Business

Pakistan plans 2026 launch for first attack submarine under $5B China deal – SUCH TV

The Pakistan Navy expects its first Chinese-designed attack submarine to enter service next year, Naval Chief Admiral Naveed Ashraf told Chinese state media, strengthening Beijing’s regional influence and its ability to counter India while projecting power toward the Middle East.

Under a $5 billion deal, Islamabad will acquire eight Hangor-class submarines by 2028, a plan Admiral Ashraf described as “progressing smoothly” in an interview with the Global Times published Sunday.

The submarines are expected to enhance Pakistan’s patrol capabilities in the North Arabian Sea and the Indian Ocean.

The announcement comes after Pakistan’s Air Force used Chinese-made J-10 fighter jets in May to down several Indian aircraft, including French-made Rafales, surprising military analysts and raising questions about the effectiveness of Western platforms versus Chinese systems.

According to the agreement, the first four diesel-electric submarines will be constructed in China, while the remaining four will be assembled in Pakistan, helping to boost the country’s technical expertise in submarine operations.

Three of the submarines have already been launched from a shipyard on China’s Yangtze River in Hubei province.

“Chinese-origin platforms and equipment have proven reliable, technologically advanced, and well-suited to the Pakistan Navy’s operational needs,” Admiral Ashraf said.

He added that as modern warfare evolves, technologies such as unmanned systems, AI, and advanced electronic warfare are becoming increasingly important, and the Pakistan Navy is exploring further collaboration with China in these areas.

Pakistan has historically been one of China’s top arms customers. Between 2020 and 2024, the country purchased over 60 percent of China’s exported weapons, according to the Stockholm International Peace Research Institute.

In addition to arms sales, Beijing has invested heavily in the China-Pakistan Economic Corridor, a 3,000 km (1,864-mile) trade and transport route connecting China’s Xinjiang region to Pakistan’s deep-water port of Gwadar, further cementing strategic ties between the two nations.

The China-Pakistan Economic Corridor, part of President Xi Jinping’s flagship ‘Belt and Road’ infrastructure initiative, aims to secure a route for the world’s largest energy importer to bring in supplies from the Middle East, bypassing the Straits of Malacca — a strategic chokepoint between Malaysia and Indonesia that could be blocked in wartime.

The initiative also extends China’s sphere of influence toward Afghanistan and Iran and onto Central Asia, and effectively encircles India, given Beijing’s ties to the junta in Myanmar and good relations with Bangladesh.

India currently operates three indigenously developed nuclear-powered submarines, along with three classes of diesel-electric attack submarines acquired or developed over decades with France, Germany, and Russia.

“This cooperation (with China) goes beyond hardware; it reflects a shared strategic outlook, mutual trust, and a long-standing partnership,” Admiral Ashraf said and added “In the coming decade, we expect this relationship to grow, encompassing not only shipbuilding and training, but also enhanced interoperability, research, technology sharing and industrial collaboration.”

Business

US monetary policy: Fed’s official sees no urgency for further rate cuts, flags distorted inflation data – The Times of India

A senior US Federal Reserve official has said there is no immediate need to cut interest rates further, cautioning that recent inflation data may have been distorted due to disruptions in data collection during the federal government shutdown, AFP reported.Speaking to CNBC on Friday, New York Federal Reserve President John Williams said inflation readings for recent months were likely affected because government agencies were unable to collect price data in October and the first half of November amid the record-long shutdown.“Because of that, I think the data were distorted in some of the categories, and that pushed down the consumer price index reading probably by a tenth or so,” Williams said, adding that it was difficult to precisely quantify the impact.He said inflation data for December could provide a clearer picture of the extent of the distortion.Williams’ remarks followed the release of a delayed US consumer price index report earlier this week, which showed inflation easing to 2.7 per cent in November from 3 per cent in September. Several economists had warned that the figures may not fully reflect underlying price pressures.Some analysts pointed out that a higher share of price quotes may have been collected during the Black Friday discount period, potentially biasing the data downward — a concern Williams echoed.Asked how the latest data influenced his outlook on interest rates, Williams said the Fed’s policy stance was appropriate for now.“I don’t personally have a sense of urgency to need to act further on monetary policy right now,” he said, adding that the rate cuts already delivered had positioned policymakers well.The Federal Reserve has cut interest rates three times this year as the labour market weakened, but has signalled a higher threshold for additional easing. The central bank’s next policy meeting is scheduled for late January.

Business

Young people to be hit hardest by UK’s ageing society, report suggests

Young people will be hit hardest by successive governments’ failure to focus on financial and societal challenges caused by an ageing population, a House of Lords report has suggested.

They will need to plan and prepare to work longer and save more from a much earlier age, the economic affairs committee said.

The report also found that the crisis in adult social care “remains a scandal” which needs to be addressed urgently.

Committee chair Lord Wood of Anfield told the BBC it was a “struggle to find where in government” there was a focus on ageing and the “transformational effects” it was going to have on people.

“Ageing is something that we’re just watching happening”, he told BBC Radio 4’s Today programme, adding: “We know that adaptation is the way forward”.

Policies governments have used to address the impact of declining fertility and rising life expectancy in the UK – raising the state pension age or increasing immigration for example – were not adequate solutions on their own, the report said.

Getting more people in their 50s and 60s to stay in or return to work “is key”, the committee said, and the government must prioritise incentives to do so.

It found that while age discrimination may reduce the number of over 50s working, it heard evidence that its most damaging form may be self-directed, with older workers mistaken about the extent they faced and then limiting their own decisions.

It also said an ageing population will need more care workers, leaving fewer workers for other parts of the economy.

