Business

IMF relief sought on flood losses | The Express Tribune

ISLAMABAD:

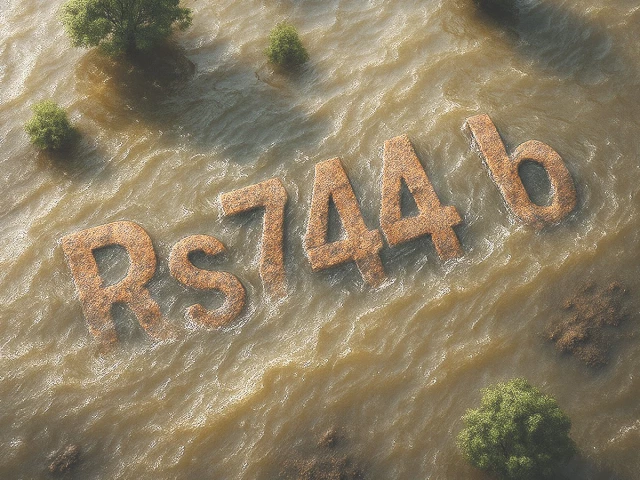

Pakistan on Wednesday informed the International Monetary Fund (IMF) that its economy suffered Rs744 billion in losses due to floods, with 60% of the damage occurring in the agriculture sector and again sought adjustment of these losses against the programme targets.

The preliminary damage assessment has been shared with the IMF, as Finance Minister Muhammad Aurangzeb confirmed that the review talks concluded with the global lender on Wednesday. The talks were aimed at securing two loan tranches totalling around $1.2 billion under separate loan programmes.

Aurangzeb said that the IMF had shared the Memorandum for Economic and Financial Policies (MEFP) and that the Staff-Level Agreement for completing the second review would be announced after further discussions. The MEFP is a set of policy documents agreed upon by both sides. “There has been a broader consensus with the IMF,” said the finance minister during an informal discussion outside the Q Block with journalists from two media outlets.

Sources said that towards the conclusion of the talks, discussions focused on adjusting the impact of the floods against the programme’s targets of primary budget surplus and provincial cash surplus. The finance ministry also briefed the prime minister in this regard, they added.

The IMF had set the primary budget surplus target at Rs3.1 trillion and had earlier indicated roughly Rs500 billion adjustments within the budget to offset the flood impact. Sources said that the finance ministry wanted the IMF to allow adjustments against the target to the extent of the actual damages.

According to preliminary findings shared with the IMF, the economy sustained Rs744 billion in losses. After adjusting these losses, the economic growth is now projected to remain at 3.5%, against the annual target of 4.2%. The revised growth projection is still about 1% higher than the World Bank’s recent projection of 2.6%, which also cited flood damage.

Of the Rs744 billion losses, Punjab bore Rs632 billion, according to initial assessments. Khyber-Pakhtunkhwa (K-P) reported Rs51.3 billion in losses, followed by Sindh with Rs32.2 billion, another Rs12.6 billion in K-P, and Rs6.8 billion in Balochistan.

Flooding in three rivers and flash rains in the country’s upper regions inundated large areas, forcing the evacuation of 6.5 million people.

The projected Rs744 billion losses are double the earlier Rs370 billion estimate shared with the IMF.

Details show the agriculture sector sustained Rs439 billion in losses, roughly 60% of the total. Almost all these were crop-related. As a result, agriculture growth is now projected at 3%, compared to the 4.5% target. Growth in the crops sub-sector is expected to fall below 1%, against the target of 5.4%. Crops on 3.3 million acres and 22,841 livestock were affected.

Roughly one-third of the cotton crop was destroyed, with output now projected at 7.2 million bales, a reduction of up to 3.4 million bales, as per preliminary estimates.

Authorities estimated that 12.6% of the rice crop was damaged, with expected production at 8.9 million tonnes, representing a loss of 600,000 to 1.2 million tonnes. Sugarcane production has been revised to 79 million tonnes, reflecting losses between 1.3 million and 3.3 million tonnes, or 4% of budget estimates. Maize production is projected to decline by 13%, with output capped at 9.2 million tonnes.

The industrial sector sustained Rs48 billion in losses, with its annual growth rate revised slightly down to 4.1%, according to the assessment.

The services sector is projected to have suffered the second-highest losses of Rs257 billion, reducing its growth forecast by 0.4% to 3.6%. Within services, the transport and storage subsector incurred the highest loss, Rs150 billion, cutting its growth rate almost by half to 1.9%. Real estate activities recorded Rs55 billion in losses, while wholesale and trade sectors lost Rs40 billion.

