Business

US says ‘all options’ on table to help stabilise Argentina’s fiscal turmoil

Getty Images

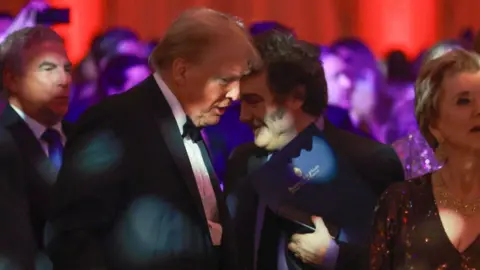

Getty ImagesUS Treasury Secretary Scott Bessent has said the US is “ready to do what is needed” to help stabilise Argentina’s escalating financial turmoil.

“All options for stabilization are on the table,” Bessent wrote on social media, calling Argentina a “systematically important US ally in Latin America”.

The message helped to calm financial markets, which have been rattled as recent election losses raise doubts about the future of Javier Milei’s cost-cutting, free-market agenda.

The value of the peso has been plunging, while investors dump Argentine stocks and bonds.

Milei, a libertarian economist and ally of US President Donald Trump, was elected president of Argentina in 2023 as an outsider candidate who promised to control soaring inflation through radical government spending cuts and other reforms.

A stable Argentine peso is critical to that pledge.

But the currency has lost value as investors move money out of the country, in part worried about the government’s ability to keep the peso steady.

In recent weeks, the Argentine central bank has stepped in to try to stave off further weakness in the peso.

But that effort, which included spending $1.1bn (£810m) of its reserves last week to buy pesos, also depleted its holdings, putting the country in a more precarious position when it comes to paying back its debt.

Bessent said the US government was considering intervening in Argentina’s current fiscal turmoil with purchases of Argentine pesos and dollar-denominated government debt among other forms of support.

More details will be announced after President Donald Trump meets with Milei in New York on Tuesday, he added.

“We remain confident that [President Milei’s] support for fiscal discipline and pro-growth reforms are necessary to break Argentina’s long history of decline,” he wrote.

Milei expressed “enormous gratitude” for the US’s pledge of support, which helped lift Argentine stocks and prices for the country’s dollar-denominated debt in financial markets.

“Those of us who defend the ideas of freedom must work together for the welfare of our peoples,” he wrote on social media.

Milei was the first foreign leader to meet with Trump after his victory in the November 2024 US presidential election and his economic policies have won him admiration among many conservatives in the US, including Elon Musk.

But he has been on the defensive at home, especially in recent weeks, as his government has been grappling with losses in recent local elections and a bribery scandal involving his sister, who is accused of taking kickbacks from drug companies seeking government contracts.

Argentina will host national mid-term elections in October, which are expected to serve as a referendum on his controversial policies, which include cuts to social programmes such as subsidies for transportation.

In April, Bessent also provided key backing to help Argentina secure a new $20bn four-year loan from the the International Monetary Fund.

Business

Piyush Goyal Dismisses Rahul Gandhi’s Farmer Meet Video, Rebuts ‘Fake Narrative’ On India-US Trade Deal

Last Updated:

The minister offered a detailed reality check to counter what he termed ‘Rahul ji’s fakery’

Goyal reiterated that Prime Minister Narendra Modi’s policies are intrinsically linked to farmer welfare. (File Photo: PTI)

Union Commerce Minister Piyush Goyal has accused Congress leader Rahul Gandhi of orchestrating a “fake narrative” aimed at provoking India’s farming community. Responding to a video released on social media by the Leader of the Opposition on Friday, Goyal dismissed the interaction as a stage-managed performance featuring Congress activists masquerading as genuine farmer leaders. He asserted that the dialogue followed a predetermined script designed to mislead the public regarding the safeguards in the recent India-US trade deal.

Rahul Gandhi has alleged that “any trade deal that takes away the livelihood of farmers or weakens the food security of the country is anti-farmer”. He was pointing to the recently concluded India-US framework agreement for bilateral trade, which is expected to be signed after tweaks by the end of March.

Piyush Goyal offered a detailed reality check to counter what he termed “Rahul ji’s fakery”, placing on record that the Narendra Modi government has fully protected the interests of annadatas, fishermen, MSMEs, and artisans. The minister categorically clarified that sensitive crops like soyameal and maize have been granted no concessions whatsoever in the agreement, ensuring that domestic farmers remain shielded from competitive pressure. He criticised the opposition for repeating “baseless allegations” in an attempt to instill unnecessary fear among the rural population.

Addressing specific claims regarding apple and walnut imports, the minister provided a technical breakdown of the protectionist measures in place. He noted that while India already imports approximately 550,000 tonnes of apples annually due to high domestic demand, the new US deal does not allow unlimited entry. Instead, a strict quota has been established, far below current import levels, and subject to a Minimum Import Price (MIP) of Rs 80 per kg. With an additional duty of Rs 25, the landed cost of US apples will be roughly Rs 105 per kg—significantly higher than the current average landed cost of Rs 75 per kg from other nations—thereby ensuring Indian growers are not undercut. Similarly, for walnuts, the US has been offered a modest quota of 13,000 metric tonnes against India’s total annual import requirement of 60,000 metric tonnes, making it impossible for the deal to harm local producers.

Goyal also took a swipe at the historical record of the Congress party, pointing out the irony of its current stance. He reminded the public that during the Congress-led UPA era, India imported nearly $20 billion worth of agricultural products, including dairy items, which the current administration has strictly excluded from the US pact. He challenged Rahul Gandhi to explain his “betrayal of farmers” and questioned how much longer the opposition intended to peddle fabricated stories.

