Income doesn’t come regularlyFreelancers earn from different clients at different times, making it hard to know the final income figure early Multiple clients mean scattered TDSTax...

New Delhi: The Central Board of Direct Taxes (CBDT) has said that it is launching the second Nonintrusive Usage of Data to Guide and Enable (NUDGE)...

New Delhi: A social media post is going viral that claims, from 1st April 2026, the Income Tax Department will have the authority to access your...

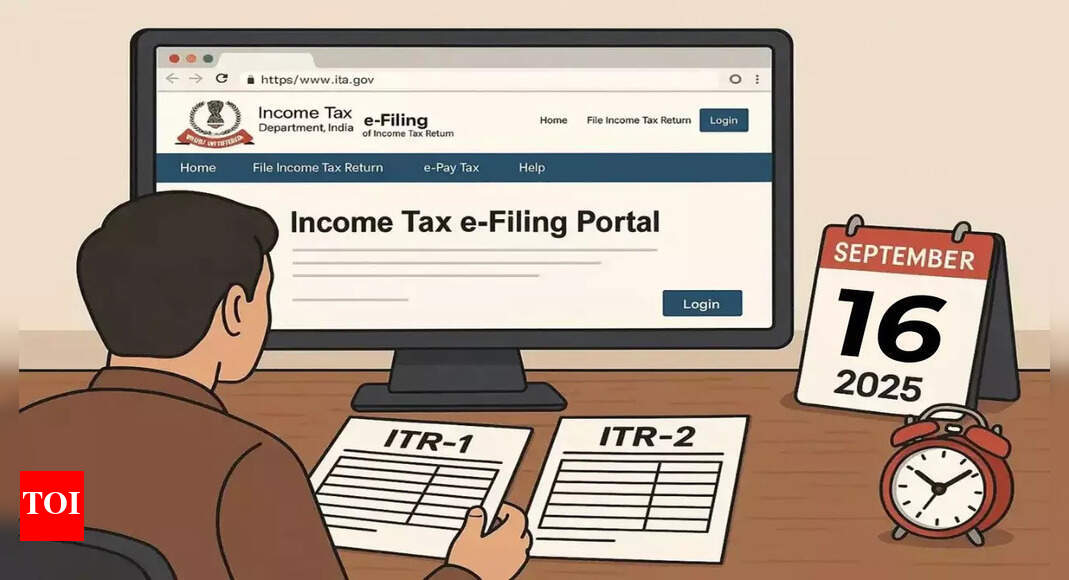

Taxpayers continue to struggle with the ITR submission process due to technical difficulties on the Income Tax department’s official portal. (AI image) ITR filing FY 2024-25...

New Delhi: In The wake of glitches and technical errors being reported on the Income Tax Portal, the Central Board of Direct Taxes has given into...

Last Updated:September 16, 2025, 00:29 IST ITR Filing Due Date Extended: The CBDT decides to further extend the due date for filing these ITRs for AY...

Last Updated:August 26, 2025, 16:51 IST Form-16 is a document detailing an individual’s salary, taxable income, and tax deducted. It can be downloaded conveniently from the...