Business

US retailers pull Chinese electronics | The Express Tribune

WASHINGTON:

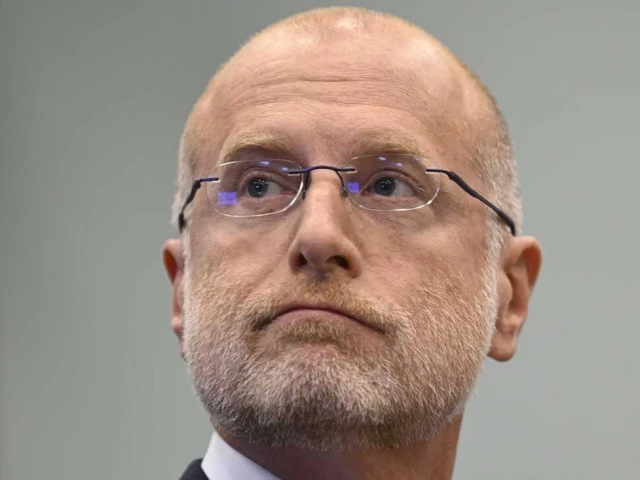

The chair of the Federal Communications Commission (FCC) said on Friday that major US online retail websites have removed several million listings for prohibited Chinese electronics as part of a crackdown by the agency.

FCC Chair Brendan Carr said in an interview that the items removed are either on a US list of barred equipment or were not authorised by the agency, including items like home security cameras and smart watches from companies including Huawei, Hangzhou Hikvision, ZTE and Dahua Technology Company.

Carr said companies are putting new processes in place to prevent future prohibited items as a result of FCC oversight.

“We’re going to keep our efforts up,” Carr said.

The FCC issued a new national security notice reminding companies of prohibited items including video surveillance equipment. Carr said the items could allow China to “surveil Americans, disrupt communications networks and otherwise threaten US national security.” US agencies in recent years have taken a series of actions against Chinese tech companies, including telecom, semiconductors, vehicles and others raising national security concerns. This is the latest push to prevent unapproved Chinese electronics from getting to the US market.

Earlier this week, the FCC said it plans to vote this month to tighten restrictions on telecommunications equipment made by Chinese companies deemed national security risks, the latest in a series of US actions targeting Beijing.

The US telecom regulator previously named companies including Huawei, ZTE, China Mobile and China Telecom to the so-called “Covered List,” which bars the FCC from authorising the import or sale of new equipment from those companies.

The agency will vote on October 28 to prohibit authorisation of devices containing component parts that are on the Covered List and authorise the agency to prohibit the sale of previously authorised Covered List equipment in specific cases.

Business

Restaurant group changes name after bid to buys pubs across the UK

Restaurant group Various Eateries is poised for a significant expansion, announcing plans to rebrand as the Coppa Collective and venture into the pub sector. The company, known for its Coppa Club and Noci venues, confirmed the name change alongside a deal to acquire a portfolio of pubs with rooms from Grosvenor Pubs and Inns.

The acquisition of four initial sites is expected to be finalised on or around 23 March, with an additional agreement for a potential fifth location. The pubs joining the new collective are Wild Thyme & Honey in the Cotswolds, The Hare & Hounds in Berkshire, The Stag on the River in Surrey, and The Wellington Arms in Hampshire.

Furthermore, terms have been secured for the potential acquisition of The Queen’s Head, also situated in Surrey.

This venue is subject to an “asset of community value” process, meaning it can only be sold after the relevant statutory notification and moratorium period has expired, which could take up to six weeks.

The group, which was founded by Punch Pubs founder Hugh Osmond, will pay £11.25 million for the initial four pubs once the deal completes.

Various Eateries will create a third brand within its portfolio, called The Linwood Collection, after completing the deal.

The hospitality group currently runs 20 sites, including restaurant, club house and hotel venues.

The deal comes a month after the business said it was considering merger and acquisition opportunities in a bid to drive growth.

Mark Loughborough, chief executive of Various Eateries, said: “Linwood marks an important step in the evolution of the group.

“We are bringing into the business a small collection of premium pubs with rooms that have earned their reputations the right way, through great hospitality, careful attention to detail and a real sense of place.

“This is also a format we know well and rate highly in the current market.

“Premium pubs with rooms combine food and drink with accommodation and a broader, destination-led appeal.”

Business

Flipkart Layoffs 2026: Why Has E-Commerce Firm Sacked Around 500 Employees?

Last Updated:

The layoffs account for 3-4% of Flipkart’s workforce, which is higher than the company’s practice of letting go of 1-2% of employees in the lowest performance bracket every year.

Flipkart Layoffs 2026.

Flipkart Layoffs 2026: Flipkart, the Walmart-owned e-commerce giant, has reportedly asked around 400-500 employees to exit the company this year following its annual performance review process. According to a report by The Economic Times, the layoffs account for roughly 3-4% of Flipkart’s workforce, which is higher than the company’s usual practice of letting go of 1-2% of employees in the lowest performance bracket every year.

Why Has Flipkart Laid Off Employees?

Responding to queries, Flipkart said the move is part of its routine evaluation process. “Flipkart conducts regular performance reviews aligned with clearly defined expectations. As part of this process, a small percentage of employees may transition from the organisation. We are supporting affected employees with transition support,” the company said, according to Mint.

Layoffs Across Teams, Hiring Continues For Senior Roles

The job cuts have reportedly impacted employees across multiple departments and job levels. At the same time, the company continues to recruit senior executives as it prepares for a potential initial public offering (IPO).

According to a report by ANI, Flipkart has recently strengthened its leadership team with several senior appointments.

These include Somnath Das as vice-president (supply chain), Digbijay Mishra as vice-president (corporate communications), Vipin Kapooria as vice-president (business finance), Yogita Shanbhag as vice-president (human resources), and Amer Hussain as vice-president (supply chain for its grocery and quick-commerce businesses).

Flipkart Preparing For India IPO

In December 2025, Flipkart received approval from the National Company Law Tribunal to shift its legal domicile from Singapore to India, a key step ahead of a potential domestic listing.

The restructuring involved merging eight Singapore-based entities into Flipkart Internet Pvt Ltd, simplifying the group’s holding structure across businesses such as fashion, health and logistics.

Loss Widens Despite Revenue Growth

Financial data shows that Flipkart continues to expand its business, although losses have widened.

According to data from Tofler, Flipkart India reported a consolidated loss of Rs 5,189 crore in FY25, compared with Rs 4,248.3 crore in FY24.

However, revenue from operations rose 17.3% to Rs 82,787.3 crore, up from Rs 70,541.9 crore a year earlier.

Total expenses also increased 17.4% to Rs 88,121.4 crore, largely due to higher stock-in-trade purchases, which climbed to Rs 87,737.8 crore, compared with Rs 74,271.2 crore in the previous financial year.

Follow News18 on Google. Join the fun, play games on News18. Stay updated with all the latest business news, including market trends, stock updates, tax, IPO, banking finance, real estate, savings and investments. To Get in-depth analysis, expert opinions, and real-time updates. Also Download the News18 App to stay updated.

March 07, 2026, 14:51 IST

Read More

Business

US–Israel War With Iran Sends Shockwaves Through Global Business – SUCH TV

Global businesses are feeling the impact of the escalating conflict between the United States, Israel, and Iran, as rising energy prices and disrupted trade routes create uncertainty across markets.

Oil and Energy Prices Surge

The conflict has triggered a sharp rise in global oil and gas prices. Brent crude prices have climbed close to $90 per barrel, raising concerns among businesses and policymakers about inflation and higher operating costs.

Industry leaders warn that prolonged price increases could affect nearly every sector of the global economy.

Higher fuel costs are already pushing up prices for transportation, manufacturing, and consumer goods.

Trade Routes Under Pressure

Shipping routes through the Strait of Hormuz, which handles about 20% of global oil supplies, have slowed significantly as tensions escalate.

Air travel routes across the Gulf have also been disrupted, creating delays for cargo shipments and international flights.

Industries Facing Supply Disruptions

Several industries are beginning to feel the effects:

Aluminium production has been disrupted as shipments through the Gulf face restrictions.

Helium supplies, crucial for semiconductor manufacturing, could also be affected.

Chemical and energy-intensive industries in Europe are already reducing production due to rising gas prices.

The Gulf region accounts for roughly 8% of global aluminium production, making any supply disruption a major concern for global manufacturing.

Businesses Prepare for Economic Impact

Major companies are now hedging energy costs and reviewing supply chains to manage the uncertainty.

Analysts warn that if oil prices reach $100 per barrel, global economic growth could slow significantly.

Some financial institutions estimate global growth could drop by 0.4 percentage points if the conflict persists.

Risk of Another Energy Crisis

Experts say the situation highlights how vulnerable global markets remain to geopolitical shocks.

Business leaders warn that energy volatility, supply chain disruption, and rising inflation could lead to a new global economic slowdown if the conflict continues for an extended period.

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Business1 week ago

Business1 week agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports1 week ago

Sports1 week agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Fashion1 week ago

Fashion1 week agoSouth Korea’s Misto Holdings completes planned leadership transition

-

Entertainment1 week ago

Entertainment1 week agoBobby J. Brown, “The Wire” and “Law & Order: SUV” actor, dies of smoke inhalation after reported fire

-

Fashion1 week ago

Fashion1 week agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026

-

Entertainment1 week ago

Entertainment1 week agoPakistan’s semi-final qualification scenario after England defeat New Zealand