Business

How the new order of the Murdoch dynasty is playing out

Katie RazzallCulture and Media Editor

BBC

BBCChristmas is a time when families get together if they can – and, until this year, the Murdochs were no different. With members of the media dynasty spread across the globe, full family gatherings were rare, although in 2008, according to biographer Michael Wolff, the Murdochs spent the festive season together on a flotilla of private yachts.

But more often in recent years it was Rupert – for many decades the most influential media titan in the world – and his daughter Elisabeth who would make time for each other.

She would certainly have room this year to host her father at the luxurious home she has renovated on the edge of the Cotswolds. But after a bruising closed-court battle in Nevada that became public and an eventual agreement that shut Elisabeth and two of her siblings out of the family firm for good, relations are likely still too strained for even the Murdoch family peacemaker to suggest communal tree-decorating.

WireImage

WireImageRupert’s eldest child by his second wife, Elisabeth is the co-founder and executive chairman of the production company, Sister, which is behind hit television series, including Black Doves, The Split and This is Going To Hurt. In my experience, she is generous, intelligent and hard-working.

Friends are fiercely loyal and protective of her privacy. Nobody I have spoken to has a bad word to say about her. Many acknowledge, though, that it has been an incredibly testing year on the family front – even if Elisabeth, her younger brother, James, and elder half-sister, Prudence, are each around a billion dollars richer.

Money doesn’t compensate for a father who, in his mid-90s, decided to rip his family apart because he believed it was in the interests of his business. The Murdochs have never been a traditional family – one reason why their story is said to have inspired the power struggles and backstabbing in the acclaimed TV drama, Succession. But this time, the schism feels more permanent. And as one person put it to me, the TV show concluded too early by killing off Logan Roy: there was more drama to come.

‘James and Rupert will never patch up differences’

James Murdoch’s relationship with his father and older brother Lachlan appears irreconcilable. Earlier this year, he described his dad as a “misogynist” in an interview in US magazine The Atlantic, and referred to some of Rupert’s behaviour in the courtroom fight as “twisted”.

He is known to feel betrayed and angered by Rupert’s decision to force him, Elisabeth and Prudence formally to cut ties with Fox Corp and News Corp. Driven by fears over the more liberal direction they might want the companies to take after his death, the media mogul tried to change the terms of a trust that gave his four oldest children equal control when he dies.

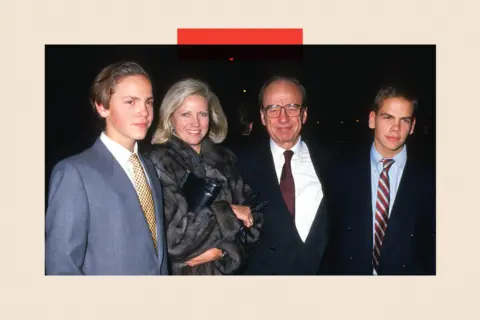

Ron Galella Collection via Getty Images

Ron Galella Collection via Getty ImagesLachlan, who Rupert had already chosen to run the business, is now – definitively – the only one who will take the reins after his father’s demise.

Lachlan and Rupert Murdoch actually lost the first round of their court fight. The trust had been set up in 1999, when Rupert divorced Anna, the mother of Lachlan, Elisabeth and James.

The judge ruled that changing it was in bad faith. But behind the scenes, the warring sides eventually came to an agreement. James, Elisabeth and Prudence agreed to sell their shares. They have accepted terms that include not being allowed to buy any equity in the family company in future.

“It’s a sad ending,” Claire Atkinson, whose biography of Rupert Murdoch will come out next year, told us on The Media Show.

“These kids worked in the business, they grew up in the business, and the press release said, ‘You can’t buy shares in this company,’ and effectively said, ‘Don’t let the door hit you on the way out.'”

She also told me: “This break is extremely permanent. It feels like James and Rupert will never patch up their differences.”

Lachlan Murdoch has been quoted as saying that the resolution is “good news for investors” and “gives us clarity about our strategy going forward”.

Ironically, his successful leadership of Fox Corp, where he’s been CEO since 2019 (he became chairman of Fox and also News Corp in 2023 when his father became chairman emeritus), made the deal more costly.

Getty Images

Getty ImagesFox Corp has seen its share price double under Lachlan and the Trump presidency has brought a ratings bonanza. It raised the amount he had to pay his siblings to get them out – a presumably unwelcome side effect.

