Business

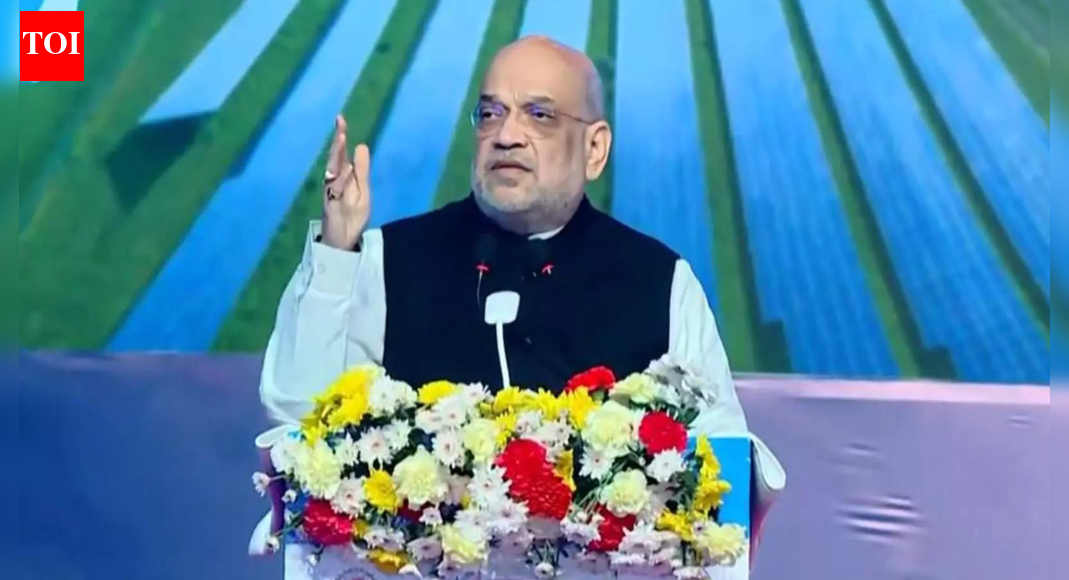

‘Made strong entry’: Amit shah hails semiconductor sector’s growth despite being ‘bit late’; confident of ‘exports soon’ – The Times of India

NEW DELHI: India would soon establish itself in the semiconductor industry by starting exports, even though it’s entry was late, said Union home minister Amit Shah.“We have made a strong entry into the semiconductor industry, although a bit late. In no time, we will not only become self-reliant in the semiconductor sector, but will also start exporting it,” he said, addressing the ‘Abhyudaya Madhya Pradesh Growth Summit’.Speaking at the summit, Shah highlighted Madhya Pradesh’s attractive geographical location and fertile land.He also inaugurated industrial projects worth Rs 2 lakh crore, on the occasion of former Prime Minister Atal Bihari Vajpayee‘s 101st birth anniversary. He remembered Vajpayee as “a great orator, a sensitive poet, a leader dedicated to public welfare and remained ‘ajatashatru’ (person without enemies) in politics.”He noted that even small investments in the state could yield substantial returns. He praised Madhya Pradesh’s transformation from a power-deficient state to one with surplus electricity. He also commended the state’s achievements in cleanliness, saying it has surpassed other states in this aspect.During the event, Shah also paid tributes to Pandit Madan Mohan Malviya on his birth anniversary and C Rajagopalachari on his death anniversary. The Growth Summit attracted 25,000 beneficiaries and thousands of entrepreneurs and investors. Officials confirmed that the industrial projects launched during the event will create 193,000 new jobs.Shah’s visit also included inaugurating the Gwalior Fair and dedicating the renovated Atal Museum to the public, further marking the celebrations of Vajpayee’s birth anniversary.

Business

India adopts quota-based auto duty cuts, alcohol tariff relief under US pact; export access widens – The Times of India

Benchmarking its market access strategy to product sensitivity, India will grant quota-based duty concessions in the automobile sector while offering market access to alcoholic beverages under tariff reduction and minimum import price-based formulations under the trade pact with the United States, the government said on Monday, PTI reported. Under the agreement, tariffs on $30.94 billion of India’s exports will be reduced from 50 per cent to 18 per cent, while reciprocal tariffs on another $10.03 billion will be eliminated.

