Business

Energy boss says China’s tech marks ‘golden opportunity’ for UK

The head of Britain’s largest energy supplier has warned that the UK risks being “left behind” if it fails to collaborate with China on renewable technology, suggesting that importing Chinese wind farm innovations could create thousands of jobs.

Greg Jackson, founder and chief executive of Octopus Energy, recently accompanied Sir Keir Starmer on a UK delegation to China. He emphasised China’s significant advancements in technology and renewables, which he believes could provide Britain with crucial energy security.

This push for closer ties follows Octopus Energy’s recent joint venture with Chinese firm PCG Power, marking its first expansion into China.

The agreement will enable Octopus to trade renewable energy within the world’s largest clean energy market.

Furthermore, Octopus has previously indicated its desire to deploy wind turbines from leading Chinese manufacturers across its UK projects, utilising the country’s renewable technology to enhance Britain’s capabilities.

However, these potential collaborations are set against a backdrop of ongoing national security concerns regarding China, following a period of strained relations between the two nations.

Mr Jackson told the Press Association: “However you feel about China, it’s the second-largest economy in the world.

“In many areas it’s setting the global pace because of its investment in research and development, and technology.

“There are many people concerned about China’s motives or the way in which it’s run, but … if you don’t look at how to work with them, then you’ll get left behind.”

He added that working with China and gaining access to its technology was a “golden opportunity” that has the potential to bring down energy bills, create jobs and help boost the UK economy.

He told PA: “We need to be prepared to defend our own sovereignty and ensure our own security while working and trading with countries who can make people in Britain better off.

“There’s this obsession with whether or not we’re helping their economy, but the reality is we need to help our own economy.”

In September last year, Octopus struck a deal to co-operate on wind farm projects with Ming Yang Smart Energy Group in China, which could pave the way for UK firms to bring Chinese turbine machinery into Britain for the first time.

Mr Jackson said the firm is hoping to start bringing the turbine technology over in the next couple of years, which is said to be around 30 per cent cheaper than from Europe.

“We would hope to create thousands of jobs here to produce some of the wind turbines that the UK is planning on building,” he said.

He insisted security would be the firm’s “number one priority” in rolling out the technology, but that the UK needs to take action to reduce its reliance on imported gas and bring the cost of bills down.

“We should work intelligently and carefully with the appropriate security frameworks,” he said.

“They’re opening up to us in an appropriate way and we need to think about how we’ll work with them here.”

Octopus, which has 7.6 million customers in the UK, overtook British Gas to become the UK’s largest energy supplier earlier this year, with a market share of 24 per cent.

It also has an AI-powered platform, called Kraken Technologies, which is used by other global energy retailers to improve customer service and billing and is valued at around £6.4 billion.

The Government last month said it was investing £25 million into Kraken through the British Business Bank (BBB) ahead of the division being spun out in the next few months.

Business

Rooftops could turn into landing pads as India eyes air taxis to beat traffic

New Delhi: A new report by the Confederation of Indian Industry (CII) suggests that setting up a pilot air corridor connecting Gurugram, Connaught Place, and Jewar International Airport could help India reduce travel time from hours to minutes. The model is seen as a high-impact solution to urban traffic congestion and could be scaled up across the country.

The report, titled Navigating the Future of Advanced Air Mobility in India, was launched by Civil Aviation Minister Rammohan Naidu Kinjarapu. He said India’s aviation sector is moving toward a “high-tech, multi-dimensional mobility ecosystem.”

One of the key highlights of the report is the use of rooftops as landing and parking sites for electric air taxis, known as eVTOLs. This approach could turn existing buildings into revenue-generating assets. As acquiring land for ground-based landing pads is costly, rooftops offer a faster and more affordable way to launch such services in cities like Delhi, Mumbai, and Bengaluru.

“The integration of Advanced Air Mobility reflects our commitment to innovation, sustainability, and world-class urban connectivity,” said Union Minister Kinjarapu. He added that the report provides a “timely and practical blueprint to realise a faster, cleaner, and more connected India.”

However, the report notes that current regulations do not permit regular commercial rooftop operations. To address this, it recommends forming a dedicated team within the Directorate General of Civil Aviation (DGCA) to develop safety and operational standards for these emerging technologies.

Amit Dutta, Chairman of the CII Task Force on Advanced Air Mobility, said the study helps turn the concept into reality. “By analysing a hypothetical Delhi-NCR corridor through structured modelling and regulatory scenario testing, this study moves from concept to operational assessment,” he said, adding that it addresses key regulatory, infrastructure, and airspace challenges linked to early AAM pilots.

The report also recommends initially using drones to transport cargo and medical supplies over distances of 50–100 km. It suggests regions such as GIFT City and Andhra Pradesh as testing zones, where relaxed regulations could support faster adoption. To enable this growth, CII has urged banks and government agencies to create dedicated funding mechanisms for air mobility infrastructure.

Business

Gold, iPhone, Laptop From Dubai: How Much Can You Bring To India Without Paying Customs Duty?

Last Updated:

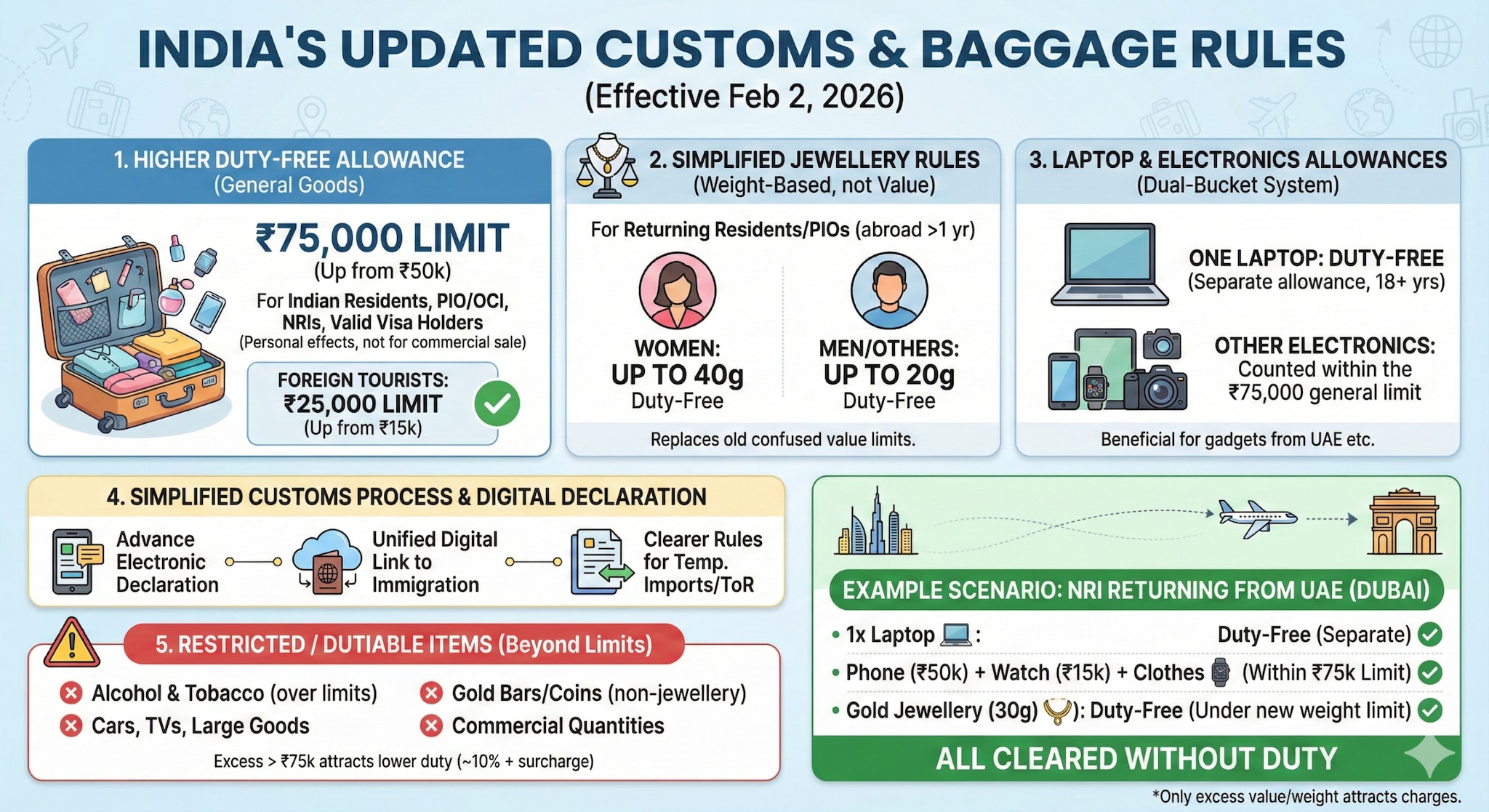

India’s Baggage Rules 2026 raise duty-free limits to Rs 75,000, introduce weight-based jewellery allowances, allow one laptop duty-free, and simplify customs for arrivals.

Items that exceed the Rs 75,000 limit will attract customs duty (typically around 10% + social welfare surcharge on the duty), which is significantly lower than earlier effective rates.

India has updated its customs and baggage rules affecting what international passengers, including people arriving from the UAE, can bring into the country without paying duty. These changes are part of the Baggage Rules, 2026, and the Customs Baggage (Declaration & Processing) Regulations, 2026, which came into effect from February 2, 2026, following announcements in the Union Budget 2026.

