Business

Government to water down business rate rise for pubs

Simon Jack,BBC Business Editorand

Lucy Hooker,Business reporter

Getty Images

Getty ImagesA climbdown on forthcoming increases to the business rates bills faced by pubs in England is set to be announced by the government in the next few days.

The government is expected to say it will make changes to how pubs’ business rates are calculated, resulting in smaller rises to bills.

Treasury officials say they have recognised the financial difficulties facing many pubs after sharp rises in the rateable value of their premises.

The move follows pressure from landlords and industry groups that included more than 1,000 pubs banning Labour MPs from their premises.

The BBC understands it will apply only to pubs and not the whole hospitality sector.

The Treasury is also thought to be ready to relax licensing rules to allow longer opening and more pavement areas for drinking.

In her November Budget, Chancellor Rachel Reeves scaled back business rate discounts that have been in force since the pandemic from 75% to 40% – and announced that there would be no discount at all from April.

That, combined with big upward adjustments to rateable values of pub premises, left landlords with the prospect of much higher rates bills.

A campaign to dilute the impact of these rises has been gaining traction in recent weeks, with pub owners and industry groups lobbying for more support.

Conversations between the government and the hospitality sector were “ongoing”, DWP minister Dame Diana Johnson said.

Speaking to Radio 4’s PM programme, she said: “We as a government want to make business rates fairer but you’ll also know we’re coming to the end of the transitional relief that was available because of Covid.”

On Wednesday Labour MPs called on the government to rethink its support for the industry.

Conservative leader Kemi Badenoch said: “What has happened is that over Christmas Labour MPs were banned from every single pub they tried to get into… so now they are pushing for a U-turn.”

She said the Conservatives had a “much better plan” which was to “slash business rates for all of the High Street, not just pubs”. She said business rates bills of less than £110,000 would be scrapped completely.

Reform also welcomed the climbdown, saying “pubs have already been lumbered with astronomical energy costs”.

The party’s deputy leader Richard Tice said: “Pubs are the backbone of our communities and a huge part of British heritage. Their closures would be a cultural catastrophe as much as an economic one.”

To calculate a pub’s business rate bill the rateable value of its premises is multiplied by a set figure: “the multiplier”.

The government had already offered some relief by reducing the multiplier for pubs, and may be about to reduce it further.

Alternatively they could boost the £4.3bn “transitional relief” fund brought in to ease the impact of withdrawing support following the pandemic.

Geoff Robbins

Geoff RobbinsGeoff Robbins, who owns the Wheatsheaf Pub in Faringdon, Oxfordshire with his wife Jo, said it was “a great relief” that more help was on the way.

His rates are due to rise by around 80% over the next three years. He needs a discount on most of that, he reckons, after factoring in higher gas, electricity and staffing costs.

“Rates are a tax against your business whether you make a profit or loss… you’ve got to pay, there’s no way round it,” said Geoff, who got in touch with BBC Your Voice.

Industry groups also welcomed news there would be additional help.

Emma McClarkin, chief executive of the British Beer and Pub Association, said it was “potentially a huge win” for the sector.

“This could save locals, jobs, and means publicans can breathe a huge sigh of relief,” she said.

Kate Nicholls, chair of UK Hospitality, representing the industry, said the support should apply not just to pubs, but to all hospitality businesses affected by rising rates, including cafés and restaurants.

“We need a hospitality-wide solution, which is why the government should implement the maximum possible 20p discount to the multiplier for all hospitality properties,” she said.

Other sectors are calling for the support to be even broader, to include live music venues, theatres, galleries, gyms and retailers.

Unpicking the recent Budget would be seen by many as another U-turn following climbdowns on winter fuel payments, disability benefits and inheritance tax on farms and family businesses.

Shadow business and trade secretary Andrew Griffith said the change showed Rachel Reeves’ Budget was “falling apart”.

“Labour were wrong to attack pubs and now have been forced into another screeching U-turn,” he said.

Liberal Democrat Treasury spokesperson Daisy Cooper said: “This is literally the last chance saloon for our treasured pubs and high streets – so the government must U-turn, today.

“These businesses are worried sick, making decisions now, and can’t wait a minute longer.”

The calculation of business rates is an issue that is devolved in all four UK nations.

The discount on rates during the pandemic only applied to hospitality businesses in England.

Scottish businesses are waiting for the Budget there next week to hear how the Edinburgh government will approach the issue.

Pubs there will hope the Scottish government follows the UK government in offering some relief.

Additional reporting by Kris Bramwell

Business

Angel One 1:10 Stock Split 2026: Broking Stock Fixes Record Date

Last Updated:

Angel One sets Feb 26 as record date for 1:10 stock split. Shareholders will get 10 shares for each held.

Angel One Stock Split 2026

Angel One Stock Split Record Date: Domestic brokerage firm Angel One has fixed February 26 as the record date for its previously approved 1:10 stock split, moving ahead with a proposal cleared by its Board last month.

The company had earlier informed stock exchanges on Jan. 15 that its Board of Directors approved the sub-division of equity shares in a 1:10 ratio.

Board Approval For Share Sub-Division

Under the approved proposal, each fully paid-up equity share with a face value of Rs 10 will be split into 10 fully paid-up equity shares with a face value of Re 1 each.

In its Jan. 15 stock exchange filing, the company stated that the Board had approved the sub-division of one existing equity share of face value Rs 10, fully paid-up, into 10 equity shares of face value Re 1 each, fully paid-up. The move is aimed at increasing the number of outstanding shares and improving liquidity in the counter.

Stock splits typically make shares more affordable for retail investors by reducing the market price per share, although the overall market capitalization of the company remains unchanged.

Feb 26 Fixed As Record Date

In a subsequent filing dated Feb. 18, Angel One confirmed that its executive committee has fixed Thursday, Feb. 26, as the record date to determine eligible shareholders for the stock split.

The record date serves as the cut-off to identify shareholders who will be entitled to receive the additional shares. Investors holding the stock on or before Feb. 26 will qualify for the sub-division benefit.

What The Stock Split Means For Investors

Shareholders will receive 10 equity shares for every one share currently held. While the face value per share will reduce from Rs 10 to Re 1, the total value of an investor’s holdings will remain unchanged, as the split does not alter ownership percentage or overall wealth.

Angel One Q3 FY26: Profit Dips Amid Higher Costs

For the quarter ended Dec. 31, 2025, Angel One reported a 4.5% year-on-year decline in consolidated profit after tax to Rs 269 crore, compared with Rs 281.5 crore in the same quarter last year.

However, total income rose 5.8% to Rs 1,338 crore from Rs 1,264 crore in Q3 FY25. Total expenses increased to Rs 964.2 crore from Rs 876.5 crore, primarily due to higher employee benefit costs, elevated ESOP expenses, and increased operating expenditure.

Check JEE Mains Result 2026 Link Here

February 25, 2026, 07:20 IST

Read More

Business

Lucid widely misses earnings expectations, forecasts continued EV growth in 2026

A Lucid Gravity coming off the line at the company’s factory in Casa Grande, Arizona.

Lucid Group reported mixed fourth-quarter results Tuesday as the electric vehicle maker continues to face challenging market conditions and internal struggles.

The company widely missed Wall Street’s quarterly earnings expectations, while beating average revenue estimates by roughly 12%. It also revised its 2025 production results due to internal validation issues, but guided for a notable increase in vehicle production this year.

Here’s how the company performed in the fourth quarter compared with average estimates compiled by LSEG:

- Loss per share: $3.62 vs. a loss of $2.62 cents expected

- Revenue: $523 million vs. $468 million expected

Lucid’s results come days after the company laid off 12% of its U.S. salaried workforce in an effort to streamline operations and “operate with greater efficiency and deliver on our commitments to gross margin improvement and long term growth,” according to a statement from the company.

Interim Lucid CEO Marc Winterhoff described the cuts Tuesday to CNBC as a needed realignment of the company’s workforce amid broader market and economic concerns as well as needed gains in efficiency.

“We are adjusting and going to a level where we think we want to be and need to be,” he said. “But it’s nothing that will continue in the future.”

For 2026, the company announced a vehicle production target of between 25,000 and 27,000 units. That would mark an increase of roughly 40% to 51% compared with the year-end figures the company released Tuesday.

Lucid said the revision for the year — from 18,378 units to 17,840 units — came as “538 vehicles had not completed certain internal procedures required under its final validation process to be classified as produced.”

The company said the vehicles are expected to be completed this year, with the change not affecting its previously reported financial results.

Winterhoff described the expected growth as “healthy,” but not “outrageous” given the current slowdown in overall vehicle sales, including EVs.

“Our initial plans were higher, but we wanted to really be conservative and make sure that we are hitting the numbers that we are projecting,” he told CNBC.

Lucid is expected to begin production of a new, less expensive midsize vehicle at the end of this year, but Winterhoff said it will not be material to its 2026 production plans. He said the automaker’s Gravity SUV is expected to account for the majority of its production and sales this year, followed by the Air sedan. The company also plans to launch its first Lucid robotaxis with previously announced partners.

Winterhoff said the company’s main priorities this year are achieving its production target, growing sales, continuing efficiency gains and preparing for production of the midsize vehicle and robotaxis.

“We really want to make sure that we [are] on our path to profitability, make sure that we’re not spending money that we don’t have to. That’s very, very important,” he told CNBC.

