Business

From tinker tool to daily assistant: AI’s quiet rise – The Times of India

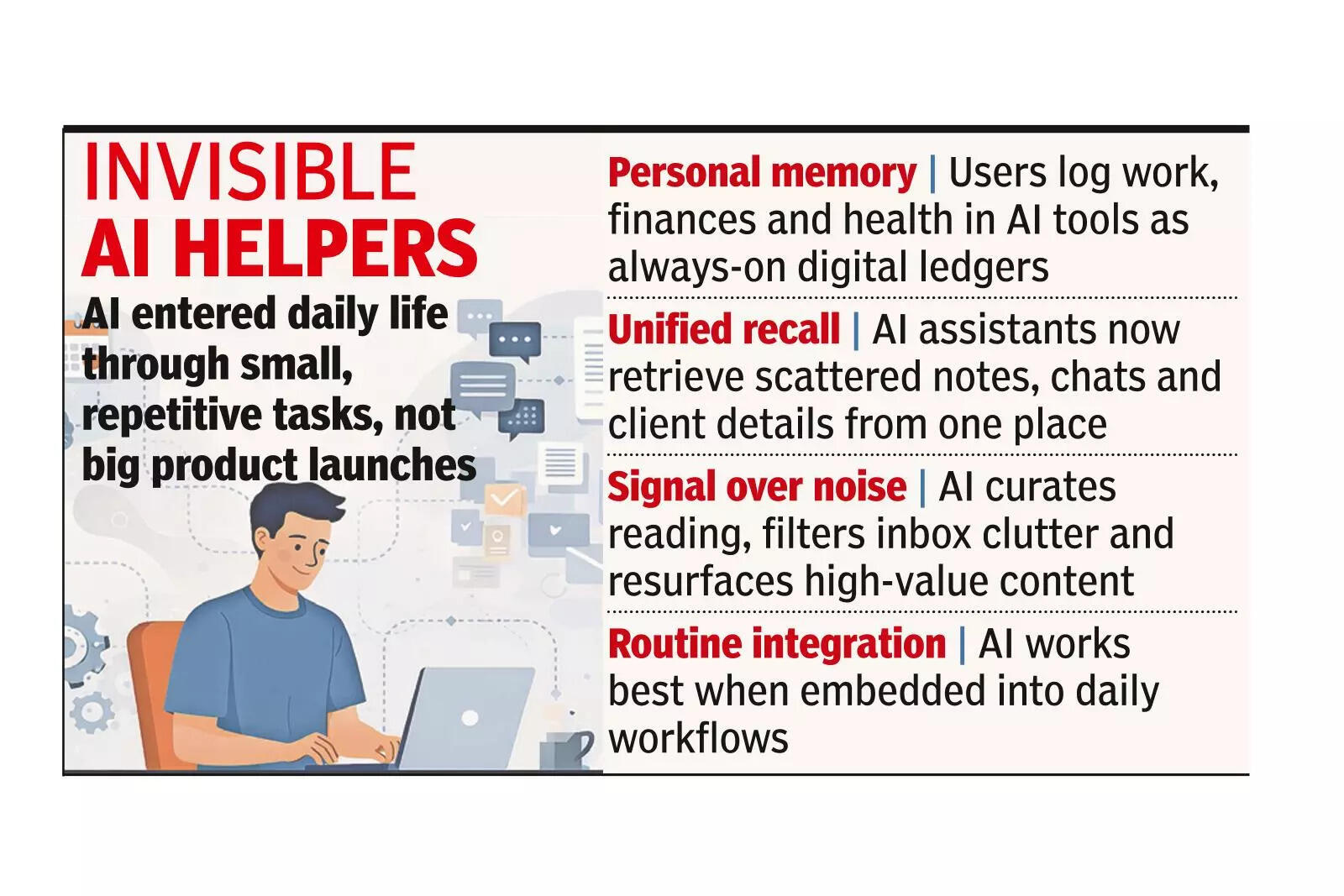

BENGALURU: For much of 2025, artificial intelligence did not enter people’s lives through dramatic product launches or viral demos. Instead, it slipped in quietly, taking over small, repetitive tasks that many users barely noticed. What began as casual experimentation with chatbots has, for many, evolved into a set of everyday tools that now handle remembering, planning, drafting and filtering information in the background.One of the most common uses of AI today is as a personal memory and life ledger. Hyderabad-based AI product manager Saumya Shikhar uses ChatGPT to log work achievements, skills he is building and challenges he encounters on the job. He also maintains separate chats to track RBI interest rate movements that affect his loan repayments, and another to record his health history. “That way, I feel like I have personal assistants with infinite memory and quick wisdom all the time,” he said.

