Business

PM urged to fast-track spectrum auction | The Express Tribune

ISLAMABAD:

The Pakistan Telecommunication Authority (PTA) has approached Prime Minister Shehbaz Sharif, requesting him to expedite the process of new spectrum auction.

The Senate Standing Committee on Information Technology and Telecommunication, which met on Monday, voiced concerns over Ufone’s continued financial losses. It also got a briefing on alleged overbilling by Jazz, cartelisation in the telecom sector and the persistent service quality issues.

The Senate penal was informed that service quality problems primarily stemmed from the delay in spectrum auctions. Pakistan is currently operating with 274 MHz of spectrum, which is insufficient to meet the rising consumer demand. Internet slowdowns were the result of limited network capacity while several spectrum-related cases remained pending in courts.

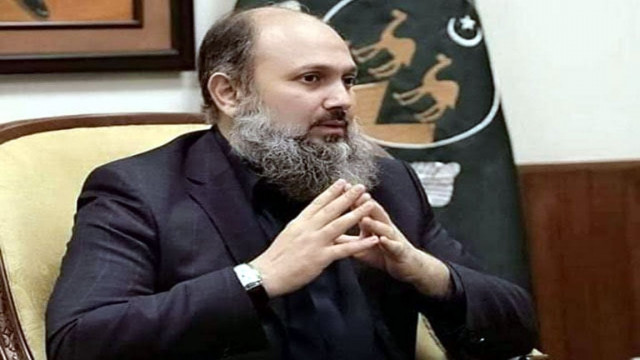

Speaking in the meeting, PTA Chairman Hafeezur Rehman said that the shortage of spectrum was a major factor behind poor service quality, though the PTA was fully prepared for spectrum auctions. He noted that Ufone-Telenor merger had been delayed for 18 months, further straining the telecom market.

PTA has also requested the PM to fast-track spectrum auctions in an effort to improve service delivery.

The Senate committee was concerned over the continued losses of Ufone that impacted the financial health of Pakistan Telecommunication Company Ltd (PTCL). The losses of Ufone, a subsidiary of PTCL, have also halted PTCL-Telenor merger.

The PTA chairman asserted that Ufone was the only mobile services company that was incurring losses, while others were profitable.

Senator Humayun Mohmand claimed that the company continued to suffer owing to the influence of the government. However, Senator Afnanullah countered that Ufone’s management was entirely private and the state had no operational role in it.

The PTA chairman acknowledged that Jazz increased tariffs by 19% in 2024, but insisted that the regulator’s role was to maintain market balance. PTA officials told the committee that Jazz wanted to increase tariffs further but it was restrained.

When asked by the committee chair if the PTA supported Jazz’s tariff hikes, the PTA chairman replied: “I will not defend Jazz under any circumstances.”

He clarified that the telecom authority regulates tariffs and protects consumers and no company could increase tariffs without prior approval. He stressed that the objections raised in an audit report had already been addressed and they were based on misunderstanding.

