Business

US government to auction 600 million tonnes of coal: Who will buy? Climate concerns also loom – The Times of India

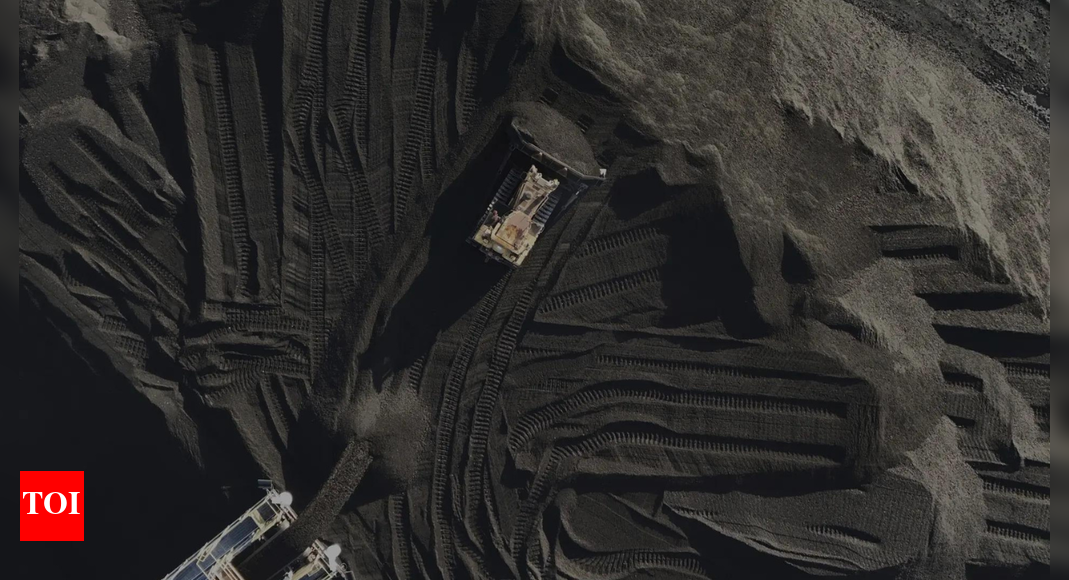

In the coming days, US authorities will conduct the nation’s largest coal auctions in over a decade, offering 600 million tonnes from state-owned reserves adjacent to strip mines in Montana and Wyoming. The leases, located in the Powder River Basin—the country’s most productive coal region—were expedited following a January executive order by President Donald Trump.While the auctions align with Trump’s goal of increasing coal extraction from federal lands for power generation, an Associated Press analysis shows that many power stations served by these mines plan to stop using coal within a decade.The forthcoming sales will go ahead despite the government shutdown, as workers handling fossil fuel permits and leases are exempt from furlough. Then-President Biden had attempted to block future coal leases in the region last year, citing climate change concerns. According to the Department of Energy, burning coal from these leases could generate over 1 billion tonnes of carbon dioxide.Interior Secretary Doug Burgum announced that more than 20,000 square miles of federal lands would be opened for mining—an area larger than New Hampshire and Vermont combined. The administration has also reduced federal coal royalty rates, extended a Michigan coal plant’s operation, and allocated $625 million for plant modernisation, citing rising electricity demand from AI and data centres. “We’re putting American miners back to work,” Burgum said. “We’ve got a demand curve coming at us in terms of the demand for electricity that is literally going through the roof.”

Who will buy the coal?

The key question remains: who will actually purchase this coal? Data from the US Energy Information Administration and Global Energy Monitor indicate declining demand for the mines slated for expansion or new leases, as power stations reduce coal consumption or plan to cease operations entirely.Montana and Wyoming sales were requested by Navajo Transitional Energy Co. (NTEC), which acquired several Powder River Basin mines in a 2019 bankruptcy auction. These mines supply 34 power stations across 19 states, but 21 of these stations plan to stop using coal within a decade, including all five served by NTEC’s Spring Creek mine in Montana.In government filings, NTEC valued 167 million tonnes of federal coal near Spring Creek at around $126,000—less than one-tenth of a penny per tonne, far below historical prices. NTEC justified the low valuation, citing forecasts of declining coal demand:“The market for coal will decline significantly over the next two decades. There are fewer coal mines expanding their reserves, there are fewer buyers of thermal coal and there are more regulatory constraints.”The government will auction 440 million tonnes near NTEC’s Antelope Mine in central Wyoming on Wednesday. Over half of the 29 power stations served by this mine plan to cease coal use by 2035, including Colorado’s Rawhide plant, which is scheduled to switch from coal to natural gas and 30 megawatts of solar power by 2029.Peabody Energy, the largest US coal company, offers a more optimistic outlook. They estimate coal demand could increase by 250 million tonnes annually, nearly 50 per cent above current levels, citing delays in new nuclear and gas facilities. “US coal is clearly in comeback mode,” said Peabody president James Grech. “The US has more energy in its coal reserves than any nation has in any one energy source.”Energy specialists remain sceptical. Umed Paliwal, an electricity market specialist at Lawrence Berkeley National Laboratory, said:“Eventually coal will get pushed out of the market. The economics will just eat the coal generation over time.”No major coal power stations have opened in the US since 2013, and most existing facilities are over 40 years old. Experts suggest the administration’s $625 million modernisation fund may be insufficient, with a single boiler component costing up to $25 million, according to GridLab energy consultant Nikhil Kumar.

