Business

India-EU FTA finalised: Top 15 frequently asked questions on trade deal answered – The Times of India

India-EU FTA sealed: India and the European Union on Tuesday announced the conclusion of a free trade agreement that is widely being described as the “mother of all deals”. The deal comes at a time of heightened global uncertainty and trade disruptions driven largely by Donald Trump’s tariff policies. Calling it the largest FTA India has ever signed, Prime Minister Narendra Modi said the landmark pact was finalised following summit-level discussions with European Commission President Ursula von der Leyen and European Council President Antonio Costa, who represent the 27-member bloc.“This is not just a trade agreement. This is a new blueprint for shared prosperity,” Modi said in a media statement, underlining the broader strategic significance of the accord. Alongside the trade pact, the two sides also formalised a strategic defence partnership and concluded a mobility agreement, reinforcing cooperation beyond commerce.Costa said the agreement marked the start of a “new chapter” in India–EU relations, spanning trade, security and people-to-people engagement. Emphasising its scale, he noted that trade agreements strengthen a rules-based economic system and foster shared growth, adding that the pact ranks among the most ambitious ever signed. Von der Leyen echoed the sentiment, saying, “We delivered the mother of all deals.”

India-EU FTA: FAQs Answered

What does the India-EU FTA mean for the two economic blocks? Here are the top FAQs answered:1. Why has the EU negotiated a Free Trade Agreement (FTA) with India?The deal will strengthen economic and political ties between the world’s two largest democracies at a time of rising geopolitical tensions and global economic challenges.India is the world’s fourth-largest economy with the world’s largest population. Despite this, EU exports there are relatively low compared to our exports elsewhere. This is due to very high tariffs amongst others.The deal will reduce tariffs and administrative burdens, making trading easier, cheaper and faster. This will help EU companies and farmers export more. EU exports to India already support 800,000 European jobs and the export growth can contribute to even more.2. How is the agreement going to affect EU exports? The agreement is expected to double EU exports to India. Additionally, enhanced access to the Indian services market, particularly in financial services, maritime services, and other key sectors, will open new business opportunities and foster job creation.3. What are the key benefits for EU exporters under this agreement?

- Tariffs on over 90% of EU goods exports will be eliminated or reduced.

- Saving up to €4 billion per year in duties on European products.

- Competitive advantage for EU exporters, with biggest trade opening India has given to any trade partner.

- Privileged access to India for EU service providers in key areas financial services and maritime services.

- Simplification of customs procedures to make exports quicker and easier.

- Protection of EU intellectual property such as trademarks.

- A dedicated chapter for small EU businesses.

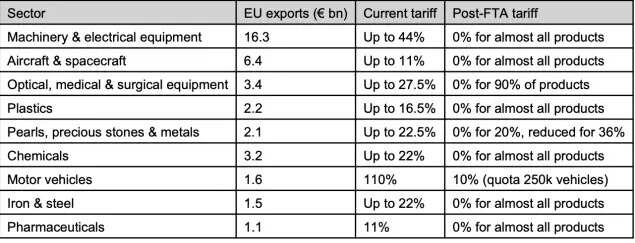

4. How does the agreement benefit EU industry? India will grant the EU tariff reductions that none of its other trading partners have received, dramatically improving market access for EU exports. For example, tariffs on cars will gradually go down from 110% to 10% with a quota of 250,000 vehicles a year. High tariffs of up to 44% on machinery, 22% on chemicals and 11% on pharmaceuticals will be mostly eliminated.Examples for EU industrial sectors that will benefit:

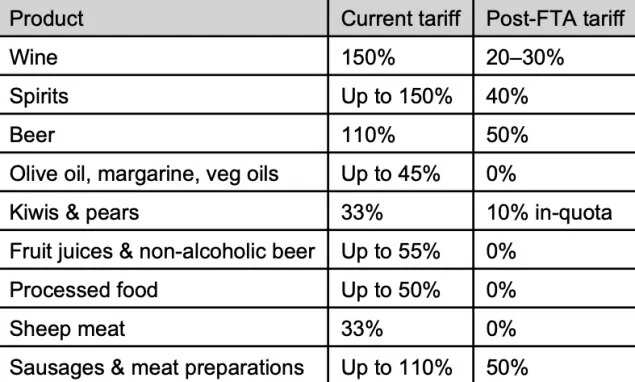

5. How does the agreement benefits EU farmers?The agreement removes or reduces often prohibitive tariffs (over 36% on average) on EU exports of agri-food products, opening a massive market to European farmers. Sensitive European agricultural sectors such as beef, sugar or rice will not be liberalised at all.Examples of EU agri-food sectors that will benefit:

