Business

Azerbaijan open to investing $2b | The Express Tribune

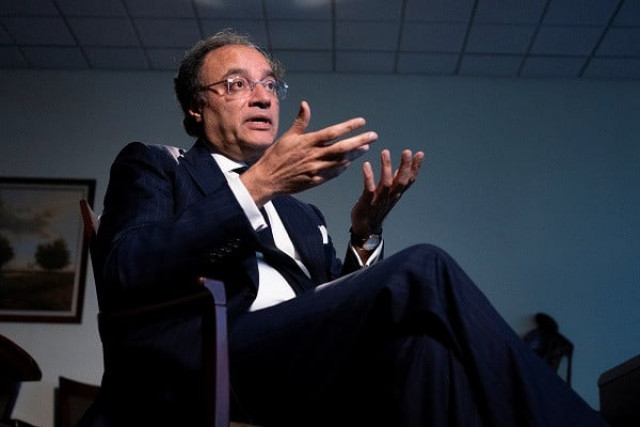

Finance Minister Muhammad Aurangzeb is interviewed during the G20 Finance Ministers and Central Bank Governors’ Meeting at the IMF and World Bank’s 2024 annual Spring Meetings in Washington. PHOTO: REUTERS

ISLAMABAD:

Federal Minister for Finance and Revenue Senator Muhammad Aurangzeb on Tuesday said Pakistan and Azerbaijan were working to translate their strong relations into tangible trade and investment outcomes, with Azerbaijan expressing an appetite to invest close to $2 billion in Pakistan.

In an interview with Report, the minister said bilateral relations, particularly with Azerbaijan, had grown stronger since the current government assumed office, with frequent high-level engagements including visits by Prime Minister Muhammad Shehbaz Sharif and Pakistan’s participation during the COP29 timeframe in Baku.

He said the focus was now on enhancing trade and investment flows, adding that energy, oil and gas, as well as minerals and mining, had emerged as key sectors for potential joint projects. “These are clear areas of focus as we move forward,” he remarked.

Providing details on the proposed investment package, Aurangzeb said discussions were underway with Azerbaijan’s state oil company SOCAR, which was exploring the possibility of investing in an oil pipeline project in Pakistan. He termed the talks as being at an early stage but expressed hope that it could be among the first projects to materialise.

Commenting on Azerbaijan’s readiness to provide a further $1 billion loan to Pakistan, the finance minister said the financing could take multiple forms, including placements with the State Bank of Pakistan or support for Azerbaijani investors operating in Pakistan. He said the current bilateral trade of less than $50 million did not reflect the true potential, and efforts were underway to identify priority sectors to make trade flows more meaningful.

Business

Budget eases PF, ESI deduction rules for employers, allows relief for delayed deposits – The Times of India

In a move expected to bring relief to employers and reduce routine tax disallowances, the finance bill has proposed a key change to the treatment of employees’ provident fund (PF), ESI and similar contributions, allowing deductions even where there is a delay in deposit, provided the amount is deposited by the employer entity with the relevant welfare fund authorities before the due date of its Income-tax return.At present, employers can claim deduction for employees’ PF and ESI contributions only if the amounts are deposited within the strict timelines prescribed under the respective welfare laws. Even a minor delay permanently disqualifies the expense for tax purposes, a position that had been settled by the Supreme Court (SC) after years of litigationUnder the proposed amendment to Section 29 of the Income-tax Act, 2025, the definition of “due date” for claiming deduction of employees’ contributions is set to be aligned with the due date for filing the income-tax return by the employer entity.Explaining the shift, Deepak Joshi, a SC advocate said employers are currently held to a rigid standard. “The law, as interpreted by the SC, meant that if employee contributions were not deposited within the due date under the relevant welfare fund laws, no deduction was allowed — even if the payment was made before filing the income-tax return,” he said.“The proposed amendment substitutes the definition of ‘due date’ to mean the due date of filing the income-tax return. The positive impact is that even if there is a slight delay in depositing employees’ contributions, so long as the amount is deposited before the return-filing deadline, the employer will be allowed the deduction,” Joshi added. Experts view the move as part of the government’s broader effort to soften compliance rigidities and reduce avoidable litigation.

Business

Free baby bundles sent to newborn parents but some miss out

Baby boxes are being delivered to expectant families in some of Wales’ most deprived areas.

Source link

Business

Investors suffer a big blow, Bitcoin price suddenly drops – SUCH TV

After the drop in gold price, Bitcoin price also fell.

Bitcoin fell below $77,000 in the global market, Bitcoin price fell by more than 13% in a week.

Bitcoin’s highest price in 6 months fell below $126,000, Bitcoin price has dropped by more than $49,000.

-

Sports6 days ago

Sports6 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment6 days ago

Entertainment6 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Tech1 week ago

Tech1 week agoICE Asks Companies About ‘Ad Tech and Big Data’ Tools It Could Use in Investigations

-

Business6 days ago

Business6 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Sports6 days ago

Sports6 days agoCollege football’s top 100 games of the 2025 season

-

Politics1 week ago

Politics1 week agoFresh protests after man shot dead in Minneapolis operation

-

Politics6 days ago

Politics6 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings