Range anxiety is the biggest barrier. Just like mobile phones, when they first came, people worried about charging. Now it’s second nature. Once people get used to plugging in their car every night, PHEVs will become normal. They are the ideal step to ease consumers into new technology.”

For now, PHEVs offer a practical answer to the anxieties of daily commutes, giving drivers the reassurance of fuel with the efficiency of electricity. They point to a future where habits may gradually shift, but the direction of that shift will depend on how the industry responds. Automakers and dealers now face the challenge of matching consumer expectations with products, pricing, and infrastructure, and it is here that companies like BYD have begun to stake their claim.

Shaping the market

Pakistan’s shift toward cleaner mobility is still in its infancy, but the entry of global automakers has begun to shape how this market will look in the years ahead. Toyota, Honda, and Hyundai continue to push their conventional hybrids, while MG introduced one of the first mass-market EVs. More recently, BYD has entered with both PHEVs and EVs with launching Pakistan’s first NEV below PKR 9 million, signaling that the transition will not be limited to luxury niches.

For BYD, the decision to arrive now is tied directly to the pressures facing Pakistan. Danish Khaliq explained, “Pakistan is at a critical point. We are facing climate calamities, yet transportation is still one of the biggest consumers of imported fuel, which strains foreign exchange and harms the environment. That is why we felt the timing was right to introduce sustainable mobility. It is similar to how Pakistan skipped landline saturation and directly moved to mobile phones. We do not need to wait decades before shifting to EVs. The technology is affordable and accessible now, and we can benefit immediately.”

The question is how quickly these benefits can be realized. Khaliq noted that both EVs and PHEVs have measurable environmental gains. “The impact depends on adoption. EVs eliminate tailpipe emissions, and even with mixed-fuel electricity, emissions drop by around 80 percent. PHEVs can reduce them by 60 to 70 percent.

For adoption, three issues need tackling: product availability, charging infrastructure, and price parity. We are addressing these by rolling out charging stations through HUBCO Green, our sister concern, who has partnered with leading Oil Marketing Companies (OMCs)like PSO and Attock Petroleum PARCO Gunvor, and also by installing chargers in malls, offices, and towers. The government is supporting with new charging policies, which helps confidence in adoption.”

That confidence is tested by how the technologies are sequenced. Should Pakistan rely on conventional hybrids as a halfway step, or push more directly toward PHEVs and EVs? “Hybrid electric vehicles have small batteries and limited environmental benefit. PHEVs and EVs are what Pakistan needs, because they give real emission reductions and efficiency. Both can work together. EVs give the additional benefit of maximum tailpipe emission reductions while PHEVs address range anxiety until charging infrastructure expands,” Khaliq said.

He also reiterated the future readiness of the company’s technology. “BYD began as a battery company, which gives us an edge. Our Blade Battery is one of the safest in the world. It passes the nail penetration ‘Everest’ test where others explode. Beyond that, BYD invests heavily in R&D with 100,000 engineers working on EV platforms, making batteries denser, safer, and more efficient every year.”

The pitch to consumers is framed not only around technology but also everyday savings. “Buying a car is buying an asset, and Pakistani consumers are very informed. Our Ato 3 is already cheaper than many local hybrids. Driving 400 km on an EV costs around Rs. 2,500 to PKR 3,000 in electricity costs, compared to Rs. 10,000–12,000 in petrol. That is a three to four times savings on running costs.

Maintenance is also reduced to a half or one-third the cost of ICE vehicles since there is no requirement for engine oil and filters (oil).. We have set up after-sales centers across the largest cities in Pakistan, are continuously training local staff, and are building a state-of-the-art local assembly plant. Adopting EVs and PHEVs is not just about being futuristic. It is practical, economical, and necessary for Pakistan’s environment and energy security,” Khaliq said.

For industry observers, the arrival of new models such as the Shark 6 pickup truck could broaden the market further. Sunil Manch described it as a potential disruptor in a segment long dominated by a single option. “In Pakistan, the pickup market had almost no options besides the Vigo. The Shark offers power, fuel economy, and cabin comfort, especially rear seat comfort, which has always been poor in pickups here. This makes it ideal for Pakistani families. But the real buyer will depend on the price. If the price is right, it will disrupt the market.”

He also pointed out how safety and reassurance could expand the appeal beyond traditional buyers. “Range anxiety often discourages women drivers. With the Shark 6, the combined fuel and charge range removes that risk. Its safety features and driving comfort make it reassuring for both men and women.”