The EU and India are currently negotiating a separate agreement on Geographical Indications (GIs), which will help traditional EU farming products sell more in India, by removing unfair competition in the form of imitations.6. How will the agreement help EU service providers? The agreement will grant EU companies privileged access to the Indian services market, including key sectors such as financial services and maritime services. It has the most ambitious commitments on financial services by India in any trade agreement, going beyond what they have given to other partners.7. How will the agreement help small businesses? The deal has a dedicated chapter to help small businesses. They will be able to easily access all information on doing and setting up business in the EU and India. SME contact points will work on making trading easier for small companies. The tariff reductions, removal of regulatory barriers, transparency, stable and predictable rules will help companies import-export in a cheaper, simpler and more effective way.8. How will the agreement promote sustainable trade? Dedicated sustainability provisions will enhance environment and climate protection, promote the protection of workers’ rights and support women’s empowerment, strengthen dialogue and cooperation, ensure effective implementation mechanism.9. How will the agreement protect workers’ rights and women’s empowerment? The agreement requires respect for the core International Labour Organisation principles and includes legally binding commitments on issues such as decent working conditions, labour inspection, and responsible business conduct. It contains provisions on UN and ILO conventions advancing women’s economic empowerment and gender equality.10. How will the agreement support the green transition?Both the EU and India commit to work together on climate change issues and the sustainable management of natural resources and to work towards implementing agreements such as the Paris Agreement, the Convention on Biological Diversity and the Convention on International Trade in Endangered Species of Wild Fauna and Flora.11. How will the sustainability commitments in the agreement be enforced?Many of the commitments on Trade and Sustainable Development are legally binding and enforceable through a dedicated consultation mechanism. The mechanism will provide an avenue to address labour, environmental and gender equality issues in a sustainable and inclusive matter, so that improvement is achieved on the ground, and not just on paper.12. How will the deal avoid that products of non-Indian origin are imported into the EU through India just to benefit from the tariffs?The EU and India have agreed rules of origin that ensure that only products that have been significantly processed in one of the parties can benefit from the tariff preferences of the agreement. This will help avoid, that other countries simply export to India and reexport to the EU benefit of the tariffs.13. What does the FTA do to cut red tape?The EU and India agreed simplified procedures, to maintain a transparent and predictable regulatory environment and ensure quicker release of goods at customs. These will all make actual exporting/importing easier, quicker and cheaper. We also agreed with India to deepen cooperation on supply chain security and to strengthen risk management and controls at the EU border.14. How does the deal protect EU health and safety?All imports from India to the EU will continue to be subject to the EU’s strict health and product safety rules, with no exception. The EU is ensuring compliance through controls. Furthermore, the deal creates a framework to cooperate on strengthening policies and defining programs that contribute to the development of sustainable, inclusive, healthy and resilient food systems and to jointly engage in the transition towards sustainable food systems.15. How does the agreement promote digital trade?The chapter on digital trade contributes to a predictable, secure, and fair digital trade environment. It provides rules that build consumer trust and ensure legal certainty for business and support innovation while maintaining the right to regulate for public policy, privacy, and security and deepening EU-India cooperation in the digital economy.16. How does the agreement ensure the protection of intellectual property?The agreement provides a high level of protection and enforcement of intellectual property rights, including with respect to copyright, trademarks, designs, protection of trade secrets and undisclosed information, plant varieties. It also requires measures, procedures and remedies to ensure the enforcement of intellectual property rights.17. How does the deal help address disagreements on trade?The so-called “dispute settlement” mechanism will help avoid or settle efficiently any disagreement concerning the agreement. Independent panels will decide on the disputes. A pre-established list of experts will ensure that panels can start working quickly. Panel reports will be binding and can be enforced through suspension of concessions. All procedures and hearing will be fully transparent. Mediation is also possible, making the process even quicker.18. What needs to happen for the deal to start working?Here are the steps the EU still needs to take:

- Publish negotiated draft texts

- Legal revision and translation into all official EU languages

- Propose the agreement to the Council for the signature and conclusion

- Adoption by the Council

- Signing of the agreement between the EU and India

- European Parliament’s agreement to the deal

- The Council’s decision on concluding the deal

Once India also ratifies the Agreement, it can enter into force.

Business

Education Budget 2026 Live Updates: What Will The Education Sector Get From FM Nirmala Sitharaman?

Union Education Budget 2026 Live Updates: Union Finance Minister Nirmala Sitharaman will present the Union Budget 2026–27 on February 1, with a strong focus expected on the Education Budget 2026, a key area of interest for students, teachers, and institutions across the country.

In the previous budget, the Bharatiya Janata Party government announced plans to add 75,000 medical seats over five years and strengthen infrastructure at IITs established after 2014. For 2025, the Centre had earmarked Rs 1,28,650.05 crore for education, a 6.65 percent rise compared to the previous year.

Meanwhile, the Economic Survey 2025–26, tabled in the Parliament of India, points to persistent challenges in school education. While enrolment at the school level is close to universal, this has not translated into consistent learning outcomes, especially beyond elementary classes. The net enrolment rate drops sharply at the secondary level, standing at just over 52 per cent.