Lucid has yet to say when the company expects to be profitable. It is scheduled to host an investor day on March 12 in New York.

Lucid said it ended last year with approximately $4.6 billion in total liquidity, which Lucid CFO Taoufiq Boussaid said was “strong” and would provide flexibility “to execute near-term objectives while investing in future growth.”

Lucid reported a net loss of $2.7 billion in 2025, in line with a $2.71 billion loss a year earlier. That includes more than doubling its year-over-year losses during the fourth quarter to $814 million. It reported a loss of $12.09 per share for the year.

The company’s 2025 revenue was up 68% to $1.35 billion, including more than doubling year-over-year results during the fourth quarter.

Business

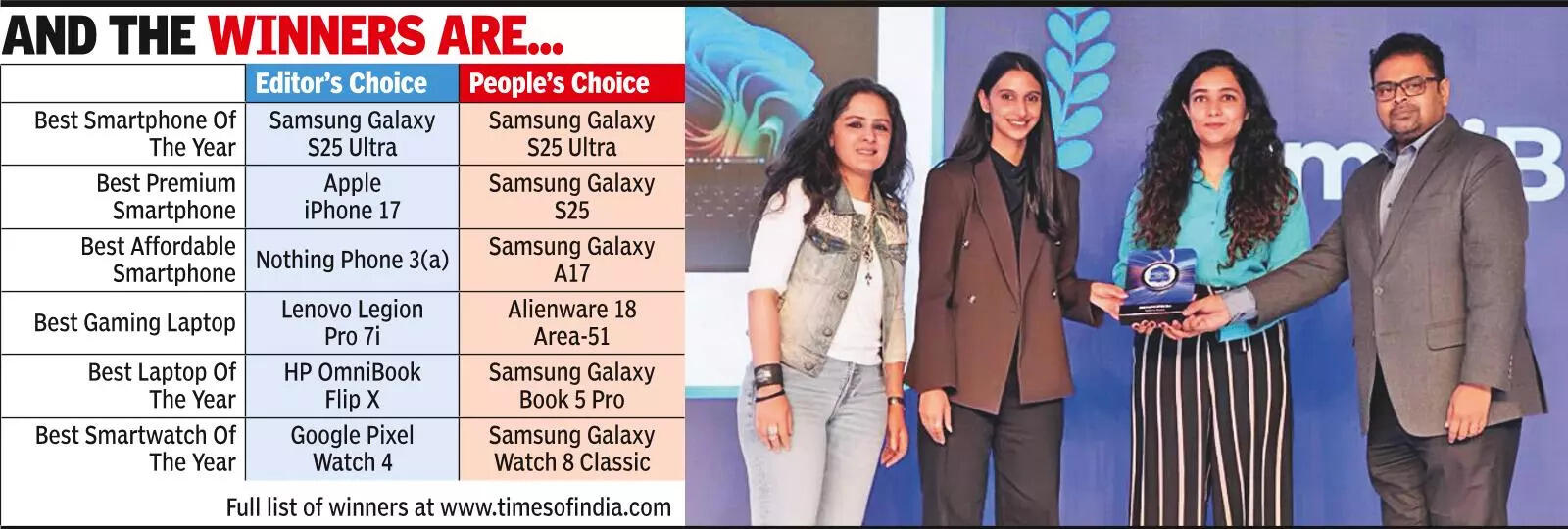

Gadgets Now Awards 2025 recognise tech excellence – The Times of India

NEW DELHI: The Times of India Gadgets Now Awards 2025 celebrated last year’s standout gadgets at an event on Monday where technology met glamour. The event drew an eclectic gathering of distinguished guests who came together to recognise technological excellence across key categories, including smartphones, smartwatches, audio products, televisions and more.This year, the Awards that are in its 6th edition went a step further and also recognised India’s leading influencers and creators who are redefining the tech content landscape.

The winners included Samsung Galaxy S25 Ultra, which scored a double win as the Best Smartphone Editor’s Choice and Popular Choice.Apple iPhone 17 was adjudged the Best Premium Smartphone Editor’s Choice, while Samsung Galaxy S 25 won the Popular Choice in the same category.Samsung once again picked up 2 awards as Galaxy Z Fold 7 was crowned the Editor’s Choice and Popular Choice winner in the Best Foldable Smartphone category.Samsung Galaxy Book 5 Pro won the Editor’s Choice Best AI-powered gadget, while Neosapien Neo 1 was the Popular Choice winner.

-

Entertainment1 week ago

Entertainment1 week agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech1 week ago

Tech1 week agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics1 week ago

Politics1 week agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment1 week ago

Entertainment1 week agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Business1 week ago

Business1 week agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Politics1 week ago

Politics1 week agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Tech1 week ago

Tech1 week agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports1 week ago

Sports1 week agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash