Business

Supply ‘too reliant’ on one asset, says South East Water boss

Fiona Irving,South East environment correspondentand

Craig Buchan,South East

BBC

BBCThe boss of South East Water has said the company is too dependant on individual facilities after a six-day supply failure affected thousands of people in Kent.

About 24,000 properties in and around Tunbridge Wells had no or low pressure tap water from 29 November until supplies returned to most on 4 December. For the next nine days, residents were told to boil the restored tap water before consumption.

A disinfection problem at Pembury Water Treatment Works had caused the failure but there was no evidence supply became infected, said South East Water.

The water company’s chief executive, David Hinton, said the firm was “just too reliant in some areas on one asset”.

Mr Hinton was speaking to the BBC earlier in the week and said the company wants to “do more” at a separate works at Bewl Water reservoir, near Wadhurst in East Sussex, and spend £30m on expanding output capacity.

The proposal would give the company the ability to “rapidly fill the area of Tunbridge Wells, for example, as soon as we see any issue”, said Mr Hinton.

He said this would allow “extra resilience should any other challenges hit any other treatment works” without further draining the reservoir.

“It’s not only for Tunbridge Wells, it’s for the wider parts of Kent as well,” added the chief executive, who has faced calls to resign over the supply issues.

South East Water was one of five companies to contest regulator Ofwat’s latest price controls, which already allowed it to increase an average annual bill from £232 to £274 by 2030.

The firms argued the 36% average price increase for customers in England over the next five years was not enough to deliver better infrastructure.

The Competition and Markets Authority has provisionally agreed that South East Water can increase bills by an extra 4%, pending a final decision in 2026.

Mr Hinton said the Bewl Water proposal was a reason why the company was asking the competition regulator to allow it to raise more money from customers.

South East Water suspects “something to do with the level” of water at its Pembury reservoir contributed to the supply failure but the firm wants to “do a full investigation”, he said.

The company introduced hosepipe restrictions in July for Kent and Sussex customers after dry weather earlier in 2025.

The Drinking Water Inspectorate said it was investigating the Tunbridge Wells loss of supply incident.

Business

Gold, Silver ETFs Sink Up To 10% As Precious Metals Rout Deepens; What Should Investors Do Now?

Last Updated:

Silver and gold-linked commodity ETFs extended their slide, falling as much as 10%, tracking sharp drop in precious metal futures on the MCX

Silver ETFs

Silver and gold-linked commodity ETFs extended their slide on Friday, falling as much as 10%, tracking a sharp drop in precious metal futures on the MCX for the second straight session.

The decline came amid a global sell-off in technology stocks and a strengthening US dollar, which wiped out most of the gains from a brief rebound earlier in the week.

Silver ETFs lead losses

Kotak Silver ETF was the worst hit, tumbling 10%, while HDFC Silver ETF, SBI Silver ETF and Edelweiss Silver ETF declined about 9% each. Bandhan Silver ETF limited losses to around 6%.

Among gold-linked funds, Angel One Gold ETF slipped 8%, while Zerodha Gold ETF fell about 5%.

Volatility persists after steep correction

Hareesh V, Head of Commodity Research at Geojit Investments, said gold and silver continue to witness heightened volatility after last week’s sharp selloff. The correction was driven by hawkish US Federal Reserve expectations following Kevin Warsh’s nomination, a stronger dollar, and steep margin hikes by the CME that forced leveraged positions to unwind. Profit-taking after record highs further amplified price swings, keeping sentiment fragile.

He advised bullion investors to remain patient and avoid reacting to short-term volatility driven by margin hikes, profit booking and policy uncertainty.

“Gradual, staggered accumulation can help manage timing risks, as long-term fundamentals such as geopolitical tensions, central bank demand and currency pressures remain supportive. Closely tracking the US dollar and upcoming Federal Reserve signals is crucial in this phase of elevated volatility,” he said.

MCX futures slide sharply

In Friday’s session, MCX silver futures for March 5 delivery plunged 6%, or ₹14,628, to ₹2,29,187 per kg. Gold futures for April 2 delivery also weakened, slipping ₹2,675, or 2%, to ₹1,49,396 per 10 grams.

Globally, silver remained extremely volatile. Prices rebounded as much as 3% after plunging 10% to below the $65 level, a more than six-week low. Despite the bounce, silver was still down nearly 16% for the week. In the previous week, it had fallen 18%, marking its steepest weekly decline since 2011.

Margin hikes add pressure

The selloff spilled into domestic ETFs after sharp margin hikes in precious metal futures. On Thursday, commodity-based ETFs dropped as much as 21%, led by silver ETFs, while gold ETFs declined up to 7%.

Margins on silver futures were raised by 4.5% and on gold futures by 1% effective February 5, followed by an additional hike of 2.5% on silver and 2% on gold on Friday. As a result, total additional margins now stand at 7% for silver futures and 3% for gold futures from February 6.

“Markets often see sharp corrections after extended rallies. Broader risk sentiment and geopolitical cues can trigger profit booking in commodities, especially where positioning has been crowded,” said Nirpendra Yadav, Senior Commodity Research Analyst at Bonanza.

However, he added that industrial demand for silver remains strong, with a tight global supply environment and persistent deficits supporting prices over the medium to long term. Short-term intraday swings, he said, do not alter the long-term outlook.

Trade deal, macro cues in focus

Ross Maxwell, Global Strategy Operations Lead at VT Markets, said the India–US trade deal could improve risk appetite by easing supply-chain frictions and reducing tariff-linked inflation pressures.

“In this context, gold and silver will balance lower trade tensions against ongoing macro uncertainty. A clearer trade outlook can reduce risk aversion, limiting upside in precious metals,” he said.

Maxwell added that gold remains supported by concerns around inflation, currency stability and geopolitical risks, making it attractive as a strategic hedge rather than a short-term trade. Silver, he noted, also benefits from industrial demand, meaning improved global trade expectations could lend support through stronger manufacturing activity.

“While reduced tariffs may dampen fear-driven buying, both gold and silver are likely to remain structurally firm as long as economic and policy uncertainty persists,” he said.

February 06, 2026, 12:08 IST

Read More

Business

RBI holds repo rate steady at 5.25% in February 2026 MPC meeting

New Delhi: The Reserve Bank of India (RBI) has kept the repo rate unchanged at 5.25 PERCENT in its February 2026 monetary policy review, maintaining a neutral policy stance as inflation pressures remain under control and economic growth stays stable.

The decision was announced by RBI Governor Sanjay Malhotra after the three-day meeting of the Monetary Policy Committee (MPC), which began on February 4 and concluded on February 6.

Focus on Inflation and Growth

The MPC chose to pause after a series of rate cuts over the past year, preferring to evaluate how earlier policy changes are affecting borrowing costs, liquidity, and overall economic activity.

Inflation has remained within the RBI’s comfort range, giving policymakers room to maintain the current rate while monitoring global economic conditions and domestic demand.

The RBI’s monetary policy framework aims to keep inflation close to 4 PERCENT with a tolerance band of 2–6 PERCENT, which continues to guide interest-rate decisions.

Impact on Loans, EMIs, and Markets

Since the repo rate directly influences borrowing costs for banks, the decision to keep rates unchanged means loan EMIs are unlikely to change immediately. However, banks and financial markets will continue to watch RBI signals on liquidity and future rate moves.

The central bank has already reduced rates by about 125 basis points since early 2025, which helped support economic growth while inflation eased.

What Happens Next

Economists believe the RBI may now focus more on policy transmission and liquidity management rather than further rate cuts in the near term.

Governor Malhotra is expected to outline the RBI’s outlook on inflation, growth, and financial stability in the coming quarters during the post-policy press conference.

Business

$2 trillion wiped off crypto markets! Bitcoin halves since October; investor company shares sink to multiyear lows – The Times of India