The survey also flags concerns over student retention after Class 8, particularly in rural areas. It notes an uneven spread of schools, with a majority offering only foundational and preparatory education, while far fewer institutions provide secondary-level schooling. This gap, the survey suggests, is a key reason behind low enrolment in higher classes.

Stay tuned to this LIVE blog for all the latest updates on the Education Budget 2026 LIVE.

Business

LPG Rates Increased After OGRA Decision – SUCH TV

The Oil and Gas Regulatory Authority (Ogra) has increased the price of liquefied petroleum gas (LPG). According to a notification, the price of LPG has risen by Rs6.37 per kilogram. Following the increase, the price of a domestic LPG cylinder has gone up by Rs75.21. The revised prices have come into effect immediately.

The rise in LPG prices has added to the inflationary burden on household consumers.

Business

Budget 2026: Fiscal deficit, capex, borrowing and debt roadmap among key numbers to track – The Times of India

Finance Minister Nirmala Sitharaman is set to present her record ninth straight Union Budget, with markets closely tracking headline numbers ranging from the fiscal deficit and capital expenditure to borrowing and tax revenue projections, as India charts its course as the world’s fastest-growing major economy.The Budget will be presented in a paperless format, continuing the practice of recent years. Sitharaman had, in her maiden Budget in 2019, replaced the traditional leather briefcase with a red cloth–wrapped bahi-khata, marking a symbolic shift in presentation.Here are the key numbers and signals that investors, economists and policymakers will be watching in the Union Budget for 2025-26 and beyond:

Fiscal deficit

The fiscal deficit for the current financial year (FY26) is budgeted at 4.4 per cent of GDP, as reported PTI. With the government having achieved its consolidation goal of keeping the deficit below 4.5 per cent, attention will turn to guidance for FY27. Markets expect the government to indicate a deficit closer to 4 per cent of GDP next year, alongside clarity on the medium-term debt reduction path.

Capital expenditure

Capital spending remains a central pillar of the government’s growth strategy. Capex for FY26 is pegged at Rs 11.2 lakh crore. In the upcoming Budget, the government is expected to continue prioritising infrastructure outlays, with a possible 10–15 per cent increase that could take capex beyond Rs 12 lakh crore, especially as private investment sentiment remains cautious.

Debt roadmap

In her previous Budget speech, the finance minister had said fiscal policy from 2026-27 onwards would aim to keep central government debt on a declining trajectory as a share of GDP. Markets will look for a clearer timeline on when general government debt-to-GDP could move towards the 60 per cent target. General government debt stood at about 85 per cent of GDP in 2024, including central government debt of around 57 per cent.

Borrowing programme

Gross market borrowing for FY26 is estimated at Rs 14.80 lakh crore. The borrowing number announced in the Budget will be closely scrutinised, as it signals the government’s funding needs, fiscal discipline and potential impact on bond yields.

Tax revenue

Gross tax revenue for 2025-26 has been estimated at Rs 42.70 lakh crore, implying an 11 per cent growth over FY25. This includes Rs 25.20 lakh crore from direct taxes—personal income tax and corporate tax—and Rs 17.5 lakh crore from indirect taxes such as customs, excise duty and GST.

GST collections

Goods and Services Tax collections for FY26 are projected to rise 11 per cent to Rs 11.78 lakh crore. Projections for FY27 will be keenly watched, especially as GST revenue growth is expected to gather pace following rate rationalisation measures implemented since September 2025.

Nominal GDP growth

Nominal GDP growth for FY26 was initially estimated at 10.1 per cent but has since been revised down to about 8 per cent due to lower-than-expected inflation, even as real GDP growth is pegged at 7.4 per cent by the National Statistics Office. The FY27 nominal GDP assumption—likely in the 10.5–11 per cent range—will offer clues on the government’s inflation and growth outlook.

Spending priorities

Beyond the headline aggregates, the Budget will also be scanned for allocations to key social and development schemes, as well as spending on priority sectors such as health and education.Together, these numbers will shape expectations on fiscal discipline, growth momentum and policy support as India navigates a complex global economic environment.

-

Business1 week ago

Business1 week agoSuccess Story: This IITian Failed 17 Times Before Building A ₹40,000 Crore Giant

-

Business1 week ago

Business1 week agoSilver ETFs Jump Up To 10%, Gold ETFs Gain Over 3% On Record Bullion Prices

-

Tech1 week ago

Tech1 week agoRuckus gears up for networking partnership with TGR Haas F1 Team | Computer Weekly

-

Fashion1 week ago

Fashion1 week agoSouth Korea tilts sourcing towards China as apparel imports shift

-

Sports1 week ago

Sports1 week agoTransfer rumors, news: Saudi league eyes Salah, Vinícius Jr. plus 50 more

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment1 week ago

Entertainment1 week agoTrump touts ‘total access’ Greenland deal as Nato asks allies to step up

-

Entertainment1 week ago

Entertainment1 week agoTikTok seals deal for new US joint venture to avoid American ban