Business

PSX lacks direction as investors weigh rollover week | The Express Tribune

KSE-100 index slips 130 points amid subdued trading ahead of 75% PIA stake bidding

Trading at the Pakistan Stock Exchange (PSX) moved cautiously on Tuesday, caught in a quiet rhythm as investors weighed rollover week adjustments and awaited clearer market signals ahead of bidding for Pakistan International Airlines’ (PIA) privatisation.

The session kicked off on a subtle note, lacking fresh energy, causing the market to drift cautiously.

As the day progressed, the KSE-100 index showed a brief spark early on, but buying interest quickly faded as investors chose to remain defensive. Light selling emerged after midday, nudging the index slightly lower, though no significant pressure was felt. A mild recovery towards the close helped stabilise the market.

Today, 60% of the total equity value traded at PSX was in Shariah-compliant stocks!

Learn about the top 3 Shariah Compliant Stocks in today’s PSX Market Breakdown pic.twitter.com/c1tk9XGDUw

— PSX (@pakstockexgltd) December 23, 2025

Movement stayed restricted, with the index hovering between 171,867.32 and 170,968.31 throughout the session. Interest around the PIA privatisation process kept select stocks in focus, but the absence of any immediate positivity from the sealed bids for 75% of the airline’s stake kept the momentum muted.

Subsequently, the benchmark index finished at 171,073.73, slipping 130.44 points, or 0.08%.

KTrade Securities observed that stocks remained range-bound for another session as subdued volumes in the regular counter kept market movement muted. The KSE-100 index closed marginally lower by 130 points (-0.08%) day-on-day at 171,073.

Selling pressure was largely seen in heavyweight stocks such as Engro Holdings, Fauji Fertiliser, Systems Limited, Lucky Cement, Oil & Gas Development Company, and Pakistan State Oil, which weighed on index performance; it added.

Read: SBP urged to rethink banking for high-tech growth

On the other hand, selective buying interest in Habib Bank Limited, Kohat Cement, United Bank, Pakistan Telecommunication, and Dolmen City REIT provided some support and helped limit the downside.

Market participation stayed healthy, with all-share volumes reaching 648 million shares, indicating adequate liquidity and sustained investor interest. Looking ahead, the broader market outlook remains constructive on the back of improving macroeconomic conditions following the State Bank of Pakistan’s policy rate cut. However, KTrade expects the rollover activity amid a shortened trading week to keep sentiment cautious in the near term.

Overall trading volume decreased to 650.1 million against Monday’s tally of 684.5 million. Value of traded shares stood at Rs28.2 billion. Shares of 481 companies were traded. Of these, 151 closed higher, 287 fell, and 43 remained unchanged. PIA Holding was the volume leader with trading in 45 million shares, losing Rs2.95 to close at Rs37.62.

Business

Southwest’s profits are down 42% this year but it’s the top U.S. airline stock

A Southwest Airlines Boeing 737 airplane arrives at Los Angeles International Airport from San Francisco on March 28, 2025 in Los Angeles, California.

Kevin Carter | Getty Images News | Getty Images

Southwest Airlines‘ profit fell 42% in the first nine months of the year compared with the same period in 2024. But its stock has been on a tear.

Shares of Southwest are up nearly 24% so far in 2025, more than any other U.S. passenger carrier. Industry profit leaders Delta Air Lines and United Airlines have risen about 17% each this year.

Southwest stock this week hit a 2½ year high. Analysts and investors have high hopes for the carrier next year, when it completes its planned transformation from a one-size-all-fits airline to one that looks more like its larger rivals.

“What’s helping Southwest’s stock is clearly the initiatives, not the [demand] environment, because if it was you’d see it in all the other stocks as well,” said Savanthi Syth, airline analyst at Raymond James.

Southwest Airlines stock compared with the NYSE Arca Airline index

Starting Jan. 27, Southwest is ditching open seating and moving to assigned seats on its all-Boeing 737 fleet. The first rows of seats have extra legroom — for a fee. Seat prices vary, but, for example, a Baltimore to Las Vegas flight in early February showed the seats going for about $80 each way.

Southwest in October forecast that assigned seating and extra legroom seats could drive $1 billion in pretax earnings next year and $1.5 billion in pretax earnings in 2027.

“Because the assigned seating, the extra legroom, kicks in and there’s a lot of value in that, of course, [results are] going to be better year over year,” Southwest CEO Bob Jordan told CNBC on Dec. 10. “The bookings that we’re seeing reflect the business case for assigned seating and extra legroom.”

Barclays upgraded Southwest’s stock earlier this month, with transportation analyst Brandon Oglenski forecasting Southwest’s adjusted earnings will be above $4 per share next year and surpass $6 per share in 2027.

The end of the cattle call boarding lineup comes months after the Dallas carrier got rid of another decades-old policy: two free checked bags for customers. It also started selling its first-ever no-frills basic economy fares.

Southwest, like other airlines, cut its profit forecast for 2025 after demand dipped early this year as President Donald Trump‘s tariffs and cost cutting in Washington weighed on bookings. More recently, the government shutdown that ended last month hurt demand prompting Southwest to again lower its earnings outlook for the year.

Southwest typically provides its yearly outlook alongside the previous year’s earnings in late January.

Business

Deal approvals: CCI clears Blackstone’s Federal Bank entry; Tata Steel gets nod for BlueScope buyout – The Times of India

The Competition Commission of India on Tuesday approved US-based private equity firm Blackstone’s proposal to acquire up to 9.99 per cent stake in Federal Bank through warrants, clearing the way for the global investor’s entry into the private sector lender.In a release, the fair trade regulator said the proposed transaction involves Asia II Topco XIII Pte Ltd, an arm of Blackstone, acquiring warrants that carry the right to subscribe to equity shares of Federal Bank, PTI reported.“The proposed combination envisages acquisition of certain warrants by Asia II Topco XIII Pte Ltd (acquirer), each carrying a right to subscribe to one fully paid-up equity share of Federal Bank Ltd (target),” the regulator said.Upon full exercise of the warrants, the acquirer will hold 9.99 per cent of the paid-up share capital of Federal Bank on a fully diluted basis, according to the CCI. Blackstone will also have the right to nominate a director on the bank’s board as long as it holds at least a 5 per cent stake.Federal Bank is a private sector commercial lender offering a range of banking products and services, including deposits, loans and payment solutions.In a separate approval, the CCI also cleared Tata Steel Ltd’s proposal to acquire sole control of Tata BlueScope Steel by purchasing the remaining 50 per cent equity stake held by BlueScope Steel Asia Holdings Pty Ltd.“Commission approves Tata Steel Limited’s proposed acquisition of sole control in Tata BlueScope Steel Pvt. Ltd. by purchasing the remaining 50 per cent equity shareholding currently held by BlueScope Steel Asia Holdings Pty Ltd,” the watchdog said in a post on X.Tata BlueScope Steel is currently a 50:50 joint venture between BlueScope Steel Ltd of Australia and Tata Steel Downstream Products Ltd. Tata Steel is engaged in iron ore mining and steel production, while Tata Steel Downstream Products operates in the coated steel segment, offering surface-coated steel products and related solutions.Transactions crossing specified thresholds require clearance from the competition regulator, which is mandated to prevent unfair business practices and ensure fair competition in the market.

Business

FTSE 100 moves ahead amid surprise US growth jump

The FTSE 100 was in festive mood on Tuesday, closing higher after a report showed improved UK business confidence and the US economy grew more than forecast in the third quarter.

The FTSE 100 index closed up 23.25 points, 0.2%, at 9,889.22. The FTSE 250 ended up just 6.83 points at 22,349.55, while the AIM All-Share closed down 1.67 points, 0.2%, at 758.81.

UK business confidence increased to 47% in December, rising five points from last month and standing 10 points higher than the start of 2025, according to the latest Lloyds Business Barometer.

In addition, optimism towards the wider economy reached a four-month high, up 11 points to 42%. The renewed economic optimism offset a slight dip in firms’ expectations for their own trading prospects, which decreased by one point to 52%.

“It is great to see business confidence ending the year on a higher note,” said Hann-Ju Ho, senior economist at Lloyds Commercial Banking.

Construction saw the sharpest improvement, up 22 points to 61%, its highest level seen this year.

Manufacturing also was up five points to 49%, while retail firms edged higher to 47%, likely reflecting seasonal demand.

In European equities, the CAC 40 in Paris closed down 0.2%, while the DAX 40 ended up 0.2%.

In Copenhagen, Novo Nordisk jumped 9.2% after the US Food and Drug Administration approved its once‑daily Wegovy pill, the first oral glucagon‑like peptide‑1 therapy cleared for weight management.

“As the first oral GLP-1 treatment for people living with overweight or obesity, the Wegovy pill provides patients with a new, convenient treatment option that can help patients start or continue their weight loss journey,” said Novo chief executive Mike Doustdar in a statement late on Monday.

The company expects to launch the Wegovy pill in the US in early January 2026.

Stocks in New York were higher at the time of the London equity market close. The Dow Jones Industrial Average was up 0.2%, while the S&P 500 and the Nasdaq Composite were both 0.3% higher.

The yield on the US 10-year Treasury was quoted at 4.18%, widened from 4.17%. The yield on the US 30-year Treasury was quoted at 4.84%, stretched from 4.83%.

Figures showed US economic growth accelerated in the third quarter of the year, markedly outperforming expectations.

