Business

Petrol, Diesel Fresh Prices Announced: Check Rates In Your City On October 7

Last Updated:

Petrol, Diesel Price On October 7: Check City-Wise Rates Across India Including In Delhi, Mumbai and Chennai.

Petrol, Diesel Prices On October 7.

Petrol and Diesel Prices on October 7, 2025: OMCs update petrol and diesel prices daily at 6 AM, aligning them with fluctuations in global crude oil prices and currency exchange rates. This daily revision promotes transparency and ensures consumers have access to the most up-to-date and accurate fuel prices.

Petrol Diesel Price Today In India

Check city-wise petrol and diesel prices on October 7:

| City | Petrol (₹/L) | Diesel (₹/L) |

|---|---|---|

| New Delhi | 94.72 | 87.62 |

| Mumbai | 104.21 | 92.15 |

| Kolkata | 103.94 | 90.76 |

| Chennai | 100.75 | 92.34 |

| Ahmedabad | 94.49 | 90.17 |

| Bengaluru | 102.92 | 89.02 |

| Hyderabad | 107.46 | 95.70 |

| Jaipur | 104.72 | 90.21 |

| Lucknow | 94.69 | 87.80 |

| Pune | 104.04 | 90.57 |

| Chandigarh | 94.30 | 82.45 |

| Indore | 106.48 | 91.88 |

| Patna | 105.58 | 93.80 |

| Surat | 95.00 | 89.00 |

| Nashik | 95.50 | 89.50 |

Key Factors Behind Petrol and Diesel Rates

Petrol and diesel prices in India have remained unchanged since May 2022, following tax reductions by the central and several state governments.

Oil Marketing Companies (OMCs) update fuel prices daily at 6 am, adjusting for fluctuations in global crude oil markets. While these rates are technically market-linked, they are also influenced by regulatory measures such as excise duties, base pricing frameworks, and informal price caps.

Key Factors Influencing Fuel Prices in India

-

Crude Oil Prices: Global crude oil prices are a primary driver of fuel prices, as crude is the main input in petrol and diesel production.

-

Exchange Rate: Since India relies heavily on crude oil imports, the value of the Indian rupee against the US dollar significantly affects fuel costs. A weaker rupee typically translates to higher prices.

-

Taxes: Central and state-level taxes constitute a major portion of retail fuel prices. Tax rates vary across states, leading to regional price differences.

-

Refining Costs: The cost of processing crude oil into usable fuel impacts retail prices. These costs can fluctuate depending on crude quality and refinery efficiency.

-

Demand-Supply Dynamics: Market demand also influences fuel pricing. Higher demand can push prices up as supply adjusts to consumption trends.

How to Check Petrol and Diesel Prices via SMS

You can easily check the latest petrol and diesel prices in your city through SMS. For Indian Oil customers, text the city code followed by “RSP” to 9224992249. BPCL customers can send “RSP” to 9223112222, and HPCL customers can text “HP Price” to 9222201122 to receive the current fuel prices.

Aparna Deb is a Subeditor and writes for the business vertical of News18.com. She has a nose for news that matters. She is inquisitive and curious about things. Among other things, financial markets, economy, a…Read More

Aparna Deb is a Subeditor and writes for the business vertical of News18.com. She has a nose for news that matters. She is inquisitive and curious about things. Among other things, financial markets, economy, a… Read More

October 07, 2025, 07:39 IST

Read More

Business

Gadgets Now Awards 2025 recognise tech excellence – The Times of India

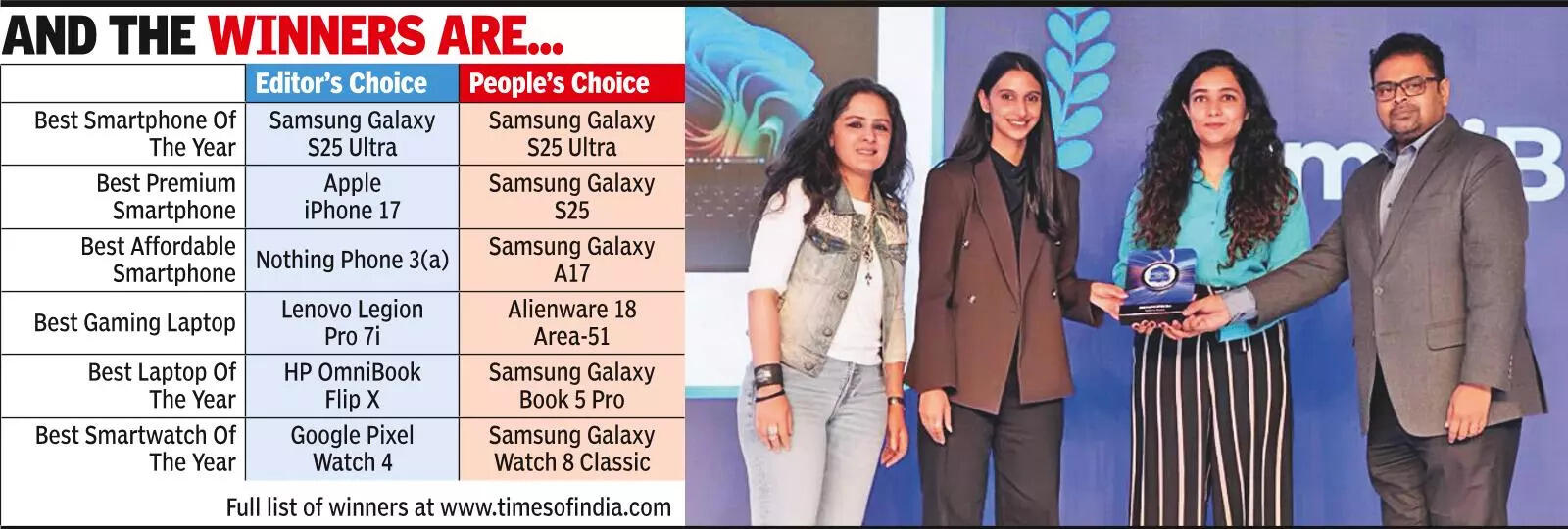

NEW DELHI: The Times of India Gadgets Now Awards 2025 celebrated last year’s standout gadgets at an event on Monday where technology met glamour. The event drew an eclectic gathering of distinguished guests who came together to recognise technological excellence across key categories, including smartphones, smartwatches, audio products, televisions and more.This year, the Awards that are in its 6th edition went a step further and also recognised India’s leading influencers and creators who are redefining the tech content landscape.

The winners included Samsung Galaxy S25 Ultra, which scored a double win as the Best Smartphone Editor’s Choice and Popular Choice.Apple iPhone 17 was adjudged the Best Premium Smartphone Editor’s Choice, while Samsung Galaxy S 25 won the Popular Choice in the same category.Samsung once again picked up 2 awards as Galaxy Z Fold 7 was crowned the Editor’s Choice and Popular Choice winner in the Best Foldable Smartphone category.Samsung Galaxy Book 5 Pro won the Editor’s Choice Best AI-powered gadget, while Neosapien Neo 1 was the Popular Choice winner.

Business

Google apologises for Baftas alert to ‘see more’ on racial slur

Google said the news alert was an error that should not have happened.

Source link

Business

Trump’s new global tariff comes into effect at 10%

The global levy comes in at 10%, lower than the rate the president had threatened at the weekend.

Source link

-

Entertainment1 week ago

Entertainment1 week agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech1 week ago

Tech1 week agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics1 week ago

Politics1 week agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment1 week ago

Entertainment1 week agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Business1 week ago

Business1 week agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Politics1 week ago

Politics1 week agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Tech1 week ago

Tech1 week agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports1 week ago

Sports1 week agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash