Business

CCP seeks creation of steel ministry to revive Pakistan’s struggling industry | The Express Tribune

Pakistan’s competition watchdog has called for national steel policy, dedicated ministry to rescue ailing sector

ISLAMABAD:

The Competition Commission of Pakistan (CCP) has recommended the overhaul of the steel industry by announcing a national policy and setting up a dedicated ministry to revive the sector, which is struggling to survive in the face of several challenges.

The CCP on Monday released a report titled “Competition Assessment Study of the Steel Sector in Pakistan.” It quoted the example of Pakistan Steel Mills (PSM), which has collapsed, leaving liabilities of Rs400 billion.

The commission also highlighted key competition-related challenges being faced by the industry. The study pointed to the absence of a national steel policy and recommended the establishment of a dedicated steel ministry, citing the successful models in China and India.

The CCP emphasised in its report that Pakistan’s manufacturing sector had remained a cornerstone of economic expansion, contributing 71% of total exports and employing about 15% of the workforce. Within this sector, the steel industry plays a vital role. The report explores it from a competition perspective. Large-scale manufacturing (LSM) dominates the sector, accounting for more than 69% of manufacturing and 8.2% of GDP.

PSM, once a strategic asset with 1.1 million tons of annual production capacity, has not been operational since 2015 due to financial losses and outdated technology, leaving liabilities of Rs400 billion. In contrast, international peers like China, India and Russia have advanced through government support, innovation and strategic investment.

Lessons from global players highlight the need for Pakistan to develop local coal and iron ore, modernise infrastructure and adopt sustainable, energy-efficient technologies.

Business

Hyundai Motor India’s Q3 profit rises 6.3% to Rs 1,234 crore

Mumbai: Hyundai Motor India Limited on Monday reported a solid performance in the third quarter (Q3) of FY26, with its consolidated net profit rising 6.3 per cent year-on-year to Rs 1,234.4 crore. The growth was supported by steady demand in the domestic market, strong export numbers and higher sales during the festive season, the company said in its stock exchange filing.

Revenue from operations during the quarter increased 8 percent compared to last year to Rs 17,973.5 crore. Operating performance also improved, with EBITDA rising 7.6 percent year-on-year to Rs 2,018.3 crore. The EBITDA margin stood at 11.2 percent, remaining broadly stable compared to the same period last financial year.

The company said domestic demand during the quarter benefited from GST 2.0-related advantages and festive-season momentum.

Wholesale volumes rose 5 per cent sequentially, supported by strong retail sales across key models.

Exports played an important role in overall growth, with export volumes jumping 21 per cent year-on-year in the December quarter.

Exports contributed around 25 per cent to Hyundai Motor India’s total sales during the period.

On the product front, the Creta once again emerged as a key growth driver. The SUV reclaimed its position as India’s best-selling SUV and achieved its highest-ever annual sales of more than 2 lakh units in calendar year 2025.

The newly launched Venue also saw healthy demand, with nearly 80,000 bookings so far. The company said first-time buyers accounted for 48 per cent of the total bookings for the model.

For the nine months ended December 31, 2025, Hyundai Motor India reported EBITDA of Rs 6,632.5 crore, marking a year-on-year growth of 3.3 per cent.

EBITDA margins expanded to 12.8 per cent despite higher costs related to capacity stabilisation and commodity prices. Net profit for the nine-month period rose to Rs 4,175.9 crore.

Commenting on the results, Managing Director and CEO Tarun Garg said the company delivered healthy growth in volumes, revenue and profitability during the quarter.

He added that an improved sales mix and disciplined cost management helped support margins on a year-to-date basis.

Garg also highlighted strong sales in January 2026 as a positive sign for the rest of the financial year.

Business

India-US trade deal: Hope and uncertainty as Trump cuts tariffs

Indian industry has welcomed lower tariffs, but experts caution against celebration until details are clearer.

