Business

Here’s where the economy is starting to show ‘K-shaped’ bifurcation

Coke beverages are displayed in a 7-eleven convenient store on July 17, 2025 in Austin, Texas.

Brandon Bell | Getty Images

Amid recession fears, a government shutdown and tariff uncertainty, consumers are increasingly diverging in their spending.

Wealthier Americans are engaging their purchasing power, while lower-income Americans are starting to pull back — commonly described as a “K-shaped” economy. Friday’s consumer price index report shed more light on the pressures facing large swaths of the country.

The CPI report, which measures price changes across a range of goods and services, was delayed due to the government shutdown, originally scheduled to be released nine days prior. The report came in cooler-than-expected, showing a 0.3% increase on the month. That put the annual inflation rate at 3% and signals a likely rate cut by the Federal Reserve next week.

A subset of the CPI report also helps determine the Social Security Administration’s cost-of-living adjustment, which the agency said Friday will be 2.8% in 2026.

Lower- and middle-income consumers have been hit hardest by rising costs on daily essentials like groceries and gas. Meanwhile, wealthier investors have benefited from stock market rallies and rising home values. Recent data from JPMorgan’s Cost of Living Survey found that income bracket was a large factor in Americans’ varying views of the current state of the economy.

Here’s where bifurcation is beginning to take hold:

Food and beverage

Coca-Cola, often viewed as a bellwether for the financial health of consumer, has been seeing the divergence across its business.

Pricier products that are more exposed to high-income consumers, like Topo Chico sparkling water and Fairlife protein shakes, are fueling the company’s sales growth, CEO James Quincey told CNBC’s “Squawk on the Street” Tuesday.

At the same time, Coke is seeing higher demand at both dollar stores that cater to low-income consumers looking for deals and higher-end outlets that skew toward wealthier consumers, like fast-casual restaurants and amusement parks.

McDonald’s CEO Chris Kempczinski told CNBC’s “Squawk Box” in early September that the burger chain’s expansion of its value menu was in response to a divided consumer landscape, or what he called a “two-tier economy.”

While Kempczinski said the company is seeing upper-income consumers performing well, its lower- and middle-income diners are “a different story.”

“Traffic for lower-income consumers is down double digits, and it’s because people are either choosing to skip a meal… or they’re choosing to just eat at home,” he said last month.

A similar dynamic is playing out at Chipotle, according to Chief Financial Officer Adam Rymer.

“There are certain cohorts of the consumer, definitely on the lower-income side, that are feeling pressure right now. That’s something that we’ll have to take into consideration when looking at price going forward,” Rymer told Reuters in July.

On Friday, Procter & Gamble said the company is seeing K-shaped shopping behaviors among its consumers, with wealthier shoppers buying bigger pack sizes from club retailers and lower-income shoppers exhausting their pantry inventory before returning to the stores.

“The consumer environment is not great, but stable,” CFO Andre Schulten said on a call with reporters.

Autos and airfare

Last month, the average price for a new vehicle surpassed $50,000 for the first time ever, according to Cox Automotive’s Kelley Blue Book.

The record pricing comes as auto loan defaults and repossessions are on the rise, particularly for those with FICO scores below 620.

“Today’s auto market is being driven by wealthier households who have access to capital, good loan rates and are propping up the higher end of the market,” said Cox Automotive executive analyst Erin Keating in a statement last week.

And though airlines have been piloting premium offerings for years, the higher-cost tickets have gained momentum in recent months.

Delta Air Lines said earlier this month that revenue from its premium offerings is expected to surpass the coach cabin next year, with CEO Ed Bastian saying he’s not seeing any signs of slowdown in the roomier, more expensive seats.

Hospitality

Still, though there are signs of a “K-shaped” economy, some argue it’s not here to stay.

Hilton CEO Christopher Nassetta told CNBC last month that he’s seeing a bifurcation, but he doesn’t expect that pattern to last much longer, partly because he sees inflation and interest rates decreasing.

“My own belief is that as we look into the fourth quarter and particularly into next year, we’re going to see a very big shift in those dynamics, meaning, I don’t think you’re going to continue to have this bifurcation,” Nassetta said. “That’s not to say I think the high end is going to get worse or bad, I just think the middle and the low end is going to move up.”

On Wednesday, the hotel chain reported a drop in revenue for affordable brands like Hampton by Hilton and Homewood Suites by Hilton.

Meanwhile, Nassetta told investors on an earnings call that revenue from luxury offerings performed exceedingly well and remains a focus for Hilton moving forward.

— CNBC’s Amelia Lucas, Michael Wayland, Alex Harring, Luke Fountain and Leslie Josephs contributed to this report.

Business

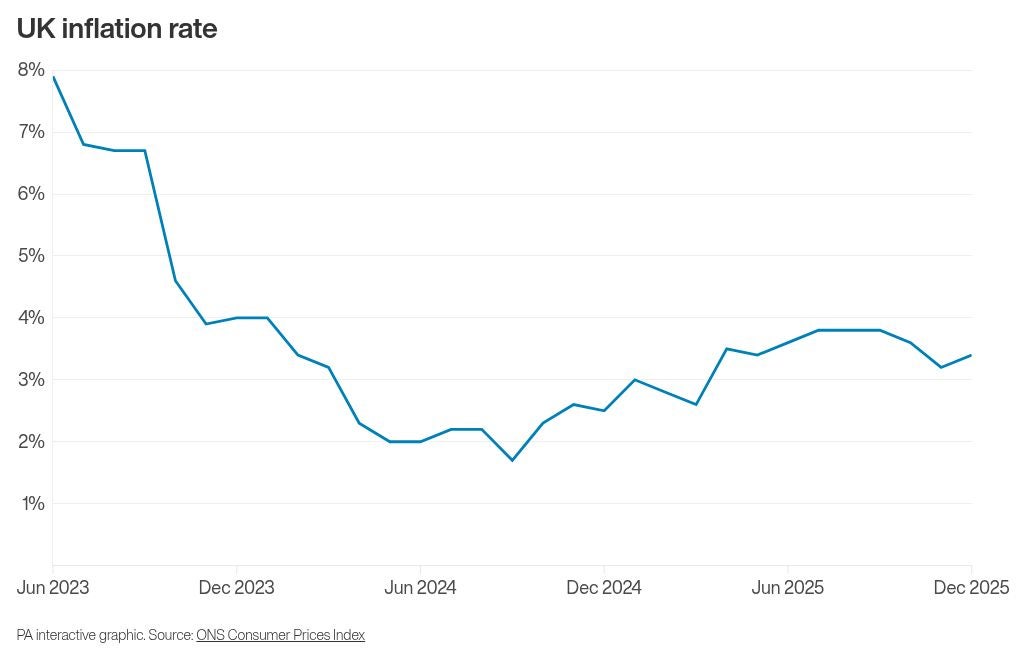

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’