Despite the payout, Atkinson says, “There is a fracture in the company and a fracture in the family.”

So where do the Murdochs go from here, privately and corporately?

Court battles, rifts and an ageing patriarch

Elisabeth and her half-sister Prudence are said to be concentrating on moving on.

Their father turned 94 in March, with the court battle in full swing. The sisters are mindful that he won’t be around forever and I am told they are hoping at some point to repair the rift.

Reuters

ReutersHowever much they have felt betrayed by him (and there is no doubt, they have felt it, very painfully), there’s an understanding of the dwindling number of years he has left.

But Christmas may still be too soon for reconciliation. Lachlan hosted his annual party for the Australian elite at his harbour-side Sydney home earlier this month. Fox Corp may operate out of the US, but he is said to prefer the laid-back nature of Australian life, even if the trade-off is business calls in the middle of the night because of the time difference, as well as a lot of flights.

Atkinson says he is popular and well-liked within the business. “The difficulty that Lachlan has is that he’s been in charge for years, but everybody is always going to project that every decision is Rupert’s. He’s never going to want to say, ‘Hey, that’s me,’ and so I think it’s a little hard to come out from Dad’s shadow.”

At the same time, Rodney Benson, professor of media, culture, and communication at New York University, says that while Rupert remains a presence in the company “what’s really unique about Lachlan’s approach, or what will be unique about his approach, won’t fully emerge”.

Lachlan’s ‘business over politics’ strategy

Fox News is the financial cash cow, which may explain Rupert Murdoch’s concerns that his children might have wanted to change its political affiliations.

Under Lachlan, there’s been a successful strategy to expand into digital and streaming, most notably the ad-supported video-on-demand service, Tubi.

In September, US President Donald Trump said Rupert and Lachlan Murdoch were expected to be part of a group of investors trying to buy TikTok in the US. On Thursday, TikTok parent company ByteDance announced to staff that it had signed an agreement to sell a portion of TikTok to a group of mostly US based investors. Lachlan and Rupert were not named as part of the deal.

Reuters

ReutersPresenting the Fox Corporation’s results for July to September, Lachlan said Tubi had achieved rapid revenue growth and growth in view time, confirming its position as the top premium advertising-based video-on-demand platform in the US.

“And I’m happy to say Tubi reached profitability this past quarter,” he added. “It’s a great milestone.”

He also said Fox News had maintained strong ratings throughout the quarter, cementing its status as the most-watched cable network in prime time, and leading to the highest advertising revenue for July-September quarter in Fox’s history.

Rupert Murdoch’s 70-year career saw him as “both an interventionist editor-in-chief figure and a political kingmaker”, according to Paddy Manning, an investigative journalist who wrote The Successor: The High-Stakes Life of Lachlan Murdoch. But he adds, “Lachlan is less of the journalist and powerbroker than his father, and more of a businessman.

Getty Images

Getty Images“If you look at the signature deals that Lachlan has made over his career, they have not been designed to increase his political influence. From digital real estate to sports betting to commercial radio to Tubi, Lachlan’s investment decisions are focused on the bottom line, not burnishing his political credentials.”

But Prof Benson suggests the significant debt the Murdoch businesses have taken on as part of the settlement with Lachlan’s siblings increases pressure to make profit, and therefore to pursue “politically sensationalistic… outrage journalism”.

“The proven way to be profitable in cable/streaming news is not by becoming more centrist and civil, it’s by becoming more extreme, more polarising, and more willing to stir outrage,” he says.

Rupert has had a hotline to major political figures for decades. In September he was on President Trump’s guestlist for the state banquet at Windsor Castle. I’m told he spent nearly two weeks in London and was in the News UK office most days.

While Lachlan now runs the company, his father is still very much involved. Rupert’s been described to me, at 94, as still “the sharpest person in the room” and a “phenomenon who loves papers and has ink in his veins”. His voice may be a little softer, but he is mentally as strong and influential as ever, I’m told.

AFP via Getty Images

AFP via Getty ImagesAt one point the editor of the Times introduced Rupert to a slightly startled young journalist on the newsdesk and asked him to show the boss the paper’s recently launched Live app and what it showed around reader engagement on specific stories.

Rupert also spoke to Fraser Nelson, the former Spectator editor now Times columnist, who usually sits at the open plan table in the office. They discussed the company’s pivot to video and the work Nelson had been trialling around short form video. Rupert also wanted to talk to his paper’s new star about whether Nigel Farage would end up in government.

A family ‘deeply divided’

Three months on from the family trust dispute settlement, Mr Manning claims that the Murdochs are “deeply divided”.

“While Lachlan works closely with his father, I understand he remains estranged from his elder siblings,” he alleges.

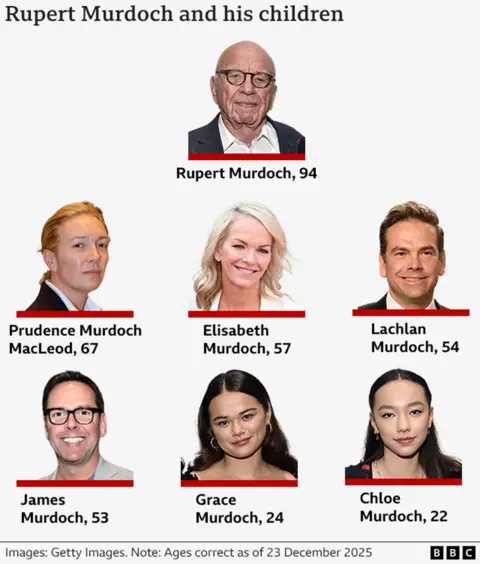

Rupert Murdoch and his children Lachlan, James, Elisabeth and Prudence were all approached for comment.

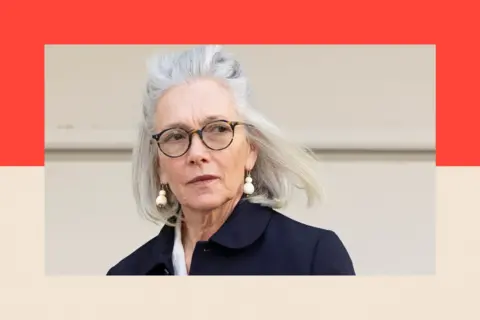

Presciently, Anna Murdoch – Lachlan, James and Elisabeth’s mother – predicted much of the fallout back in the 1980s.

In her novel Family Business, Anna, a journalist and author, wrote about the rise of a fictional newspaper dynasty and explored sibling rivalry, jealousy and how parental power can negatively impact family relationships. The plot of the book, published while her children were in their teens, follows how a newspaper owner’s children are shaped by a parent who turns them into competitors in a power struggle.

Getty Images

Getty ImagesA decade after it was published – by which time the pair had divorced and Rupert had married third wife Wendi Deng – Anna gave an interview to an Australian women’s magazine, during which she was asked which of her children would be best suited to take over from her ex-husband.

“Actually I’d like none of them to,” she said. “I think they’re all so good that they could do whatever they wanted really. But I think there’s going to be a lot of heartbreak and hardship with this [succession]. There’s been such a lot of pressure that they needn’t have had at their age.”

The family trust, agreed between Rupert and Anna as part of their divorce settlement, was her way of safeguarding her children’s futures, by ensuring they had equality after Rupert’s death. But that blew up – through a court fight in Nevada and a settlement.

And with that, relations with three of his six children may have blown up too – perhaps for good.

Top picture credits: Getty Images and Reuters

BBC InDepth is the home on the website and app for the best analysis, with fresh perspectives that challenge assumptions and deep reporting on the biggest issues of the day. You can now sign up for notifications that will alert you whenever an InDepth story is published – click here to find out how.

Business

Govt must monitor unfairly priced steel imports, says Tata Steel CEO TV Narendran – The Times of India

