Business

GM expects next year’s results to top 2025 earnings

The GM logo is seen on the facade of the General Motors headquarters in Detroit on March 16, 2021.

Rebecca Cook | Reuters

DETROIT — General Motors CFO Paul Jacobson on Tuesday said the company expects earnings next year to top its 2025 results, which have performed far better than Wall Street’s expectations.

Investors had been hoping to hear comments about 2026 guidance as the automaker reported third-quarter earnings that included raising 2025 guidance and topping Wall Street’s expectations.

“Looking ahead to 2026, we have multiple levers to carry our current momentum forward, including progress on [electric vehicle] losses, warranty costs, tariff offsets, regulatory requirements and fixed costs,” Jacobson said. “As a result, we expect next year to be even better than 2025.”

The company’s shares rose more than 15% on Tuesday. The stock closed Monday at $58 per share.

Jacobson also said the automaker will continue to repurchase shares, which the company has been aggressive about in recent years. At the end of the third quarter, GM’s outstanding shares were at 954 million, a 15% decline from a year earlier.

“We’re going to continue to just focus on executing the business and executing the plan, and that’s worked really well for us and we expect it will in ’26,” Jacobson said.

GM stock in 2025.

Jacobson and GM CEO Mary Barra said the company’s top priority is returning adjusted profit margins in North America – its core market – to 8% to 10% but did not give a time frame for meeting that goal. The margin was 6.2% during the third quarter.

GM’s updated 2025 guidance includes adjusted earnings before interest and taxes of between $12 billion and $13 billion, or $9.75 to $10.50 adjusted EPS, up from $10 billion to $12.5 billion, or $8.25 to $10 adjusted EPS, and adjusted automotive free cash flow of $10 billion to $11 billion, up from $7.5 billion to $10 billion.

“This commentary is encouraging and consistent with our incoming view that automakers could convey positive messaging beyond 2025,” TD Cowen analyst Itay Michaeli said Tuesday in an investor note about 2026.

RBC Capital Markets analyst Tom Narayan said he expects 2026 analyst consensus to “move significantly higher” following the third-quarter results and adjusted guidance.

Citi’s Michael Ward said the recent results and guidance signal a larger cultural change for GM: “In the past it was said it was difficult to turn the big ship GM too quickly. Given the changing landscape, GM has found a way to turn it much faster than in the past.”

— CNBC’s Michael Bloom contributed to this report.

Correction: At the end of the third quarter, GM’s outstanding shares were at 954 million. An earlier version mischaracterized the figure.

Business

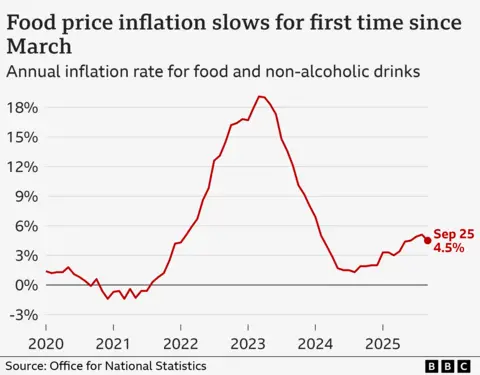

Food price rises slow as UK inflation remains at 3.8%

Charlotte EdwardsBusiness reporter, BBC News

Getty Images

Getty ImagesFood and drinks prices in the UK are increasing at their slowest rate in more than a year, while overall inflation remains unchanged for the third month in a row.

Month-on-month, the cost of food and non-alcoholic drinks actually edged down slightly in September – the first fall since May 2024. The ONS said his was likely to have been driven by increased sales and discounting by retailers.

The UK inflation rate for all items remained stable at a lower-than-expected 3.8% in the year to September, official figures show.

Chancellor Rachel Reeves said she was “not satisfied with the numbers” on inflation, while shadow chancellor Mel Stride said it was “pushing up the cost of living”.

Elaine Doran/BBC

Elaine Doran/BBCThe inflation rate for food and non-alcoholic drinks was down to 4.5% for the year to September from 5.1% in the year to August.

This means the price shoppers pay for groceries and non-alcoholic drinks is still going up, just more slowly than before.

But between August and September this year, the cost of food and non-alcoholic drinks overall actually fell by 0.2% – the first fall for 16 months.

The drop was driven by slightly cheaper vegetables, milk, cheese and eggs, bread and cereals, fish, mineral waters, soft drinks and juices.

However, the cost of specific items such as red meat and chocolate continued to rise.

Kayleigh Brannan, a mother to baby Hadley, told the BBC she had noticed the price of meat rising in particular, and that now Hadley has started eating solid foods, she expected her expenses would be going up.

“It’s not too bad at the moment but you can see the prices going up,” she said.

She added: “The maternity pay is not enough. You’ve still got the same bills, you’ve still got to pay the mortgage… obviously you have more pressure then.”

Britain’s inflation rate was also 3.8% in July and August, according to the ONS, which is still much higher than the Bank of England’s 2% target.