Taken together, these perspectives show how the industry is starting to respond to both opportunity and skepticism. Big names still rule Pakistan’s roads, but newer players are starting to test old assumptions about cost, performance and safety. The real measure, though, will come once these cars leave the polished floors of showrooms and settle into the routines of daily life. It is in the experiences of actual users that the promises of technology will be weighed against the realities of the road.

Life behind the wheel

Policy debates and corporate strategies tell one side of the story. The other unfolds quietly on city streets, in homes where drivers are learning what it actually means to own and maintain a PHEV or EV in Pakistan.

Ali Raza, 38, from Lahore, said his decision came after months of watching petrol prices eat into his income. Filling the tank of his old car felt like handing over half his salary each time. The numbers pushed him toward a EV, a choice he felt was both lighter on the wallet and more in step with where the world is heading.

For Raza, the vehicle is not a luxury toy but a family workhorse. “This is not my secondary car. It is the one I use every day, whether it is for dropping my kids to school, going to the office, but visiting relatives in another city, that’s still my fear. Initially people thought I would keep it as a backup, but it has now replaced my main car.”

The shift has already shown up in his household budget. “On fuel alone I save close to 30,000 rupees a month. Maintenance is another relief because there is no engine oil or filters to worry about. If I compare it with my old petrol car, the running cost is almost one-third. For the first time in years, I feel like a car is not draining my wallet.”

Yet the transition has not erased all worries. Raza admitted that resale value and after-sales service still weigh on his mind. “My biggest concern is what happens after three or four years. Will people be willing to buy it second-hand. Will parts and service be as easily available as they are for Toyota or Honda. Charging is less of an issue for me because I installed one at home, but I still wonder what will happen on a long trip outside Lahore.”

Khaliq informed that to meet long-term adoption targets, they have chosen to challenge the perception that electric means expensive. “Earlier entrants introduced luxury EVs, creating a perception that electric means expensive. We challenged that with the Ato3 at Rs. 9 million, which is even competitively priced than some of the locally assembled hybrids. We also invested in charging infrastructure ourselves and set up our own experience centers and after-sales service to give customers confidence. Our strategy is simple: competitive pricing, infrastructure development, strong after-sales, and continuous consumer education,” Khaliq explained.

The question of local capacity inevitably follows. Batteries account for a large share of an EV’s value, and whether Pakistan can one day produce them domestically remains uncertain. “Batteries make up 35 to 40 percent of an EV’s value. Initially, we will import them, as Pakistan does not yet have the scale or technology to manufacture. Once local assembly grows and applications like energy storage expand, battery assembly and later manufacturing could follow. But the first step is setting up EV assembly plants, which we are already working on,” Khaliq said.

The experiences of early adopters point to the questions that remain unanswered. What happens when thousands more make the switch. Can the infrastructure keep pace. And will the market evolve fast enough to support them.

Roadblocks on the journey

Every new technology carries its own hurdles, and Pakistan’s early encounter with NEVs is no different. For all the optimism about cleaner transport, the realities of infrastructure, affordability, and market confidence continue to weigh heavily.

For industry observers like Sunil, the most immediate concern remains charging. “Our charging network is really in bad shape right now. Even today, you can count the number of commercial chargers in Lahore, Islamabad, and Karachi. It is such a shame. But if I see the glass half full, for the first time we have surplus electricity in the country. We just need the charging units, and BYD says they will help set those up.” His words echo what many potential buyers fear most: the anxiety of not finding a reliable charging point when it is needed most.

Affordability is another obstacle. Khaliq pointed out that while wealthy early adopters may not depend on government support, broader uptake cannot happen without it. “Early adopters do not necessarily rely on subsidies, but for mass adoption, price support will be needed. Globally, there are demand-side incentives like rebates and subsidies and supply-side ones such as local assembly support through tax and duties relaxation. In Pakistan, supply-side incentives are more sustainable because they encourage local assembly and industry growth, rather than draining subsidy pools quickly.”

The frustrations are not limited to policy or infrastructure. The excitement of owning something new has not erased the day-to-day frustrations. Raza remembered how friends and family congratulated him on the savings, only for him to discover the limits of the system the first time he looked for a fast charger on the motorway. The network, he said, is patchy at best, and moments like that remind him how early Pakistan still is in this journey.

These obstacles show that adoption is not simply about technology arriving in showrooms. It is about the conditions around it, from policy execution to consumer trust

Business

Zee Real Heroes Awards 2026: ‘The world will have to yield before India…’ Baba Ramdev calls US trade deal a reflection of India’s strength

The fourth edition of ‘Zee Samvaad with Real Heroes’ is being held in Mumbai today, February 6, 2026. The event saw the presence of several prominent personalities from politics, entertainment and sports. It was hosted by lyricist Manoj Muntashir.