NEW DELHI: Govt must keep a watch on unfairly priced steel imports, Tata Steel MD and CEO TV Narendran told TOI in an interview, while adding that the price of the key industrial product is expected to rise in the domestic market in the current quarter. He also said that EU’s carbon border tax (CBAM) will have little impact on Tata Steel’s Indian operations and is a positive for its Europe business, as it levels the carbon cost for all suppliers selling into the region.Tata Steel CFO Koushik Chatterjee said the company managed to protect its margins in one of the toughest years for the steel industry in five years and that the India-EU FTA is an opportunity for Indian companies to transition into low-carbon technologies to export into the EU. Excerpts:PAT has jumped sharply year on year. How do you see the third quarter numbers?Chatterjee: The last three quarters’ consolidated numbers had an almost consistent EBITDA margin of about 15% in spite of very weak markets, especially in the second and the third quarter. It is attributable to the cost-takeout program that we announced in the beginning of the year, and we are almost on track, except in the Netherlands, where delays in the negotiations with the unions have pushed timing. What would have come by March will come now around June once the restructuring is completed. Our target has been to be in that zone of 15% EBITDA margin consolidated, which is essentially in the region of 22 to 24% for a standalone basis. With the Kalinganagar plant now commissioned almost fully and the downstream products mix also coming into play, India margins will look to expand. In the Netherlands we should see margin expansion because of consistent operating performance and two big regulatory impacts — CBAM, which will push the price up, and tariff quotas, which will come in from July. Overall, in one of the most challenging years in the last four or five years, we have been able to maintain this, we should be holding on to our cost gains and building on it. When the market provides that tailwind, we should be in a better position.Global and Indian steel prices have been weak. What is your outlook on margins for the next two quarters?Narendran: Steel prices seem to have hit its bottom in the last quarter. We are expecting steel prices to go up in India; realizations will be about Rs 2,200 higher per tonne for India for Tata Steel in the fourth quarter compared to the third. While the spot prices have started going up, the realizations quarter on quarter for us will be down about Rs 3,200 because of the mix, because we’re selling more volumes and some of the lower-price segments even though spot prices are up. Overall, we expect margins to be better in Q4. Volumes are also better for us in Q4 compared to Q3, by almost half a million tonnes and hopefully the momentum will carry on. We are watchful on coking-coal prices which have also gone up by about $50 in the last few weeks. The worst is behind us.Given India’s dependence on imported coking coal, are you seeing any structural relief on sourcing, or is cost volatility continuing?Narendran: Coking coal is not a very liquid market; it’s highly volatile depending on one-off events. If bad weather in Australia impacts ports, then coking coal prices shoot up. That’s a problem compared with iron ore, which is a much more liquid market for Tata Steel India. Most of the coal we import will be from Australia because that’s the best coal for us. The US trade deal opens up options from the US but those are not suitable for most of Tata Steel’s coal carbons because we use a technology called stamp charging for which Australian or Indian coal is better. The US coal is not so great… We buy some volumes for India where we use top-charged coal, coke-making technology at small volumes, but we buy coal from the US for the Netherlands. This will be a volatile market.On CBAM, how do you view the EU’s CBAM regulation and what impact will it have on your business?Narendran: CBAM is actually a carbon-equalization tax; it is less of a trade issue and more of a carbon-equalization tax. We operate in Europe, where we pay a carbon tax in Europe and CBAM ensures that anyone who sells in Europe pays the same carbon tax. So CBAM is positive for our European operation. We don’t sell much steel from India to Europe. So we are not impacted by CBAM significantly for the Indian operation.Indian steel volumes have been very strong. Which sectors are driving demand, and do you see any early signs of slowdown?Narendran: Indian steel demand has been strong. We’ve always said over the last few years that steel demand growth in India will be at a higher growth rate than the GDP growth rate because it’s investment-led growth. Earlier it used to be more consumption-led growth. So, if GDP was growing at 7%, steel demand would grow at 5%. Now when GDP is growing at 7%, we are seeing steel demand grow at 9-10%. We are seeing strong growth across sectors. Automotive is very strong. Construction is also continuing to pick up because of infrastructure spending. Some concerns have been payments from state governments; particularly the MSME sector gets impacted when projects’ payments come late, so liquidity has been a bit of a concern in the market. Otherwise, from a pure demand point of view, the Indian demand story has been great.How confident is Tata Steel in maintaining current utilisation levels at its Indian factories amid imports and rising competition?Narendran: We’ve always had among the highest capacity utilizations in the country. We are pretty much at 100% all the time, every year apart from the COVID year. Otherwise, we run full out unless there is a planned shutdown like blast-furnace refractory linings. Largely we are confident because we have a very strong franchise in the domestic market. Our exports are typically 5–10% of production because we are able to sell all that we produce in the domestic market. I don’t see that as a problem. We work well in advance of production to develop inroads in the market.How do you see the India-EU FTA impacting Tata Steel, given your international operations, and will it help collaboration on green steel?Chatterjee: One important thing in the FTA has been that CBAM has been kept as a carbon-equalisation measure because local players in the EU pay that carbon cost. CBAM itself is meant to trigger transition to green steel. We are seeing that in the Netherlands where we are involved and others of our peers are doing that and it may help Indian companies move towards a green-steel configuration especially those who want to export into the EU. To export into the EU you have to reduce your carbon footprint and modify technologies which will ensure CO2 levels go down. The carbon tax or the EU ETS tax will be a hindrance in exporting competitively into the EU. If the EU increases spending on defence, infrastructure and engineering, it can become an attractive market needing low-carbon steel. It is an opportunity for Indian companies to think about transiting into low-carbon technologies and making green steel if they have interest in exporting into the EU.How effective have recent safeguards by the Indian govt been in protecting the steel industry, and what more does the industry expect from the government?Narendran: The safeguard has been helpful. When it was announced, it was for six months, which created uncertainty; the notification ended in Nov and there was a period when it was not sure if it would get extended. That confirmation is helpful to give us long-term certainty. It’s been extended for another two years which is good. While we had originally asked for more safeguard, even this level is fine for the time being. Our ask of the government is always to keep a watch on unfairly priced imports. The steel sector is the biggest private-sector capital investor in the country and we shouldn’t be derailed by unfairly priced imports from countries and companies who are not making money at those prices. The second part is whenever there are trade complaints action should be taken fast because the damage is caused fast. The third part, which is already getting addressed in the budget, is to continue to spend on infrastructure because that not only helps demand for steel but also lowers the cost of doing business outside factory gates — logistics and transportation costs are important components of our costs. These are the areas where we can get help from the government, which we’re getting.What are Tata Steel’s top priorities over the next three years?Narendran: First, continued growth in India, not only in volume but also in terms of the right product mix. We will keep investing in downstream businesses. Second, transformation in Europe both in terms of financial performance in the UK as well as moving to greener process routes in the UK and the Netherlands. Third, in the Netherlands, where we are dealing with some challenges to our social licence to operate, we need to address those.There is a probe underway by the CCI against major steel players, including Tata Steel. What is your response, and have there been any discussions with the government?Narendran: We will follow due process. These are allegations being made and we have accessed the report and are reviewing it. From what we’ve seen, the commentary is more on steel prices moving up and down; steel prices reflect global prices and commodity movements like coking coal costs. It’s very open and transparent so we will make our submissions to the CCI. We will have the opportunity over the next few months and we feel we’ve done nothing wrong. Steel prices move up and down. We’ve also had the lowest steel prices in the last few three years so I don’t think anyone anywhere can control steel prices simply because it’s a global product and its price is determined by international factors. We’ll make a submission to the CCI and hopefully they will hear and appreciate our point of view.

