Business

China’s smaller manufacturers look to catch the automation wave – The Times of India

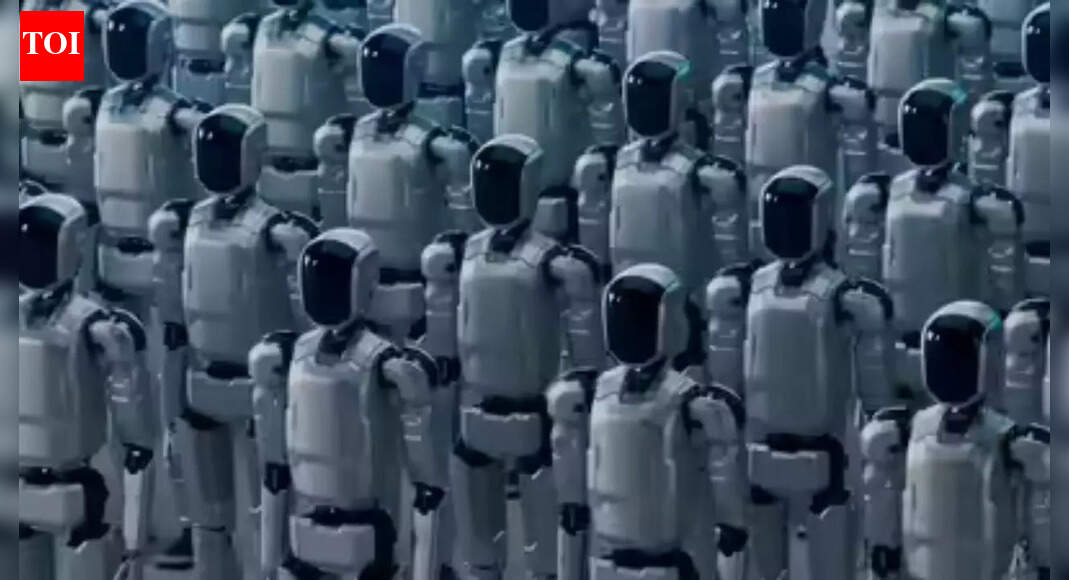

In a light-filled workshop in eastern China, a robotic arm moved a partially assembled autonomous vehicle as workers calibrated its cameras, typical of the incremental automation being adopted even across smaller factories in the world’s manufacturing powerhouse.China is already the world’s largest market for industrial robots, and the government is pouring billions of dollars into robotics and artificial intelligence to boost its presence in the sector.

The first essentially humanlessfactoriesare already in operation, even as widespread automation raises questions about job losses as well as the cost and difficulty of transition for smaller and medium-sized companies. The answer for many is a hybrid approach, experts and factory owners told AFP. At the autonomous vehicle workshop, manager Liu Jingyao told AFP that humans are still a crucial part of even technologically advanced manufacturing. “Many decisions require human judgement,” said Liu, whose company Neolix produces small van-like vehicles that transport parcels across Chinese cities. “These decisions involve certain skill-based elements that still need to be handled by people.”At the Neolix factory, 300 kilometres (186 miles) north of Shanghai, newly built driverless vehicles zoomed around a testing track simulating obstacles including puddles and bridges.In a closed-off room, workers assembled vehicles’ “brains”, testing their cameras and computer chips.“Automation… primarily serve(s) to assist humans, reducing labour intensity rather than replacing them,” Liu said.But Ni Jun, a mechanical engineering expert at Shanghai’s Jiaotong University, said China’s strategy of focusing on industrial applications for AI means full automation is already feasible in many sectors.Among others, tech giant Xiaomi operates a “dark factory” — where the absence of people means no need for lights — with robotic arms and sensors able to make smartphones without humans.– Digital divide –Ni described a “digital divide” between larger companies with the funds to invest heavily in modernisation, and smaller businesses struggling to keep up.For Zhu Yefeng’s Far East Precision Printing Company, part of China’s vast network of small independent factories employing up to a few dozen people each, full automation is a distant dream.At the company just outside Shanghai, workers in small rooms fed sheets of instruction manuals into folding machines and operated equipment that printed labels for electronic devices.The company used pen and paper to track its workflow until two years ago, with managers having to run around the factory to communicate order information.“Things were, to put it bluntly, a complete mess,” Zhu told AFP.The company has since adopted software that allows employees to scan QR codes that send updates to a factory-wide tracker.On a screen in his office, Zhu can see detailed charts breaking down each order’s completion level and individual employees’ productivity statistics.“This is a start,” Zhu told AFP. “We will move toward more advanced technology like automation, in order to receive even bigger orders from clients.”Financial constraints are a major barrier though. “As a small company, we can’t afford certain expenses,” said Zhu. His team is trying to develop its own robotic quality testing machine, but for now humans continue to check final products.– Employment pressures –The potential unemployment caused by widespread automation will be a challenge, said Jacob Gunter from the Berlin-based Mercator Institute for China Studies. “Companies will be quite happy to decrease their headcount… but the government will not like that and will be under a lot of pressure to navigate this,” Gunter told AFP.Beijing’s push to develop industrial robots will “intersect with the need for maintaining high employment at a time when employment pressure is considerable”, he added. Going forward, manufacturers must strike a balance “between the technical feasibility, social responsibility, and business necessity”, Jiaotong University’s Ni told AFP.Zhou Yuxiang, the CEO of Black Lake Technologies — the start-up that provided the software for Zhu’s factory — told AFP he thought factories would “always be hybrid”. “If you ask every owner of a factory, is a dark factory the goal? No, that’s just a superficial description,” Zhou said. “The goal for factories is to optimise production, deliver things that their end customers want, and also make money.”

Business

D-St blues! Sensex sheds 1.5K, biggest drop on a Budget day – The Times of India

At a time when global markets are witnessing high volatility due to geopolitical uncertainties, the hike in securities transaction tax (STT) on derivatives trades hit investor sentiment on Dalal Street on the Budget day. This in turn led to a sharp sell-off that pulled the sensex down by nearly 1,500 points—its biggest points loss on a Budget day—to close at 80,773 points. The sell-off also left investors poorer by Rs 9.4 lakh crore, the biggest Budget day loss in BSE’s market capitalisation.The day’s trading was marked by high volatility. The sensex rallied over 400 points as FM started her speech, fell about 1,100 points after the STT hike proposal was announced, partially recovered by mid-session to trade 600 points down on the day and then sold-off to close below the 81K mark for the first time in four months.On the NSE, Nifty too treaded a similar path to close 495 points (2%) lower at 24,825 points. Fund managers and market players feel the day’s sell-off was overdone, compounded by the absence of most institutional players since it was a Sunday. “The market’s reaction (to the hike in STT rates) was a bit overdone, although the decision itself was unexpected,” said Taher Badshah, President & Chief Investment Officer, Invesco Mutual Fund. “I think markets should settle down in 2-3 days.” Badshah said the Budget was in line with govt’s set path of the past few years, showing a conservative approach to setting targets.“The revenue and expenditure targets for FY27 are achievable. And since the rate of inflation is lower now, the nominal GDP growth rate of 10% may turn out to be on the higher side as inflation normalises during the year,” the top fund manager said. In Sunday’s market, of the 30 sensex stocks, 26 closed in the red. Among index constituents, Reliance Industries, SBI and ICICI Bank contributed the most to the day’s loss. Buying in software services majors Infosys and TCS cushioned the slide. In all, 2,444 stocks closed in the red compared to 1,699 that closed in the green, BSE data showed.STT hike aimed at curbing F&O speculation The decision to raise securities transaction tax (STT) for trading in equity derivatives means trading futures & options (F&O) will be more expensive from April 1. STT on futures trading rises from 0.02% to 0.05% now, and on options premium and exercise of options to 0.15% from 0.1% and 0.125% respectively. This could more than double statutory costs of trading F&O contracts.While the move is to curb excessive speculation by retail traders who mostly suffer losses, investors sold stocks of those companies that derive a large portion of their turnover from this segment. Stock price of Angel One crashed nearly 9%, BSE crashed 8.1%, Billionbrains Garage Ventures that runs the Groww trading platform, lost 5.1% and Nuvama Wealth Management lost 7.3%. STT hike follows a Sebi survey that showed that 91% of the retail investors lost money in the F&O market with average loss per investor surpassing Rs 1 lakh per year. Institutional and some high net worth players took home most of the profits from the segment.18% GST on brokerage for FPIs removedThe Budget proposed to do away with 18% GST charged on the brokerage that foreign portfolio investors pay in India. Among the host of changes to the GST laws that the finance minister proposed, one was abolishing clause (b) of sub-section (8) of section 13 of the Integrated Goods and Services Tax Act, 2017. This is being “omitted so as to provide that the place of supply for ‘intermediary services’ will be determined as per the default provision under section 13(2) of the IGST Act,” the Budget proposal said.

Business

Buying property from NRIs? Time to lose the TAN – The Times of India

Buying property from an NRI? Worried about obtaining TAN? Not anymore. To relax the compliance burden, the Budget has proposed that resident individuals and HUFs need not have a Tax Deduction and Collection Account Number (TAN) if they are purchasing a property from a non-resident Indian (NRI). The amendment will take effect from Oct 1, 2026.Under the proposed framework, resident individuals or HUFs can report the tax deducted at source (TDS) by quoting PAN, as is done when the transactions are between two residents. Presently, if a person buys an immovable property from a resident seller, the person is not required to obtain TAN to deduct tax at source. However, where the seller of the immovable property is a non-resident, the buyer is required to obtain TAN to deduct tax at source.Ameet Patel, partner at Manohar Chowdhry & Associates, said this used to be a detailed process. “At present, if a resident were to purchase an immovable property from an NRI, there is no separate relaxation regarding compliance with TDS responsibilities. As a result, in such cases, the buyer needs to obtain a TAN, register on the portal, and then deduct TDS u/s. 195, and pay to the govt. Under section 195, as with all other regular TDS sections, a quarterly e-TDS statement is required. A buyer would need professional help for all this.”Hinesh Doshi, CA, welcomed the move. “There used to be an unnecessary compliance burden due to this. While the process to obtain TAN is simple, people used to obtain TAN for just one transaction. So, this is a good riddance.”

Business

Harry Styles and Anthony Joshua among UK’s top tax payers

The former One Direction member-turned-solo artist appears on the Sunday Times list for the first time.

Source link

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment5 days ago

Entertainment5 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Tech1 week ago

Tech1 week agoICE Asks Companies About ‘Ad Tech and Big Data’ Tools It Could Use in Investigations

-

Sports5 days ago

Sports5 days agoCollege football’s top 100 games of the 2025 season

-

Business6 days ago

Business6 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Politics1 week ago

Politics1 week agoFresh protests after man shot dead in Minneapolis operation

-

Fashion1 week ago

Fashion1 week agoTurkiye cuts benchmark rate to 37%, flags confidence on inflation