“This means a substantial share of Indian goods entering the US market will now face either sharply lower tariffs or completely duty-free access, significantly improving price competitiveness,” the government said.The government said $1.36 billion of Indian agricultural exports will receive zero additional US duty access. Key products include spices, tea, coffee, fruits, nuts and processed foods.

Sectoral gains across textiles, gems, agriculture

Sensitive sectors such as automobiles have been liberalised through a mix of quota and duty reduction mechanisms. According to an official, India is not granting any duty concessions on electric vehicles to the US.Medical devices have been placed under long and staggered phasing schedules, while precious metals and other sensitive industrial products are being managed through quota-based tariff lowering.“Alcoholic beverages have been offered under tariff reduction along with minimum import price-based formulations, consistent with India’s approach in other FTAs (free trade agreements),” it added.Listing sectoral gains, the government said tariffs on textile exports will be cut from 50 per cent to 18 per cent, while silk will get nil duty access, opening opportunities in the US textile market valued at $113 billion.Tariffs for the domestic gems and jewellery sector will also fall to 18 per cent, providing preferential access to the US market valued at $61 billion.“In addition, 0 per cent duty market access has been secured for major product categories including diamonds, platinum and coins, covering a US market of $29 billion,” it added.Key export segments expected to gain include cut and polished diamonds, lab-grown synthetic diamonds, coloured gemstones, synthetic stones and articles made of gold, silver and platinum.

Agri access structured by sensitivity, protection retained

India maintains a $1.3 billion trade surplus in agricultural trade with the US, with exports of $3.4 billion and imports of $2.1 billion in 2024, the government said.The United States will apply zero additional duty on Indian exports worth $1.36 billion. Beneficiary items include spices, tea, coffee, copra, coconut oil, cashew nuts, chestnuts, avocados, bananas, guavas, mangoes, kiwis, papayas, pineapples and mushrooms.Cereals such as barley and canary seeds, bakery products, cocoa and cocoa preparations, sesame and poppy seeds, and processed food products such as fruit pulp, juices and jams will also benefit.In line with India’s existing FTA approach, agricultural market access has been structured based on product sensitivity, including immediate duty elimination, phased elimination of up to 10 years, tariff reduction, margin of preference and tariff rate quota mechanisms.Highly sensitive agricultural sectors remain fully protected under an exemption category. These include meat, poultry, dairy products, GM food products, soyameal, maize and cereals.For select sensitive products, tariff reduction has been applied to maintain measured duty protection. Examples include plant parts, olives, pyrethrum and oil cakes.Certain highly sensitive items have been liberalised under tariff rate quotas (TRQs), allowing limited quantities at reduced duties. These include in-shell almonds, walnuts, pistachios and lentils.Phased tariff elimination of up to 10 years has been offered for certain intermediate food processing inputs sourced from multiple countries, including albumins, coconut oil, castor oil, cotton seed oil and plant derivatives.“Immediate duty elimination has been offered only for select non-sensitive products that are already liberalised under other FTAs,” it said.

Industrial goods and digital trade framework

For industrial goods, the agreement secures zero additional duty access for exports valued at $38 billion, the government said.India will get zero reciprocal duty access in key industrial categories including gems and diamonds, platinum and coins, clocks and watches, essential oils, inorganic chemicals, paper articles, plastics, wood products and natural rubber.Market access for American industrial goods has been structured strictly based on product sensitivity, combining immediate tariff elimination, phased reduction of up to 10 years and quota-based access.In digital trade, India’s digitally delivered services exports stood at $0.28 trillion in 2024, growing 10.3 per cent year-on-year.India ranks fifth globally in digitally delivered services exports and eleventh in imports, while the US ranks first in both categories.“A structured digital trade framework between the two countries reduces regulatory uncertainty, lowers compliance friction and facilitates smoother cross-border service delivery,” the government said.

Business

Beauty brand Barry M bought out of administration by Warpaint

High street beauty brand Barry M has been bought out of administration by cosmetics firm Warpaint for £1.4 million.

The acquisition includes the brand and intellectual property, but not Barry M’s factory and staff.

London-listed Warpaint, which owns make-up brands W7 and Technic, said it expects the move to help it grow into key retail channels in the UK.

Barry M has stands in more than 1,300 stores including Superdrug, Boots, Sainsbury’s and Tesco, as well as selling products online.

The British brand is known for its colourful nail varnishes and affordable make-up, positioned as vegan and cruelty-free, having grown to become staples of the UK high street.

It was founded by Barry Mero in 1982, with the leadership of the business passed down to his don Dean Mero after his death in 2014.

The brand moved to appoint administrators last year after warning over “geopolitical issues” and rising prices which it said were absorbed into its cost base.

It nonetheless generated a £17.4 million turnover and a £172,000 pre-tax profit for the year to the end of February 2024, according to its most recently published results.

It had more than 120 staff on average during the year, with most employed at its manufacturing site in London.

Warpaint, whose products are also stocked in high street retailers, told investors that earnings for the 2025 financial year were expected to come in at around £22 million.

But it said the collapse of beauty retailer Bodycare last year and subsequent closure of all its stores negatively impacted the group, as it was a significant retail customer of its brand Technic.

Business

US stocks today: S&P 500, Dow edge lower as global rally runs out of steam – The Times of India

US stocks edged lower on Monday as the momentum from a strong global rally that began in Asia lost steam by the time trading reached Wall Street.The S&P 500 slipped 0.2 per cent in early trade. The Dow Jones Industrial Average fell 62 points, or 0.1 per cent, as of 9:35 a.m. Eastern time, while the Nasdaq Composite declined 0.4 per cent, AP reported.The softer start followed a sharp surge in Asian markets, where Japan’s Nikkei 225 jumped 3.9 per cent to a record high after the ruling party secured a landslide victory in parliamentary elections. Investors expect the political outcome to strengthen Prime Minister Sanae Takaichi’s ability to push economic and market reforms.On Wall Street, markets paused after Friday’s strong rally, which marked the best session since May. However, concerns continue to linger over stretched valuations, with the S&P 500 still trading near its all-time high set last month.Investors are also increasingly questioning whether heavy spending by Big Tech and other companies on artificial intelligence will generate sufficient profits to justify the scale of investments.Volatility across other asset classes showed signs of easing after recent sharp swings. Bitcoin slipped below $69,000 after briefly crossing $71,000 over the weekend, having dropped close to $60,000 last week, more than halfway below its record high hit in October.Gold rose 1.2 per cent to move back above $5,000 per ounce, continuing sharp price swings after roughly doubling over the past year. Silver also advanced 3 per cent, extending its volatile trading pattern.Among stocks, Kroger gained 6.1 per cent after appointing a former Walmart executive as its new chief executive officer. Workday fell 5.9 per cent after announcing CEO Carl Eschenbach would step down, with co-founder Aneel Bhusri set to return to the role.Transocean slipped 1 per cent after announcing plans to acquire Valaris in an all-stock deal valued at $5.8 billion, while Valaris shares surged 22.3 per cent.In bond markets, US Treasury yields remained largely steady ahead of key economic data due later this week, including monthly jobs data on Wednesday and consumer inflation data on Friday. Both reports are expected to shape expectations around the Federal Reserve’s interest rate outlook.The Fed has paused rate cuts for now, but a weaker labour market could accelerate easing, while persistently high inflation could delay further rate reductions.The yield on the 10-year Treasury held steady at 4.22 per cent.Across global markets, Asian equities rallied strongly, led by Japan. South Korea’s Kospi surged 4.1 per cent, while Hong Kong rose 1.8 per cent and Shanghai gained 1.4 per cent. European markets, however, traded mixed with modest movements.

-

Entertainment3 days ago

Entertainment3 days agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Tech1 week ago

Tech1 week agoHow to Watch the 2026 Winter Olympics

-

Business1 week ago

Business1 week agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

-

Entertainment1 week ago

Entertainment1 week agoThe Traitors’ winner Rachel Duffy breaks heart with touching tribute to mum Anne

-

Tech1 week ago

Tech1 week agoI Tested 10 Popular Date-Night Boxes With My Hinge Dates

-

Business7 days ago

Business7 days agoNew York AG issues warning around prediction markets ahead of Super Bowl

-

Fashion1 week ago

Fashion1 week agoCanada could lift GDP 7% by easing internal trade barriers

-

Business1 week ago

Business1 week agoInvestors suffer a big blow, Bitcoin price suddenly drops – SUCH TV