Business

US kicks off controversial financial rescue plan for Argentina

The US has purchased Argentine pesos, taking the next step in a controversial effort to calm a currency crisis hitting the South American country and its president, Trump ally Javier Milei.

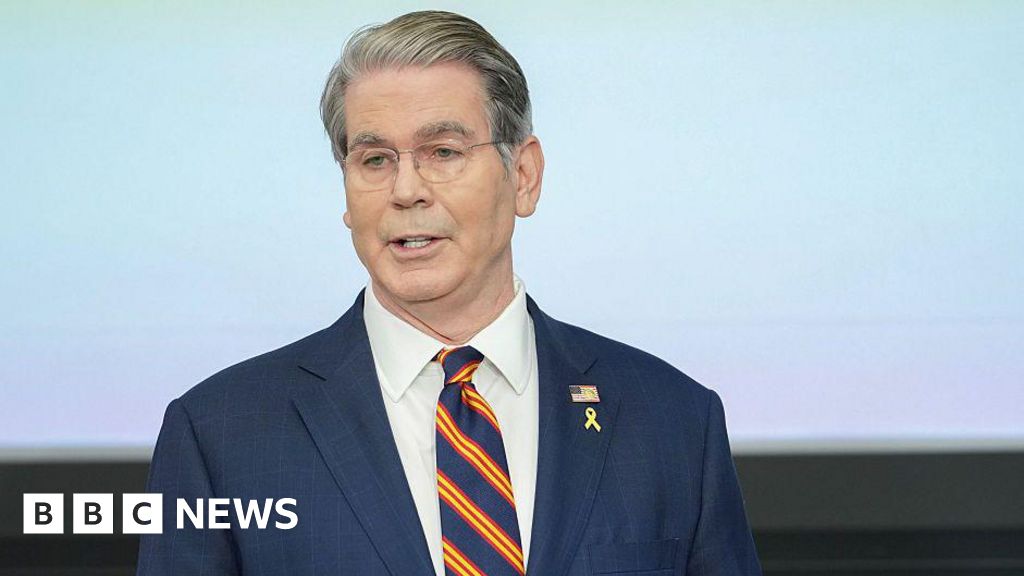

Treasury Secretary Scott Bessent announced the purchase on social media, while saying the US had finalised terms of a planned $20bn (£15bn) financial rescue for the country.

“The US Treasury is prepared, immediately, to take whatever exceptional measures are warranted,” he said.

The announcement helped boost the peso and Argentine debt on financial markets but renewed debate in the US, where the decision to extend financial support to Argentina at a time of spending cuts at home has drawn scrutiny.

“Instead of using our dollars to buy Argentine pesos, Donald Trump should help Americans afford health care,” Democratic Senator Elizabeth Warren wrote on social media in response to the announcement, referring to a key issue driving a stand-off over the government shutdown in the US.

Argentina has been facing increasing financial turmoil ahead of national midterm elections set for 26 October, as questions rise about whether voters will continue to back Milei’s cost-cutting, free-market reform agenda after recent losses in a provincial election.

The value of the peso has declined sharply in recent months, while investors have been dumping Argentine stocks and bonds.

Milei’s government has tried to stabilise the situation, but the moves have drained the country’s reserves a few months before billions in debt payments will come due.

Bessent, who made his name as a trader involved in the “Black Wednesday” episode in 1992 that forced the UK to devalue the pound, said in a statement that the success of Argentina’s “reform agenda” was of “systemic importance”.

“A strong, stable Argentina which helps anchor a prosperous Western Hemisphere is in the strategic interest of the United States,” he added. “Their success should be a bipartisan priority.”

The Treasury Department did not respond to questions seeking more detail about the US support, including how much of embattled peso the administration had purchased or the terms of the $20bn currency swap line, which will allow Argentina to exchange pesos for dollars.

Speaking later on Fox News, Bessent said the support was not a bailout for Argentina and that the peso was undervalued.

In a social media post, Milei thanked Trump and Bessent for support.

“Together, as the closest of allies, we will make a hemisphere of economic freedom and prosperity,” he said.

Argentina has defaulted on its debt three times since 2001, including most recently in 2020.

But investors, including some with ties to Bessent such as Robert Citrone, had taken renewed interest in the country in recent years in a bet on Milei’s libertarian financial reforms.

Since he took office in 2023, he has introduced deregulation and sweeping cuts to public spending to curb inflation and achieve a fiscal surplus – where the state spends less than it takes in revenue.

Domestically, the austerity measures have been met with growing backlash, as people’s purchasing power declines and the country faces a likely economic recession.

But those measures have helped to rein in inflation and have been largely welcomed by international investors and the International Monetary Fund, a key lender to Argentina.

With Milei styling himself as a Trump-like figure, complete with “Make Argentina Great Again” rhetoric, they have also won admiration from many conservatives in the US. He has met repeatedly with Trump, with another visit expected next week.

Nonetheless, the decision to extend financial support to Argentina has sparked backlash among American farmers, a key part of Trump’s voter base, who have been concerned as China shifts purchases of soybeans to countries including Argentina.

“Why would USA help bail out Argentina while they take American soybean producers’ biggest market???” Republican Senator Chuck Grassley, who represents Iowa, a key soybean producer, wrote on social media last month, when the US first pledged its support.

Bessent’s announcement followed four days of meetings with Argentina’s economy minister Luis Caputo.

In his announcement, Bessent said the international community was “unified behind Argentina and its prudent fiscal strategy, but only the United States can act swiftly. And act we will.”

He has previously pushed back at suggestions that the support amounted to a bailout for what Warren, in a statement on Thursday, dubbed the administration’s “billionaire buddies”.

“This trope that we’re helping out wealthy Americans with interests down there couldn’t be more false,” Bessent told CNBC earlier this month.

“What we’re doing is maintaining US strategic interest in the Western hemisphere,” he said, warning that inaction risked a “failed state”.

Business

Stock market today: Which are the top losers and gainers on March 6- check list – The Times of India

Benchmark equity indices Sensex and Nifty fell sharply on Friday, retreating by more than 1 per cent after a brief recovery in the previous session as escalating tensions in West Asia and surging crude oil prices weighed on investor sentiment.The 30-share BSE Sensex declined 1,097 points, or 1.37 per cent, to close at 78,918.90. During the session, it had plunged 1,203.72 points, or 1.50 per cent, to 78,812.18. The NSE Nifty dropped 315.45 points, or 1.27 per cent, to settle at 24,450.45.

Nifty50 top gainers

- Bharat Electronics (1.84%)

- Reliance Industries (1.11%)

- ONGC (0.95%)

- Sun Pharma (0.84%)

- NTPC (0.68%)

- Hindalco (0.42%)

- HCL Tech (0.20%)

- Infosys (0.20%)

- Bajaj Auto (0.12%)

- Nestle India (0.12%)

Nifty50 top losers

- ICICI Bank (-3.26%)

- Eternal (-3.16%)

- Shriram Finance (-3.08%)

- Axis Bank (-2.47%)

- UltraTech Cement (-2.45%)

- Kwality Wall’s (-2.42%)

- InterGlobe Aviation (-2.41%)

- Adani Enterprises (-2.36%)

- HDFC Bank (-2.36%)

- HDFC Life (-2.31%)

BSE Sensex top gainers

- Bharat Electronics (1.84%)

- Reliance Industries (1.11%)

- Sun Pharma (0.84%)

- NTPC (0.68%)

- HCL Tech (0.20%)

- Infosys (0.20%)

BSE Sensex top losers

- ICICI Bank (-3.26%)

- Eternal (-3.16%)

- Axis Bank (-2.47%)

- UltraTech Cem. (-2.45%)

- Kwality Wall’s (-2.42%)

- InterGlobe (-2.41%)

- HDFC Bank (-2.36%)

- SBI (-2.27%)

- Bajaj Finserv (-2.25%)

- L&T (-2.21%)

The decline came as Brent crude, the global oil benchmark, jumped 2.53 per cent to $87.57 per barrel, raising concerns about inflation and macroeconomic stability.“Indian equity markets extended their decline following the prior session’s relief rally, as escalating US-Iran tensions disrupted key Middle Eastern oil and gas supplies, driving crude prices higher. A sustained rise in oil prices could weigh on investor sentiment and adversely affect India’s twin deficits, inflation trajectory, and the RBI’s monetary stance,” said Vinod Nair, Head of Research, Geojit Investments Ltd, PTI quoted.Elsewhere in Asia, South Korea’s Kospi, Japan’s Nikkei 225, Shanghai’s SSE Composite index and Hong Kong’s Hang Seng index ended higher.European markets, however, were trading in the red, while US markets ended lower on Thursday.Foreign Institutional Investors (FIIs) sold equities worth Rs 3,752.52 crore on Thursday, while Domestic Institutional Investors (DIIs) purchased stocks worth Rs 5,153.37 crore, according to exchange data.On Thursday, the Sensex had rebounded 899.71 points, or 1.14 per cent, to settle at 80,015.90, snapping its four-day losing streak. The Nifty had climbed 285.40 points, or 1.17 per cent, to close at 24,765.90, ending its three-day decline.

Business

Watch: How war in Iran may affect food and fuel prices

As the US and Israel continue strikes on Iran, and with retaliatory strikes hitting nearby Middle East states, key shipping routes are being disrupted. Oil and gas production in the region is also being affected.

The BBC’s Nick Marsh examines how the war could cause a rise in living costs around the world.

Business

Stock Market Updates: Sensex Tanks 1,100 Points, Nifty Tests 24,450; India VIX Jumps Over 11%

Last Updated:

The Nifty50 and the Sensex declined at open amid weak global cues.

Sensex Today

Indian benchmark equity indices extended their losses in a volatile trading session on Friday as investors remained cautious amid escalating tensions in West Asia linked to the US-Iran conflict.

As of 3:19 PM, the Nifty50 was trading 1.21 per cent or 300 points down at 24,465, and the Sensex was trading 1,136 points or 1.42 per cent down at 78.879.

Market volatility spiked during the session, with the India VIX rising as much as 11.31% to 19.88.

Among Nifty50 constituents, InterGlobe Aviation, ICICI Bank, and Max Healthcare Institute were the top losers. On the other hand, Bharat Electronics Limited, Reliance Industries, and NTPC Limited were among the top gainers.

Broader markets also traded lower, with the Nifty Midcap 100 and Nifty Smallcap 100 declining 0.47% and 0.06%, respectively.

On the sectoral front, the Nifty IT Index was the only major gainer, rising 0.34% on the back of gains in Persistent Systems and Infosys.

Meanwhile, the Nifty Realty Index emerged as the worst-performing sector, falling nearly 2%, dragged down by losses in Godrej Properties, The Phoenix Mills, and Prestige Estates Projects.

The Nifty Private Bank Index and Nifty Financial Services Index were also among the major laggards during the session.

Global cues

Most markets across the Asia-Pacific region traded in the red as crude oil prices climbed amid rising concerns over supply disruptions linked to the escalating conflict involving the United States, Israel, and Iran.

In Asia, mainland China’s CSI 300 Index slipped around 0.1%, while South Korea’s Kospi Index declined 1.6%.

Overnight on Wall Street, the S&P 500 fell 0.57%, while the Dow Jones Industrial Average dropped 1.61%. The Nasdaq Composite ended 0.26% lower.

Market uncertainty also intensified after Letitia James and attorneys general from 23 US states reportedly filed another lawsuit seeking to block tariff measures announced by Donald Trump.

Oil and gold prices

Oil prices surged as traders remained concerned about potential supply disruptions. According to a Reuters report, Brent crude futures rose nearly 5% to $85.41 per barrel in the previous session.

During the Asian trading session, Brent Crude Oil was trading 0.15% higher at $84.16 per barrel.

Meanwhile, safe-haven demand pushed Gold Futures up 1.34% to $5,146.39, supported by ongoing geopolitical tensions.

Follow News18 on Google. Join the fun, play games on News18. Stay updated with all the latest business news, including market trends, stock updates, tax, IPO, banking finance, real estate, savings and investments. To Get in-depth analysis, expert opinions, and real-time updates. Also Download the News18 App to stay updated.

March 06, 2026, 09:20 IST

Read More

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Business1 week ago

Business1 week agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Sports7 days ago

Sports7 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Entertainment7 days ago

Entertainment7 days agoWhat’s new in Pokémon? Every game, update, surprise from 30th anniversary event

-

Business7 days ago

Business7 days agoGreggs to reveal trading amid pressure from cost of living and weight loss drugs