Business

Hassett pivots to possible ‘Trump cards’ amid credit card interest rate battle with banks

Kevin Hassett, director of the National Economic Council, speaks to members of the media outside the White House in Washington, DC, US, on Friday, Oct. 24, 2025.

Francis Chung | Bloomberg | Getty Images

White House economic advisor Kevin Hassett said Friday that large U.S. banks could voluntarily provide credit cards to underserved Americans as a means to address President Donald Trump’s affordability push.

A week ago, Trump called for banks to cap credit card interest rates at 10%, an idea that has been roundly rejected by industry executives and their lobbyists this week.

Now, Hassett, who is director of the National Economic Council, is floating a different plan, this one more narrowly focused on consumers who don’t have credit access but have the income to justify credit lines.

“They could potentially voluntarily provide for people who are in that sort of sweet spot of not having financial leverage very much because they don’t have access to credit, but they have enough income and stability in their lives so they’re worthy of credit,” Hassett told Fox Business host Maria Bartiromo.

“Our expectation is that it won’t necessarily require legislation, because there will be really great new ‘Trump cards’ presented for folks that are voluntarily provided by the banks,” he said.

The comments could indicate that the administration is downgrading its efforts for broad changes to the card industry that would be difficult to enact and that could hit consumer spending and the economy.

This week, bankers discussing fourth-quarter results said that rather than offering cards at a 10% interest rate, as Trump has said should happen by Jan. 20, the banks would simply close many customers’ accounts.

Hassett’s statement came in response to a question about whether bankers would be forced to comply with Trump’s rate cap, a move that would probably require new legislation.

The administration has been talking with “CEOs of many of the big banks who think that the president’s onto something,” Hassett said.

A major credit card issuer and a bank lobbyist representing big lenders told CNBC that they haven’t yet had any discussions with the administration about the “Trump card” concept.

Business

Mining companies hold FTSE back in quiet end to the week

Stocks in London ended little changed on Friday, with blue chips edging lower after notching another record as investors held fire ahead of the long weekend in the US.

“Investors have been kept on their toes year-to-date with non-stop geopolitical issues, and mixed messages from the business world. A quieter day on the corporate reporting calendar gave investors a chance to catch their breath and take stock of events,” said Dan Coatsworth, head of markets at AJ Bell.

The FTSE 100 index closed down just 3.65 points at 10,235.29. It had earlier hit a new intra-day best level of 10,257.75.

The FTSE 250 ended up 31.39 points, 0.1%, at 23,311.37, and the AIM All-Share closed just 0.27 of a point higher at 804.75.

For the week, the FTSE 100 rose 1.1%, the FTSE 250 climbed 1.2%, and the AIM All-Share advanced 2.1%.

In European equities on Friday, the CAC 40 in Paris closed down 0.7%, while the DAX 40 in Frankfurt ended 0.2% lower.

“There was a slightly negative tone across European stock indices on Friday,” commented David Morrison, senior market analyst, at Trade Nation. “It appeared that investors were more comfortable taking some risk off the table, no doubt mindful that US markets will be closed on Monday for Martin Luther King Day.”

In London, the FTSE 100 was pegged back by weak mining stocks, a key factor behind recent index strength.

The price of copper fell 3.0%, and silver slumped 3.7%, giving up some recent gains, while gold nursed less severe falls.

Gold was quoted at 4,594.24 dollars an ounce on Friday, down from 4,616.76 on Thursday.

In response, Endeavour Mining fell 2.7%, Anglo American declined 2.4%, Antofagasta dipped 2.9%, and Glencore fell 2.5%.

Strategists at Bank of America downgraded the mining sector to ‘underweight’ and lifted energy to ‘market weight’.

“After sharp outperformance for mining, the potential downside risks stemming from the sector’s macro drivers are becoming hard to ignore,” BofA said.

BofA noted that a historical divergence in commodity prices has led to a decoupling among European resources with a surge in metal prices over recent months, including a 50% rally in copper, alongside a “roll-over” in energy prices, with the oil price down 30% to four-year lows recently.

As a result, the copper-to-oil ratio has risen close to a 40-year high, which in turn has led to significant divergence between European resources sectors, with mining outperforming by 40% since April, while energy has underperformed by nearly 15%.

“Resources sector pricing looks stretched in both directions,” BofA added.

Brent oil traded higher at 64.48 dollars a barrel on Friday, up from 63.55 late on Thursday.

Pearson ended a miserable week for investors, with a further 4.1% decline.

The educational publisher has seen its shares fall 12% this week after a poorly received trading update.

A previously undisclosed contract loss for US student assessment in New Jersey, which will drag on first-half growth, was blamed for the stock fall, although analysts note Pearson is confident that the loss of the contract will have no bearing on other renewals in the coming years.

Heading higher were property companies British Land and Land Securities, up 1.4% and 1.3% respectively, on hopes lower interest rates will spark a sector upturn, while BAE Systems, up 2.3%, remained in favour amid geopolitical jitters.

Stocks in New York were little changed. The Dow Jones Industrial Average was slightly lower, while the S&P 500 index was up 0.1%, as was the Nasdaq Composite.

Economic data showed that US industrial production rose faster than expected in December.

The Federal Reserve said that on a monthly basis, industrial production increased by 0.4% in December, the same pace as in November, which was revised up from 0.2%. It was better than the FXStreet-cited consensus of a 0.1% uptick.

On an annual basis, total industrial production was 2.0% higher in December than a year prior.

Shannon Glein, analyst at Wells Fargo, said the underlying details show a “key theme from last year – everything high-tech and AI related outperformed”.

“We expect this trend to persist going forward, but it’s also worth noting that the slow yet steady ascent in all other industrial production on a year-ago basis is a sign that broader activity may be starting to recover,” she added.

The pound was quoted lower at 1.3382 dollars at the time of the London equities close on Friday, compared to 1.3388 on Thursday.

The euro stood at 1.1596 dollars, lower against 1.1607.

The yield on the US 10-year Treasury was quoted at 4.21%, widening from 4.16%. The yield on the US 30-year Treasury was quoted at 4.82%, stretched from 4.78%.

Back in London, Genus led the FTSE 250 risers, advancing 7.8%, after reporting that adjusted pretax profit for the six months to December 31 would be about £50 million, ahead of expectations.

Berenberg pointed out it was “the second guidance raise in the past three months, making it one of the standout performers within our coverage”.

“Importantly, the upgrades are being driven by strong trading in the PIC (pigs) business, which reflects the benefits of the group’s shift towards a royalty-driven model. This is increasing the defensiveness and predictability of earnings and sets a very positive tone for a year that we believe has more positive catalysts to come”, the bank added.

The biggest risers on the FTSE 100 were BAE Systems, up 47.0 pence at 2,088.0p, NatWest, up 13.8p at 652.8p, Smiths Group, up 50.0p at 2,612.0p, Schroders, up 8.6p at 467.0p and National Grid, up 20.5p at 1,201.5p.

The biggest fallers on the FTSE 100 were Pearson, down 39.6p at 939.0p, Entain, down 23.8p at 703.0p, Antofagasta, down 105.0p at 3,560.0p, Endeavour Mining, down 110.0p at 3,996.0p and Glencore, down 12.4p at 478.6p.

Monday’s global economic calendar features a slew of data from China, including GDP, retail sales, and industrial production.

In Canada, inflation figures will be published, while US financial markets are closed for Martin Luther King Jr Day.

Monday’s UK corporate calendar has a trading statement from building materials firm Marshalls.

Later in the week, trading statements are due from luxury goods retailer Burberry, sports retailer JD Sports Fashion and miner Rio Tinto.

Contributed by Alliance News.

Business

Zipcar to end UK operations affecting 650,000 drivers

Car-sharing firm Zipcar has confirmed it is stopping operations in the UK after launching a consultation late last year.

The move will hit the company’s roughly 650,000 drivers across the country.

On December 1, the US-based company told customers in the UK that it planned to suspend new bookings temporarily at the turn of the year.

The business, which had 71 UK employees at the end of 2024, launched a formal consultation with staff as a result.

On Friday, in a fresh email to customers, the business said it “can now confirm that Zipcar will cease operating in the UK”.

The company added: “In accordance with clause 7.5 of the member terms, please take this as your written notice that we will formally close your account in 30 days’ time.

“It’s not possible to make any new bookings with Zipcar UK at this time, but your account will remain open until February 16.”

It added that customers will be entitled to a pro-rated refund for any remaining periods on current plans or subscriptions, from the start of 2026.

Zipcar said this will be done automatically and will not require any action from users.

Accounts showed that the van and car hire firm saw losses deepen to £5.7 million in 2024 after a decrease in customer trips.

-

Sports6 days ago

Sports6 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Tech4 days ago

Tech4 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Sports7 days ago

Commanders go young, promote David Blough to be offensive coordinator

-

Fashion6 days ago

Fashion6 days agoSouth India cotton yarn gains but market unease over US tariff fears

-

Fashion6 days ago

Fashion6 days agoChina’s central bank conducts $157-bn outright reverse repo operation

-

Entertainment3 days ago

Entertainment3 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Sports6 days ago

Sports6 days agoUS figure skating power couple makes history with record breaking seventh national championship