There is “widespread ignorance” of how much it costs to retire, it said, and the government should consider an education campaign – as well as finding out if the UK’s financial services sector is equipped to provide for the population as it ages.

Lord Wood said that the government and financial services industry needs to devise “more innovative ways of getting younger people to think about lives frankly they can’t conceive of at the moment – when they’re in their eighties and early nineties.”

“There’s a long time for them to be financially planning for at a time when we know young people are doing less financial planning,” he added.

“Raising the state pension age, which saves the government money, but increases pensioner poverty as many people have already stopped working by their sixties, is a red herring.

“To successfully confront this challenge, the approach to financial management of today’s and tomorrow’s young people will need to change.”

Business

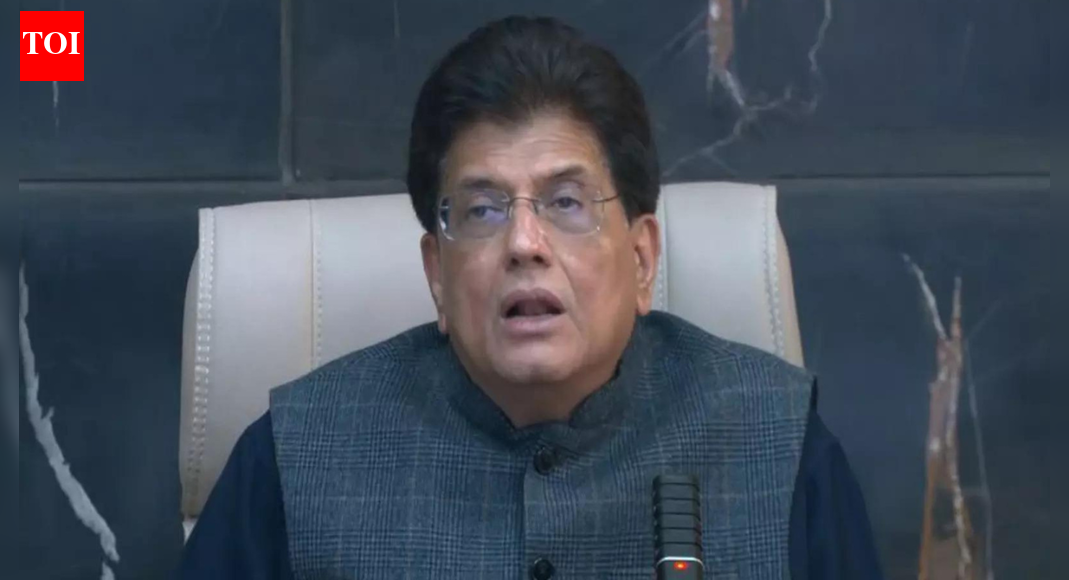

India-Oman CEPA rollout: Trade pact may take effect in three month; Piyush Goyal flags faster execution – The Times of India

India and Oman are aiming to operationalise their recently signed Comprehensive Economic Partnership Agreement (CEPA) within the next three months, Commerce and Industry Minister Piyush Goyal said on Friday, signalling a faster rollout than several past trade pacts, PTI reported.The India–Oman free trade agreement was signed on December 18. Under the CEPA, Oman has offered zero-duty access on more than 98 per cent of its tariff lines, covering 99.38 per cent of India’s exports to the Gulf country. At present, these products attract import duties ranging from 5 per cent to as high as 100 per cent.

“All major labour-intensive sectors will get nil duty,” Goyal said, listing gems and jewellery, textiles, leather, footwear, sports goods, plastics, furniture, agricultural products, engineering goods, pharmaceuticals, medical devices and automobiles as key beneficiaries.On the Indian side, New Delhi has offered tariff concessions on 77.79 per cent of its total tariff lines, or 12,556 product categories, which together account for 94.81 per cent of India’s imports from Oman by value.“The Oman minister and I have discussed that this agreement, we will try to operationalise within three months,” Goyal told reporters, contrasting the timeline with Oman’s earlier trade deal with the US, which was finalised in 2006 but implemented only in 2009.Highlighting investment opportunities, Goyal said sectors such as steel, energy, education and healthcare held strong potential for Indian companies in Oman, particularly resource-linked industries. He pointed to a large green steel project in the pipeline and growing interest in converting energy into green hydrogen or green ammonia for exports.“There is a lot of interest because they have large land banks,” he said, adding that opportunities also exist in marble processing, battery manufacturing, education and healthcare.Goyal said Omani businesses were keen to partner with Indian firms, citing interest from an Omani dairy company in forming a joint venture with Amul. He added that Oman’s sovereign wealth fund and companies had been invited to explore investments in India.

-

Business6 days ago

Business6 days agoHitting The ‘High Notes’ In Ties: Nepal Set To Lift Ban On Indian Bills Above ₹100

-

Politics1 week ago

Politics1 week agoTrump launches gold card programme for expedited visas with a $1m price tag

-

Fashion1 week ago

Fashion1 week agoTommy Hilfiger appoints Sergio Pérez as global menswear ambassador

-

Sports1 week ago

Sports1 week agoU.S. House passes bill to combat stadium drones

-

Sports1 week ago

Sports1 week agoPolice detain Michigan head football coach Sherrone Moore after firing, salacious details emerge: report

-

Business1 week ago

Business1 week agoCoca-Cola taps COO Henrique Braun to replace James Quincey as CEO in 2026

-

Tech1 week ago

Tech1 week agoGoogle DeepMind partners with UK government to deliver AI | Computer Weekly

-

Fashion1 week ago

Fashion1 week agoBrunello Cucinelli lifts 2025 revenue growth forecast to up to 12%