Business

‘Indian aviation may lose Rs 18,000 cr this fiscal, up from Rs 5600 in FY25:’ ICRA – The Times of India

NEW DELHI: Credit rating agency ICRA has projected a sharp rise in India aviation industry’s losses to Rs 17,000-18,000 crore in FY2026, compared to Rs 5,600 crore in FY2025, due to multiple factors like slowing domestic traffic growth, increase in jet fuel prices and the depreciating rupee. Additionally, 133 aircraft of Indian carriers — representing 15-17% of the total capacity — are grounded for a number of reasons that puts supply side pressure too.Calendar year 2025 is seen as one of the worst years for Indian aviation due to the tragic AI 171 Ahmedabad crash, IndiGo schedule collapse, Delhi ATC software issue and many other events.“The Indian aviation sector is under sustained financial and operational pressure, with growth momentum moderating and industry losses widening…. due to operational disruptions, elevated forex losses, higher cost structures and slowing passenger traffic growth,” ICRA said.Domestic air passenger traffic in December 2025 declined by 3.9% YoY to 143.4 lakh passengers, and fell 5.9% sequentially from November 2025. For the full year, ICRA now expects FY2026 domestic air passenger traffic growth of just 0–3%, reaching 165–170 million, revised downward from earlier estimates of 4–6%. International traffic remains relatively resilient.

“Domestic capacity deployment in Dec 2025 declined by 7.3% YoY and 7.6% MoM, with around 91,769 departures, largely due to large-scale operational disruptions at IndiGo, including around 4,500 flight cancellations in early December 2025.”“Aviation turbine fuel (ATF) continues to be a major cost variable. In January 2026, ATF prices were 2.2% higher YoY, but 7.2% lower sequentially. For FY2025, average ATF prices stood at ₹95,181/KL, down 8.0% YoY. Fuel costs account for 30–40% of airlines’ operating expenses, while 35–50% of total operating costs are dollar-denominated, exposing airlines to exchange rate volatility.”“The continued weakening of the rupee against the USD in FY2026 has resulted in significant foreign exchange losses, with further pressure expected in Q3 FY2026. The industry’s interest coverage ratio is projected at 0.7–0.9 times in FY2026, reflecting stressed financial sustainability.”

Business

Bank depositors’ role in funding credit growth on decline: RBI data – The Times of India

