Business

Tariff row: GTRI’s 3-step plan for India to protect its interests; key remarks on Russian oil – The Times of India

Global Trade Research Initiative (GTRI) has proposed a three-step strategy to safeguard India’s trade interests as discussions with the United States have stepped into the “advanced stage.” The agency has suggested measures like scaling back Russian oil imports, seeking trade parity and resuming talks on fair terms.

Here’s what GTRI’s 3 step plan says:

1. Halting Russian oil imports under sanctions

According to the think tank, the first move should be to stop importing oil from Russian companies currently under US sanctions, specifically Rosneft and Lukoil, which together account for 57% of Russia’s crude output. GTRI said that continuing to source crude from these firms exposes India to potential secondary sanctions that could extend and affect critical infrastructure. The note cautioned that more secondary sanctions might be far more damaging than tariffs, as they could disrupt SWIFT access, dollar payments and essential digital systems, potentially paralysing operations across refineries, ports and banks.

2. Removal of additional tariffs

Once such imports are halted, the advisory body recommends India to “press Washington to withdraw the punitive 25% “Russian oil” tariff.” Scrapping the tariff would cut India’s duty burden in the US by half, from 50% to 25%, and improve export competitiveness.These additional duties were introduced on July 31 which the US called a “Russian oil” tariff, accusing India of fueling Moscow’s war machine. Since then, India’s overall duty burden in the US market has climbed to 50%, coinciding with a noticeable drop in exports, down 37% between May and September.

3. Starting on fair terms

Only after tariffs return to normal levels, GTRI suggested to “restart trade negotiations…only on fair, balanced terms.”The organisation said India should push for tariff parity with its other major trade partners by targeting average duties of roughly 15% and securing duty-free access for priority sectors such as textiles, gems and jewellery, and pharmaceuticals.Commerce minister Piyush Goyal has signalled progress on a bilateral trade agreement with the United States, saying that the negotiations have reached an “advanced stage”. The development aligns with US President Donald Trump’s recent hint that a deal with India may be imminent.According to a TOI report, the proposed trade agreement could bring down US tariffs on Indian exports from 50% to 15%. In return, India is expected to scale back purchases of Russian oil and increase energy imports from the United States, along with fulfilling other commitments.

Business

From Manufacturing To Infra And AI: Capex Boost Flags Off Budget 2026 ‘Reforms Express’

Last Updated:

Budget 2026: FM Nirmala Sitharaman gives a strong push to manufacturing, infrastructure and job creation, while proposing a simpler tax and customs system.

Finance Minister Nirmala Sitharaman presents the Union Budget 2026-27.

Budget 2026 Takeaways: Finance Minister Nirmala Sitharaman on Sunday presented the Union Budget 2026-27, giving a strong push to manufacturing, infrastructure and job creation, proposing a simpler tax and customs regime, and hailing the government’s modernisation drive as a “reforms express”.

The Budget 2026 is anchored around three ‘kartavyas’ — driving growth by enhancing productivity and competitiveness, building people’s capacity, and ensuring inclusive development under the vision of Sabka Saath, Sabka Vikaas.

In her ninth consecutive Budget in Parliament, Sitharaman laid out a multi-pronged strategy to sustain growth amid global uncertainty, including expanding domestic electronics and semiconductor capabilities, de-risking infrastructure projects, skilling India’s youth for emerging technologies, and easing compliance for taxpayers and importers.

Here are the key takeaways from Budget 2026 across manufacturing, infrastructure, skills, AI, taxation and customs duty.

Manufacturing Gets A Boost

Budget 2026 put a special emphasis on the manufacturing landscape in India. The outlay for electronics components manufacturing was raised sharply to Rs 40,000 crore, while new schemes for rare earth magnets, chemical parks, container manufacturing and capital goods seek to reduce import dependency, and strengthen domestic supply chains. Textiles got an integrated, employment-oriented package covering fibres, clusters, skilling and sustainability.

Infrastructure-Led Growth

Infrastructure got a boost with a higher capex allocation and initiatives like a risk guarantee fund to de-risk projects for private developers, new dedicated freight corridors and national waterways, dedicated REITs (real estate investment trusts) for recycling of significant real estate assets of central public sector enterprises (CPSEs), and a seaplane VGF (viability gap funding) scheme.

The Centre’s capital expenditure (capex) target has been increased to Rs 12.2 lakh crore for FY27, up from Rs 11.2 lakh crore earmarked for the current financial year. Moreover, maintaining the fiscal discipline, Sitharaman said the government expects the fiscal deficit to be at 4.3 per cent of the GDP in 2026-27, lower than 4.4 per cent projected for the current financial year.

Tier-II and Tier-III cities were placed at the centre of urban growth via City Economic Regions, backed by reform-linked funding.

“We shall continue to focus on developing infrastructure in cities with over 5 lakh population (Tier II and Tier III), which have expanded to become growth centres,” Sitharaman said in her Budget Speech.

Greater Emphasis On Skilling

The Budget placed renewed emphasis on the services economy as a jobs engine. A high-powered Education-to-Employment and Enterprise Committee will realign skilling with market needs, including the impact of emerging technologies.

Content creation and creative industries get a boost through AVGC labs in schools and colleges, support for animation, gaming and comics, and new institutional capacity for design and hospitality. Tourism-linked skilling, from guides to digital heritage documentation, signals a clear intent to convert culture and content into employment and exports.

“I propose to support the Indian Institute of Creative Technologies, Mumbai in setting up AVGC Content Creator Labs in 15,000 secondary schools and 500 colleges,” FM Sitharaman said. AVGC stands for animation, visual effects, gaming and comics.

AI & Semiconductors Push

Artificial intelligence (AI) was positioned as a cross-sector force multiplier rather than a standalone theme. The Budget provided a push to artificial intelligence (AI) by promoting adoption with governance, agriculture, education and skilling, including proposals for AI-enabled advisory tools for farmers and AI integration in education curricula.

On hardware, the semiconductor strategy expanded decisively under ISM 2.0 (India Semiconductor Mission 2.0), with focus on domestic equipment manufacturing, materials, research centres and workforce development, signalling a long-term commitment to building a resilient chip ecosystem in India.

Taxation, ITR, TDS, TCS

A major structural reform comes with the Income Tax Act, 2025, effective April 1, 2026, containing simpler rules and redesigned forms.

Budget 2026 provided compliance relief for individuals, including extended timelines for revising returns to March 31 from December 31 earlier, staggered ITR due dates, and easier filing of Form 15G/15H through depositories.

Individuals with ITR-1 and ITR-2 returns will continue to file till July 31, and non-audit business cases or trusts are proposed to be allowed time till August 31, according to the Budget Speech 2026-27.

“I propose to extend time available for revising returns from 31st December to up to 31st March with the payment of a nominal fee. I also propose to stagger the timeline for filing of tax returns. Individuals with ITR 1 and ITR 2 returns will continue to file till 31st July and non-audit business cases or trusts are proposed to be allowed time till 31st August,” Sitharaman said.

TDS (Tax deducted at source) rules were clarified for manpower services, while a rule-based system for lower or nil TDS certificates is proposed. TCS rates were cut to 2% for overseas tour packages, education and medical expenses under liberalised remittance scheme (LRS). Litigation is targeted through integrated assessment and penalty orders, lower pre-deposit requirements, and wider immunity provisions.

TDS on the sale of immovable property by a non-resident will be deducted and deposited through resident buyer’s PAN (Permanent Account Number)-based challan instead of requiring TAN (Tax Deduction and Collection Account Number), Sitharaman said.

Customs Duty Tweaks

Customs duty rationalisation continued with a clear focus on domestic manufacturing, energy transition and ease of living. Exemptions have been extended or introduced for capital goods used in lithium-ion batteries, critical minerals processing, nuclear power projects and aircraft manufacturing.

Personal imports will become cheaper with a reduction in duty on goods for personal use from 20% to 10%. Seventeen cancer drugs and additional rare-disease treatments were exempted from customs duty. Process reforms aimed at trust-based, tech-driven clearances, faster cargo movement and lower compliance costs, especially for exporters and MSMEs (micro, small, medium and enterprises).

STT On F&O Hiked

The Budget increased securities transaction tax (STT) on futures trading from 0.02% to 0.05% and on options trading from 0.10% to 0.15%, a move that upset the capital markets with the BSE Sensex crashing more than 2,300 points from the day’s high and the NSE Nifty dropping to 24,571.75.

Securities Transaction Tax (STT) is a direct tax imposed on the buying and selling of securities in India.

Commenting on the Budget, Prime Minister Narendra Modi said, “The Union Budget reflects the aspirations of 140 crore Indians. It strengthens the reform journey and charts a clear roadmap for Viksit Bharat.”

February 01, 2026, 14:43 IST

Read More

Business

‘Holistic And Forward-Looking’: Piyush Goyal Says Budget 2026 Reflects Future-Ready India

Last Updated:

Piyush Goyal termed the Budget “economically and fundamentally very strong”, and stated that it “reflects the aspirations of the youth of the country”.

Minister of Commerce and Industry Piyush Goyal. (File photo)

Union Minister Piyush Goyal on Sunday termed Budget 2026 “futuristic and holistic”, and stated that it “reflects the aspirations of the youth of the country and is forward-looking”.

Speaking exclusively to CNN-News18 on Budget 2026, presented by Finance Minister Nirmala Sitharaman, Goyal said, “This is a fabulous budget and it is very futuristic. The Budget 2026 has covered all sectors including technology, infrastructure, etc.”

“The technology sector has been given a thrust. The budget focuses on infrastructure. It is a holistic and forward-looking budget refecting future ready Bharat,” he said, adding, “The budget meets the aspirations of the youth and new India.”

Stating that the Budget is economically and fundamentally very strong, the Union Minister said, “Farmers, animal husbandry and labour-intensive sectors get a major push as this Budget focuses on investment, value addition and jobs.”

#Exclusive | “The Budget is economically and fundamentally very strong,”Preparing India for Viksit Bharat. Farmers, animal husbandry and labour-intensive sectors get a major push as the Budget focuses on investment, value addition and jobs.@Parikshitl in an exclusive… pic.twitter.com/tJr2SItcaW

— News18 (@CNNnews18) February 1, 2026

‘Budget 2026 Is Human-Centric’: PM Modi

Prime Minister Narendra Modi on Sunday said that the Union Budget 2026 is “human-centric and strengthens India’s foundation with path-breaking reforms.” The Prime Minister also described it as historic and a catalyst for accelerating the country’s reform trajectory and long-term growth.

Following the presentation of the Budget in Parliament, PM Modi said the proposals would energise the economy, empower citizens and give India’s youth fresh opportunities to scale new heights.

“This budget brings the dreams of the present to life and strengthens the foundation of India’s bright future. This budget is a strong foundation for our high-flying aspirations of a developed India by 2047,” he said.

Calling the government’s reform agenda a “Reform Express”, the Prime Minister added, “The reform express that India is riding today will gain new energy and new momentum from this budget.”

February 01, 2026, 19:01 IST

Read More

Business

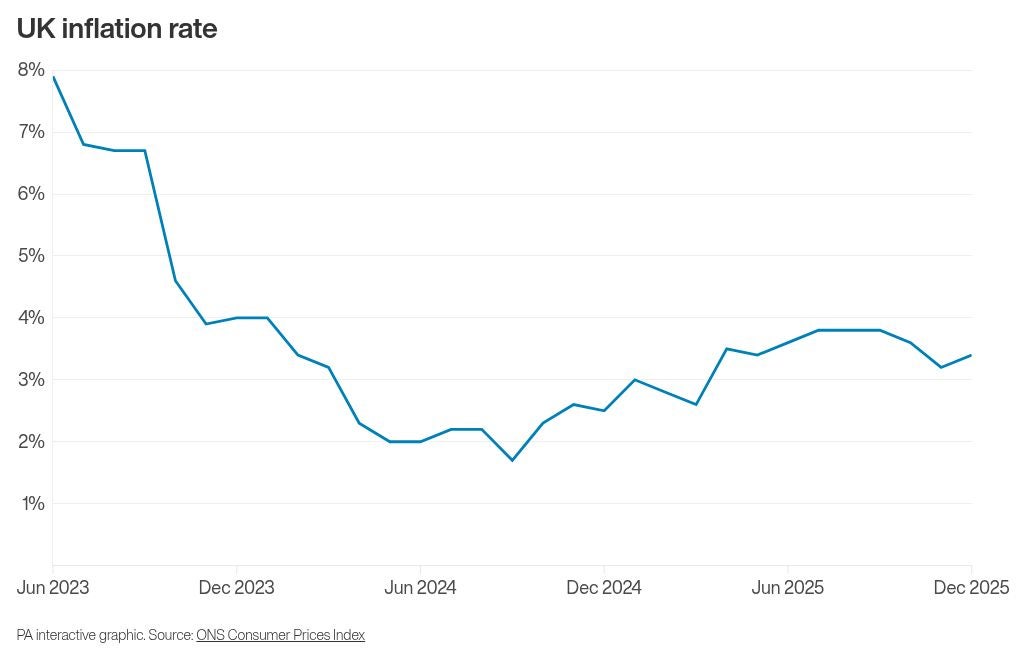

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Entertainment5 days ago

Entertainment5 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Sports5 days ago

Sports5 days agoCollege football’s top 100 games of the 2025 season

-

Entertainment1 week ago

Entertainment1 week agoPrince Harry’s female admirers are many but no wedding rings

-

Tech1 week ago

Tech1 week ago‘Uncanny Valley’: Donald Trump’s Davos Drama, AI Midterms, and ChatGPT’s Last Resort