Preliminary assessments showed that 229,763 houses were damaged, 790 bridges destroyed, and 866 water infrastructure systems washed away. About 2,811 kilometres of roads were damaged.

In Punjab alone, 213,097 houses were damaged, followed by 6,370 in Balochistan, 3,332 in Sindh, 3,222 in K-P, 2,417 in Azad Kashmir, and 1,260 in Gilgit-Baltistan. In Punjab, 1,216 kilometres of roads and 462 bridges were destroyed, while 5,467 livestock perished.

A total of 1,037 deaths and 1,067 injuries were reported nationwide. The highest number of deaths, 509, occurred in K-P, followed by 322 in Punjab, 90 in Sindh, 38 each in Balochistan and Azad Jammu and Kashmir, 31 in Gilgit-Baltistan, and nine in Islamabad.

Floodwaters also affected eight mines and 1,297 commercial shops. About 2,267 educational institutions, 243 health facilities, and 129 public buildings were damaged. The floods disrupted normal life in 70 districts, affecting 6.5 million people, of whom four million were relocated to safer areas.

Business

Netflix ditches deal for Warner Bros. Discovery after Paramount’s offer is deemed superior

Netflix is walking away from a deal to buy Warner Bros. Discovery’s studio and streaming assets after the WBD board on Thursday deemed a revised bid by Paramount Skydance to be a superior offer.

Earlier this week, Paramount raised its bid to buy the entirety of WBD to $31 per share, up from $30 per share, all cash. It was the latest amendment to Paramount’s multiple offers in recent months — and since moving forward with a hostile bid to buy the company — and it’s now unseated a deal between WBD and Netflix to sell the legacy media company’s studio and streaming businesses for $27.75 per share.

Last week, Netflix granted WBD a seven-day waiver to reengage with Paramount, resulting in the higher bid. Paramount’s offer is for the entirety of WBD, including its pay-TV networks, such as CNN, TBS and TNT.

Netflix had four business days to make changes to its own proposal in light of Paramount’s superior bid, the WBD board said in a statement Thursday.

Instead, the decision by the streaming giant to walk away puts a pin in a drawn-out saga that saw amended offers from both bidders.

Netflix stock spiked 10% in extended trading Thursday, while Paramount stock gained 5%. Shares of Warner Bros. Discovery fell 2%.

“The transaction we negotiated would have created shareholder value with a clear path to regulatory approval,” Netflix co-CEOs Ted Sarandos and Greg Peters said in a statement. “However, we’ve always been disciplined, and at the price required to match Paramount Skydance’s latest offer, the deal is no longer financially attractive, so we are declining to match the Paramount Skydance bid.”

The latest Paramount bid included a $7 billion breakup fee in the event the proposed merger doesn’t win regulatory approval. The company also agreed to pay the $2.8 billion breakup fee that WBD would owe Netflix if that deal didn’t go through.

Sarandos told CNBC’s Julia Boorstin in an interview last week that Netflix granted WBD the waiver to reopen Paramount talks in order to give shareholders clarity.

“Paramount had been making a ton of noise, flooding the zone with confusion for shareholders … including floating all these hypothetical offers and talking directly to the shareholders and bypassing the Warner Bros. Discovery board,” Sarandos said at the time. “So we’ve given the opportunity to get those shareholders exactly what they deserve, which is complete clarity and certainty.”

However, Sarandos had fallen short of commenting on whether Netflix would up its own offer to match a revised Paramount bid.

And Thursday, Sarandos attended meetings at the White House to discuss the potential tie-up.

“Warner Bros. is a world-class organization, and we want to thank David Zaslav, Gunnar Wiedenfels, Bruce Campbell, Brad Singer and the WBD Board for running a fair and rigorous process,” the Netflix co-CEOs said in their statement.

“We believe we would have been strong stewards of Warner Bros.’ iconic brands, and that our deal would have strengthened the entertainment industry and preserved and created more production jobs in the U.S.,” they said. “But this transaction was always a ‘nice to have’ at the right price, not a ‘must have’ at any price.”

Business

Lawsuit over $21 million donor-advised fund highlights risks of DAF giving

Ridvan_celik | Istock | Getty Images

A version of this article first appeared in CNBC’s Inside Wealth newsletter with Robert Frank, a weekly guide to the high-net-worth investor and consumer. Sign up to receive future editions, straight to your inbox.

With donor-advised funds gaining popularity as a vehicle for the wealthy to give back, risks and potential conflicts of interests are emerging — and being put on display in a lawsuit over a family’s $21 million charitable fund.

