Entertainment

Fear, fiat and the future

Pakistan has quietly crossed an important threshold. After laying the legal foundations for a regulated digital-assets ecosystem through the Digital Nation Pakistan Act and the Virtual Asset Regulatory Ordinance earlier this year, the Pakistan Virtual Asset Regulatory Authority (PVARA) began accepting licence applications for crypto exchanges on December 2.

That shift was underscored at the highest levels of the state on December 6, when Binance Global CEO Richard Teng met in Islamabad with senior policymakers, alongside Prime Minister Muhammad Shehbaz Sharif and COAS-CDF Field Marshal Syed Asim Munir.

The engagement reflected not market curiosity, but institutional intent: an acknowledgement that questions of money, payments and digital value now sit alongside national economic and security priorities.

In practical terms, this means that, in due course, buying bitcoin through regulated local payment rails will become easier, cleaner and compliant.

This is a notable development, arriving at a familiar moment of fear. Bitcoin prices are down again. Critics are loud. Headlines speak of exhaustion, excess, and the end of the cycle. Cash-outs accelerate. Confidence wobbles. Fear, once again, dominates the conversation.

But history offers perspective. Similar periods of pessimism marked the closing phases of the previous four-year bitcoin cycles: from 2014 to 2017, and again from 2018 to 2021. Viewed through that lens, the currency cycle that began in 2022 is not collapsing; it is maturing.

Focusing solely on price action obscures the deeper issue. The real risk is not bitcoin’s volatility. It is the financial system that bitcoin was created to question. Nowhere is that system’s failure more visible than in Pakistan. At its core, that failure manifests through inflation: a process widely misunderstood and routinely misdescribed. Inflation is often explained as prices going up.

That description is convenient and incomplete. Prices are not the cause of inflation; they are its effect. Inflation begins with the continuous expansion of the money supply. When currency is created year after year, the purchasing power of every unit declines. Savers lose quietly. Salaries lag. Living standards erode.

In Pakistan, the consequences are everywhere. Food, fuel, rent and education cost more each year: not because they have become intrinsically more valuable, but because the currency measuring them buys less. The result is a population trapped in short-term thinking: working harder, saving less and feeling perpetually behind.

Crucially, this erosion occurs without transparency or consent. A small group controls the monetary system. Everyone else must ask permission to use their own money through banks and intermediaries. Profits are privatised. Losses are socialised. Asset bubbles form, crises follow and wealth concentrates further at the top.

No matter how hard most people work, the value of their earnings continues to erode unless they gain access to assets ahead of inflation or become part of the system itself. Pakistan’s recurring economic crises are not isolated national failures; they are local expressions of a global monetary order that rewards access over effort. This is the quiet failure of money.

Which brings us to the alternative. Bitcoin enters this landscape not as an investment pitch, but as a monetary alternative. It is decentralised and returns agency to individuals. It functions as an equaliser in societies increasingly fractured by economic stress and resentment. Its properties are straightforward.

Bitcoin has a fixed supply of 21 million coins, permanently capped. No central authority can expand it. No political emergency can dilute it. Its rules are enforced by code rather than discretion, and its security rests on energy and mathematics, not faith in institutions.

While bitcoin is often dismissed as volatile, that volatility has unfolded within a clear long-term upward trajectory, while its underlying fundamentals have remained unchanged. Over longer horizons, it has been the best-performing asset of the past decade. More revealing, however, is what happens when goods are priced in bitcoin rather than local currency.

Housing, technology and productive assets often become cheaper over time: not because value disappears, but because the money measuring them improves.

In 2012, a modest home in Islamabad priced at a few million rupees would have required thousands of bitcoins. Today, that same property may cost tens of millions of rupees, yet only a single-digit amount of bitcoin. The house did not change. The currency did.

For Pakistan, a country where money not only underperforms but also routinely collapses as a store of value, and where debasement is felt long before it is formally acknowledged, this distinction matters. Regulation does not validate bitcoin’s price, nor does it eliminate risk.

What it does is legitimise access. As compliant frameworks take shape and local rails develop, bitcoin is increasingly encountered not as a speculative instrument but as a savings technology, competing directly with a currency that has struggled to preserve purchasing power.

This matters most for a younger generation priced out of real estate, excluded from traditional asset classes and increasingly sceptical of institutions that promise stability but deliver erosion. Bitcoin does not require property deeds, brokerage accounts or political proximity. It requires only time, discipline and a long-term horizon.

Bitcoin offers no guarantees. It carries real risk. But it restores something modern money has quietly taken away: the choice to opt out of a system designed to dilute by default. In a world where money has quietly failed its most basic functions, that choice may be the most powerful feature of all.

Disclaimer: The viewpoints expressed in this piece are the writer’s own and don’t necessarily reflect Geo.tv’s editorial policy.

The writer is an Islamabad-based lawyer and Strategic Legal Counsel at HP | FKM. She can be reached at: [email protected]

Originally published in The News

Entertainment

Who was Elyse Donalson? A look into her life and career

Elyse Donalson, best known for her role in Halloween: The Curse of Michael Myers and her appearances on acclaimed television dramas, built a career that spanned more than two decades in Hollywood.

