Business

FTSE 100 posts best performance since global financial crisis recovery – and beats US

.jpeg?trim=0,0,0,0&width=1200&height=800&crop=1200:800)

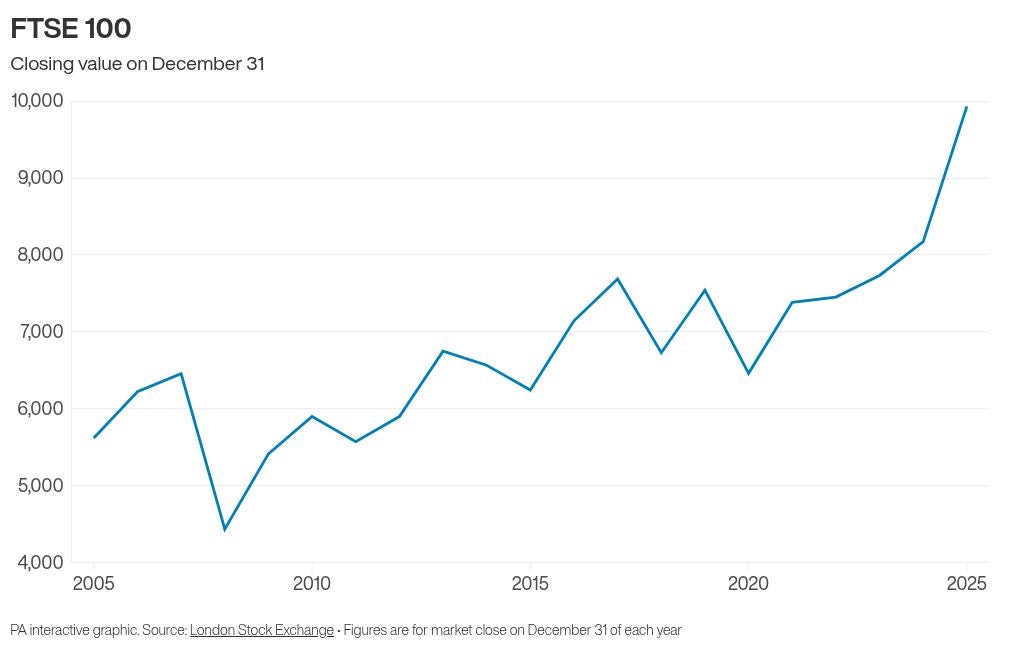

The government want more British people to start investing and could hardly have had a better advertising campaign handed to them, as the FTSE 100 – the index of the biggest firms listed on the London Stock Exchange – posted the best annual returns across 2025 since the rebound from the financial crisis.

In total, the UK’s biggest stock market index gained 1,758.36 points, or 21.5 per cent, from the last trading day of 2024 to December 31 2025.

That’s in comparison to the 16.7 per cent gains made by the collection of Europe’s biggest firms, the Stoxx 600, America’s S&P 500 which gained 17 per cent, and the tech-focused Nasdaq Composite which rose 21 per cent across the year.

The strong gains realised by the British-listed contingent in the FTSE 100 were particularly notable among many mining corporations, defence firms and finance businesses.

That came despite the backdrop of political and economic uncertainty on both a domestic and global landscape all year, which included the dramatic stock market drops from Trump tariffs being announced, the oil price shock as Iran threatened to close the Strait of Hormuz, Rachel Reeves’ delayed Budget and a worryingly stagnant British economy.

It marks a fifth-straight year of gains for the FTSE 100 and means the index has risen in eight of the last ten years, though the usual gains are rarely this outsized, as evidenced by this being the best year since 2009 when it rose 22.1 per cent in the aftermath of the global financial crash.

Over the last decade the FTSE 100 has averaged around 9 per cent gains, a far higher return for money than savings accounts will typically offer – and a notable difference when interest rates are in lowering cycles, as is the case now.

Closing 2025 at 9,931.38, the index shot past record high levels on multiple occasions through the year and teetered close to surpassing the 10,000 mark for the first time.

The year’s success for the blue-chip index has meant it has outperformed European and US peers, including France’s Cac 40 – while the gains were more or less on par with Germany’s Dax.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Investors were drawn to the steady gains of FTSE-listed firms despite broader weaknesses in the UK economy and political uncertainty prompting significant volatility in the global stock markets.

It was a particularly strong year for precious metal producer Fresnillo, whose share price soared by about five-fold over 2025, while gold miner Endeavor Mining’s shares jumped by nearly three-fold.

Defence firms Rolls-Royce and Babcock also strengthened considerably during a year where geopolitical tensions continued to rise, with their share prices roughly doubling.

Bank stocks also rallied amid elevated profits and business progress, with Lloyds Banking Group leading the charge with its share price nearly doubling as a result of steady gains over the course of the year.

Stock market turbulence came to a head in early April when investors were reacting to US president Donald Trump announcing his plans to raise tariffs for countries around the world on US imports. The FTSE 100 suffered its biggest single-day decline since the start of the Covid-19 pandemic, as did Wall Street’s S&P 500 and Dow Jones indexes, before clawing back its losses and returning to growth.

Dan Coatsworth, head of markets at AJ Bell, said the FTSE 100 “has had precisely the right ingredients desired by investors in a year full of political, trade and market uncertainty”.

“This year’s success for the blue-chip index is not a flash in the pan,” he added.

“The FTSE 100 has delivered positive returns in eight of the past 10 years, averaging 9.1% annually over that period including dividends. This kind of performance reinforces the attraction of investing over the long term.

“There may be years when performance disappoints, but history suggests it’s worth pursuing.”

Despite the FTSE 100 strengthening, 2025 has also seen a raft of listed businesses choose to abandon the London Stock Exchange (LSE) for foreign stock markets or to be taken into private hands.

Direct Line was delisted from the LSE after its takeover by rival Aviva in a £3.7 billion deal that created a major force in the UK’s insurance market.

Drinks maker Britvic was also snapped up by Carlsberg at the beginning of the year, taking it off the stock market and into the hands of the Danish brewing giant.

Meanwhile, further setbacks for the London market came as drug maker Indivior announced plans to delist from the LSE after moving its primary listing to the US’s Nasdaq last year, and British fintech Wise said it planned to switch its primary listing from London to New York.

Companies including Royal Mail’s owner International Distribution Services (IDS), Hargreaves Lansdown and industrial group Spectris were among those to be taken private in high-value takeovers completed this year.

Nevertheless, it was also a stronger year for IPO activity with 11 listings on the LSE in 2025, raising total proceeds of £1.9 billion – the most since 2021, according to analysis by PwC.

Additional reporting by PA

Business

Yotta Bets Big On Nvidia’s Latest Chips To Build Asia’s Largest AI Supercluster

Last Updated:

Yotta Data Services to spend $2 billion to deploy Nvidia’s latest Blackwell chips in India, building one of Asia’s largest AI superclusters

Yotta Infrastructure’s Greater Noida data centre park (Photo Credit: Yotta’s website)

India’s data centre sector is entering a new era of scale. Yotta Data Services said Wednesday, February 18, that it will deploy Nvidia’s most-advanced artificial intelligence chips in a $2-billion project that will establish one of the largest AI computing hubs in Asia, positioning the country as a serious contender in the global race for AI infrastructure.

The investment centres on the first-ever deployment of Nvidia’s Blackwell B300 graphics processing units in India, to be housed at Yotta’s hyperscale campus in Noida, just outside New Delhi. The supercluster is expected to go live by August.

Anchoring the project is a four-year agreement with Nvidia valued at roughly $1 billion, under which the chipmaker will establish one of Asia-Pacific’s largest DGX Cloud clusters within Yotta’s infrastructure. Sunil Gupta, managing director and chief executive of Yotta, told The Economic Times that Nvidia will deploy approximately 10,300 GPUs through the arrangement to serve its global Asia-Pacific customers and run its own models and services. “Nvidia is creating one of Asia’s largest DGX Cloud clusters on our supercluster,” Gupta said.

The deal underscores a broader shift in how hyperscalers and chipmakers are approaching India. Global cloud providers, including Microsoft and Amazon, have been expanding AI data centre capacity in the country, drawn by surging demand for generative AI services and government pressure to localise advanced computing infrastructure, according to Reuters. Nvidia’s direct commitment within Yotta’s facility goes a step further, signalling confidence in India as a viable hub for serving enterprise AI workloads across the region.

A significant share of remaining capacity will be dedicated to India’s national AI Mission, which has received more than 500 applications from start-ups seeking affordable compute access. Gupta told The Economic Times that the expansion will increase the country’s compute capacity “by almost five to six times”, addressing what he described as enormous pressure on existing resources. The infrastructure will support state-backed Indian language model initiatives, including Bhashini, Sarvam, BharatGen and Soket, all aimed at building foundational AI models trained on Indian-language datasets.

Yotta currently holds around 10,000 advanced Nvidia GPUs, accounting for nearly 75% of India’s GPU compute capacity. With the new deployment, its total GPU count will rise from roughly 40,000 to more than 75,000 over the next two years.

The capital push is being funded through a combination of debt and equity. Speaking to CNBC-TV18, Gupta said the company is targeting a fundraise of close to $1 billion to support its current phase of GPU deployment. Yotta has already invested over $1.5 billion in infrastructure and expects to commit an additional $2 billion toward advanced chips. A pre-IPO equity round is underway, with the company aiming to enter public markets within the current financial year.

Yotta is part of Indian billionaire Niranjan Hiranandani’s real estate conglomerate and operates data centre campuses in Mumbai, Gujarat and near New Delhi. Additional capacity from its Mumbai facility will supplement the Noida supercluster.

The timing of the investment is notable. US export controls have reshaped global supply chains for advanced AI semiconductors, pushing technology firms to deepen partnerships in markets that remain accessible. India, which has cultivated strong ties with Washington and positioned itself as a neutral beneficiary of great-power competition in technology, has emerged as one of the cleaner plays for companies looking to expand AI compute outside China.

Speaking to CNBC-TV18, Gupta said that India’s AI ambitions are grounded in practical outcomes, with the goal of delivering impact across agriculture, healthcare, education and climate. He drew a comparison to the Unified Payments Interface, suggesting AI-led transformation could similarly reshape how services are delivered at scale across the country.

For Nvidia, the DGX Cloud anchor at Yotta is the latest in a string of sovereign and commercial AI infrastructure deals across Asia, as the company works to deepen its footprint ahead of any potential tightening of chip export restrictions.

Check JEE Mains Result 2026 Link Here

February 18, 2026, 11:30 IST

Read More

Business

Stock market today: Nifty50 opens near 25,700; BSE Sensex flat in trade – The Times of India

Stock market today: Indian equity benchmarks opened flat in trade on Wednesday. While the 50-share index Nifty was near 25,700, the 30-share BSE Sensex was down marginally. At 9:16 AM, Nifty50 was trading at 25,716.35, down 9 points or 0.035%. BSE Sensex was at 83,438.94, down 12 points or 0.014%.Experts believe that the stock market is likely to remain steady with a positive undertone in the near term, supported by global trends.Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited says, “The better-than-expected Q3 results and indications of continuing momentum in earnings growth, going forward, are positive factors that will keep the market resilient. The volatility in IT stocks may continue, in response to incoming news relating to the sector. Overall, IT stocks may remain weak since uncertainty surrounding the sector is huge and large institutional investors are unlikely to invest big time in IT stocks, unless valuations become compelling. There can be churns away from IT towards other sectors like banking and financials, automobiles, telecom, pharmaceuticals etc where there is good earnings visibility.”“This is the time to gradually increase exposure to equity. But many retail investors are increasing investments in gold and silver ETFs, which is a risky game in the present context. Early signs of a shift in the investment strategy of FIIs are visible now. In the cash market, FIIs have been buyers in eight out of the last thirteen trading days. This trend and improving prospects for corporate earnings bode well for the market.“US equities ended marginally higher after a weak start to the session, helped by a rebound in technology stocks and support from financial shares. The recovery followed earlier volatility as investors assessed the outlook for artificial intelligence after recent turbulence that had pulled major indices away from record levels.Asian markets also posted modest gains in thin holiday trading. Investor sentiment remained cautious as markets continued to digest recent swings in global equities linked to concerns around AI-driven disruptions.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)

Business

DISCOs seek additional Rs10.8b | The Express Tribune

Iesco stood on top in the wake of its plausible performance to curb losses, improve recoveries and act in line with the time frame for new connections. PHOTO: FILE

ISLAMABAD:

The National Electric Power Regulatory Authority (Nepra) on Tuesday held a public hearing on the second quarterly adjustment for the current fiscal year, where power distribution companies (DISCOs) sought additional charges of Rs10.76 billion that could translate into a nationwide tariff hike of 43 paisa per unit, including K-Electric. Electricity companies pressed for recovery of costs mainly linked to the capacity payments made between October and December 2025.

Officials told the regulator that Rs24.25 billion was being sought under capacity payments for the Oct-Dec quarter. However, Nepra was also informed of a reduction of about Rs13.5 billion in other components, including operations and maintenance, use-of-system charges and the so-called incremental consumption package.

Nepra officials said the net impact of the adjustment could result in a tariff increase of 43 paisa per unit, but stressed that the authority would review the figures before making a final decision. Any determination will be applicable to consumers across the country.

The hearing drew strong criticism from consumer representatives, who accused the government of shifting the burden of flawed policies on to the general public. Several participants said the incremental consumption package was benefiting selective industries while harming others, arguing that the data shared under the scheme was misleading.

“Without real growth in industrial demand, how can consumers benefit from such incentives?” a hearing participant asked, urging Nepra to reassess the figures submitted by the Central Power Purchasing Agency (CPPA).

CPPA officials said around Rs431 billion in capacity payments would be required for the quarter, compared with Rs459 billion needed by distribution companies in the previous year. Of the total capacity payments to the independent power producers (IPPs), there was a shortfall of Rs24 billion due to low electricity consumption, which would be recovered from the consumers. They also told the regulator that furnace oil-based power plants would not be operated in the future as the government shifted away from costly generation sources.

-

Business1 week ago

Business1 week agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Fashion1 week ago

Fashion1 week agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Business7 days ago

Business7 days agoGold price today: How much 18K, 22K and 24K gold costs in Delhi, Mumbai & more – Check rates for your city – The Times of India

-

Tech1 week ago

Tech1 week agoRemoving barriers to tech careers

-

Fashion1 week ago

Fashion1 week agoSaint Laurent retains top spot as hottest brand in Q4 2025 Lyst Index

-

Fashion5 days ago

Fashion5 days ago$10→ $12.10 FOB: The real price of zero-duty apparel

-

Business5 days ago

Business5 days agoTop stocks to buy today: Stock recommendations for February 13, 2026 – check list – The Times of India

-

Fashion6 days ago

Fashion6 days agoIndia’s PDS Q3 revenue up 2% as margins remain under pressure