Yoga guru Baba Ramdev also joined him on stage, where they discussed a range of topics including the India–US trade agreement and the changing global order. During the conversation, Baba Ramdev also targeted the Opposition.

‘The World Will Have to Yield Before India…’

Manoj Muntashir asked Baba Ramdev about the recent India–US trade agreement. Responding to the question, Baba Ramdev said, “I don’t see it merely as India’s achievement, but as India’s strength. Whether it is Trump or any other global power, they will ultimately have to yield before India. This is the power of India’s market. It is the strength of India’s millions of people — and also America’s compulsion.”

He added that if Trump wants to control inflation in the United States, reducing tariffs becomes a necessity. According to him, that necessity reflects India’s growing strength. Baba Ramdev further said that no country can become a superpower by ignoring India, and that India itself is the next superpower. He remarked that if others choose to approach India first, they would be welcomed respectfully.

Is the Reduction from 50% to 18% Tariff India’s Victory?

Responding to the question, Baba Ramdev said that as India moves forward, some people — whom he described as immature in their political thinking and lacking a clear vision for the country — continue to question such developments. However, he stressed that India is progressing rapidly across sectors, whether it is agriculture, manufacturing, science and technology, innovation and invention-driven creation, healthcare, education, or future research initiatives.

He added that India is strong in terms of natural resources, land, scientific capability, climate, knowledge, cultural depth, and the spirit of hard work and determination. According to him, with this strength and momentum, not just Trump or America, but the entire world will eventually have to acknowledge and bow before India’s rise.

Opposition Says India Has ‘Knelt Down’

Manoj Muntashir asked Baba Ramdev about the Opposition’s claim that India had “knelt down” and that key decisions related to India would now be taken by Trump. Responding to this, Ramdev said that if Trump raises tariffs, he can also reduce them. He added that Prime Minister Modi is acting with patience, as Trump can change his stance at any time.

Ramdev further remarked that Trump has a tendency to stay in the headlines. He said the global order is now changing and that India will have to maintain a balance in its relations with China. He also stated that although some Muslims in India may criticise Prime Minister Modi, many of the world’s most influential Muslim leaders respect him — which, according to Ramdev, reflects the Prime Minister’s diplomatic success.

Business

Stellantis shares plunge 27% after automaker announces $26 billion hit from business overhaul

Stellantis logo is pictured at one of its assembly plants following a company’s announcement saying it will pause production there, in Toluca, state of Mexico, Mexico April 4, 2025.

Henry Romero | Reuters

Shares of automaker Stellantis plunged 27% in European trading on Friday, after the company said it expects to take a 22-billion-euro ($26 billion) hit from a business reset and hinted at a pull-back from its electrification push.

In Milan, the company’s Italian shares were 26% lower. In early trading on Wall Street, the transatlantic firm’s New York-listed stock plummeted 25%.

Other French auto stocks also fell Friday morning, with Valeo and Forvia both down more than 1.2% and Renault sliding 2%.

“The charges announced today largely reflect the cost of over-estimating the pace of the energy transition that distanced us from many car buyers’ real-world needs, means and desires,” said Stellantis CEO Antonio Filosa in a statement.

“They also reflect the impact of previous poor operational execution, the effects of which are being progressively addressed by our new Team.”

Going forward, Stellantis said it would remain at the forefront of EV development, but said its own electrification journey would continue at “a pace that needs to be governed by demand rather than command.”

Stellantis also pre-released some figures for the fourth quarter on Friday, saying it anticipates a net loss for 2025. In recognition of that net loss, it has suspended its dividend for 2026 and plans to raise up to 5 billion euros by issuing hybrid bonds.

For 2026, the auto giant is targeting a mid-single-digit percentage increase in net revenue and a low-single-digit increase in its adjusted operating income margin.

The company said its dividend pause and bond issuance would help preserve its balance sheet, and outlined the actions it had taken last year as part of its reset strategy.

These included announcing “the largest investment in Stellantis’ U.S. history” — totalling $13 billion over four years — as well as launching 10 new products, canceling products that could not achieve profit at scale, and restructuring its global manufacturing and quality management capabilities.

Under the U.S. investment drive, the transatlantic automaker has said it will add 5,000 jobs to its American workforce.

While these moves had resulted in costs of 22.2 billion euros, the company said they had collectively delivered a return to positive volume growth in 2025.

In the second half of the year, Stellantis’ U.S. market share rose to 7.9%, while the company said it retained its overall second-place market share position in the enlarged Europe.

Stellantis’ writedown follows multibillion-dollar hits at rivals Ford and GM, which recently announced their own hits worth $19.5 billion and $7.1 billion, respectively — both being related to EV pullbacks.