Business

D-St blues! Sensex sheds 1.5K, biggest drop on a Budget day – The Times of India

At a time when global markets are witnessing high volatility due to geopolitical uncertainties, the hike in securities transaction tax (STT) on derivatives trades hit investor sentiment on Dalal Street on the Budget day. This in turn led to a sharp sell-off that pulled the sensex down by nearly 1,500 points—its biggest points loss on a Budget day—to close at 80,773 points. The sell-off also left investors poorer by Rs 9.4 lakh crore, the biggest Budget day loss in BSE’s market capitalisation.The day’s trading was marked by high volatility. The sensex rallied over 400 points as FM started her speech, fell about 1,100 points after the STT hike proposal was announced, partially recovered by mid-session to trade 600 points down on the day and then sold-off to close below the 81K mark for the first time in four months.On the NSE, Nifty too treaded a similar path to close 495 points (2%) lower at 24,825 points. Fund managers and market players feel the day’s sell-off was overdone, compounded by the absence of most institutional players since it was a Sunday. “The market’s reaction (to the hike in STT rates) was a bit overdone, although the decision itself was unexpected,” said Taher Badshah, President & Chief Investment Officer, Invesco Mutual Fund. “I think markets should settle down in 2-3 days.” Badshah said the Budget was in line with govt’s set path of the past few years, showing a conservative approach to setting targets.“The revenue and expenditure targets for FY27 are achievable. And since the rate of inflation is lower now, the nominal GDP growth rate of 10% may turn out to be on the higher side as inflation normalises during the year,” the top fund manager said. In Sunday’s market, of the 30 sensex stocks, 26 closed in the red. Among index constituents, Reliance Industries, SBI and ICICI Bank contributed the most to the day’s loss. Buying in software services majors Infosys and TCS cushioned the slide. In all, 2,444 stocks closed in the red compared to 1,699 that closed in the green, BSE data showed.STT hike aimed at curbing F&O speculation The decision to raise securities transaction tax (STT) for trading in equity derivatives means trading futures & options (F&O) will be more expensive from April 1. STT on futures trading rises from 0.02% to 0.05% now, and on options premium and exercise of options to 0.15% from 0.1% and 0.125% respectively. This could more than double statutory costs of trading F&O contracts.While the move is to curb excessive speculation by retail traders who mostly suffer losses, investors sold stocks of those companies that derive a large portion of their turnover from this segment. Stock price of Angel One crashed nearly 9%, BSE crashed 8.1%, Billionbrains Garage Ventures that runs the Groww trading platform, lost 5.1% and Nuvama Wealth Management lost 7.3%. STT hike follows a Sebi survey that showed that 91% of the retail investors lost money in the F&O market with average loss per investor surpassing Rs 1 lakh per year. Institutional and some high net worth players took home most of the profits from the segment.18% GST on brokerage for FPIs removedThe Budget proposed to do away with 18% GST charged on the brokerage that foreign portfolio investors pay in India. Among the host of changes to the GST laws that the finance minister proposed, one was abolishing clause (b) of sub-section (8) of section 13 of the Integrated Goods and Services Tax Act, 2017. This is being “omitted so as to provide that the place of supply for ‘intermediary services’ will be determined as per the default provision under section 13(2) of the IGST Act,” the Budget proposal said.

Business

Buying property from NRIs? Time to lose the TAN – The Times of India

Buying property from an NRI? Worried about obtaining TAN? Not anymore. To relax the compliance burden, the Budget has proposed that resident individuals and HUFs need not have a Tax Deduction and Collection Account Number (TAN) if they are purchasing a property from a non-resident Indian (NRI). The amendment will take effect from Oct 1, 2026.Under the proposed framework, resident individuals or HUFs can report the tax deducted at source (TDS) by quoting PAN, as is done when the transactions are between two residents. Presently, if a person buys an immovable property from a resident seller, the person is not required to obtain TAN to deduct tax at source. However, where the seller of the immovable property is a non-resident, the buyer is required to obtain TAN to deduct tax at source.Ameet Patel, partner at Manohar Chowdhry & Associates, said this used to be a detailed process. “At present, if a resident were to purchase an immovable property from an NRI, there is no separate relaxation regarding compliance with TDS responsibilities. As a result, in such cases, the buyer needs to obtain a TAN, register on the portal, and then deduct TDS u/s. 195, and pay to the govt. Under section 195, as with all other regular TDS sections, a quarterly e-TDS statement is required. A buyer would need professional help for all this.”Hinesh Doshi, CA, welcomed the move. “There used to be an unnecessary compliance burden due to this. While the process to obtain TAN is simple, people used to obtain TAN for just one transaction. So, this is a good riddance.”

Business

Harry Styles and Anthony Joshua among UK’s top tax payers

The former One Direction member-turned-solo artist appears on the Sunday Times list for the first time.

Source link

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment5 days ago

Entertainment5 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Business6 days ago

Business6 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Tech1 week ago

Tech1 week agoICE Asks Companies About ‘Ad Tech and Big Data’ Tools It Could Use in Investigations

-

Sports5 days ago

Sports5 days agoCollege football’s top 100 games of the 2025 season

-

Sports1 week ago

Sports1 week agoBarcelona deny Madrid another trophy, but the gap is closing

-

Politics1 week ago

Politics1 week agoFresh protests after man shot dead in Minneapolis operation