Business

What are National Insurance and income tax and what could change in the Budget?

Getty Images

Getty ImagesThere has been speculation that November’s Budget could see Chancellor Rachel Reeves break Labour’s pre-election pledge not to increase income tax, National Insurance (NI) or VAT for working people.

It’s been suggested that she could extend a freeze to the income thresholds at which people start paying the taxes, or have to pay more.

What is National Insurance and what does it pay for?

The government uses National Insurance to pay benefits and help fund the NHS.

It is paid by employees, employers and the self-employed across the UK. Those over the state pension age do not pay it, even if they are working.

Eligibility for some benefits, including the state pension, depends on the National Insurance contributions (NICs) you make across your working life. It may be possible to make voluntary payments to fill gaps in your contribution history.

How much do employees pay in National Insurance?

The type and amount of NI you pay depends on your age, employment status and income.

Workers start paying NI when they turn 16 and earn more than £242 a week, or have self-employed profits of more than £12,570 a year.

The amount owed is usually deducted automatically from employees’ wages along with income tax.

The starting rate for NI for employees fell twice in 2024: from 12% to 10%, and then again to 8%. The previous Conservative government said these cuts were worth about £900 a year for a worker earning £35,000.

For the self-employed, the rate of NI paid on all earnings between £12,570 and £50,270 fell from 9% to 6%. This was said to be worth £350 to a self-employed person earning £28,200.

Most self-employed people pay their NICs through their self assessment tax return.

The NI rate on income and profits above £50,270 is 2% for all workers.

How much do employers pay in National Insurance?

Since April 2025, employers pay NI at 15% on most employees’ wages above £5,000. They previously paid 13.8% on salaries above £9,100.

Businesses also pay 15% NI on expenses and benefits they give to their staff – such as company cars or health insurance.

The employment allowance – the amount employers can claim back from their NI bill – rose from £5,000 to £10,500.

What are the current income tax rates?

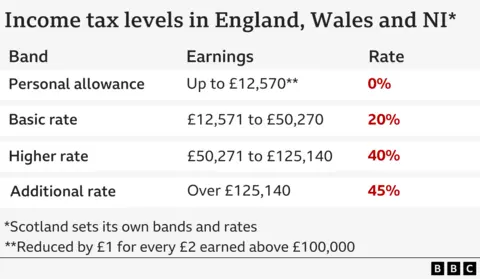

You have to pay income tax on your earnings from employment, or profits from self-employment, above the tax-free personal allowance of £12,570.

Income tax is also paid on some benefits and pensions, income from renting out property, and returns from savings and investments above certain limits.

The basic rate of 20% is paid on annual earnings between £12,571 and £50,270.

The higher rate of 40% is paid on earnings between £50,271 and £125,140.

Once you earn more than £100,000, you also start losing the £12,570 tax-free personal allowance. You lose £1 of your personal allowance for every £2 that your income goes above £100,000.

Anyone earning more than £125,140 a year no longer has any tax-free personal allowance.

They also pay an additional rate of income tax of 45% on all earnings above that amount.

These rates apply in England, Wales and Northern Ireland.

Some income tax rates are different in Scotland, where a new 45% band took effect in April 2024. At the same time the top rate also rose from 47% to 48%.

What are NI and income tax thresholds and why do they matter?

Changes to the income thresholds mean that millions are paying more tax overall, despite the 2024 NI cuts.

The thresholds are the income levels at which people start paying NI or income tax, or have to pay higher rates. These used to rise every year in line with inflation.

However, the previous Conservative government froze the NI threshold and tax-free personal allowance at £12,570 until 2028. It also kept the higher-rate tax threshold at £50,270.

Prime Minister Sir Keir Starmer and the chancellor have both refused to rule out extending the current freeze.

Freezing the thresholds means that more people start paying tax and NI as their wages increase, and more people pay higher rates.

According to the Institute for Fiscal Studies (IFS) think thank, the freeze cancelled out the benefits of the 2024 NI cuts for some workers.

In the 2024-25 tax year, it said an average earner would have a tax cut of about £340 – from the combined tax changes – and people earning between £26,000 and £60,000 would be better off.

But by 2027, it said the average earner would be only £140 better off – and only people earning between £32,000 and £55,000 a year would still benefit.

Business

Saudi Oil Supply Assurance Lifts Pakistan Stock Market – SUCH TV

KARACHI: The Pakistan Stock Exchange rallied on Thursday after Saudi Arabia assured Pakistan of facilitating crude oil shipments through the Red Sea port of Yanbu Port, easing concerns over potential fuel supply disruptions.

The benchmark KSE-100 Index climbed sharply during the trading session, rising 4,439.93 points (2.85%) to reach an intraday high of 160,217.14 points.

Market Recovery

Analysts attributed the market rebound to renewed institutional buying and improving investor sentiment after Saudi assurances on oil supplies.

Market expert Ahsan Mehanti, CEO of Arif Habib Commodities, said easing fuel supply concerns played a key role in the recovery.

He added that rising global crude prices, expectations of a new International Monetary Fund loan tranche for Pakistan, and positive economic indicators also boosted investor confidence.

Alternative Oil Route

Pakistan sought an alternative supply route after Iran announced the closure of the Strait of Hormuz, a crucial global oil transit corridor.

Federal Petroleum Minister Ali Pervaiz Malik held talks with Nawaf bin Said Al-Malki, requesting Saudi support for uninterrupted energy supplies.

Saudi authorities reportedly assured Pakistan that oil shipments could be routed through Yanbu, and one crude vessel has already been prepared for dispatch.

Global Oil Market Impact

Oil prices continued to rise amid tensions in the Middle East conflict involving Iran, Israel and the United States.

Brent crude: up 3.26% to $83.99 per barrel

West Texas Intermediate (WTI): up 3.70% to $77.42 per barrel

Energy markets remain volatile as shipping disruptions threaten supply through the Strait of Hormuz, a route that handles nearly 20% of global oil trade.

Analysts say the Saudi assurance helped calm fears about Pakistan’s energy supply chain, contributing to the strong recovery at the PSX.

Business

Asian stocks today: Markets inch higher mirroring Wall Street gains; Kospi jumps 10%, Nikkei up 1,400 points – The Times of India

Asian stocks inched higher on Thursday, after days of trading in red amid ongoing Middle East tensions. This comes as equities were lifted by a rebound on Wall Street as oil prices paused their recent spike and economic updates painted a more positive picture of the American economy. In South Korea, Kospi hit a pause on its downward rally to add a whopping 10% or 513 points, to reach 5,606. Japan’s Nikkei 225 also climbed 2.7% to 55,713. Hong Kong’s HSI also traded in green, rising 353 points to 25,603 as of 9:10 am. Shanghai and Shenzhen added 0.9% and 1.7% respectively. Gains elsewhere in the region were more modest. Australia’s S&P/ASX 200 added 0.3% to 8,927.20, while New Zealand’s benchmark index moved 0.9% higher. In contrast, US futures indicated a subdued start ahead. Futures linked to the Dow Jones Industrial Average were almost unchanged, while S&P 500 futures ticked up 0.2%. The S&P 500 advanced 0.8% on Wednesday, clawing back much of the decline seen since the onset of the Iran conflict. The Dow Jones Industrial Average rose 0.5%, and the Nasdaq Composite outperformed with a 1.3% gain. Globally, market sentiment has remained sensitive to developments in the Middle East, with oil price swings continuing to steer trading direction. Crude prices eased during Wednesday’s session. Brent crude briefly moved above $84 a barrel before settling at $81.40, roughly matching the previous day’s level. US benchmark crude edged up 0.1% to finish at $74.66 per barrel. By early Thursday, however, oil was on the rise again. Brent crude climbed 2.4% to $83.32 per barrel, while U.S. benchmark crude jumped 2.5% to $76.53 per barrel.

Business

China sets lowest economic growth target since 1991

It is also the first time the target has been lowered since it was cut to “around 5%” in 2023.

Source link

-

Business6 days ago

Business6 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Business7 days ago

Business7 days agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics7 days ago

Politics7 days agoWhat are Iran’s ballistic missile capabilities?

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Business1 week ago

Business1 week agoHouseholds set for lower energy bills amid price cap shake-up

-

Fashion1 week ago

Fashion1 week agoOECD GDP growth slows to 0.3% in Q4 amid mixed trends

-

Fashion7 days ago

Fashion7 days agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports6 days ago

Sports6 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’