Given the “magnitude of the kitchen sinking” and the soft 2026 guidance, UBS analysts said the negative share-price reaction was expected. They added, however, that new management’s “decisive” clean-up and solid regional market fundamentals leave the stock attractive as a potential U.S. “comeback” play.

‘Year of execution’

Friday’s writedown announcement came alongside news that Stellantis will offload its stake in NextStar Energy, a joint venture with LG Energy Solution that built and operated a Canadian battery manufacturing facility. LG Energy Solution will take over Stellantis’ 49% stake, the firms said on Friday morning.

The joint venture was part of Stellantis’ broader electrification strategy. In 2022, former CEO Carlos Tavares set a goal for 100% of sales in Europe and 50% of sales in the U.S. to be battery electric vehicles by the end of the decade.

The company is set to present an updated long-term strategy at its Capital Markets Day in May.

Stellantis’ stock has been under pressure for some time, with its Italian shares slumping nearly 25% last year and 40.5% the previous year. Shares are currently down more than 13% since the beginning of 2026.

Stellantis share price

Filosa previously dubbed 2026 the “year of execution” for the embattled automaker, which has been grappling with falling sales, leadership changes and disappointing earnings for several years. In July, the company said it expected to take a tariffs hit of around 1.5 billion euros in 2025, as it reported a first-half net loss of 2.3 billion euros.

In a Friday note, Russ Mould, investment director at AJ Bell, said Stellantis had placed a “miscalculated bet” on electric vehicles – but said the broader picture on EV adoption raised questions about Stellantis’ marketability.

“The long-held argument about why many drivers won’t go electric yet are concerns about price, access to charging infrastructure, and how long a battery will last during their journey,” he said.

“However, prices are coming down, more chargers are being installed, and battery range is improving. The success of companies like BYD suggests there are plenty of people willing to take the leap. That begs the question as to whether Stellantis’ frustration over its EV sales is linked to market issues or that drivers simply don’t like its vehicles.”

Stellantis is scheduled to publish its 2025 earnings in full on Feb. 26.

Business

Mandelson’s lobbying firm cuts all ties with disgraced peer amid Epstein fallout

A lobbying firm co-founded by Peter Mandelson has severed all connections with the peer.

Its chief executive, Benjamin Wegg-Prosser, has also announced his departure.

The decision follows mounting pressure on Global Counsel over Lord Mandelson’s association with convicted sex offender Jeffrey Epstein.

The firm confirmed that the former US ambassador no longer holds a stake in the business nor exerts any influence.

Mr Wegg-Prosser said he was stepping down as it was “time to draw a line” between the firm and Lord Mandelson’s “actions”.

Global Counsel added in a statement that it had reached an agreement to fully divest the peer’s shares, thereby ending all connections with him.

Its chair, Archie Norman, said: “With the completion of this process today, Peter Mandelson no longer has any shareholding, role or association with Global Counsel and has no influence over the firm in any capacity.”

Mr Wegg-Prosser said: “With the completion of the divestment of Peter Mandelson’s stake in the business, I feel that now is the time to draw a line between Global Counsel and his actions.

“I have nothing but immense pride in the business I founded and the work our amazing team deliver every day.”

He has been replaced as head of the firm by its managing director Rebecca Park, and his page on the company’s website has already been taken down.

Ms Park has also acquired the remaining shares that were held by Lord Mandelson.

Lord Mandelson co-founded the London-based firm with Mr Wegg-Prosser in 2010 after Labour lost the general election.

It is understood that Barclays has cut ties with Global Counsel amid the scrutiny.

Lord Mandelson was sacked as US ambassador in late 2025 after it emerged that he had maintained ties with Epstein after the financier was jailed for a child sex offence.

Epstein killed himself in a prison cell in 2019 while awaiting trial on further child sex charges.

-

Business1 week ago

Business1 week agoPSX witnesses 6,000-point on Middle East tensions | The Express Tribune

-

Tech1 week ago

Tech1 week agoThe Surface Laptop Is $400 Off

-

Tech4 days ago

Tech4 days agoHow to Watch the 2026 Winter Olympics

-

Tech1 week ago

Tech1 week agoHere’s the Company That Sold DHS ICE’s Notorious Face Recognition App

-

Tech7 days ago

Tech7 days agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Sports1 week ago

Sports1 week agoDarian Mensah, Duke settle; QB commits to Miami

-

Fashion1 week ago

Fashion1 week agoItaly’s Brunello Cucinelli debuts Callimacus AI e-commerce experience

-

Business7 days ago

Business7 days agoLabubu to open seven UK shops, after PM’s China visit