She passed away unexpectedly at her Studio City home at the age of 78 leaving behind a legacy of memorable performances and a life rooted in both Texas and Los Angeles.

Born Mary Elise Donalson on October 5, 1947, in Victoria, Texas, she grew up in a family where her father managed the family lumberyard and her mother worked as a church secretary and bookkeeper.

After graduating from Victoria High School in 1965, she attended Southwest Texas State University (now Texas State University), where she acted in plays and met her future husband, Joe Houde.

The couple eventually moved to Los Angeles, where Donalson pursued her passion for acting.

Her Hollywood journey began in the early 1980s, when she took acting classes and landed her first role in 1983 on CBS’s fantasy series Wizards and Warriors.

From there, she appeared in more than two dozen television series including Doogie Howser, M.D., Anything But Love, Chicago Hope, The Practice, and Beverly Hills, 90210.

She became a familiar face in guest roles across popular shows of the era.

Donalson’s film work included her memorable appearance in Halloween: The Curse of Michael Myers (1995), where she played a sanitarium patient in a chilling scene opposite Paul Rudd’s Tommy Doyle.

On television, she portrayed a nun in St. Elsewhere (1986), a judge in Matlock (1988), a nurse in Quantum Leap (1989), and an elderly woman in The X-Files (2000).

Fans of Dr. Quinn, Medicine Woman may remember her as Mrs. Marley in the 1993 Christmas episode Mike’s Dream: A Christmas Tale.

Beyond acting, Donalson was a longtime member of SAG-AFTRA and balanced her career by working at law firms in Los Angeles.

She was known for her love of animals and movies.

She is survived by her sister Harriette Meyer (who shared news of her sister’s death to The Hollywood Reporter), nieces Kellie and Kate, her brother-in-law Jimmie, great-nieces Madison, Macy, and Piper and her great-nephew Clay.

Donalson’s journey from Texas to Hollywood reflects the determination of an actress who carved out her place in the industry while remaining deeply connected to her family and personal passions.

Entertainment

Over Rs540m worth of kites sold ahead of Basant in Lahore

- 500,000 kites sold in Lahore markets on Tuesday alone: officials.

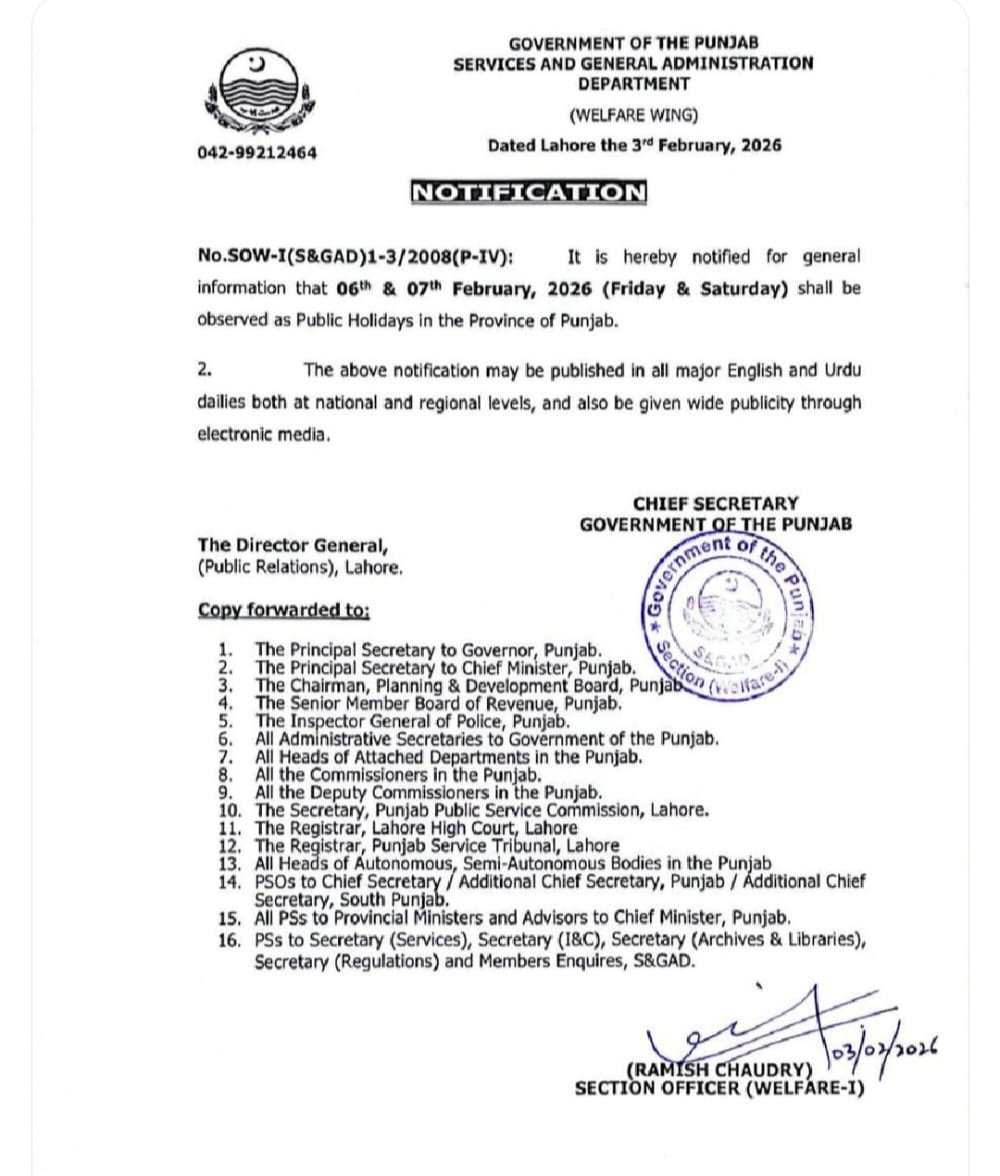

- Two-day public holiday announced in Punjab on Feb 6-7.

- Met Office says weather to remain suitable for kite-flying.

More than Rs540 million worth of kite string and kites were sold in Lahore over three days ahead of Basant, reflecting strong public enthusiasm as the historic festival returns to the city after 25 years.

According to the Kite Association, over 500,000 kites were sold in city markets on Tuesday alone, as buying activity for Basant continued for the third consecutive day.

The festival is set to be celebrated in Lahore from February 6 to 8, following the lifting of a long-standing ban under strict conditions.

Markets designated for kite-flying material remained crowded as enthusiasts prepared for the festival’s return after more than two decades.

A large number of buyers thronged the Mochi Gate market to purchase kite strings and kites of their choice. The festive mood was heightened by the district administration’s Basant float, where the beats of dhol added to the excitement of shoppers.

Some citizens, however, complained that the prices of kites and string were too high, calling on the government to take steps to bring prices down.

Senior Provincial Minister Maryam Aurangzeb also visited Mochi Gate to review Basant shopping arrangements. Speaking to the media, she said that preparations for a safe Basant had been completed and urged citizens to strictly follow SOPs while celebrating the festival.

Meanwhile, Punjab Chief Minister Maryam Nawaz announced a Basant celebration at Liberty Chowk on February 7.

Moreover, public holiday has been announced across the province on February 6 and 7, according to an official notification issued by the Punjab administration.

Lahore has been swept in colours as the Basant preparations peaked, with a giant kite installed at Liberty Chowk as part of the celebrations.

It may be noted that the Punjab cabinet allowed the manufacturing of kite-flying material not only in Lahore but also in four other districts. The provincial government has said foolproof security arrangements are being put in place to ensure safety during the event.

According to the Pakistan Meteorological Department, Lahore’s weather during Basant will remain cold and dry on February 6 and 7, while partly cloudy conditions are expected on February 8. The department said the weather conditions from

February 6 to 8 will be suitable for kite flying, with winds blowing at 10 to 15 kilometres per hour.

The Met Office has advised kite flyers to avoid electricity wires.

Entertainment

Nelson Peltz offers his stance amid Brooklyn Beckham’s bombshell claims

Nicola Peltz’s billionaire father, Nelson, has weighed in on the Beckham feud.

Nelson’s son-in-law Brooklyn, 26, released a bombshell statement last week in which he criticised his parents, Sir David 51, and Lady Victoria Beckham 50, and accused them of mistreating his wife, 30.

Now, the business magnate, 83, who was previously reported to give his daughter $1 million a-month allowance spoke about the family drama during a Q and A at WSJD’s Invest Live in West Beach event on Tuesday.

Nelson said: ‘My daughter and the Beckhams are a whole other story and that’s not for coverage here today. But I’ll tell you my daughter is great, my son-in-law Brooklyn is great and I look forward to them having a long, happy marriage together.’

Nelson was also asked if he gave the couple advice in how to navigate a difficult situation.

He replied: ‘I do. Sometimes they give me advice.’

For context, Nicola’s father is a businessman with an estimated net worth of $1.6billion, compared with the Beckhams’ reported $680million.

Meanwhile, Brooklyn’s family have maintained silence since the aspiring chef penned his frustrations about his parents, sharing his reasons for cutting ties with them.

Brooklyn’s parents Sir David and Victoria and his siblings Romeo, 23, Cruz, 20, and Harper, 14, instead put on their own show of unity at Haute Couture Fashion Week last week.

-

Sports1 week ago

Sports1 week agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment1 week ago

Entertainment1 week agoClaire Danes reveals how she reacted to pregnancy at 44

-

Sports1 week ago

Sports1 week agoCollege football’s top 100 games of the 2025 season

-

Business1 week ago

Business1 week agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Politics1 week ago

Politics1 week agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports1 week ago

Sports1 week agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Entertainment1 week ago

Entertainment1 week agoK-Pop star Rosé to appear in special podcast before Grammy’s

-

Tech1 week ago

Tech1 week agoBrighten Your Darkest Time (of Year) With This Smart Home Upgrade