Source link

Business

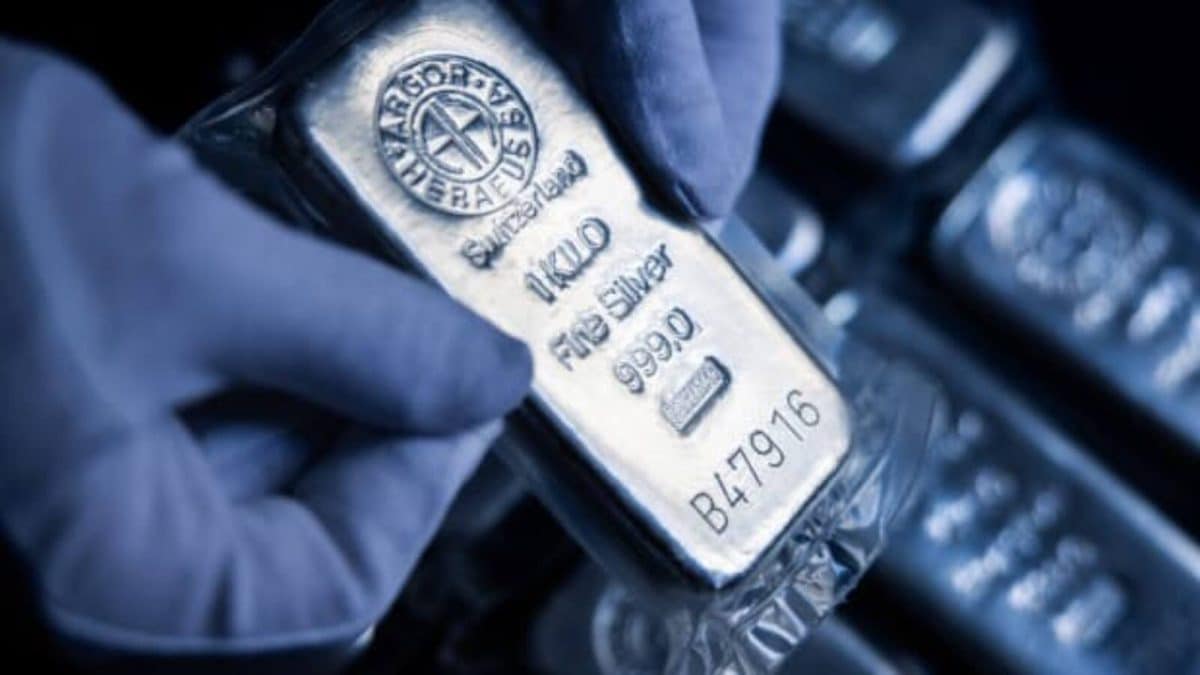

MCX Silver Jumps 6% To Hit Upper Circuit After 46% Crash; Can India–US Deal Spark A Sustained Rally?

Last Updated:

Silver prices staged a sharp rebound on Tuesday after an intense phase of liquidation that followed the abrupt unwinding of a record-setting rally

Silver Rates Surge Today

Silver Rates Today: Silver prices staged a sharp rebound on Tuesday after an intense phase of liquidation that followed the abrupt unwinding of a record-setting rally. The earlier sell-off had pulled prices down more than 46% from their peak in just three sessions, highlighting the extreme volatility in the precious metals space. Gold prices also recovered alongside silver.

On the MCX, silver hit the 6% upper circuit at Rs 2,50,436 per kg on February 3, while MCX gold climbed 3% to Rs 1,48,310 per 10 grams.

A key macro catalyst emerged after US President Donald Trump announced a trade agreement with India. The deal lowers US tariffs on Indian goods to 18% from 50% in exchange for India halting Russian oil purchases and easing certain trade barriers. The development added a fresh geopolitical layer to already jittery commodity markets.

Gold mirrored silver’s recovery in global trade. Spot gold rose as much as 4.2% to move above $4,855 an ounce after sliding 4.8% in the previous session. That decline had extended Friday’s slump, the steepest in over a decade.

Earlier, on January 30, spot gold had tumbled nearly 10% in its sharpest single-day fall since 1983, dragging prices back below the $5,000-an-ounce mark that had been crossed only days before and erasing a sizable portion of the year’s gains.

The rebound extended beyond gold and silver. Spot platinum advanced 3% to $2,183.64 an ounce after touching a record $2,918.80 on January 26, while palladium rose 2.7% to $1,765.75, joining the broader recovery across precious metals.

What drove the rebound after the crash?

Domestic sentiment got a lift from the India–US trade deal, while investors also reassessed geopolitical risks, currency movements and the outlook for US monetary leadership. Strong buying from Chinese retail investors ahead of the Lunar New Year further supported demand, although China’s markets are set to shut for over a week from February 16, temporarily sidelining a key source of consumption.

Traders are also watching developments involving Iran after Trump signalled that talks on a potential new nuclear agreement could begin soon. Any diplomatic progress could reduce gold’s safe-haven appeal and cap gains.

The earlier sell-off in bullion was initially triggered by Trump’s nomination of Kevin Warsh as the next Federal Reserve chair, which strengthened the US dollar and pressured metals. The slide intensified after CME Group raised margin requirements for precious metals futures, forcing leveraged traders to unwind positions quickly. A stronger dollar combined with higher trading costs led to a sharp liquidity squeeze, accelerating the fall.

Will the rally sustain?

Hareesh V, Head of Commodity Research at Geojit Investments, said longer-term drivers such as geopolitical tensions, central bank buying and macro uncertainty remain supportive for precious metals.

He noted that the previous correction was magnified by extremely overbought conditions after gold and silver had surged to record highs, with silver rallying more than 60% in a month and gold over 20%. Profit-booking snowballed into panic selling as liquidity thinned and volatility spiked.

“The violent drop was more of a technical correction than a deterioration in core fundamentals,” he said, suggesting that the broader structural support for the metals remains intact.

February 03, 2026, 11:07 IST

Read More

-

Sports7 days ago

Sports7 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Sports7 days ago

Sports7 days agoCollege football’s top 100 games of the 2025 season

-

Entertainment6 days ago

Entertainment6 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Business1 week ago

Business1 week agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Politics6 days ago

Politics6 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports6 days ago

Sports6 days agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Entertainment6 days ago

Entertainment6 days agoK-Pop star Rosé to appear in special podcast before Grammy’s

-

Tech7 days ago

Tech7 days agoBrighten Your Darkest Time (of Year) With This Smart Home Upgrade