Here’s a detailed breakdown of what’s changed and what it means:

1. Higher Duty-Free Allowance for Personal Items

Passengers arriving by air or sea can now bring goods worth up to Rs 75,000 duty-free, higher than the Rs 50,000 limit earlier.

This limit applies to Indian residents, people of Indian origin (PIO/OCI), NRIs, and foreign nationals with valid visas. It covers personal effects and items carried in bona fide accompanied baggage — personal use items, not for commercial sale.

Foreign tourists have a separate duty-free cap of Rs 25,000 (up from Rs 15,000 earlier).

For crew members, the limit is Rs 2,500.

2. Simplified Jewellery Rules

The old value-based limits on jewellery imports have been replaced with weight-based allowances for returning residents/PIOs:

• Women: up to 40 grams of jewellery duty-free

• Men/Others: up to 20 grams duty-free

This applies to passengers who have stayed abroad for at least a year and are bringing jewellery in bona fide baggage.

Earlier, jewellery allowances were defined by value rather than weight, which often caused confusion and disputes at customs.

3. Laptop and Electronics Allowances

• One laptop can be brought in duty-free, separate from the Rs 75,000 general limit, for travellers aged over 18 years (excluding airline crew).

• Other electronics (smartphones, watches, cameras, etc.) are counted within the Rs 75,000 allowance.

This dual-bucket system (laptop + Rs 75,000 limit) is particularly beneficial for travellers bringing gadgets from the UAE, where prices are often lower.

4. Simplified Customs Process

The new regulations also introduce:

• Advance and electronic baggage declaration to streamline arrival processing.

• Unified digital declaration linked to immigration systems, reducing paperwork.

• Clearer rules around temporary imports / re-imports and Transfer of Residence (ToR) benefits for long-term expatriates.

5. What Still Requires Duty or Has Restrictions

Even under the new rules, certain items remain outside duty-free allowances and must be declared:

• Alcohol beyond allowed limits

• Tobacco products above the limits

• Cars, TVs, and other large goods

• Gold bars/coins or precious metals in non-jewellery form

• Commercial quantities of any item

Items that exceed the Rs 75,000 limit will attract customs duty (typically around 10% + social welfare surcharge on the duty), which is significantly lower than earlier effective rates.

Example (From UAE To India)

If an NRI returning from Dubai brings:

• One laptop: duty-free separate allowance

• A phone (Rs 50,000), watch (Rs 15,000) & clothes: these total Rs 65,000 — all duty-free within the Rs 75,000 limit

• Gold jewellery (30 g): duty-free under the new weight limits

The above would be cleared without duty. Only items or values above these thresholds may attract charges. However, for updated and item-specific rules, check customs rules from official government website.

February 08, 2026, 16:01 IST

Read More

Business

PM Kisan 22nd instalment update: Is farmer ID mandatory to receive Rs 2,000 payment?

New Delhi: Farmers across India are waiting for the 22nd instalment of the PM Kisan Samman Nidhi scheme, under which eligible beneficiaries receive Rs 2,000 directly in their bank accounts. While the government has not officially announced the release date, the next payment is expected between February and March 2026, based on the scheme’s usual schedule.

The PM Kisan scheme provides Rs 6,000 per year in three equal instalments to landholding farmer families through direct benefit transfer.

Farmer ID Requirement

A key update this year is the growing importance of the Farmer ID, which is being introduced as part of the government’s farmer-registry initiative. The ID is mandatory for new registrations in several states where the registry system has already started, though it may not yet be required everywhere in the country.

Authorities say the Farmer ID will help verify beneficiaries, prevent duplication, and ensure that financial assistance reaches genuine farmers.

e-KYC Still Essential

Along with the Farmer ID, e-KYC remains compulsory for all registered PM Kisan beneficiaries. Farmers who fail to complete e-KYC or update their records may face delays in receiving the next instalment.

The government has also introduced new methods such as OTP-based and facial-authentication e-KYC to make the process easier for farmers.

What Farmers Should Do

To avoid missing the next instalment, farmers should:

Complete e-KYC verification

Ensure Aadhaar is linked to their bank account

Update land and registration details

Obtain a Farmer ID if required in their state

-

Tech7 days ago

Tech7 days agoHow to Watch the 2026 Winter Olympics

-

Business7 days ago

Business7 days agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

-

Fashion7 days ago

Fashion7 days agoCanada could lift GDP 7% by easing internal trade barriers

-

Tech1 week ago

Tech1 week agoI Tested 10 Popular Date-Night Boxes With My Hinge Dates

-

Entertainment7 days ago

Entertainment7 days agoThe Traitors’ winner Rachel Duffy breaks heart with touching tribute to mum Anne

-

Entertainment3 days ago

Entertainment3 days agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Sports7 days ago

Sports7 days agoPakistan Shaheens announce squad for T20’s, ODI’s – SUCH TV

-

Business7 days ago

Business7 days agoInvestors suffer a big blow, Bitcoin price suddenly drops – SUCH TV