Business

Mone-linked firm PPE Medpro owes £39m in tax

A company linked to Baroness Michelle Mone and her husband Doug Barrowman owes £39m in tax on top of the £148m it was ordered to pay the government for breaching a contract to supply PPE.

Documents filed by PPE Medpro’s administrator on Tuesday revealed the figure owed to His Majesty’s Revenue and Customs (HMRC).

Last month a court ruled the company breached a contract to supply medical gowns during the Covid pandemic because they did not meet certification requirements for sterility.

HMRC and the administrators declined to comment.

PPE Medpro was put into administration last month, and Health Secretary Wes Streeting said the government would pursue the company “with everything we’ve got” to recover the cash.

PPE Medpro has £672,774 available to unsecured creditors, far less than the money owed to the DHSC, the administrators’ filings show.

They also reveal that the debt to the government is even bigger than previously known.

During the outbreak of the Covid pandemic in 2020, the government scrambled to secure supplies of PPE as the country went into lockdown and hospitals across the country were reporting shortages of clothing and accessories to protect medics from the virus.

In May that year, PPE Medpro was set up by a consortium led by Baroness Mone’s husband, Doug Barrowman, and won its first government contract to supply masks through a so-called VIP lane after being recommended by Baroness Mone.

The Department of Health and Social Care sued PPE Medpro and won damages over claims the company breached its contract to supply medical gowns.

Mr Barrowman told the BBC in an interview in 2023 that he was the ultimate beneficial owner of PPE Medpro. The shares are held in the name of an accountant, Arthur Lancaster, according to Companies House documents.

In that same interview he admitted receiving more than £60m in profits from PPE Medpro.

Baroness Mone, best known for founding the lingerie company Ultimo, admitted that millions of pounds from those profits were put into a trust from which she and her children stood to benefit.

An Isle of Man company linked to Mr Barrowman, Angelo (PTC), has a secured debt of £1m to the PPE Medpro, which means it is likely to rank ahead of government creditors when it comes to paying out whatever cash can be recovered from the company.

The administrators’ report says it expects there will be enough money to repay this in full.

Filings in the Isle of Man show the beneficial owner of Angelo (PTC) is Knox House Trust, part of Barrowman’s Knox group of companies.

Arthur Lancaster and a spokesperson for Doug Barrowman did not respond to requests for comment.

Business

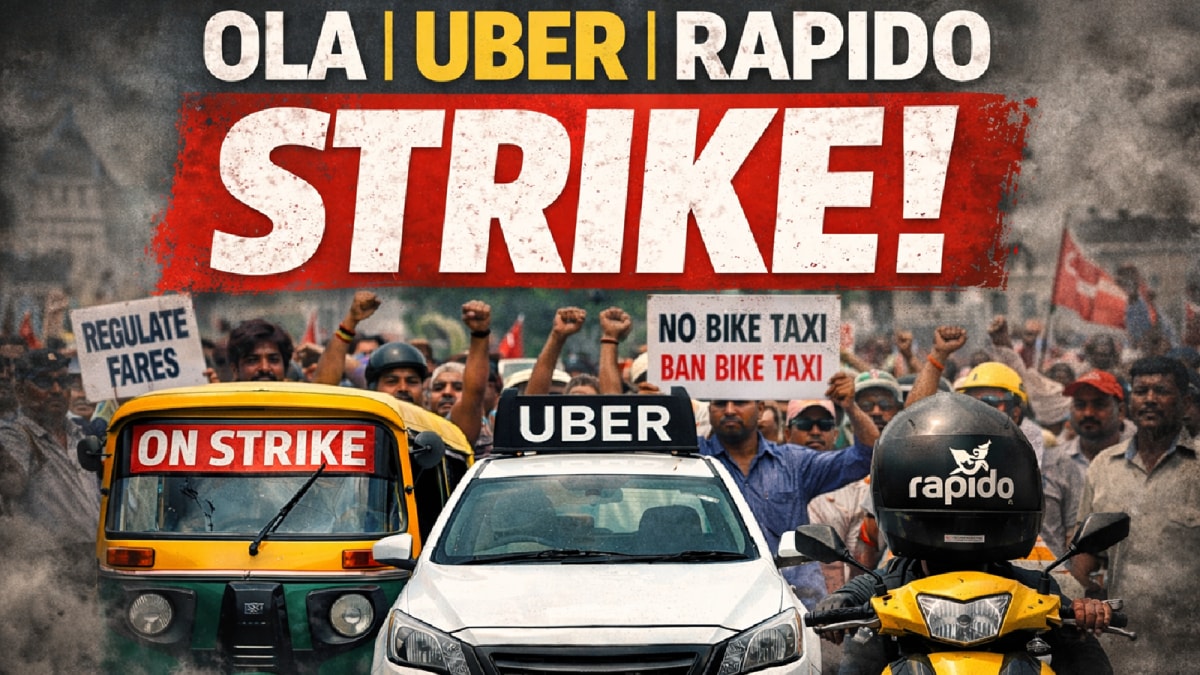

Ola, Uber, Rapido Strike Today: Will You Get A Cab Or Auto On February 7? What Commuters Should Know

Last Updated:

Drivers gather at Jantar Mantar where multiple unions flagged concerns over fare policies, alleged regulatory gaps and the use of private vehicles for commercial taxi services.

Ola, Uber, Rapido Strike Today.

Ola, Uber, Rapido Strike Today: Passengers booking taxis or autorickshaws through app-based platforms may have noticed disruptions and uncertainty on Saturday as drivers across several states held protests and strikes, demanding tighter regulation of the sector and a crackdown on bike taxi services.

Drivers gathered at Jantar Mantar, New Delhi, where multiple unions flagged concerns over fare policies, alleged regulatory gaps and the use of private vehicles for commercial taxi services. The protests brought together both app-based and conventional cab drivers, highlighting growing discontent over pricing policies, the use of private vehicles for commercial transport, and what unions describe as uneven enforcement of rules.

What Are Drivers Demanding?

Driver unions are seeking structural changes rather than temporary relief. Their key demands include the creation of a Rashtriya Chalak Ayog, a national drivers’ welfare body, an all-India ban on private bike taxis, and stricter action against the use of unlicensed private vehicles as taxis.

A major concern is surge pricing on ride-hailing platforms. Drivers allege that while fares rise sharply during peak hours, the additional amount largely goes to aggregators, leaving drivers with little benefit even as commuters assume they are earning more.

Why Bike Taxis Are At The Centre Of The Dispute

Licensed taxi and autorickshaw drivers say bike taxis, often operated using private two-wheelers, are cutting into their earnings while operating in a regulatory grey zone. According to unions, enforcement against such services varies widely across states, creating uneven competition.

Drivers have also raised safety and insurance concerns, alleging that accident victims involving illegal bike taxis often struggle to get insurance compensation due to unclear liability and lack of permits.

Panic Buttons

One of the lesser-known issues affecting drivers is the mandatory installation of panic buttons in commercial vehicles. While the Centre has approved around 140 device providers, unions claim state governments have declared a large number of these companies unauthorised.

As a result, drivers say they are being forced to remove existing devices and spend up to Rs 12,000 again on new installations, turning a safety requirement into a repeated financial burden.

Will Cabs And Autos Be Available?

Despite union claims that vehicles were kept off the roads, cabs and autorickshaws continued to be available on platforms such as Uber, Ola and Rapido in many cities, though availability and waiting times varied by location.

For commuters, this means service disruptions are likely to be uneven rather than total, depending on city-wise participation and enforcement.

Why This Issue Keeps Returning

Drivers say that without a uniform national framework covering fares, commissions, licensing and welfare, disputes will continue to surface.

Unions also point to the rapid increase in autorickshaw permits under open permit policies, saying the growing supply of vehicles has reduced per-driver income without a corresponding rise in demand.

February 07, 2026, 14:23 IST

Read More

Business

Gold price surges by Rs11,700 per tola in Pakistan – SUCH TV

Gold prices in Pakistan increased on Saturday in line with the international market. In the local market, the gold price per tola reached Rs519,462 after a gain of Rs11,700.

According to All Pakistan Gems and Jewellers Association (APGJSA), 10-gram gold was sold at Rs445,354 after an increase of Rs10,030.

The international rate of gold was up by $117 to reach $4,967 per ounce (with a premium of $20).

Meanwhile, the price of silver increased by Rs444 to reach Rs8,269 per tola.

Business

From ESOPs To Bank Accounts: Foreign Income You Can Declare Under FAST-DS 2026

Last Updated:

Budget 2026 has introduced a six-month disclosure plan for foreign assets with immunity from prosecution.

Taxpayers can be fined upto Rs 10 lakh if they fail to declare. (Representative Image)

Finance Minister Nirmala Sitharaman revealed in the Union Budget 2026 that taxpayers in India who failed to report income or assets kept abroad now have a six-month opportunity to come clean and avoid fines and penalties under the Black Money (Undisclosed Foreign Income and Assets) Act.

The Foreign Assets of Small Taxpayers – Disclosure Scheme (FAST-DS) 2026 is a new option that aims to rectify previous errors by voluntary disclosure. It is specifically designed for taxpayers who might have neglected to disclose overseas assets or income on previous income tax returns (ITRs), including students, workers, young professionals, and relocated non-resident Indians (NRIs).

Who Can Use the 6-Month Window

Eligible taxpayers are permitted to register hidden foreign assets or income under FAST-DS that were either not taxed at all or were not accurately declared in the foreign assets schedule of previous returns. Examples include foreign bank accounts, overseas shares, mutual funds, employee stock options (ESOPs/RSUs), foreign real estate, and other financial interests held overseas.

The scheme is divided into two categories:

Category A: For those who have not disclosed any overseas assets or income at all, up to a value of Rs 1 crore. They cannot get immunity unless they pay taxes and penalties equal to 60 per cent of the value of their assets or income.

Category B: For people who paid taxes and declared overseas income but neglected to disclose the related asset. They can regularise the declaration by paying a one-time charge of Rs 1 lakh per asset if the asset’s worth is up to Rs 5 crore.

Taxpayers can avoid drawn-out legal proceedings and be protected from harsher penalties under the Black Money Act owing to this prompt declaration.

Penalties If You Miss the Deadline

Taxpayers will be subjected to severe penalties if they fail to disclose their assets and incomes earned from overseas during this period under the Black Money Act. The taxpayers will be fined Rs 10 lakh per asset for each year they fail to make a disclosure, and a penalty three times the tax amount will be imposed, along with a 30% tax on each income earned from overseas assets.

Furthermore, prosecution may result in jail time ranging from six months to seven years in severe circumstances.

Reopened assessments can cover up to 16 years, and tax treaty advantages such as relief under the Double Taxation Avoidance Agreement (DTAA) may no longer be accessible.

Why It Matters

According to tax professionals, this one-time window offers a unique chance to correct prior non-disclosures without worrying about legal action or severe fines. Additionally, it promotes voluntary compliance and reduces the likelihood of future disagreements between taxpayers and tax authorities.

Delhi, India, India

February 07, 2026, 10:43 IST

Read More

-

Tech5 days ago

Tech5 days agoHow to Watch the 2026 Winter Olympics

-

Fashion1 week ago

Fashion1 week agoItaly’s Brunello Cucinelli debuts Callimacus AI e-commerce experience

-

Business5 days ago

Business5 days agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

-

Tech1 week ago

Tech1 week agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Tech6 days ago

Tech6 days agoI Tested 10 Popular Date-Night Boxes With My Hinge Dates

-

Fashion5 days ago

Fashion5 days agoCanada could lift GDP 7% by easing internal trade barriers

-

Business5 days ago

Business5 days agoInvestors suffer a big blow, Bitcoin price suddenly drops – SUCH TV

-

Business1 week ago

Business1 week agoVideo: Who Is Trump’s New Fed Chair Pick?