Business

Oil rises 5% on US sanctions against Russian suppliers | The Express Tribune

Oil prices rose 5% on Thursday after the US imposed sanctions on major Russian suppliers Rosneft and Lukoil over the Ukraine war, extending gains from the previous session.

Brent crude futures were up $3.39, or 5.4%, at $65.98 a barrel at 1018 GMT, while US West Texas Intermediate crude futures were up $3.31, or 5.7%, at $61.81.

The US sanctions mean refineries in China and India, major buyers of Russian oil, will need to seek alternative suppliers to avoid exclusion from the Western banking system, according to Saxo Bank analyst Ole Hansen.

The US said it was prepared to take further action as it called on Moscow to agree immediately to a ceasefire in Ukraine.

Britain sanctioned Rosneft and Lukoil last week. EU countries have approved a 19th package of sanctions against Russia that includes a ban on imports of Russian liquefied natural gas (LNG).

Prompt Brent crude futures switched to backwardation as the first-month Brent contract traded as high as $1.98 above the contract for delivery in six months.

Read: Rs180b cess demand jolts oil industry

Right after the US sanctions were unveiled, Brent and WTI futures rose by more than $2 a barrel, with support from a surprise decline in US stockpiles.

The impact of sanctions on oil markets will depend on how India reacts and if Russia finds alternative buyers, said UBS analyst Giovanni Staunovo.

India became the largest buyer of discounted seaborne Russian crude in the aftermath of Moscow’s war in Ukraine. Indian refiners are likely to sharply curtail imports of Russian oil due to the new sanctions, industry sources said on Thursday.

Read More: Fuel prices likely to drop by Rs6/litre from Oct 16

Privately-owned Reliance Industries, the top Indian buyer of Russian crude, plans to reduce or halt such imports completely, according to two sources familiar with the matter.

But there remains some scepticism in the market about whether the US sanctions would result in a fundamental shift in supply and demand.

“So far, almost all the sanctions against Russia for the past 3-1/2 years have mostly failed to dent either the volumes produced by the country or the oil revenues,” said Rystad Energy analyst Claudio Galimberti.

Oversupply concerns following OPEC+ production increases capped crude’s gains on Thursday. UBS expects Brent to remain between $60 and $70.

On the demand side, US crude oil, gasoline and distillate inventories fell last week as refining activity and demand strengthened, the Energy Information Administration said on Wednesday.

Business

‘Holistic And Forward-Looking’: Piyush Goyal Says Budget 2026 Reflects Future-Ready India

Last Updated:

Piyush Goyal termed the Budget “economically and fundamentally very strong”, and stated that it “reflects the aspirations of the youth of the country”.

Minister of Commerce and Industry Piyush Goyal. (File photo)

Union Minister Piyush Goyal on Sunday termed Budget 2026 “futuristic and holistic”, and stated that it “reflects the aspirations of the youth of the country and is forward-looking”.

Speaking exclusively to CNN-News18 on Budget 2026, presented by Finance Minister Nirmala Sitharaman, Goyal said, “This is a fabulous budget and it is very futuristic. The Budget 2026 has covered all sectors including technology, infrastructure, etc.”

“The technology sector has been given a thrust. The budget focuses on infrastructure. It is a holistic and forward-looking budget refecting future ready Bharat,” he said, adding, “The budget meets the aspirations of the youth and new India.”

Stating that the Budget is economically and fundamentally very strong, the Union Minister said, “Farmers, animal husbandry and labour-intensive sectors get a major push as this Budget focuses on investment, value addition and jobs.”

#Exclusive | “The Budget is economically and fundamentally very strong,”Preparing India for Viksit Bharat. Farmers, animal husbandry and labour-intensive sectors get a major push as the Budget focuses on investment, value addition and jobs.@Parikshitl in an exclusive… pic.twitter.com/tJr2SItcaW

— News18 (@CNNnews18) February 1, 2026

‘Budget 2026 Is Human-Centric’: PM Modi

Prime Minister Narendra Modi on Sunday said that the Union Budget 2026 is “human-centric and strengthens India’s foundation with path-breaking reforms.” The Prime Minister also described it as historic and a catalyst for accelerating the country’s reform trajectory and long-term growth.

Following the presentation of the Budget in Parliament, PM Modi said the proposals would energise the economy, empower citizens and give India’s youth fresh opportunities to scale new heights.

“This budget brings the dreams of the present to life and strengthens the foundation of India’s bright future. This budget is a strong foundation for our high-flying aspirations of a developed India by 2047,” he said.

Calling the government’s reform agenda a “Reform Express”, the Prime Minister added, “The reform express that India is riding today will gain new energy and new momentum from this budget.”

February 01, 2026, 19:01 IST

Read More

Business

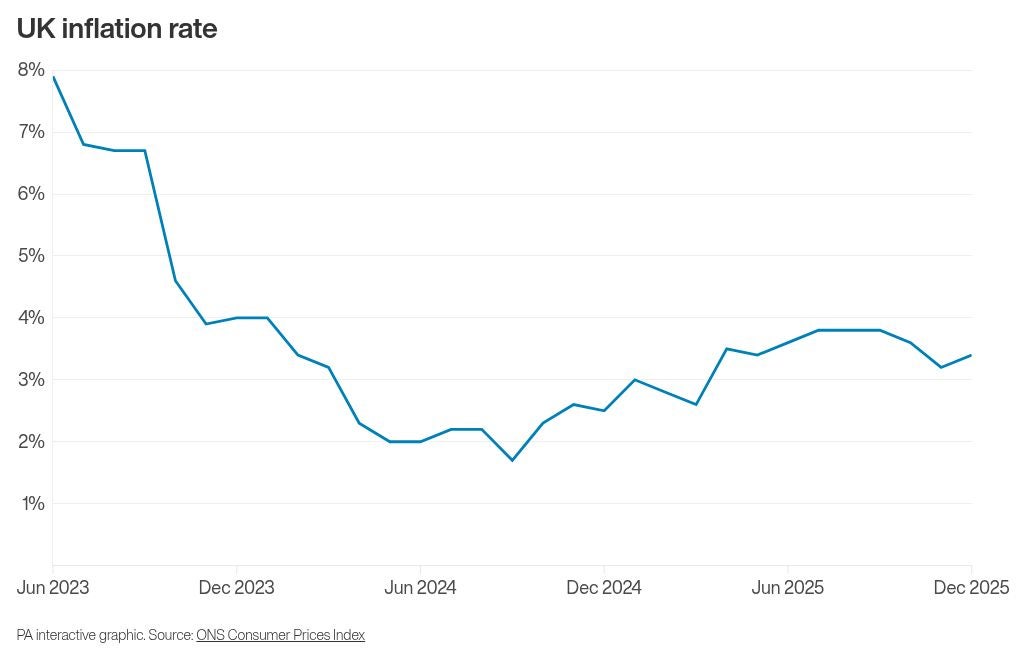

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’