Business

Cost of commuting rises as govt hikes fuel prices | The Express Tribune

People wait for their turn to get fuel at a petrol station in Peshawar. Photo: Reuters/ File

The federal government has increased the price of petrol by Rs5 per litre and high-speed diesel by Rs7.32 per litre for the next fortnight, according to a notification issued by the Petroleum Division late on Sunday night.

Petrol has been raised by Rs5 per litre, taking the price from Rs253.17 to Rs258.17 per litre.

High-speed diesel (HSD) has been increased by Rs7.32 per litre and now costs Rs275.70 per litre, up from the previous Rs268.38.

The notification further stated that the revised prices take effect immediately from February 16 and will remain in force for the next fortnight.

Fuel prices in Pakistan are reviewed fortnightly and are influenced by changes in international oil prices, exchange rate fluctuations, and domestic tax adjustments. Diesel prices are of particular concern as HSD is widely used in transport, agriculture, and power generation, meaning increases often have a direct impact on inflation and the cost of essential goods.

On February 1, in its fortnightly review, the federal government had reduced the price of high-speed diesel by Rs14 per litre from Rs282.38 to Rs268.38 per litre for the next 15 days, while keeping petrol prices unchanged at Rs253.17 per litre.

Earlier, sources had said the price of petrol might rise by Rs4.39 per litre, while high-speed diesel was likely to see an increase of Rs5.40 per litre.

Business

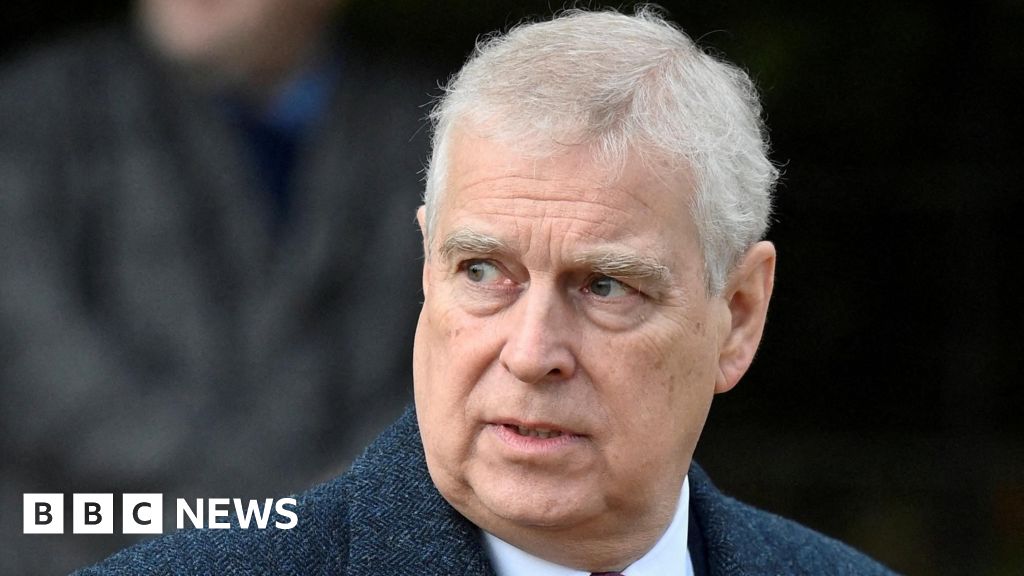

Andrew’s time as trade envoy should be investigated, says Vince Cable

The former prince’s alleged actions were “totally unacceptable”, the ex-business secretary says.

Source link

Business

Gender pay gap won’t close until 2056, warns Trades Union Congress

The average woman employee “effectively works for 47 days of the year for free,” according to the Trades Union Congress.

Source link

Business

Gold, Silver likely to consolidate in coming week amid Fed rate-cut uncertainty: Analysts – The Times of India

Precious metal prices are expected to remain volatile and witness further consolidation in the coming week as investors track key US economic indicators, including inflation data, GDP readings and signals from the Federal Reserve, analysts said.Traders are also likely to monitor US labour market data, the minutes of the Federal Open Market Committee (FOMC) meeting and speeches from Fed officials for clarity on the timing and pace of potential rate cuts, as per news agency PTI.

Volatility to persist on US GDP, PCE data

Pranav Mer, vice president, EBG – commodity & currency research at JM Financial Services Ltd, said gold and silver prices may continue to witness consolidative moves, though volatility is expected to persist.“Gold and silver prices may continue to see more consolidative moves but volatility will prevail with focus on incoming US data on GDP and the Personal Consumption Expenditures (PCE) inflation numbers and Federal Reserve official’s commentary,” he said, as per PTI.On the domestic front, silver futures on the Multi Commodity Exchange (MCX) declined Rs 5,532, or 2.2 per cent, over the past week, while gold rose Rs 444, or 0.3 per cent.

Gold corrects sharply in February

Prathamesh Mallya, DVP – research, non-agri commodities and currencies at Angel One, said gold prices have corrected in February.“Gold prices have fallen in February 2026, with prices correcting from highs of Rs 1,80,000 per 10 grams to around Rs 1,53,800 per 10 grams as on February 13,” he said, as per PTI.He attributed the weakness to stronger-than-expected US employment data, which has reduced expectations of near-term rate cuts and weighed on gold prices in the past week.“However, the yellow metal’s safe haven appeal remains intact on account of geopolitical tensions, and strong buying ahead of the Lunar New Year. It’s a tug of war between bears and bulls this week, and the volatility will continue in the week ahead,” Mallya added.

International trends and market drivers

In the international market, Comex gold futures gained $84, or 1.7 per cent, during the week, while silver edged up marginally to close at $77.27 per ounce.Mer said gold prices moved between gains and losses through most of the trading sessions but managed to end the week higher.“Gold prices see-sawed between gains and losses for most part of the trading session, but managed to close the week in positive and above $5,000 per ounce in the overseas market.“The bullions are passing through a phase of consolidation amid a lack of clarity among traders as they remain divided over the price direction and look for fresh fundamental triggers,” he said.Analysts noted that central bank buying, safe-haven demand amid a sharp sell-off in global technology and AI stocks, and a softer dollar index provided support to bullion prices.However, mixed physical demand from India and China, profit-booking by ETF investors and strong US macroeconomic data capped the upside.Mer said silver also experienced two-way price movements during the week.“The white metal was weighed by corrections in industrial metals and profit-booking after failing to breach key technical resistance. It also faced pressure from the tech-led global equity sell-off, which reduced risk appetite across asset classes,” he added.Analysts said both gold and silver are likely to remain range-bound in the near term as investors await clearer signals on the Federal Reserve’s monetary policy trajectory and broader global economic trends.

-

Business5 days ago

Business5 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Fashion5 days ago

Fashion5 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Tech6 days ago

Tech6 days agoRemoving barriers to tech careers

-

Fashion5 days ago

Fashion5 days agoADB commits $30 mn to support MSMEs in Philippines

-

Entertainment5 days ago

Entertainment5 days ago‘Harry Potter’ star David Thewlis doesn’t want you to ask him THIS question

-

Fashion5 days ago

Fashion5 days agoSaint Laurent retains top spot as hottest brand in Q4 2025 Lyst Index

-

Sports5 days ago

Sports5 days agoWinter Olympics opening ceremony host sparks fury for misidentifying Mariah Carey, other blunders

-

Entertainment1 week ago

Entertainment1 week agoVictoria Hervey calls out Andrew’s powerful circle in Epstein revelations