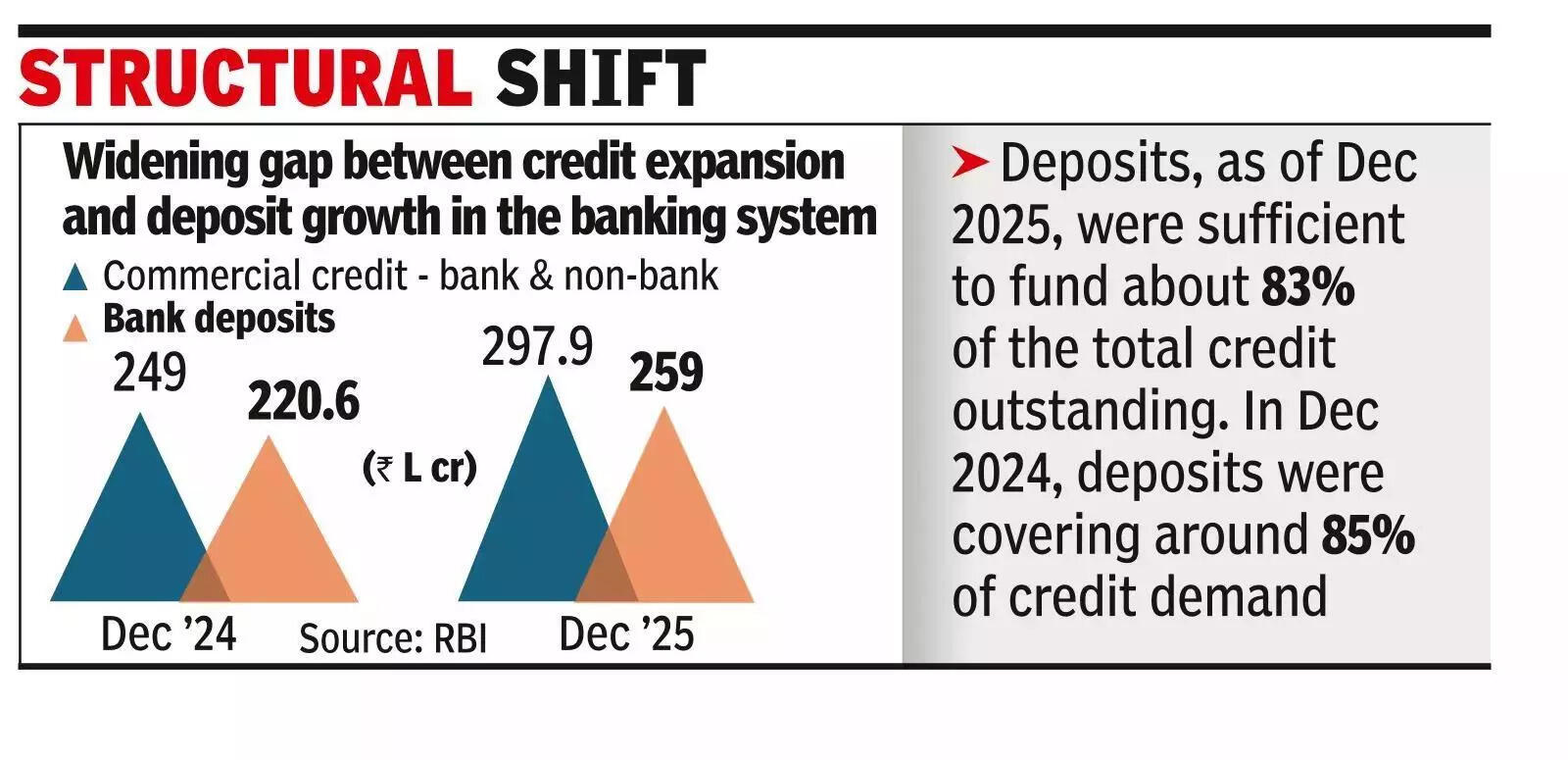

MUMBAI: India’s bank depositor remains the predominant source of credit to the commercial sector, but their relative contribution is steadily declining as credit growth outpaces deposit mobilisation, data for Dec 2025 show.As of Dec 2025, total outstanding credit to the commercial sector (bank and non-bank) rose to Rs 297.9 lakh crore, while bank deposits stood at Rs 249 lakh crore. Deposits were sufficient to fund only about 83% of the total credit outstanding. A year earlier, in Dec 2024, bank deposits amounted to Rs 220.6 lakh crore against total credit of Rs 259.01 lakh crore, covering around 85% of credit demand. The data point to a widening gap between credit expansion and deposit growth in the banking system.

.

The trend reveals a structural shift in India’s credit landscape. Banks remain central to financing the commercial sector, but their deposit base is no longer keeping pace with the demand for credit. The growing reliance on NBFCs, bond markets and foreign borrowings reflects both deeper financial markets and mounting pressure on bank balance sheets as credit demand continues to surge.The first nine months of 2025-26 saw a sharp acceleration in credit flow to the commercial sector. While banks continue to anchor the system, the pace of credit creation has increasingly relied on non-bank channels.Non-food bank credit remained the single largest source of incremental funding. Between Dec 2024 and Dec 2025, bank credit expanded by Rs 25.5 lakh crore, accounting for 65.5% of the total increase in commercial sector credit. Outstanding non-food bank credit stood at Rs 202.3 lakh crore at end-Dec 2025, reflecting a year-on-year growth of 14.4%.

Business

Video: Why Trump’s Reversal on Greenland Still Leaves Europe on Edge

new video loaded: Why Trump’s Reversal on Greenland Still Leaves Europe on Edge

By Andrew Ross Sorkin, Rebecca Suner, Coleman Lowndes and Laura Salaberry

January 22, 2026

Business

India–US trade talks: Vaishnaw sees Donald Trump’s optimism as ‘encouraging’; says India ‘deeply engaged’ – The Times of India

India remains deeply engaged on global trade issues, Union minister Ashwini Vaishnaw said on Thursday signalling confidence after US President Donald Trump expressed optimism about trade deal with New Delhi.Vaishnaw, who is in Davos for the World Economic Forum (WEF) Annual Meeting, said Trump’s comment is very encouraging. “Given India’s position and deep engagement on trade matters, it is very encouraging,” Vaishnaw told PTI when asked about the US president’s remarks.Trump, speaking at Davos a day earlier, said the United States would have a “good” trade deal with India and praised Prime Minister Narendra Modi, describing him as a ‘close friend’.“I have great respect for your Prime Minister. He’s a fantastic man and a friend of mine. We are going to have a good deal,” Trump said.Vaishnaw is leading a high-level Indian delegation to the WEF meeting, which includes Union ministers, chief ministers and senior state ministers. The Indian presence at Davos also features more than 100 CEOs, reflecting India’s push to engage global investors and policymakers amid shifting trade dynamics.Trump’s comments had come at a time when trade negotiations and tariff policies have taken centre stage globally, with several economies reassessing bilateral and multilateral trade arrangements.

-

Politics6 days ago

Politics6 days agoSaudi King Salman leaves hospital after medical tests

-

Sports1 week ago

Sports1 week agoPak-Australia T20 series tickets sale to begin tomorrow – SUCH TV

-

Business7 days ago

Business7 days agoTrump’s proposed ban on buying single-family homes introduces uncertainty for family offices

-

Fashion6 days ago

Fashion6 days agoBangladesh, Nepal agree to fast-track proposed PTA

-

Tech1 week ago

Tech1 week agoTwo Thinking Machines Lab Cofounders Are Leaving to Rejoin OpenAI

-

Tech1 week ago

Tech1 week agoMeta’s Layoffs Leave Supernatural Fitness Users in Mourning

-

Tech6 days ago

Tech6 days agoPetlibro Offers: Cat Automatic Feeders, Water Fountains and Smart Pet Care Deals

-

Fashion6 days ago

Fashion6 days agoWhoop and Samuel Ross MBE unveil multiyear design partnership