However, the central bank’s economists had forecast inflation to rise to 4% in September.

ONS chief economist Grant Fitzner said: “The largest upward drivers came from petrol prices and airfares, where the fall in prices eased in comparison to last year.”

He added: “These were offset by lower prices for a range of recreational and cultural purchases including live events.”

Mr Fitzner told BBC Radio 4’s Today programme that food prices were still “running quite high at 4.5%” but added “the fact that we have seen that steady increase dip a little is encouraging.”

“It is just one month’s numbers so we will have to see what transpires in future months – but nonetheless a small glimmer of hope there,” he said.

Paul Dales, chief UK economist for Capital Economics, said while food price inflation could rise further, “this will probably be the peak in inflation”.

James Walton, chief economist at the Institute of Grocery Distribution said the declining rate of food and drink inflation “aligns with our predictions that food inflation will start to moderate, and we may have seen the peak.”

“Whilst this is good news, prices for shoppers are still going up year on year, just more slowly,” he said.

Mr Walton noted that items such as red meat, coffee and chocolate are still seeing strong price increases and linked this to issues with production, such as bad weather.

Danni Hewson, AJ Bell head of financial analysis, said: “Staples like vegetables, milk, cheese and bread were all pared back a touch, though such tiny movements won’t make a huge difference to the overall bill when people reach supermarket tills.”

Dr Kris Hamer, director of insight at the British Retail Consortium, said the figures were “unlikely to raise consumer spirits as the cost of a weekly grocery shop was still “significantly higher than last year”.

“Nonetheless, consumers will have been happy to see the price of key staples such as rice, bread and cereal fall on the month,” he said.

The chancellor said she was “not satisfied with these numbers.”

“For too long, our economy has felt stuck, with people feeling like they are putting in more and getting less out,” Reeves said.

She added that she was determined to ensure the government supports people “struggling with higher bills and the cost of living challenges, deliver economic growth and build an economy that works for, and rewards, working people.”

In a post on X, the shadow chancellor said that inflation running at nearly double the Bank of England’s target was “pushing up the cost of living and punishing those Labour promised to protect”.

Stride claimed national insurance increases, government borrowing and not having “the backbone to reduce spending” were all contributing to inflation.

The overall inflation figure for September matters more than most other months.

That’s because the government usually uses this as the benchmark for the benefits uprating in April.

It means millions of people depending on benefits are likely to see a 3.8% increase in their payments next year.

The state pension will rise by more, because the annual increase for that is determined by the so-called triple lock.

This guarantees that the state pension goes up each year in line with either inflation, wage increases or 2.5% – whichever is the highest. September’s inflation figure of 3.8% is below average earnings for the relevant period (4.8%) which means the rise in wages will decide the state pension increase.

The inflation figures for the past three months were the joint-highest recorded since January 2024, when the rate was 4%, according to the ONS.

Inflation in the UK remains well below the 11.1% figure reached in October 2022, which was the highest rate for 40 years.

Business

India-Germany ties: Piyush Goyal to visit Berlin on 25 years of Strategic Partnership; trade, investment on agenda – The Times of India

Union commerce and industry minister Piyush Goyal will embark on an official visit to Berlin, Germany, from Thursday, marking a milestone in India-Germany engagement, as 2025 commemorates the 25th anniversary of the India–Germany Strategic Partnership. The visit aims to deepen bilateral economic ties and facilitate high-impact interactions with senior officials, industry leaders, and business associations from both countries.During the trip, Goyal will hold bilateral meetings with Katherina Reiche, German federal minister for economic affairs and energy, and Levin Holle, economic and financial policy advisor at the Federal Chancellery and Germany’s G7 and G20 Sherpa. Discussions will focus on enhancing trade and investment cooperation between India and Germany, exploring new avenues for strategic economic partnership.The minister will also engage with Xavier Bettel, deputy Prime Minister and minister of foreign affairs and trade of Luxembourg, to discuss strengthening bilateral trade relations, Luxembourg’s forthcoming State Visit to India, regional developments, and key international issues, as per the ministry statement.As part of his Berlin visit, Goyal will participate as a speaker at the third Berlin Global Dialogue (BGD), an annual summit bringing together leaders from business, government, and academia. He will be a panellist in the session titled “Leaders’ Dialogue: Growing Together – Trade and Alliances in a Changing World,” which will explore strategies for nations and businesses to navigate the evolving global trade landscape and build a sustainable trading ecosystem.A key highlight of the visit will be one-on-one meetings with CEOs of major German companies, including Schaeffler Group, Renk Vehicle Mobility Solutions, Herrenknecht AG, Infineon Technologies AG, Enertrag SE, and Mercedes-Benz Group AG. Goyal will also chair a Roundtable with CEOs and leaders of German Mittelstand companies and meet representatives of the Federation of German Industries (BDI) and the Asia-Pacific Association of German Business.“These interactions will provide a platform to explore synergies, facilitate investments, and promote stronger business-to-business linkages, particularly in sectors aligned with sustainability, innovation, and advanced manufacturing,” the ministry said, underlining that the visit reflects the deepening alignment of strategic priorities between India and its European partners, aiming to translate high-level commitments into sustainable economic partnerships.