Philip Peterson, a 63-year-old Kansas resident, filed suit in January alleging that the nonprofit that administers his family’s donor-advised fund has refused to communicate with him and has failed to make charitable grants that he has recommended since early 2024. The suit, filed in Colorado federal court, alleges the Christian nonprofit, called WaterStone, cut off his access to information about the account and that he doesn’t know how the fund has fared since the end of 2023, when it had $21 million in assets.

Counsel for WaterStone, founded as the Christian Community Foundation, said in a statement that the Colorado Springs nonprofit has respected the wishes of Peterson’s late father, who originally created the fund in 2005 and died in 2019.

The case sheds light on the growing uptake, and dangers, of donor-advised funds, or DAFs, which have quickly become one of the most dominant forces in philanthropy. Americans donated nearly $90 billion to DAFs in 2024, per the most recent annual report from the DAF Research Collaborative. According to the most recent data available, DAFs held $326 billion combined in assets in 2024.

For Americans looking to give back and save on taxes, DAFs are marketed as a flexible and simple way to do so, often described as charitable saving accounts or credit cards. Instead of writing a check to a nonprofit, donors contribute cash and other assets to a DAF. While the tax deduction is immediate, the funds can be allocated to charities later.

DAFs, unlike private foundations, are not required to distribute assets within a given timeframe, a common criticism among opponents who say DAFs are wealth hoarding vehicles.

The Peterson case offers a cautionary tale on the tradeoffs – especially when it comes to control. While donors are able to recommend how the funds are distributed to charity, the assets are legally controlled by the organizations that administer the DAF on their behalf. Though these organizations, also known as sponsors, typically respect their donors’ wishes, donors have little recourse if they do not.

“It’s sold to the public as, ‘This is your account, and you can decide where it goes, and you can move it, and you maintain full control.’ But if you don’t give up dominion and control, you don’t get the tax benefits,” said Ray Madoff, tax scholar and professor at Boston College Law School. “There’s a disconnect between the legal rules that govern it and the understanding of the parties. And this case is a perfect example of it.”

How much to give

Peterson told Inside Wealth that the rift with WaterStone started with a disagreement over how much to distribute.

In early 2024, Peterson alleges, WaterStone CEO Ken Harrison told him that the organization was going to keep the fund’s principal in perpetuity and only make grants from investment income. Peterson said he did not agree to the proposal as this would not allow the fund to make its customary annual grants of between $2.3 million and $2.5 million.

He further alleges that in March 2024, after he told Harrison over Zoom that he wanted to move the DAF to another sponsor, Harrison told him never to contact WaterStone again and abruptly ended the call.

Now Peterson is suing to assert his advisory privileges and regain access to the DAF, which was started by his late father, Gordon Peterson, a real estate investor and devout Christian, to support evangelical Christian causes. Peterson ultimately seeks the court to compel WaterStone to transfer the DAF to another organization so he can bring the fund’s giving back up to speed.

He said he requested WaterStone make a $1 million grant in 2024 but does not know if that grant – or if any grants – were issued that year. In 2025, WaterStone notified Peterson it would permit a $400,000 distribution from the fund, he said.

“I made a promise to my father. I promised him that if I was the remaining person on the account that I would direct the funds as I knew that he would 100% approve,” he said. “I want to be a man of my word.”

Philip Peterson, left, pictured with his father Gordon in 2015. Gordon Peterson passed away in 2019.

Courtesy of Philip Peterson

WaterStone declined to comment on specifics of Peterson’s allegations. The deadline for WaterStone to answer the complaint in court or move to dismiss it is mid-March.

“WaterStone has consistently carried out the articulated wishes of the donor since the donor advised fund in question was established,” WaterStone’s legal counsel said in a written statement, referring to Peterson’s father. “The plaintiff in this case is not the donor.”

Andrew Nussbaum, Peterson’s lawyer, said that WaterStone helped Gordon Peterson appoint his wife, Ruth, and son Philip as co-advisors to the DAF before he died. Ruth Peterson died in 2021, leaving Philip Peterson as the sole successor-advisor. Prior to 2024, WaterStone granted Philip Peterson’s grant requests, Nussbaum said.

Nussbaum said the lawsuit could set a chilling precedent if the court upholds WaterStone’s argument that designated successors do not have advisory privileges.

“If WaterStone is right, you’re talking about billions of dollars being beyond any kind of legal reach of the original donor-advisors or their successors to have any oversight related to the funds,” Nussbaum said.

Moreover, Peterson said he believes WaterStone has not honored his father’s wishes. He alleges that WaterStone has delayed or denied his grant recommendations even though they met the mission statement written by his father, which included a list of approved charities.

“I can tell you this: My dad would never have created a donor-advised fund if he knew that this was going to be the outcome. He felt very passionately about this,” he said.

DAF trade-offs

Law professor and DAF critic Roger Colinvaux said in his view, donors who want control of DAF assets are trying to have their cake and eat it too.

“Whether you like DAFs or not, the DAF sponsor is an independent charity. It’s an independent entity, and its duties are not to the donor,” said Colinvaux, professor at the Columbus School of Law at the Catholic University of America. “If the plaintiff wanted the sort of control that the plaintiff seems to want, as evidenced in the complaint, there’s a structure for that, and that’s a private foundation.”

Dana Brakman Reiser, professor at Brooklyn Law School, cautioned that Peterson’s story is a rare scenario. She said the biggest DAF sponsors like Fidelity Charitable and Schwab Charitable (now DAFgiving360) are affiliated with financial institutions and generally inclined to keep donors happy.

“It’s in their interest as long as honoring the donor’s request is not going to get the sponsor in trouble,” she said. Brakman Reiser added that the IRS prohibits using DAF assets to buy gala tickets or pay college tuition.

Still, the interests of sponsors and donor-advisors are rarely perfectly aligned.

Sponsors typically collect fees for managing DAF assets, creating an inherent financial incentive to disburse fewer assets, according to Chuck Collins, the director of the Program on Inequality and the Common Good at the Institute for Policy Studies, a progressive think tank. While community foundations pioneered the DAF model, they are now competing with larger commercially-affiliated sponsors for donors’ dollars, he added.

“More and more, they are having to compete with the commercial DAFs like Fidelity that have very low overhead and don’t take much in the way of fees. And so what’s the business model for a community foundation where, you know, 80% of the donations coming in are from people wanting to create DAFs?” he said. “In reality, their business model now depends on people parking their assets for longer periods of time.”

While Peterson’s case is unusual, it’s not the first legal challenge surrounding DAFs.

In 2018, a hedge fund couple sued Fidelity Charitable, contending the sponsor broke an agreement to liquidate their donated shares gradually and instead sold off 1.93 million shares, a position originally worth $100 million, in a matter of hours. Fidelity Charitable argued that it had followed the law and the case was ruled in their favor.

In another noteworthy debacle, in 2009, a Virginia-based charity called the National Heritage Foundation wiped out 9,000 DAFs worth $25 million combined to pay out creditors after it filed for bankruptcy.

Giving directly to charity doesn’t necessarily guarantee the assets will be used to the donor’s intent. But adding an intermediary into the equation adds another layer of complexity.

The handful of lawsuits filed by donor-advisors over how DAF assets are spent or invested have thus far been largely unsuccessful in court.

In short, according to Colinvaux, courts have upheld that donors have ceded any control in order to qualify for the tax break. If donors had the right to control assets — as opposed to the privilege to advise — they would not be able to claim a deduction, he said.

Nussbaum said Peterson’s case is different as it focuses on his rights to advise grants rather than control over how the assets are investments.

Peterson said he tried to resolve the dispute with Waterstone for about two years before going to court. While he knows his suit faces considerable odds, he said he felt he had no choice.

“People put an enormous amount of trust in these companies, and we’re hopefully going to find out what these companies can and can’t do,” he said. “It may have a big effect on the industry, and I don’t want to be that guy. All I want to do is to be able to continue my father’s legacy.”

Correction: This story has been updated to correct the IRS limitations on use of DAF assets.

Business

Mandelson referred to EU anti-fraud agency over Epstein emails

The European Commission says it is assessing whether the peer breached its code of conduct while its trade envoy.

Source link

-

Tech1 week ago

Tech1 week agoA $10K Bounty Awaits Anyone Who Can Hack Ring Cameras to Stop Sharing Data With Amazon

-

Fashion6 days ago

Fashion6 days agoICE cotton ticks higher on crude oil rally

-

Business6 days ago

Business6 days agoUS Top Court Blocks Trump’s Tariff Orders: Does It Mean Zero Duties For Indian Goods?

-

Business6 days ago

Business6 days agoEye-popping rise in one year: Betting on just gold and silver for long-term wealth creation? Think again! – The Times of India

-

Entertainment5 days ago

Entertainment5 days agoViral monkey Punch makes IKEA toy global sensation: Here’s what it costs

-

Sports6 days ago

Sports6 days agoBrett Favre blasts NFL for no longer appealing to ‘true’ fans: ‘There’s been a slight shift’

-

Entertainment6 days ago

Entertainment6 days agoThe White Lotus” creator Mike White reflects on his time on “Survivor

-

Sports5 days ago

Sports5 days agoKansas’ Darryn Peterson misses most of 2nd half with cramping