Business

Top stocks to buy today: Stock recommendations for November 19, 2025 – check list – The Times of India

Stock market recommendations:According to Mehul Kothari, DVP – Technical Research, Anand Rathi Shares and Stock Brokers, the top stocks to buy today are Life Insurance Corporation of India, Coromandel, and Doms Industries:Life Insurance Corporation of India – Base Formation near 200-DEMA + Dual MACD Bullish CrossoverBuy near: ₹920–₹910 | SL: ₹885 | Target: ₹975 | Time Frame: 90 DaysLife Insurance Corporation of India has developed a strong base near the 200-DEMA, indicating that the recent decline is stabilizing around a crucial long-term support. A bullish divergence on the hourly chart suggests that downside momentum is fading and buyers are gradually stepping in. On the daily timeframe, both the short-term and long-term MACD have produced a bullish crossover above the zero line — a powerful signal hinting at a potential trend reversal.These technical factors collectively point to improving strength and increase the probability of an upward move toward ₹975. Traders may look to build long positions in the ₹920–₹910 zone.Coromandel – Support at 200-DEMA/SMA + Long-Term MACD DivergenceBuy near: ₹2215–₹2200 | SL: ₹2095 | Target: ₹2450 | Time Frame: 90 DaysCoromandel has taken strong support at both the 200-DEMA and 200-SMA — a zone that has historically acted as a reliable demand area for long-term buyers. The long-term MACD has formed a bullish divergence, indicating weakening downside momentum and the possibility of a trend reversal. Price action is gradually showing early signs of recovery, while the 25-period ROC on the hourly chart has turned positive, affirming improving momentum.Given this confluence of technical signals, the stock presents a favourable risk–reward opportunity in the ₹2215–₹2200 zone for a potential move toward ₹2450.DOMS – Breakout Above 2580 + Momentum Revival Through MACDBuy near: ₹2580–₹2540 | SL: ₹2450 | Target: ₹2800 | Time Frame: 90 DaysDoms Industries Ltd has established a strong base within the ₹2500–₹2580 consolidation zone, reflecting sustained accumulation at lower levels. On 14-11-2025, the stock confirmed a decisive breakout above the ₹2580 mark, signalling fresh buying interest and a likely continuation of the prevailing uptrend. This breakout is further supported by a bullish MACD crossover above the zero line, indicating strengthening momentum on the higher timeframes.With both price structure and momentum indicators aligning positively, DOMS offers a robust setup for an upside move toward ₹2800.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)

Business

Oil prices spike! Will petrol, diesel rates be hiked in India as crude nears $80 mark on Middle East tensions? – The Times of India

Internationally, oil prices have risen by around 9-10% following Israel-US strikes on Iran, and amid the rising tensions in the Middle East are likely to remain elevated. Does that mean that petrol and diesel prices in India will go up?Brent crude, the international benchmark, moved close to $80 per barrel, while US crude futures advanced 8.6 per cent to $72.79, compared with roughly $67 on Friday.

India, which meets about 88% of its crude oil demand through imports before refining it into fuels such as petrol and diesel, faces a higher import burden when global prices rise, along with possible inflationary effects.

Middle East tensions : Will petrol, diesel prices go up?

Despite the sharp increase in global oil prices, retail petrol and diesel prices in India are not expected to be revised upward in the immediate future, according to a PTI report.According to sources quoted in the report, the government is maintaining a calibrated approach that allows oil marketing companies to improve margins during periods of lower international prices while protecting consumers when global rates increase.Also Read | Middle East oil shock risks: How much do China, India, Japan depend on Middle Eastern crude, gas?Pump prices for petrol and diesel have remained unchanged since April 2022. During this period, state-run retailers including Indian Oil Corporation, Bharat Petroleum Corporation Ltd and Hindustan Petroleum Corporation Ltd have absorbed losses when crude prices were elevated and benefited when prices declined.As a result, domestic fuel prices have stayed steady even when global fuel rates climbed due to higher crude costs. Likewise, when international fuel prices softened in line with lower crude, retail rates in India did not see a reduction.Sources added that the government intends to continue shielding consumers under this policy framework, unless crude prices witness an exceptionally sharp surge.With assembly elections approaching in key states such as West Bengal, Tamil Nadu and Assam, the government is keen to avoid developments that could provide political ammunition to the opposition, the report said.

India assesses oil security

Amid intensifying hostilities in the Middle East, Oil Minister Hardeep Singh Puri on Monday assessed the crude oil, LPG and petroleum products situation in a meeting with senior officials from his ministry and executives of public sector oil companies.

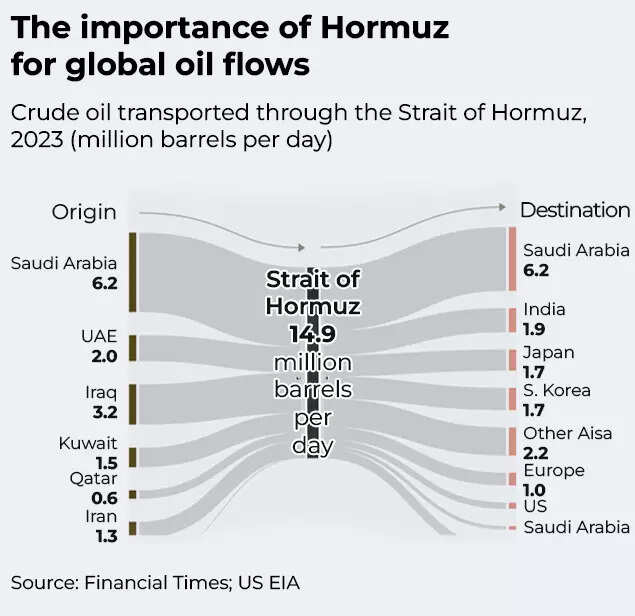

Importance of Hormuz for global oil flows

Much of India’s crude oil and gas supplies transit through the Strait of Hormuz, which Iranian authorities have threatened to close following US and Israeli strikes.“They have sufficient buffers to manage this kind of price spike,” a source with direct knowledge of the matter said, referring to oil companies. “We witnessed crude touching $119 per barrel in June 2022 after Russia’s invasion of Ukraine. That year their profits were modest, but in FY24 they recorded a record profit of Rs 81,000 crore.”Should interruptions continue, cargoes may need to be diverted around the Cape of Good Hope, resulting in longer transit durations and higher transportation expenses, along with increased freight and insurance costs.According to media accounts, the ongoing hostilities have in effect shut down the Strait of Hormuz, the vital artery for worldwide energy transportation. Nearly one-third of global seaborne crude oil exports and around 20 per cent of liquefied natural gas cargoes pass through this narrow channel.Also Read | 1970s-style oil shock loading? Crude may hit $100 if Strait of Hormuz shuts amid Middle East tensions – what it means

Business

Limited flights leave UAE while disruption continues amid Iran strikes

From the UK, flights have also been cancelled for many Middle East destinations, including all flights to Israel and Bahrain, three-quarters of the day’s scheduled flights to the United Arab Emirates, and more than two-thirds (69%) of flights to Qatar.

Business

IIP sees 4.8% YoY growth in January; manufacturing & electricity support rise – The Times of India

India’s Index of Industrial Production saw a 4.8% increase year-on-year in January 2026, according to the Ministry of Statistics & Programme Implementation. The rise in industrial output was largely driven by a 4.8 per cent expansion in manufacturing and a 5.1 per cent improvement in electricity generation. Mining activity also supported overall growth, registering a 4.3 per cent uptick during the month.Estimates placed IIP at 169.4 for January 2026, compared with 161.6 in January 2025. This follows a stronger reading in December 2025, when industrial production had grown by 7.8 per cent. For January 2026, the sector-specific indices stood at 157.2 for mining, 167.2 for manufacturing and 212.1 for electricity.Within manufacturing, 14 of the 23 industry groups at the NIC two-digit level posted year-on-year gains in January. The strongest contributors were manufacture of basic metals, which rose 13.2 per cent; manufacture of motor vehicles, trailers and semi-trailers, up 10.9 per cent; and manufacture of other non-metallic mineral products, which increased 9.9 per cent. Growth in basic metals was supported by items such as flat products of alloy steel, MS slabs, and hot-rolled coils and sheets of mild steel.The automobile category advanced on the back of higher output of auto components and spare parts, commercial vehicles, and bus and minibus bodies or chassis. In the non-metallic mineral products segment, cement of all types, cement clinkers and stone chips were key contributors.According to use-based classification, output of primary goods grew 3.1 per cent, capital goods rose 4.3 per cent and intermediate goods increased 6 per cent compared with January 2025. Infrastructure and construction goods recorded the sharpest rise at 13.7 per cent, while consumer durables expanded 6.3 per cent. In contrast, consumer non-durables declined by 2.7 per cent. The ministry identified infrastructure and construction goods, intermediate goods and primary goods as the leading drivers of growth under this classification.

-

Politics1 week ago

Politics1 week agoPakistan carries out precision strikes on seven militant hideouts in Afghanistan

-

Tech1 week ago

Tech1 week agoThese Cheap Noise-Cancelling Sony Headphones Are Even Cheaper Right Now

-

Sports1 week ago

Sports1 week agoKansas’ Darryn Peterson misses most of 2nd half with cramping

-

Entertainment1 week ago

Entertainment1 week agoViral monkey Punch makes IKEA toy global sensation: Here’s what it costs

-

Sports1 week ago

Mike Eruzione and the ‘Miracle on Ice’ team are looking for some company

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026