Business

How Much Tax Is Applicable On Gold, Silver Gains? Know Tax Rates, ETF Rules And TDS

Last Updated:

Whether you invest in physical forms such as jewellery, coins, or bars, or through paper and digital modes like ETFs or Sovereign Gold Bonds, your gains are taxable.

Tax on Gold and Silver Gains.

Tax on Gold and Silver Gains: Gold prices have surged over 60% in the past year, while silver has doubled during the period, accruing gains for investors. However, gold, like any other asset class, also attracts capital gains tax on sale. Whether you invest in physical forms such as jewellery, coins, or bars, or through paper and digital modes like Exchange-Traded Funds (ETFs) or Sovereign Gold Bonds (SGBs), your profits are taxable. Here’s all you need to know:

Here’s a detailed look at how gains on gold and silver are taxed in India, along with the rules for ETFs and TDS applicability.

1. Tax on Physical Gold and Silver

When you sell gold or silver (jewellery, coins, or bars), any profit you make is treated as a capital gain. The tax depends on the holding period.

Short-Term Capital Gains (STCG): Returns from gold held for less than 24 months are termed short-term capital gains, according to cleartax.in.

Long-Term Capital Gains (LTCG): If you sell the asset after 24 months, the profit qualifies as long-term capital gains and is taxed at 12.5%. Also, if it was purchased on or after July 23, 2024, the same will be taxed at 12.5% without the indexation benefit. But, if purchased before July 23, 2024, investors can also avail indexation benefit with a 20% tax.

2. Tax on Gold and Silver ETFs

Gold and Silver Exchange-Traded Funds (ETFs) are treated similarly to physical holdings for tax purposes.

Held for less than 24 months: Gains are considered short-term and taxed as per your income tax slab.

Held for more than 24 months: Gains qualify as long-term and are taxed at 12.5%.

3. Tax on Sovereign Gold Bonds (SGBs)

Sovereign Gold Bonds, issued by the Reserve Bank of India (RBI), have a unique tax structure:

Interest Income: The annual interest (2.5%) paid on SGBs is taxable under ‘Income from Other Sources’ as per your income tax slab.

Capital Gains: If you hold the bonds till maturity (8 years), the capital gains are fully exempt from tax.

However, if you redeem them before maturity, after the 5th year, or sell them in the secondary market, LTCG at 12.5% applies.

4. Digital Gold and Silver

Many investors today buy “digital gold” or “digital silver” through fintech apps. The tax treatment is the same as physical gold —

Less than 24 months: Taxed as per slab (STCG).

More than 24 months: Taxed at 12.5% (LTCG).

5. Tax Deducted at Source (TDS) Rules

TDS applies when you sell physical gold or silver above certain limits or make large purchases:

On Sale: If you sell gold or silver worth more than Rs 50 lakh in a financial year to a buyer required to deduct tax (like a jeweller), TDS of 1% may be deducted on the sale consideration.

On Purchase: From July 1, 2021, if you buy gold worth more than Rs 10 lakh in cash, TDS/TCS (Tax Collected at Source) of 1% applies, and PAN/Aadhaar details are mandatory.

6. Gifts and Inherited Gold or Silver

If you receive gold or silver as a gift, it is taxable if the total value of gifts received during the financial year exceeds Rs 50,000, unless received from a relative or on occasions like marriage.

If you inherit gold or silver, no tax is payable at the time of inheritance. However, when you sell it later, capital gains tax applies based on the original cost of acquisition to the previous owner.

It is important to note that a 3% GST is applicable on gold purchases, apart from making charges and a 5% tax on that.

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h…Read More

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h… Read More

October 22, 2025, 16:46 IST

Read More

-

Tech6 days ago

Tech6 days agoWhy the F5 Hack Created an ‘Imminent Threat’ for Thousands of Networks

-

Tech1 week ago

Tech1 week agoWhat Is Google One, and Should You Subscribe?

-

Tech3 days ago

Tech3 days agoHow to Protect Yourself Against Getting Locked Out of Your Cloud Accounts

-

Tech1 week ago

Tech1 week agoWhen does it pay for housing associations to replace water and sewage pipes?

-

Fashion1 week ago

Fashion1 week agoUS brand Ralph Lauren reports 2025 sustainability progress

-

Business7 days ago

Business7 days agoBaroness Mone-linked PPE firm misses deadline to pay £122m

-

Fashion1 week ago

Fashion1 week agoSelf-Portrait unveils high-profile Apple Martin campaign

-

Politics1 week ago

Politics1 week agoTears, cheers as Palestinians welcome freed prisoners home under Gaza ceasefire