Business

India adopts quota-based auto duty cuts, alcohol tariff relief under US pact; export access widens – The Times of India

Benchmarking its market access strategy to product sensitivity, India will grant quota-based duty concessions in the automobile sector while offering market access to alcoholic beverages under tariff reduction and minimum import price-based formulations under the trade pact with the United States, the government said on Monday, PTI reported. Under the agreement, tariffs on $30.94 billion of India’s exports will be reduced from 50 per cent to 18 per cent, while reciprocal tariffs on another $10.03 billion will be eliminated.

“This means a substantial share of Indian goods entering the US market will now face either sharply lower tariffs or completely duty-free access, significantly improving price competitiveness,” the government said.The government said $1.36 billion of Indian agricultural exports will receive zero additional US duty access. Key products include spices, tea, coffee, fruits, nuts and processed foods.

Sectoral gains across textiles, gems, agriculture

Sensitive sectors such as automobiles have been liberalised through a mix of quota and duty reduction mechanisms. According to an official, India is not granting any duty concessions on electric vehicles to the US.Medical devices have been placed under long and staggered phasing schedules, while precious metals and other sensitive industrial products are being managed through quota-based tariff lowering.“Alcoholic beverages have been offered under tariff reduction along with minimum import price-based formulations, consistent with India’s approach in other FTAs (free trade agreements),” it added.Listing sectoral gains, the government said tariffs on textile exports will be cut from 50 per cent to 18 per cent, while silk will get nil duty access, opening opportunities in the US textile market valued at $113 billion.Tariffs for the domestic gems and jewellery sector will also fall to 18 per cent, providing preferential access to the US market valued at $61 billion.“In addition, 0 per cent duty market access has been secured for major product categories including diamonds, platinum and coins, covering a US market of $29 billion,” it added.Key export segments expected to gain include cut and polished diamonds, lab-grown synthetic diamonds, coloured gemstones, synthetic stones and articles made of gold, silver and platinum.

Agri access structured by sensitivity, protection retained

India maintains a $1.3 billion trade surplus in agricultural trade with the US, with exports of $3.4 billion and imports of $2.1 billion in 2024, the government said.The United States will apply zero additional duty on Indian exports worth $1.36 billion. Beneficiary items include spices, tea, coffee, copra, coconut oil, cashew nuts, chestnuts, avocados, bananas, guavas, mangoes, kiwis, papayas, pineapples and mushrooms.Cereals such as barley and canary seeds, bakery products, cocoa and cocoa preparations, sesame and poppy seeds, and processed food products such as fruit pulp, juices and jams will also benefit.In line with India’s existing FTA approach, agricultural market access has been structured based on product sensitivity, including immediate duty elimination, phased elimination of up to 10 years, tariff reduction, margin of preference and tariff rate quota mechanisms.Highly sensitive agricultural sectors remain fully protected under an exemption category. These include meat, poultry, dairy products, GM food products, soyameal, maize and cereals.For select sensitive products, tariff reduction has been applied to maintain measured duty protection. Examples include plant parts, olives, pyrethrum and oil cakes.Certain highly sensitive items have been liberalised under tariff rate quotas (TRQs), allowing limited quantities at reduced duties. These include in-shell almonds, walnuts, pistachios and lentils.Phased tariff elimination of up to 10 years has been offered for certain intermediate food processing inputs sourced from multiple countries, including albumins, coconut oil, castor oil, cotton seed oil and plant derivatives.“Immediate duty elimination has been offered only for select non-sensitive products that are already liberalised under other FTAs,” it said.

Industrial goods and digital trade framework

For industrial goods, the agreement secures zero additional duty access for exports valued at $38 billion, the government said.India will get zero reciprocal duty access in key industrial categories including gems and diamonds, platinum and coins, clocks and watches, essential oils, inorganic chemicals, paper articles, plastics, wood products and natural rubber.Market access for American industrial goods has been structured strictly based on product sensitivity, combining immediate tariff elimination, phased reduction of up to 10 years and quota-based access.In digital trade, India’s digitally delivered services exports stood at $0.28 trillion in 2024, growing 10.3 per cent year-on-year.India ranks fifth globally in digitally delivered services exports and eleventh in imports, while the US ranks first in both categories.“A structured digital trade framework between the two countries reduces regulatory uncertainty, lowers compliance friction and facilitates smoother cross-border service delivery,” the government said.

Business

Beauty brand Barry M bought out of administration by Warpaint

High street beauty brand Barry M has been bought out of administration by cosmetics firm Warpaint for £1.4 million.

The acquisition includes the brand and intellectual property, but not Barry M’s factory and staff.

London-listed Warpaint, which owns make-up brands W7 and Technic, said it expects the move to help it grow into key retail channels in the UK.

Barry M has stands in more than 1,300 stores including Superdrug, Boots, Sainsbury’s and Tesco, as well as selling products online.

The British brand is known for its colourful nail varnishes and affordable make-up, positioned as vegan and cruelty-free, having grown to become staples of the UK high street.

It was founded by Barry Mero in 1982, with the leadership of the business passed down to his don Dean Mero after his death in 2014.

The brand moved to appoint administrators last year after warning over “geopolitical issues” and rising prices which it said were absorbed into its cost base.

It nonetheless generated a £17.4 million turnover and a £172,000 pre-tax profit for the year to the end of February 2024, according to its most recently published results.

It had more than 120 staff on average during the year, with most employed at its manufacturing site in London.

Warpaint, whose products are also stocked in high street retailers, told investors that earnings for the 2025 financial year were expected to come in at around £22 million.

But it said the collapse of beauty retailer Bodycare last year and subsequent closure of all its stores negatively impacted the group, as it was a significant retail customer of its brand Technic.

-

Entertainment3 days ago

Entertainment3 days agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Tech1 week ago

Tech1 week agoHow to Watch the 2026 Winter Olympics

-

Business1 week ago

Business1 week agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

-

Business1 week ago

Business1 week agoNew York AG issues warning around prediction markets ahead of Super Bowl

-

Entertainment1 week ago

Entertainment1 week agoThe Traitors’ winner Rachel Duffy breaks heart with touching tribute to mum Anne

-

Tech1 week ago

Tech1 week agoI Tested 10 Popular Date-Night Boxes With My Hinge Dates

-

Fashion1 week ago

Fashion1 week agoCanada could lift GDP 7% by easing internal trade barriers

-

Business1 week ago

Business1 week agoInvestors suffer a big blow, Bitcoin price suddenly drops – SUCH TV