Business

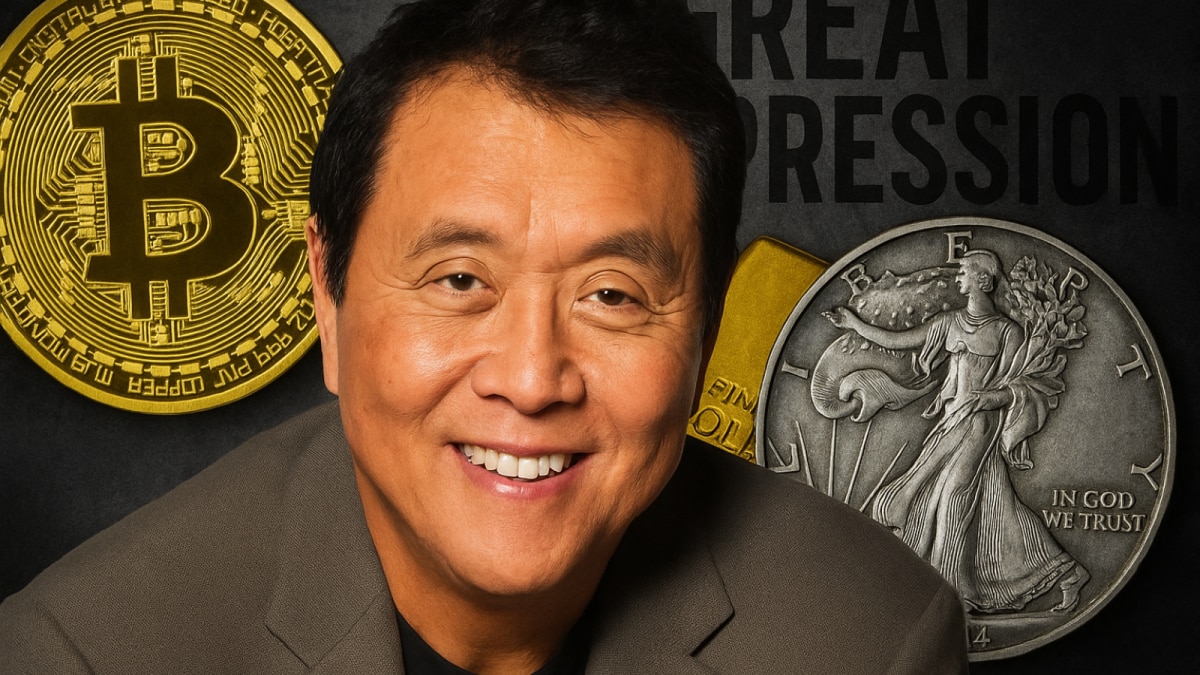

‘Millions Will Be Wiped Out’: Robert Kiyosaki Sounds Alarm On Market Crash, Shares Safe Bets

Last Updated:

Robert Kiyosaki warns of a massive stock market crash, urging investors to buy silver, gold, Bitcoin, and Ethereum as Bitcoin supply nears its limit and FOMO rises.

Kiyosaki, a long-time critic of traditional financial systems, has consistently urged investors to diversify into alternative assets such as gold, silver, and Bitcoin.

The author of popular book ‘Poor Dad Rich Dad’ Robert Kiyosaki has forewarned that a massive crash in the stock market has begun and ‘millions will be wiped out’. Kiyosaki has suggested that investors protect themselves with silver, gold, Bitcoin, and Ethereum.

MASSIVE CRASH BEGININING: Millions will be wiped out. Protect yourself. Silver, gold, Bitcoin, Ethereum investors will protect you.Take care

— Robert Kiyosaki (@theRealKiyosaki) November 1, 2025

The author said he is buying Bitcoin, calling it the “first truly scarce money.”

In a post on X (formerly Twitter), Kiyosaki noted that nearly 20 million of the total 21 million Bitcoins have already been mined, adding that buying activity is likely to accelerate as supply nears its limit.

“FOMO (fear of missing out) is real. Please do not be late,” he wrote, urging followers to act before prices climb further.

Kiyosaki has been a long-time supporter of Bitcoin, often describing it as a hedge against inflation and traditional financial systems.

The International Monetary Fund (IMF) has warned that financial risks are building beneath the surface, even as global markets appear calm.

In its Global Financial Stability Report released on Tuesday, the IMF cautioned that rising tariffs, growing debt levels, and the rapid expansion of nonbank financial institutions (NBFIs) are increasing vulnerabilities across the global financial system.

The Fund said investors are showing signs of “complacency”, overlooking risks from trade tensions, fiscal imbalances, and geopolitical uncertainties that could disrupt financial stability.

“Markets seem to have downplayed the potential effects of tariffs on growth and inflation,” the Fund said in its report, adding that the boost from front-loaded consumption and investment is fading, leading to a slowdown in near-term global growth — especially in the United States.

The IMF also highlighted growing concerns over rising government debt and widening fiscal deficits, which are adding pressure on sovereign bond markets.

“An abrupt increase in yields — triggered, for instance, by debt sustainability concerns — could strain banks’ balance sheets and weigh on financial stability,” the Fund warned.

Varun Yadav is a Sub Editor at News18 Business Digital. He writes articles on markets, personal finance, technology, and more. He completed his post-graduation diploma in English Journalism from the Indian Inst…Read More

Varun Yadav is a Sub Editor at News18 Business Digital. He writes articles on markets, personal finance, technology, and more. He completed his post-graduation diploma in English Journalism from the Indian Inst… Read More

November 02, 2025, 16:50 IST

Read More

Business

Budget eases PF, ESI deduction rules for employers, allows relief for delayed deposits – The Times of India

In a move expected to bring relief to employers and reduce routine tax disallowances, the finance bill has proposed a key change to the treatment of employees’ provident fund (PF), ESI and similar contributions, allowing deductions even where there is a delay in deposit, provided the amount is deposited by the employer entity with the relevant welfare fund authorities before the due date of its Income-tax return.At present, employers can claim deduction for employees’ PF and ESI contributions only if the amounts are deposited within the strict timelines prescribed under the respective welfare laws. Even a minor delay permanently disqualifies the expense for tax purposes, a position that had been settled by the Supreme Court (SC) after years of litigationUnder the proposed amendment to Section 29 of the Income-tax Act, 2025, the definition of “due date” for claiming deduction of employees’ contributions is set to be aligned with the due date for filing the income-tax return by the employer entity.Explaining the shift, Deepak Joshi, a SC advocate said employers are currently held to a rigid standard. “The law, as interpreted by the SC, meant that if employee contributions were not deposited within the due date under the relevant welfare fund laws, no deduction was allowed — even if the payment was made before filing the income-tax return,” he said.“The proposed amendment substitutes the definition of ‘due date’ to mean the due date of filing the income-tax return. The positive impact is that even if there is a slight delay in depositing employees’ contributions, so long as the amount is deposited before the return-filing deadline, the employer will be allowed the deduction,” Joshi added. Experts view the move as part of the government’s broader effort to soften compliance rigidities and reduce avoidable litigation.

Business

Free baby bundles sent to newborn parents but some miss out

Baby boxes are being delivered to expectant families in some of Wales’ most deprived areas.

Source link

Business

Investors suffer a big blow, Bitcoin price suddenly drops – SUCH TV

After the drop in gold price, Bitcoin price also fell.

Bitcoin fell below $77,000 in the global market, Bitcoin price fell by more than 13% in a week.

Bitcoin’s highest price in 6 months fell below $126,000, Bitcoin price has dropped by more than $49,000.

-

Sports6 days ago

Sports6 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment6 days ago

Entertainment6 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Tech1 week ago

Tech1 week agoICE Asks Companies About ‘Ad Tech and Big Data’ Tools It Could Use in Investigations

-

Business6 days ago

Business6 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Sports6 days ago

Sports6 days agoCollege football’s top 100 games of the 2025 season

-

Politics1 week ago

Politics1 week agoFresh protests after man shot dead in Minneapolis operation

-

Politics6 days ago

Politics6 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings