Business

Japan is facing a dementia crisis – can technology help?

Suranjana TewariAsia Business Correspondent, Tokyo

BBC

BBCLast year, more than 18,000 older people living with dementia left their homes and went missing in Japan. Almost 500 were later found dead.

Police say such cases have doubled since 2012.

Elderly people aged 65 and over now make up nearly 30% of Japan’s population – the second-highest proportion in the world after Monaco, according to the World Bank.

The crisis is further compounded by a shrinking workforce and tight limits on foreign workers coming in to provide care.

Japan’s government has identified dementia as one of its most urgent policy challenges, with the Health Ministry estimating that dementia-related health and social care costs will reach 14 trillion yen ($90bn; £67bn) by 2030 – up from nine trillion yen in 2025.

In its most recent strategy, the government has signalled a stronger pivot toward technology to ease the pressure.

Across the country, people are adopting GPS-based systems to keep track of those who go missing.

Some regions offer wearable GPS tags that can alert authorities the moment a person leaves a designated area.

In some towns, convenience-store workers receive real-time notifications – a kind of community safety net that can locate a missing person within hours.

Robot caregivers and AI

Other technologies aim to detect dementia earlier.

Fujitsu’s aiGait uses AI to analyse posture and walking patterns, picking up early signs of dementia – shuffling while walking, slower turns or difficulty standing – generating skeletal outlines clinicians can review during routine check-ups.

“Early detection of age-related diseases is key,” says Hidenori Fujiwara, a Fujitsu spokesperson. “If doctors can use motion-capture data, they can intervene earlier and help people remain active for longer.”

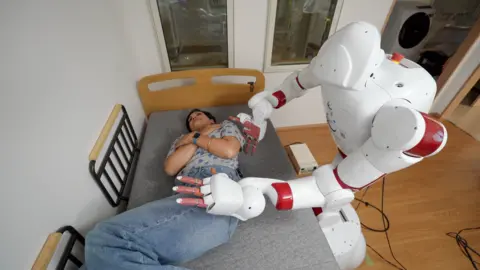

Meanwhile, researchers at Waseda University are developing AIREC, a 150kg humanoid robot designed to be a “future” caregiver.

It can help a person put on socks, scramble eggs and fold laundry. The scientists at Waseda University hope that in the future, AIREC will be able to change adult nappies and prevent bedsores in patients.

Similar robots are already being used in care homes to play music to residents or guide them in simple stretching exercises.

They are also monitoring patients at night – placed under mattresses to track sleep and conditions – and cutting back on the need for humans doing the rounds.

Although humanoid robots are being developed for the near future, Assistant Professor Tamon Miyake says the level of precision and intelligence required will take at last five years before they are safely able to interact with humans.

“It requires full-body sensing and adaptive understanding – how to adjust for each person and situation,” he says.

Emotional support is also part of the innovation drive.

Poketomo, a 12cm tall robot, can be carried around in a bag or can fit into a pocket. It reminds users to take medication, tells you how to prepare in real time for the weather outside and offers conversation for those living alone, which its creators say helps to ease social isolation.

“We’re focusing on social issues… and to use new technology to help solve those problems,” Miho Kagei, development manager from Sharp told the BBC.

While devices and robots offer new ways to assist, human connection remains irreplaceable.

“Robots should supplement, not substitute, human caregivers,” Mr Miyake, the Waseda University scientist said. “While they may take over some tasks, their main role is to assist both caregivers and patients.”

At the Restaurant of Mistaken Orders in Sengawa, Tokyo, founded by Akiko Kanna, people stream in to be served by patients suffering from dementia.

Inspired by her father’s experience with the condition, Ms Kanna wanted a place where people could remain engaged and feel purposeful.

Toshio Morita, one of the café’s servers, uses flowers to remember which table ordered what.

Despite his cognitive decline, Mr Morita enjoys the interaction. For his wife, the café provides respite and helps keep him engaged.

Kanna’s café illustrates why social interventions and community support remain essential. Technology can provide tools and relief, but meaningful engagement and human connection are what truly sustain people living with dementia.

“Honestly? I wanted a little pocket money. I like meeting all sorts of people,” Mr Morita says. “Everyone’s different – that’s what makes it fun.”

Getty Images

Getty ImagesAdditional reporting by Jaltson Akkanath Chummar

Business

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

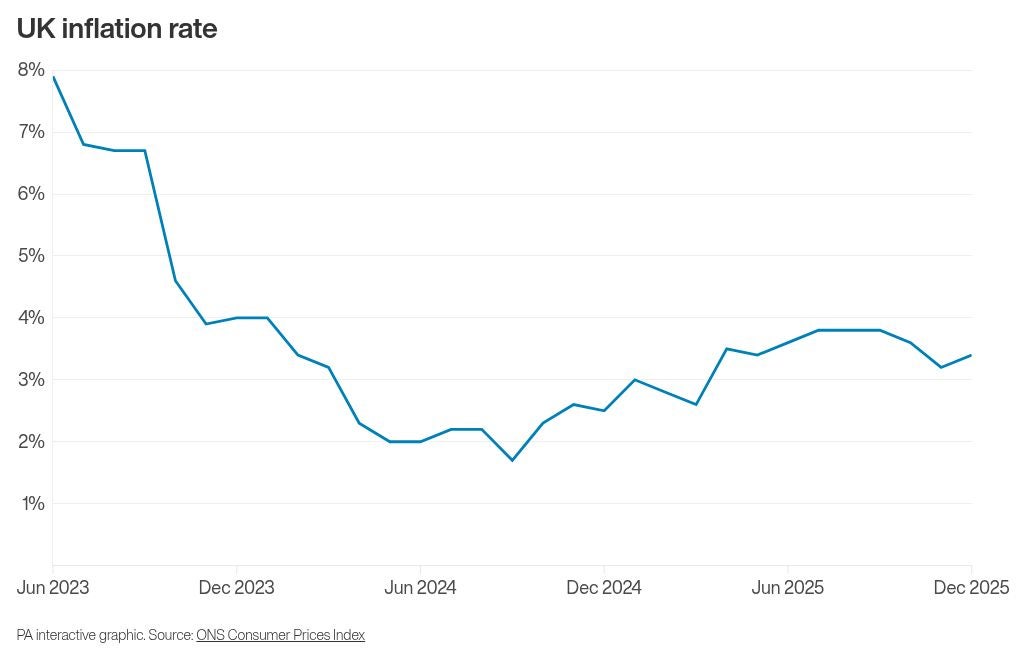

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’