Business

Peak time rail fares scrapped on ScotRail trains

Debbie JacksonBBC Scotland News

Getty Images

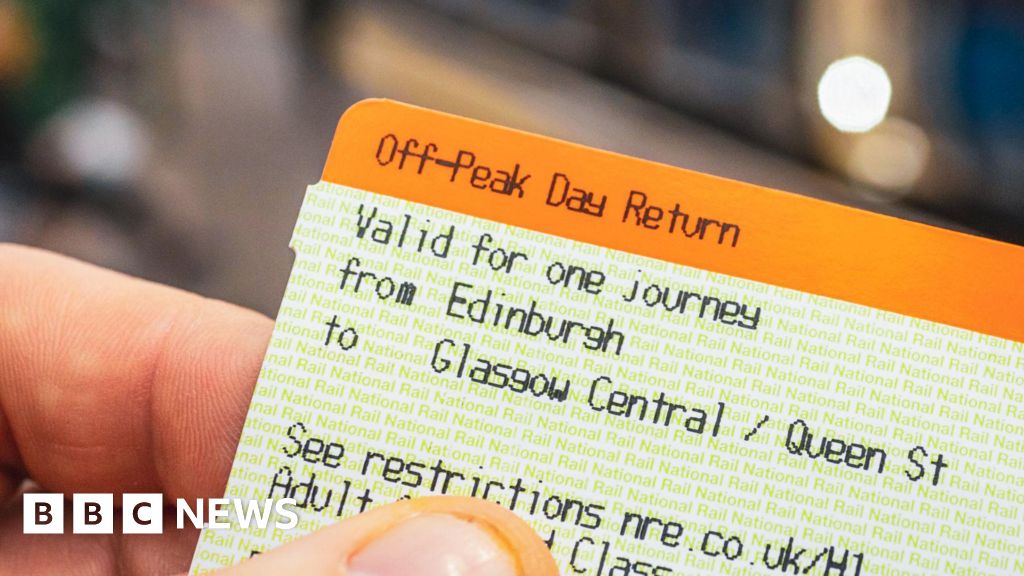

Getty ImagesPeak rail fares have been scrapped on ScotRail trains, meaning passengers will no longer pay higher prices for travelling on busy weekday trains.

Until now, many ScotRail tickets were based on the time of travel. Edinburgh to Glasgow peak times will be almost 50% cheaper, with trips between Perth and Dundee a third lower.

The Scottish government-owned operator said its aim was to get more commuters out of cars and onto trains.

Season tickets and fares on routes with peak time prices are unchanged. Multi-journey flexipass tickets have been adjusted with smaller savings.

Peak ScotRail fares used to cover tickets bought for travel before 09:15 on weekdays and certain services between 16:42 and 18:30.

A pilot scheme scrapping peak-time fares, a policy championed by the Scottish Greens, was introduced in 2023 but ended in September 2024 after ministers said the costs of the subsidy could not be justified.

However, in his programme for government speech in May, First Minister John Swinney announced that peak fares would again be scrapped.

Speaking at the launch of the scheme in Edinburgh on Monday, he said it would help people to move “from their cars onto trains”, which would provide environmental benefits.

He added: “This is financially sustainable because it’s an investment in the rail network and it’s an investment in the people of Scotland.

“People in Scotland simply travelling from Edinburgh to Glasgow on a daily basis will see their travel costs fall by almost 50%. That’s a massive saving when people are struggling financially.”

ScotRail ticketing will also be more straightforward and flexible under the new system, the firm has said.

How is scrapping peak fares being paid for?

ScotRail has been owned and run by the Scottish government since 2022.

In October 2023 the rail firm started a year-long trial of scrapping peak fares with the aim of persuading more people to swap car journeys for rail travel.

Last year, Scottish ministers announced the trial had “limited success” and would not be extended.

An evaluation of the first nine months of the trial found passenger levels increased by a maximum of about 6.8%.

This represented around four million extra rail journeys, of which two million are journeys that would previously have been made by private car.

However, the scheme required a 10% rise to be self-financing.

Scotland’s Transport Secretary Fiona Hyslop also said at the time that the pilot “primarily benefited existing train passengers and those with medium to higher incomes”.

The evaluation found the estimated cost of the scheme was “in the annual range of £25m to £30m per annum (in 2024 prices) with the possibility of being as large as £40m”.

Swinney said he expected the annual cost to be between £40m to £45m each year and lead to a “huge saving” for individuals.

If the new scheme does not become self-financing through an increase in passenger numbers, the costs will be met from the ScotRail budget.

This is made up of revenue from passenger fares and the £1.6bn the Scottish government puts into rail services every year.

Getty Images

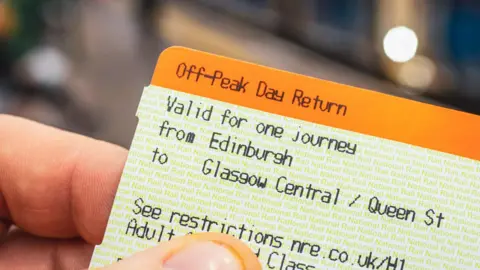

Getty ImagesJoanne Maguire, managing director at ScotRail told BBC Scotland News: “We are really excited at the opportunity to get more customers out of their cars and onto the railway.

“If you are travelling from Edinburgh to Glasgow you will see a saving of about 50%.

“From Inverkeithing to Edinburgh, you will save 40% and between Inverness and Elgin it is 35% – so it’s great news for our passengers.”

Ms Maguire said the trial period had seen an increase in passenger numbers and that ScotRail had enjoyed a successful summer of moving customers around to numerous big leisure events.

She added that the goal now was to grow the commuter passenger base.

‘Deeply unfair tax’

Several passengers at Glasgow’s Queen Street station told BBC Scotland News they were unaware that peak time fares had been dropped – but welcomed the move.

Student Robbie McCormack said: “I commute every day for college and it’s quite expensive.

“I’ll be able to save throughout the week, save more college money and get something else for lunch.”

Passenger Tommy Whitelaw travels across Scotland giving talks to charities and care homes.

He said the end of peak fares removed the limits on when many people could travel.

He added: “It makes a difference to everybody, its our duty to make everything achievable for people.

“The cost of living shrinks our world, this is one way to open it up a wee bit.”

Susan Watts, from Leeds, told BBC Your Voice that peak fares should be scrapped UK-wide.

She said: “Our complicated fare system is enough to put anyone off using trains.

“In Italy, I paid the same price for a ticket when I turned up an hour before as if I’d booked months earlier – the price is just the price.”

Green MSP Mark Ruskell said peak rail fares were a “deeply unfair tax” on people who had no say over when they needed to travel.

“I am delighted that we are finally rid of them,” he said.

“I’m glad that the Scottish government has finally listened to the Greens, the trade unions and the rail users who were responsible for securing the initial pilot.”

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

Business

Budget 2026 Live Updates: TCS On Overseas Tour Packages Slashed To 2%; TDS On Education LRS Eased

Union Budget 2026 Live Updates: Union Budget 2026 Live Updates: Finance Minister Nirmala Sitharaman is presenting the Union Budget 2026-27 in Parliament, her record ninth budget speech. During her Budget Speech, the FM will detail budgetary allocations and revenue projections for the upcoming financial year 2026-27. Sitharaman is notably dressed in a Kanjeevaram Silk saree, a nod to the traditional weaving sector in poll-bound Tamil Nadu.

The budget comes at a time when there is geopolitical turmoil, economic volatility and trade war. Different sectors are looking to get some support with new measures and relaxations ahead of the budget, especially export-oriented industries, which have borne the brunt of the higher US tariffs being imposed last year by the Trump administration.

On January 29, 2026, Sitharaman tabled the Economic Survey 2025-26, a comprehensive snapshot of the country’s macro-economic situation, in Parliament, setting the stage for the budget and showing the government’s roadmap. The survey projected that India’s economy is expected to grow 6.8%-7.2% in FY27, underscoring resilience even as global economic uncertainty persists.

Budget 2026 Expectations

Expectations across key sectors are taking shape as stakeholders look to the Budget for support that sustains growth, strengthens jobs and eases financial pressures:

Taxpayers & Households: Many taxpayers want practical improvements to the income tax structure that preserve simplicity while supporting long-term financial planning — including broader deductions for home loan interest and diversified retirement savings options.

New Tax Regime vs Old Tax Regime | New Income Tax Rules | Income Tax 2026

Businesses & Industry: With industrial output and investment showing resilience, firms are looking for policies that bolster capital formation, ease compliance, and expand infrastructure spending — especially in manufacturing and technology-driven sectors that promise jobs and exports.

Startups & Innovation: The startup ecosystem expects incentives around employee stock options and capital access, along with regulatory tweaks that encourage risk capital and talent retention without increasing compliance burdens.

Also See: Stock Market Updates Today

The Budget speech will be broadcast live here and on all other news channels. You can also catch all the updates about Budget 2026 on News18.com. News18 will provide detailed live blog updates on the Budget speech, and political, industry, and market reactions.

We are providing a full, detailed coverage of the union budget 2026 here, with a lot of insights, experts’ views and analyses. Stay tuned with us to get latest updates.

Also Read: Budget 2026 Live Streaming

Here are the Live Updates of Union Budget 2026:

Business

Budget 2026: Cabinet gives green signal to Union Budget 2026–27

New Delhi: The Cabinet on Sunday approved the Union Budget 2026-27 during a meeting in Parliament chaired by Prime Minister Narendra Modi. A meeting of the Union Cabinet was held at Sansad Bhawan at 10 a.m., and after the Cabinet’s approval, Finance Minister Nirmala Sitharaman proceeded to Parliament to present the Budget.

Earlier, FM Sitharaman met President Droupadi Murmu and offered her a copy of the digital budget. The President also offered ‘dahi-cheeni’ (curd and sugar) to Sitharaman when she arrived at the Rashtrapati Bhavan. The Finance Minister was seen carrying her trademark ‘bahi-khata’, a tablet wrapped in a red-coloured cloth bearing a golden-coloured national emblem on it.

Minister of State for Finance Pankaj Chaudhary, Chief Economic Advisor Dr V. Anantha Nageswaran, Central Board of Direct Taxes (CBDT) Chairman Ravi Agrawal and other officials were seen accompanying the Finance Minister. Sitharaman was set to present her ninth consecutive Union Budget in the Lok Sabha. In 2021, she switched to using a digital tablet to carry the Budget papers, further promoting a modern and eco-friendly approach.

The ‘bahi-khata’ is a red pouch that holds the digital tablet containing the Budget documents. This year, Sitharaman opted for a deep maroon Kanjeevaram saree from Tamil Nadu. The saree featured a deep maroon base with a contrasting border and subtle gold detailing, paired with a yellow blouse.

The Budget is likely to strike a deft balance of sustaining growth momentum and maintaining fiscal consolidation. It also needs to address near-term challenges emanating from unprecedented geopolitical flux, said economists. According to economists, the budget is likely to focus more on capital expenditure, especially in sectors deemed to be strategically important owing to prevailing geopolitical compulsions.

While the FY26 Budget was more tilted towards stimulating middle-class consumption with tax reliefs, the FY27 Budget’s approach to stimulating consumption will be selective, they added.

-

Business1 week ago

Business1 week agoSuccess Story: This IITian Failed 17 Times Before Building A ₹40,000 Crore Giant

-

Fashion1 week ago

Fashion1 week agoSouth Korea tilts sourcing towards China as apparel imports shift

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season