Cryptogiant Bitcoin has suffered sharp losses since the beginning of 2026, tumbling over 20%. The digital currency has given up almost half of its value since October’s record peak of over $124,000, sliding to $67,000, now worth less than it was at the start of President Donald Trump’s second term. Bitcoin is often pitched as “digital gold” as its returns are just like gold, offering no dividends or profits and price driven by what investors are willing to pay. The world’s largest cryptocurrency was last trading 1.64% higher at $64,153.24 after a volatile session that saw prices swing between gains and losses, having earlier touched a low of $60,008.52. The global crypto market has lost $2 trillion in value since peaking at $4.379 trillion in early October, with $800 billion wiped out in the last month alone, Reuters reported. Bitcoin has declined 28% so far this year, while ether has lost nearly 38% over the same period.As the asset slid, shares of companies holding bitcoin and other digital assets also came under heavy pressure amid ongoing turbulence in the cryptocurrency market, fuelling concerns about stress across the sector. Publicly listed firms that piled into crypto last year, encouraged by US President Donald Trump’s supportive stance, are now grappling with intensifying market challenges.The decline comes as uncertainty over Federal Reserve rate cuts and concerns over AI company valuations weigh on risk assets, pushing bitcoin to its lowest level since November 2024.Strategy shares plunge to multi-year lowsMicroStrategy’s bitcoin-focused arm, Strategy, has seen shares tumble from $457 in July to $111.27 on Thursday, marking their lowest level since August 2024. The stock was last down more than 11%, according to Reuters.In December, Strategy cut its 2025 earnings forecast, citing weak bitcoin performance, and announced plans to create a reserve to support dividend payments. The company now expects full-year earnings between a $6.3 billion profit and a $5.5 billion loss, down from its earlier forecast of $24 billion.Other notable bitcoin buyers have also been hit. UK-based Smarter Web Company (SWC.L) fell nearly 18%, Nakamoto Inc (NAKA.O) lost almost 9%, and Japan’s Metaplanet (3350.T) dropped over 7%.Bitcoin wipes out gains since Trump’s electionBitcoin itself is down nearly 28% since the start of the year, with recent selling accelerating after Trump nominated Kevin Warsh as the next Federal Reserve chair. Analysts cited by Reuters say that Warsh’s appointment could lead to a smaller Fed balance sheet, a negative for speculative assets like crypto.Bitcoin has erased all gains made since Trump’s election, when he pledged to overhaul policies toward digital assets. The cryptocurrency last traded at $67,651.“As Bitcoin continues its slide below the psychological barrier of $70,000, it’s clear the crypto market is now in full capitulation mode,” said Nic Puckrin, investment analyst and co-founder of Coin Bureau. “If previous cycles are anything to go by, this is no longer a short-term correction, but rather a transition… and these typically take months, not weeks,” Reuters cited the expert.Broader digital asset holdings also hitCompanies holding other tokens have been affected as well. Alt5 Sigma, which stocks the Trump family’s WLFI token, fell 8.4%. SharpLink Gaming, holding ether, dropped 8%, while Forward Industries, which holds solana, fell nearly 6%.Bitcoin fell to a low of $63,295.74 on Thursday, its weakest since October 2024, before rebounding slightly to $63,525, marking its largest one-day drop since November 2022. Approximately $1 billion in bitcoin positions were liquidated over 24 hours, according to CoinGlass data.Fed concerns and investor outflowsTrump’s Fed pick, Kevin Warsh, has added to market fears. Analysts say investors worry that a smaller balance sheet will remove liquidity support for speculative assets.“The market fears a hawk with him,” Manuel Villegas Franceschi from Julius Baer told Reuters. “A smaller balance sheet is not going to provide any tailwinds for crypto.”Deutsche Bank analysts highlighted massive outflows from institutional ETFs as a key driver of the decline. US spot bitcoin ETFs saw over $3 billion withdrawn in January, following $2 billion and $7 billion outflows in December and November, respectively. “This steady selling in our view signals that traditional investors are losing interest, and overall pessimism about crypto is growing,” they said.Tech sector weakness piles pressure on crypto segmentThe slide in cryptocurrencies has been compounded by a broader downturn in tech stocks, particularly software companies linked to AI. Bitcoin and other tokens have historically tracked risk appetite in technology markets, and the current weakness has intensified losses.“Concerns are being raised around the crypto miners and whether we could be looking at forced liquidations if prices continue to fall, which could lead to a vicious cycle,” said Jefferies strategist Mohit Kumar, as cited by Reuters. The analyst further added that crypto “should never be more than a very small portion of a portfolio, but its heavy retail ownership adds to overall market risk.”

-

Business1 week ago

Business1 week agoPSX witnesses 6,000-point on Middle East tensions | The Express Tribune

-

Tech1 week ago

Tech1 week agoThe Surface Laptop Is $400 Off

-

Tech1 week ago

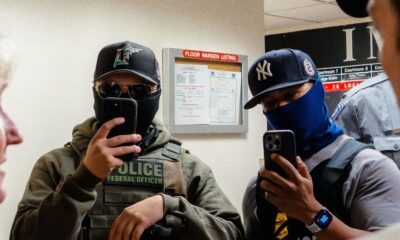

Tech1 week agoHere’s the Company That Sold DHS ICE’s Notorious Face Recognition App

-

Tech4 days ago

Tech4 days agoHow to Watch the 2026 Winter Olympics

-

Tech6 days ago

Tech6 days agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Business1 week ago

Business1 week agoBudget 2026: Defence, critical minerals and infra may get major boost

-

Entertainment1 week ago

Entertainment1 week agoPeyton List talks new season of "School Spirits" and performing in off-Broadway hit musical

-

Business6 days ago

Business6 days agoLabubu to open seven UK shops, after PM’s China visit