According to Bureau of Economic Analysis data, US gross domestic product expanded 4.3% on an annualised basis quarter-on-quarter in the three months to September 30, easily beating the 3.3% growth predicted by consensus cited by FXStreet, and accelerating from a 3.8% expansion in the second quarter.

ING said the figure was “eye-popping”, primarily due to a strong performance from net trade with exports rising 8.8% and imports falling 4.7%, while consumer spending grew a robust 3.5% versus the 2.7% rate expected.

But while it was a “fantastic outcome”, ING noted fourth-quarter GDP is likely to record growth that is considerably slower, thanks in part to the effects of the month-long government shutdown.

“We also can’t see the net trade component continuing to make such a strong contribution while consumer spending is also set to slow,” ING added.

Other US data was mixed, with industrial production beating expectations, but consumer confidence and durable goods orders falling short of hopes.

The pound was quoted at 1.3481 US dollars at the time of the London equities close on Tuesday, up from 1.3452 on Monday.

The euro stood at 1.1777 dollars, higher against 1.1759 dollars. Against the yen, the dollar was trading lower at 156.37 yen compared to 156.95.

Back in London, Metlen Energy & Metals was the best FTSE 100 performer, rising 6.8%.

It said it has completed the sale of a portfolio of solar farms and co-located battery energy storage systems in Chile to a subsidiary of Glenfarne Group at enhanced terms.

Metlen is an Athens-based aluminium producer and electricity generator. Glenfarne is a New York and Houston-based developer, owner, operator, and industrial manager of energy and infrastructure assets.

In April, Metlen had said Glenfarne unit GAC RS Chile II Spa would pay 815 million dollars (£606 million) for the assets.

On Tuesday, Metlen said the final price to be paid is 865 million dollars (£643 million), reflecting the “value creation opportunities emerging in the Chilean market”.

Videndum plunged 56% as the provider of broadcasting hardware and software said a planned refinancing will, if successful, see current shareholdings “very significantly diluted”, while completion is also not guaranteed.

The firm said the main components of a refinancing proposal have now been agreed in principle with the revolving credit facility lenders and its two largest shareholders.

But the firm warned any share issue would be “very significantly below” their current nominal value of 20p per share.

Gut Gulf Marine Services fared better, climbing 11% after reporting a new contract award that covers two of its large-class vessels in Europe.

Neither the name of the client nor the financial terms of the contract were disclosed, but Gulf Marine Services said the award increases its contracted backlog to 540 million dollars.

Brent oil was quoted at 62.09 dollars a barrel at the time of the London equities close on Tuesday, up from 61.87 dollars late on Monday.

Gold traded at 4,462.05 dollars an ounce, up from 4,440.54 on Monday.

The biggest risers on the FTSE 100 were Metlen Energy & Metals, up 2.80 euro cents at 44.00 euro, Anglo American, up 88.00 pence at 2,993.00p, Antofagasta, up 67.00p at 3,235.00p, BT, up 2.80p at 185.05p and Airtel Africa, up 4.80p at 337.80p.

The biggest fallers on the FTSE 100 were Diageo, down 29.00p at 1,588.00p, Ashtead Group, down 78.00p at 5,192.00p, Convatec, down 3.20p at 238.60p, Burberry, down 16.00p at 1,261.50p and easyJet, down 6.29p at 506.80p.

Wednesday’s economic calendar includes US weekly jobless claims data.

There are no significant events scheduled in Wednesday’s UK corporate calendar.

– Contributed by Alliance News

-

Business1 week ago

Business1 week agoStudying Abroad Is Costly, But Not Impossible: Experts On Smarter Financial Planning

-

Fashion6 days ago

Fashion6 days agoIndonesia’s thrift surge fuels waste and textile industry woes

-

Business1 week ago

Business1 week agoKSE-100 index gains 876 points amid cut in policy rate | The Express Tribune

-

Sports1 week ago

Sports1 week agoJets defensive lineman rips NFL officials after ejection vs Jaguars

-

Business6 days ago

Business6 days agoBP names new boss as current CEO leaves after less than two years

-

Tech6 days ago

Tech6 days agoT-Mobile Business Internet and Phone Deals

-

Entertainment1 week ago

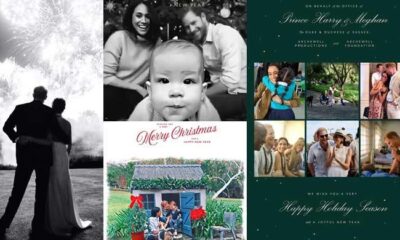

Entertainment1 week agoPrince Harry, Meghan Markle’s 2025 Christmas card: A shift in strategy

-

Sports6 days ago

Sports6 days agoPKF summons meeting after Pakistani player represents India in kabaddi tournament