Concluding with the slogan “Kisan Surakshit Desh Viksit”, Goyal reiterated that Prime Minister Narendra Modi’s policies are intrinsically linked to farmer welfare. He maintained that the India-US agreement is a balanced framework that opens new markets for Indian exports like basmati rice and spices while keeping the nation’s agricultural backbone secure.

February 14, 2026, 05:29 IST

Read More

Business

AI disruption could spark a ‘shock to the system’ in credit markets, UBS analyst says

Mesh Cube | Istock | Getty Images

The stock market has been quick to punish software firms and other perceived losers from the artificial intelligence boom in recent weeks, but credit markets are likely to be the next place where AI disruption risk shows up, according to UBS analyst Matthew Mish.

Tens of billions of dollars in corporate loans are likely to default over the next year as companies, especially software and data services firms owned by private equity, get squeezed by the AI threat, Mish said in a Wednesday research note.

“We’re pricing in part of what we call a rapid, aggressive disruption scenario,” Mish, UBS head of credit strategy, told CNBC in an interview.

The UBS analyst said he and his colleagues have rushed to update their forecasts for this year and beyond because the latest models from Anthropic and OpenAI have sped up expectations of the arrival of AI disruption.

“The market has been slow to react because they didn’t really think it was going to happen this fast,” Mish said. “People are having to recalibrate the whole way that they look at evaluating credit for this disruption risk, because it’s not a ’27 or ’28 issue.”

Investor concerns around AI boiled over this month as the market shifted from viewing the technology as a rising tide story for technology companies to more of a winner-take-all dynamic where Anthropic, OpenAI and others threaten incumbents. Software firms were hit first and hardest, but a rolling series of sell-offs hit sectors as disparate as finance, real estate and trucking.

In his note, Mish and other UBS analysts lay out a baseline scenario in which borrowers of leveraged loans and private credit see a combined $75 billion to $120 billion in fresh defaults by the end of this year.

CNBC calculated those figures by using Mish’s estimates for increases of up to 2.5% and up to 4% in defaults for leveraged loans and private credit, respectively, by late 2026. Those are markets which he estimates to be $1.5 trillion and $2 trillion in size.

‘Credit crunch’?

But Mish also highlighted the possibility of a more sudden, painful AI transition in which defaults jump by twice the estimates for his base assumption, cutting off funding for many companies, he said. The scenario is what’s known in Wall Street jargon as a “tail risk.”

“The knock-on effect will be that you will have a credit crunch in loan markets,” he said. “You will have a broad repricing of leveraged credit, and you will have a shock to the system coming from credit.”

While the risks are rising, they will be governed by the timing of AI adoption by large corporations, the pace of AI model improvements and other uncertain factors, according to the UBS analyst.

“We’re not yet calling for that tail-risk scenario, but we are moving in that direction,” he said.

Leveraged loans and private credit are generally considered among the riskier corners of corporate credit, since they often finance below-investment-grade companies, many of them backed by private equity and carrying higher levels of debt.

When it comes to the AI trade, companies can be placed into three broad categories, according to Mish: The first are creators of the foundational large language models such as Anthropic and OpenAI, which are startups but could soon be large, publicly traded companies.

The second are investment-grade software firms like Salesforce and Adobe that have robust balance sheets and can implement AI to fend off challengers.

The last category is the cohort of private equity-owned software and data services companies with relatively high levels of debt.

“The winners of this entire transformation — if it really becomes, as we’re increasingly believing, a rapid and very disruptive or severe [change] — the winners are least likely to come from that third bucket,” Mish said.

Business

Without Rera data, real estate reform risks losing credibility: Homebuyers’ body – The Times of India

New Delhi: More than 75% of state real estate regulators, Reras, have either never published annual reports, discontinued their publication or not updated them despite statutory obligation and directions from the housing and urban affairs ministry, claimed homebuyers’ body FPCE on Friday. It released status report of 21 Reras as of Feb 13.The availability of updated annual reports is crucial as these contain details of data on performance of Reras, including project completion status categorised by timely completion, completion with extensions, and incomplete projects. The ministry’s format for publishing these reports also specifies providing details such as actual execution status of refund, possession and compensation orders as well as recovery warrant execution details with values and list of defaulting builders.FPCE said annual report data is not only vital for homebuyers to assess system credibility, but is equally necessary for both state and central govts to frame effective policies, design incentivisation schemes, and develop tax policy frameworks.“Unless we have credible data proving that after Rera the real estate sector has improved in terms of delivery, fairness, and keeping its promises, we are merely firing in the air,” said FPCE president Abhay Upadhyay, who is also a member of the govt’s Central Advisory Council on Rera.As per details shared by the entity, seven states — Karnataka, Tamil Nadu, West Bengal, Andhra Pradesh, Himachal Pradesh and Goa — have never published a single annual report since Rera’s implementation, and nine states, including Maharashtra, Uttar Pradesh and Telangana, which initially published reports, have discontinued the practice.Upadhyay said when regulators themselves don’t follow the law, they lose the legal right to demand compliance from other stakeholders. “Their failure emboldens builders and weakens the very system they are meant to safeguard,” he said.

-

Entertainment1 week ago

Entertainment1 week agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Tech1 week ago

Tech1 week agoNew York Is the Latest State to Consider a Data Center Pause

-

Business4 days ago

Business4 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Tech1 week ago

Tech1 week agoPrivate LTE/5G networks reached 6,500 deployments in 2025 | Computer Weekly

-

Tech1 week ago

Tech1 week agoNordProtect Makes ID Theft Protection a Little Easier—if You Trust That It Works

-

Fashion4 days ago

Fashion4 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Business1 week ago

Business1 week agoStock market today: Here are the top gainers and losers on NSE, BSE on February 6 – check list – The Times of India

-

Business1 week ago

Business1 week agoMandelson’s lobbying firm cuts all ties with disgraced peer amid Epstein fallout