Others are embedding AI even more deeply into their daily recall. Vignesh Ramakrishnan, founder of a Bengaluru-based AI consulting firm, built a WhatsApp-based AI assistant that acts as his operational memory. The system logs voice notes, handwritten notes, calendar entries and client conversations, and can retrieve details weeks later on request. “Earlier, client details were scattered across chats, notes and spreadsheets,” he said. “Now I just ask one place.”Another widespread shift is the use of AI to filter signal from noise. Instead of scanning crowded inboxes or unread newsletters, users increasingly rely on AI-powered curation tools. Dr Sneha Jain uses Readerwise and Pocket to curate and prioritise what she reads during the week. “I start each morning by scanning only high-signal insights instead of wading through inbox noise,” she said, adding that saved articles now resurface during short breaks between meetings, turning idle minutes into focused reading time.Drafting and structuring work remains one of the most common daily uses of AI. Tools such as ChatGPT, Claude and Copilot are now routinely used to turn rough thoughts into first drafts of emails, notes and long-form documents. Newer tools like Gemini’s Nano Banana and Gamma are increasingly being used to generate presentation visuals and slide decks from basic prompts. Meeting-focused tools such as Granola are also gaining traction for recording conversations and auto-generating summaries and action points. Founder and author Pavan Govindan said the biggest change has been the removal of thinking friction. “AI hasn’t replaced judgment or creativity,” he said. “It has replaced the blank-page problem.”

Business

Asian stocks today: Markets trade in green after US SC’s blow to Trump’s tariffs; HSI jumps over 2% – The Times of India

Asian markets inched higher on Monday after the US Supreme Court invalidated a major part of President Donald Trump’s tariff framework, a policy that had shaken the global economy since last year. Hong Kong’s HSI climbed more than 2% or 579 points reaching 26,992 with ecommerce heavyweights Alibaba and JD.com each jumping over three percent. Seoul also scaled a fresh record high to 5,816, buoyed by strong gains in chipmakers Samsung Electronics and SK hynix.Markets in Singapore, Wellington, Taipei and Manila also ended in positive territory, while Sydney slipped. Meanwhile, trading in Tokyo and Shanghai was shut due to holidays.The gains across the region were driven primarily by technology stocks. These companies have powered much of Asia’s market strength this year as investors increasingly shift funds away from Wall Street in search of relatively cheaper valuations. Trump’s trade strategy suffered a significant legal setback on Friday when the nation’s highest court ruled that the International Emergency Economic Powers Act, which the White House relied on in April to introduce broad tariffs, “does not authorise the president to impose tariffs”. In response, the president pledged to introduce a fresh global tariff of 10% using another legal route, which by Saturday, he had increased to 15%. The latest developments have injected a new layer of uncertainty into the trade outlook. There are now also demands for authorities to return funds collected under the earlier tariff scheme, while analysts caution that the administration could still look for alternative mechanisms to enforce duties.The court’s decision has also affected the outlook for trade agreements negotiated by Washington. Even so, investors in Asia largely welcomed the ruling, which is widely viewed as supportive for China and India. Technology counters emerged as the biggest winners.In currency markets, the dollar came under pressure, falling sharply against the yen, pound and euro. Meanwhile, oil prices declined by more than one percent on optimism surrounding a potential Iran nuclear deal.

Business

Zudio, Trends: Budget fast fashion is taking small-town India by storm

More Indians in small towns are now shopping for affordable brands instead of unlabelled goods in the bazaars.

Source link

Business

AI contributes to spike in fashion sales complaints to Citizens Advice

The rising use of AI by fashion retailers contributed to Citizens Advice receiving almost 18,000 complaints from customers last year – a surge of 21% on a year earlier, it has reported.

The advisory service said it was helping a consumer with a fashion purchase every seven minutes, finding that the ever-increasing use of AI “makes it easier for scammers to trick people into buying items that look nothing like the images advertised”.

According to the charity’s consumer service, 82% of complaints about clothes, shoes and accessories related to online orders (14,487), while 14% were bought in-store (2,569).

Women’s clothing caused the most headaches, making up almost half (48%) of all complaints (8,508), while men’s clothing made up 20% (3,523).

The most common five issues suffered by fashion buyers last year were faulty goods, making up 18% of all complaints, delivery failures or delays (13%), trouble returning unwanted goods (12%), breach of contract (9%) and poor customer service (6%).

Of last year’s complaints, one in 13 involved scams, including shoppers thinking they were buying items from UK-based companies, due to their advertising.

Instead, consumers had received poor quality items that were not as pictured, and, when they tried to return them, were asked to pay expensive fees to send them to an address overseas.

One consumer, Hannah, a mother in her 30s from the East Midlands who did not want her surname published, told Citizens Advice she was Christmas shopping online when she saw a jacket she liked advertised at half price.

The company selling the jacket claimed it was based in London’s Covent Garden, and Hannah bought it for £35 using a debit card.

Hannah said: “The jacket took a few weeks to come and when it did, it was a totally different material and colour, and not as premium as it was pictured. The pockets were different and it had massive plastic buttons, but the one in the photograph had nice metal ones. It even smelled cheap.”

Hannah emailed the company to complain and request a refund.

She said: “The service felt very different to any other clothing company I’d dealt with. They asked for pictures of the jacket I’d received and I thought ‘this company sent the item to me, surely they should know what it looks like’. They also emailed me on Boxing Day.

“They said I could return the jacket if I sent it to China at my own expense, it left me fuming. I looked up the cost of shipping and it was about £15. The website clearly stated it was a UK business, which was deceptive.”

Hannah reported the incident to the Citizens Advice Consumer Service, and was able to get a full refund through her bank, which covered the cost. Eventually, the company did issue a refund itself.

Jane Parsons, consumer spokeswoman at Citizens Advice, said: “Shopping should be simple and stress-free, but every year we hear from thousands of frustrated people who have a tough time trying to resolve issues with retailers and sellers.

“Consumers face all kinds of problems from receiving faulty items, to waiting weeks for deliveries and poor customer service. Plus, the ever-increasing use of AI makes it easier for scammers to trick people into buying items that look nothing like the images advertised.

“It’s important consumers know what steps to take before they part with their cash or after there’s an issue. It can make all the difference in avoiding a trap or getting a refund.”

Mike Andrews, national coordinator of the National Trading Standards eCrime Team, said: “Online retail scams leave shoppers out of pocket and understandably frustrated.

“What appears to be a genuine retailer can turn out to be a fake website, a misleading advert or goods that never arrive.

“Criminals are increasingly using professional-looking sites and convincing promotions to exploit people’s confidence in well-known brands.

“We would encourage consumers to pause before buying online – check the retailer using a URL checker from a reputable website like Get Safe Online, be cautious of offers that seem too good to be true, avoid buying directly through social media adverts and always pay by card or a secure payment platform.”

UK consumer laws are difficult to enforce when sellers turn out to be based overseas.

Citizens Advice suggests the following before buying from an unfamiliar company:

– Check reviews on search engines and third party websites– Watch out for heavily discounted, ‘too good to be true’ prices and huge closing down sales– Be mindful of the targeted shopping adverts in your social media feeds – this is often how customers are drawn in– Consider whether images used to advertise an item were created by AI. This can be difficult, but look for overly airbrushed images, inconsistent textures or distortions on the face and body– Check the company’s website delivery information. Overseas stores offer shipping to the UK in a much longer timeframe than a genuine UK brand would– If you’ve been caught out by this type of scam and you paid by debit or credit card, you may be able to use a ‘chargeback scheme’ or a ‘section 75’ claim to get a refund.

-

Entertainment6 days ago

Entertainment6 days agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech6 days ago

Tech6 days agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics6 days ago

Politics6 days agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment6 days ago

Entertainment6 days agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Politics6 days ago

Politics6 days agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Sports6 days ago

Sports6 days agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash

-

Fashion6 days ago

Fashion6 days agoAustralia’s GDP projected to grow 2.1% in 2026: IMF

-

Business6 days ago

Business6 days agoTax Saving FD: This Simple Investment Can Help You Earn And Save More