Fashion

Sustained, slower improvement in US manufacturing operating conditions

The seasonally-adjusted US manufacturing PMI recorded 51.8 in December. That was down from 52.2 in November and signaled the weakest expansion of the manufacturing economy in the current five-month growth sequence.

December’s S&P Global PMI data indicated a sustained, albeit slower, improvement in US manufacturing sector operating conditions.

The seasonally-adjusted manufacturing PMI was 51.8 in December.

Weaker growth resulted from a mild contraction in new order intakes.

Global sales continued to fall, in part linked to tariffs.

Confidence in the outlook remained positive despite easing slightly since November.

Weaker growth emanated from a mild contraction in new order intakes, the first in a year.

International sales continued to fall, in part linked to tariffs, which also continued to push up operating expenses at an elevated pace.

Although remaining historically elevated, both input and output prices rose at their slowest rates for 11 months.

US firms reported that employment growth was sustained into the end of 2025, with job creation reaching the most pronounced since August.

Confidence in the outlook also remained positive despite easing slightly since November.

Exports were also a source of demand weakness, falling for the seventh successive month.

Tariffs were reported to have weighed on export sales, especially to Canada. A reduction in demand led to weaker output gains in December, the softest in three months.

Amid a reduction in sales, production increased sufficiently for firms to continued adding to their stocks of finished goods for the fifth month in a row, though the rate of accumulation moderated noticeably from November’s survey record.

Work outstanding declined for the fourth month in a row during December, partly due to an expansion in labour capacity.

Meanwhile, difficulties receiving inputs due to supplier capacity constraints were noted to have driven average lead times higher in December. The latest lengthening of lead times was the most marked in seven months.

Fibre2Fashion News Desk (DS)

Fashion

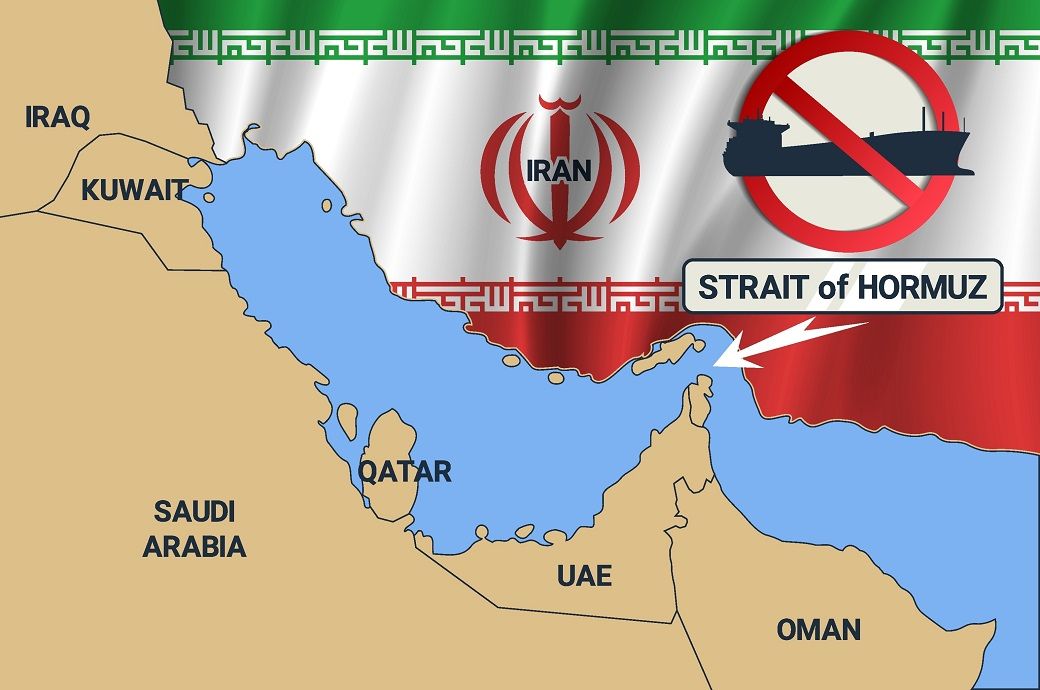

Hormuz risk: The hidden polyester shock to global apparel

As tensions between the United States and Iran push oil markets higher, apparel faces deeper risk in polyester, which dominates global fibre output.

Any disruption in the Strait of Hormuz can quickly reprice petrochemical inputs like PTA and MEG.

Even without a full closure, volatility can squeeze mill margins and destabilise polyester-heavy supply chains.

Source link

Fashion

US’ New Balance unveils International Baseball pack

The Puerto Rico-inspired cleat introduces a vibrant new Lindor v3 colorway created with powerhouse shortstop Francisco Lindor featuring a repeating Coquí frog pattern of Puerto Rico’s national animal. The Japan model debuts as an Ohtani v1 colorway honoring Shohei Ohtani and incorporating Japan’s national colors and the Flag of Japan through a navy boot with a striking metallic red New Balance “N” Lock logo.

New Balance has introduced its International Baseball Pack, a series of performance cleats celebrating the heritage of its global athletes.

The collection includes country-inspired versions of the Lindor v3, Ohtani v1, 3000 v7, 4040 v8 and Velo v4.

Designs pay tribute to Francisco Lindor, Shohei Ohtani and others, featuring national colours, symbols and cultural details.

“I wanted the design to honor the spirit of the island I love,” said Francisco Lindor, New Balance athlete. “The Coquí frog’s sound is such an iconic symbol for Puerto Ricans, and bringing that to life on the Lindor v3 makes this cleat truly meaningful to me.”

Additional cleats in the collection include designs celebrating New Balance athletes Cal Raleigh (USA), José Altuve (Venezuela), Jeremy Peña (Dominican Republic), and Ha-Seong Kim (South Korea).

“As fans of baseball first, we have deep appreciation for the distinct styles and rhythm of play that each culture brings to the game,” said Matt Nuzzo, Sr. Product Manager, American Football and Baseball Footwear at New Balance. “The International Baseball Pack celebrates and reflects the pride of our international roster. Being able to celebrate spirit of our athlete’s home countries was incredibly meaningful to us.”

Note: The headline, insights, and image of this press release may have been refined by the Fibre2Fashion staff; the rest of the content remains unchanged.

Fibre2Fashion News Desk (RM)

Fashion

India-Israel FTA talks begin to deepen bilateral trade ties

Total merchandise trade between the two countries stood at $3.62 billion in FY24-25. They share complementarities across several sectors, and the FTA will be a catalyst to further enhance the bilateral trade by providing certainty and predictability to businesses, including micro, small, and medium enterprises (MSMEs), the Ministry of Commerce and Industry said in a press release.

India and Israel have begun the first round of FTA negotiations in New Delhi through February 26, 2026, following the November 2025 ToR signing.

With bilateral trade at $3.62 billion in FY25, talks cover goods, services, rules, SPS, TBT and IPR.

Officials highlighted opportunities in technology and innovation, aiming for a balanced pact to boost trade, supply chains and economic cooperation.

During this round, technical experts from both sides will engage in sessions covering various aspects of FTA such as trade in goods, trade in services, rules of origin, sanitary and phytosanitary measures, technical barriers to trade, customs procedure and trade facilitation, intellectual property rights, among others.

During the opening session, Indian Commerce Secretary, Rajesh Agrawal, underscored that the FTA negotiations had begun at an opportune moment of Prime Minister Narendra Modi’s visit to Israel from February 25-26, 2026.

Agrawal underscored the significant opportunities available to both sides in sectors such as innovation, science and technology, artificial intelligence, cybersecurity, high-tech manufacturing, agriculture, and services. He emphasised that the FTA would enable both countries to harness and fully leverage these opportunities.

Chief Negotiator of India, Ajay Bhadoo, Additional Secretary, Department of Commerce, reiterated the significance of this engagement for the two countries and encouraged both sides to work on a balanced agreement to build a forward-looking framework for an evolving partnership.

Chief Negotiator of Israel for the FTA, Yifat Alon Perel, Senior Director Trade Policy and Agreements and Deputy Trade Commissioner, Foreign Trade Administration, Ministry of Economy and Industry, Israel, expressed that the two countries shared a close relationship, and that the FTA has the potential to strengthen supply chains, enhance cooperation and open new markets for both countries.

This engagement highlighted the strategic importance of India-Israel bilateral relationship and reinforces India’s commitment to strengthen economic partnerships in line with national priorities and global aspirations. Both sides are working towards concluding a balanced and mutually beneficial agreement, added the release.

Fibre2Fashion News Desk (SG)

-

Entertainment1 week ago

Entertainment1 week agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech1 week ago

Tech1 week agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics1 week ago

Politics1 week agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment1 week ago

Entertainment1 week agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Politics1 week ago

Politics1 week agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Business1 week ago

Business1 week agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Tech1 week ago

Tech1 week agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports1 week ago

Sports1 week agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash