Business

FTSE 100 at new high as banks offset weak gold and US-China talks hailed

The FTSE 100 edged upwards on Monday, notching another record close, ahead of a week dominated by central bank meetings and tech earnings.

The FTSE 100 index closed up 8.20 points, or 0.1%, at 9,653.82. It had earlier set a new intra-day high of 9,672.74.

The FTSE 250 ended 17.54 points lower, or 0.1%, at 22,511.48, and the AIM All-Share declined 4.66 points, 0.6%, at 772.60.

Markets were given a lift by productive trade talks between the world’s two largest economies, China and the US.

Joshua Mahony at Scope Markets said the weekend talks between US-Chinese negotiators appear to have resulted in a “significant breakthrough”, with US Treasury Secretary Scott Bessent announcing that a “substantial framework” had been agreed upon.

That framework covers a wide range of issues, including export controls, tariff suspensions, fentanyl-related tariffs, and agricultural trade.

“With the Trump-Xi meeting always likely to be a result of significant groundwork being made by their negotiating teams, there is an optimism that the two leaders can strike a more conciliatory tone than had been seen over recent weeks,” he added.

In Europe on Monday, the CAC 40 in Paris ended up 0.2%, while the DAX 40 in Frankfurt closed 0.3% higher.

Stocks in New York were higher at the time of the London close. The Dow Jones Industrial Average was up 0.5%, the S&P 500 was 1.0% higher, and the Nasdaq Composite advanced 1.6%.

The yield on the US 10-year Treasury was quoted at 4.02%, stretched from 4.00% on Friday. The yield on the US 30-year Treasury stood at 4.59%, widened from 4.58% on Friday.

On Wall Street, the focus this week is on Wednesday’s interest rate decision and earnings from five of the ‘Magnificent 7’ with Amazon, Alphabet, Apple, Meta Platforms and Microsoft, which hit the wires after the market close on Wednesday and Thursday.

The Federal Reserve is widely expected to lower interest rates on Wednesday and possibly tee up another quarter-point reduction in December, despite a lack of data because of the federal government shutdown.

Morgan Stanley said: “Limited data availability should not stop the Fed from reducing its policy rate again in October and signalling another cut is likely in December, but it could limit how far rate guidance extends past year-end.”

After a 25 basis points cut on Wednesday, the investment bank expects further cuts in December, January, April and July, with a terminal rate of 2.75%-3.00%.

The pound was quoted higher at 1.3331 dollars at the time of the London equity market close on Monday, compared with 1.3301 dollars on Friday.

The euro stood at 1.1639 dollars, up compared with 1.1631dollars. Against the yen, the dollar was trading at 153.04 yen, higher compared with 152.79 yen.

On the FTSE 100, HSBC fell 0.3% as it said it will set aside 1.1 billion dollars (£0.82 billion) after an adverse court ruling related to the Bernard Madoff investment fraud.

The provision will be included in its third-quarter results, due for release on Tuesday.

Madoff, who died in a North Carolina prison in 2021, admitted to defrauding thousands of investors of around 65 billion dollars (£48.7 billion) through a Ponzi scheme.

“This is not a great headline and was unexpected, but the overall financial impact is not material to the investment case,” commented Shore Capital banking analyst Gary Greenwood.

But other banking stocks pushed higher, with Standard Chartered up 3.2%, Lloyds Banking up 2.3%, and NatWest and Barclays both 1.9% to the good.

Analysts at JP Morgan (JPM) think that the consistency of earnings generation and strong capital in UK domestic banks remains “underappreciated” with valuations below European peers.

“Concerns around an inflection in hedge earnings are premature, in our view, while we also see a ‘reasonable’ tax increase with the Budget as largely priced, allowing investors to re-engage with the sector,” JPM added, noting the outlook for distributions is “solid”.

But Centrica fell 1.4%, as Citi downgraded the British Gas owner to ‘hold’ from ‘buy’.

“With the stock now within touching distance to our unchanged 185p price target, with no immediate upside catalyst, some concerns gathering around UK politics and Centrica Energy for the (full year), as well as our more cautious view of commodity outlook, we struggle to see much absolute upside,” analyst Jenny Ping wrote in a research note.

The more ‘risk-on’ mood saw the safe haven of gold retreat, dragging Fresnillo and Endeavour Mining both down by 5.0%. On the FTSE 250, Hochschild Mining fell 5.2%.

Gold traded at 3,993.32 dollars an ounce on Monday, down from 4,125.47 dollars on Friday.

James Luke, senior portfolio manager, gold and commodities at Schroders said it was a “natural correction within a multi-year bull market”.

“We continue to view this bull market as incomparable with prior bull markets in terms of the breadth and depth of potential monetary demand. If, as we see it, this is the ‘Mount Everest’ of gold bull markets, while we are well into the foothills, there is a long climb yet to reach the peak,” he added.

Back on the FTSE 250, Goodwin stormed 33% higher after announcing a special dividend and stating it expects its annual profit to double.

The Stoke-on-Trent, Staffordshire-based engineering and manufacturing company said that for the financial year to April 30, it expects to report pre-tax trading profit of £71 million, doubling from £35.5 million the year prior.

The special dividend, totalling 532 pence per share, was to “acknowledge and reward shareholders for their long-term commitment”, Goodwin said.

Brent oil traded at 65.99 dollars a barrel on Monday, down from 66.56 dollars late on Friday.

The biggest risers on the FTSE 100 were Standard Chartered, up 45.5 pence at 1,470.5p, Polar Capital Technology Trust, up 10.5p at 460.5p, Lloyds Banking Group, up 1.98p at 87.84p, St James’s Place, up 30.0p at 1,369.0p and Burberry, up 29.0p at 1,325.5p.

The biggest fallers on the FTSE 100 were Endeavour Mining, down 160.0p at 3,018.0p, Fresnillo, down 111.0p at 2,102.0p, Ashtead Group, down 134.0p at 5,178.0p, Croda International, down 67.0p at 2,943.0p and Entain, down 17.6p at 807.0p.

Tuesday’s global economic diary sees the start of the two-day Federal Open Market Committee meeting, plus house price data and the Conference Board consumer confidence report in the US.

Tuesday’s domestic UK corporate calendar has a trading statement from miner Anglo American and third-quarter earnings from Asia-focused lender HSBC.

Contributed by Alliance News

Business

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

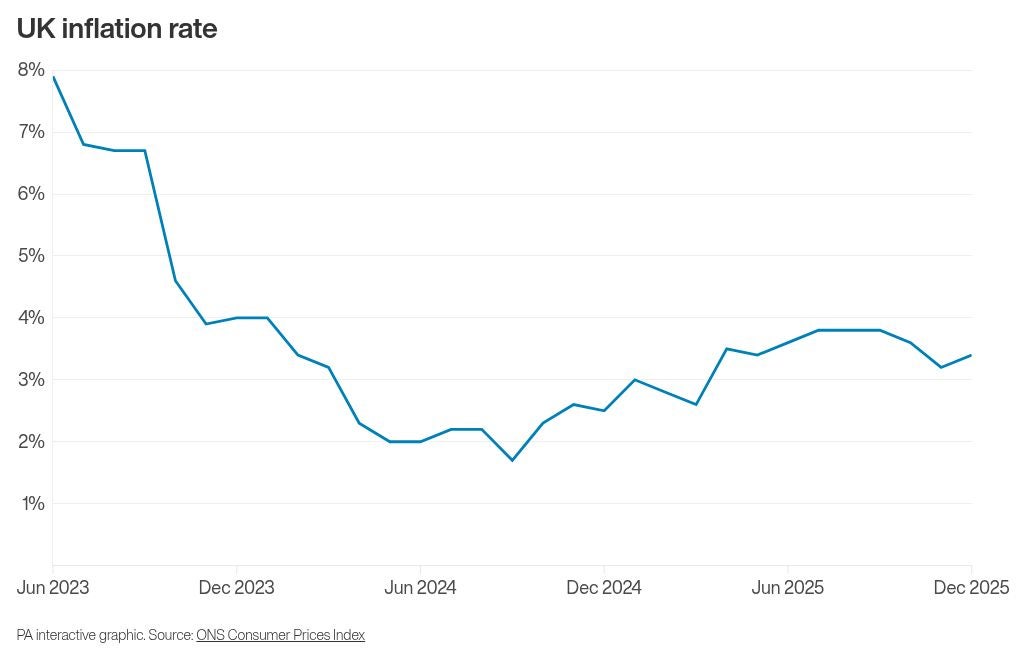

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’