Business

Interest rates cut to 3.75% but further reductions to be ‘closer call’

Michael RaceBusiness reporter

Getty Images

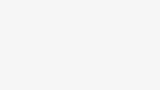

Getty ImagesInterest rates have been cut to 3.75%, the lowest level in almost three years, but further reductions are set to be a “closer call”, the Bank of England has said.

In a knife-edge vote, policymakers voted 5-4 in favour to lower rates from 4% reflecting concerns over rising unemployment and weak economic growth.

The Bank said rates were “likely to continue on a gradual downward path”, but warned judgements on further cuts next year would more contested.

Inflation is now expected to fall “closer to 2%” – the Bank’s target – next year, which is sooner than previous forecasts. However, the economy is predicted to see zero growth in the final few months of this year.

The decision to lower borrowing costs from 4% was widely expected, after figures this week showed inflation, the rate prices rise at, slowed further to 3.2% in the year to November.

“We still think rates are on a gradual path downward but with every cut we make, how much further we go becomes a closer call,” said the Bank’s governor, Andrew Bailey.

While the cut is likely to be good news for people looking to borrow cash or secure a mortgage, savers could see a reduction on their returns.

About 500,000 homeowners have a mortgage that “tracks” the Bank of England’s rate, and Thursday’s cut is likely to mean a typical reduction of £29 in monthly repayments.

Homeowners on standard variable rates are also likely to see lower payments, although the vast majority of mortgage customers have fixed-rate deals so are not affected by the latest decision.

The Bank said that, following the tax and spending policies announced in last month’s Budget and easing oil and gas prices, inflation was likely to fall close to 2% in the spring/summer of next year. Previously it did not expect this to happen until 2027.

Chancellor Rachel Reeves announced the government would cut £150 off household energy bills in the Budget, as well as freeze fuel duty and rail fares.

However, the Bank said weaker economic growth in November had led it to expect zero growth for the final few months of this year.

It said information gathered from businesses around the country suggested a “lacklustre economy”, with firms concerned by the speculation ahead of the Budget.

The Bank said consumers remained “cautious and keenly focused on value for money”, adding that food shops were “smaller than usual”.

“Some supermarkets have been concerned that the Budget will dampen spending on Christmas food and drink, but discounters say that early sales of lowered priced seasonal food are solid so far,” it added.

Latest figures showed the price of food was the main driver behind November’s drop in inflation.

The inflation rate has fallen in recent months, but this drop does not mean that prices are falling, rather they are rising at a slower rate.

Mr Bailey reiterated that the Bank believed inflation had passed its peak.

Reacting to the Bank’s decision, the chancellor said it was the “sixth interest rate cut since the election – that’s the fastest pace of cuts in 17 years, good news for families with mortgages and businesses with loans”.

But shadow chancellor Mel Stride said while lower interest rates would be “welcome news for many families”, the cut reflected “growing concerns about the weakness of our economy”.

“The economic mismanagement of Rachel Reeves has left the Bank of England with an impossible dilemma, balancing high inflation against a fragile economy.”

EPA

EPAThe Bank, which is independent of the government, sets interest rates in an attempt to try to keep consumer price rises under control.

The theory behind increasing interest rates to tackle inflation is that by making borrowing more expensive, more people will cut back on spending and that leads to demand for goods falling and price rises easing.

But it is a balancing act, as high interest rates can harm the economy as businesses hold off from investing in production and jobs.

The government has made growing the economy its main priority as part of its efforts to boost living standards.

In its most recent Monetary Policy Report, the Bank predicted UK economic growth would be 1.5% this year, but forecast it would fall to 1.2% next year before rising to 1.6% in 2027 and 1.8% in 2028.

Get our flagship newsletter with all the headlines you need to start the day. Sign up here.

Business

Why Are Gold Prices Swinging? Nirmala Sitharaman Breaks It Down

Gold prices are no longer being watched only at home but across global markets, as sudden and unexpected swings keep investors on edge. Addressing the volatility, Finance Minister Nirmala Sitharaman stated that a deepening uncertainty in international markets is driving the fluctuations. Speaking to reporters on Monday, she pointed to rising anxiety among investors in global commodity trade, explaining that unstable conditions worldwide have eroded confidence in individual currencies. As a result, many investors are turning to gold as a haven, a shift she said is naturally fuelling the sharp ups and downs in gold prices.

According to data from the Multi-Commodity Exchange (MCX), gold prices slipped slightly on Monday evening. Compared to the previous session’s closing rate, the price of ten grams of gold declined by around Rs 280, marking a fall of less than 1%. Market experts note that daily price movements are largely driven by international trends. Due to this volatility, many buyers are adopting a wait-and-watch approach.

Over the past five days, gold prices in India’s spot market have fallen sharply. On January 29, the price of ten grams of gold stood above Rs 1.7 lakh, but it has now dropped to nearly Rs 1.4 lakh. This represents a decline of over 13% in just five days, a shift that has caught regular buyers by surprise. For investors hoping for substantial gains, the sudden drop has served as a cautionary signal.

Responding to questions on the Union Budget, the Finance Minister said that investment remains the primary driver of sustained economic growth. She noted that the government is prioritising sectors that generate employment and is strengthening the economy through reforms aimed at long-term outcomes. While increasing public investment, she said, the government continues to follow disciplined fiscal policies. The overarching goal, she added, is to ensure that growth is inclusive and that every citizen becomes a stakeholder in the nation’s development.

Nirmala Sitharaman expressed confidence that India is steadily progressing towards becoming a developed nation. She stated that as a growing economy, India must play a significant role in global trade and is actively working to boost exports by integrating with international markets. She also clarified that efforts are underway to make domestic markets resilient enough to compete globally.

She further explained the decision to raise the Securities Transaction Tax (STT) in the Futures and Options segment. According to her, the move is aimed at discouraging uninformed, gambling-like participation in derivative trading. The government, she said, has taken these steps to protect small and retail investors from potential losses and to maintain overall market stability.

The Finance Minister also revealed that the disinvestment process of public sector enterprises is progressing swiftly. She said this would encourage greater public participation in government-owned companies and allow more efficient use of financial resources to fund development projects. Through transparent policies, the central government aims to maximise the value of public assets, a move she believes will yield long-term financial benefits for the country.

She concluded by stating that global economic conditions are clearly influencing domestic markets, and while price fluctuations are inevitable, the government’s reforms will help bring stability. She advised investors to avoid hasty decisions and to carefully assess market conditions before acting, adding that every reform undertaken to strengthen the economy is a step towards a developed India.

Business

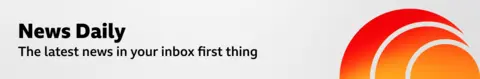

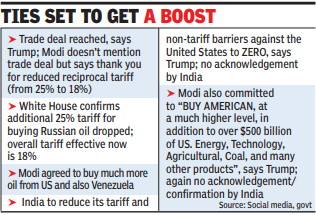

Trade deal done, says Trump; PM Modi thanks him for cutting tariff to 18% – The Times of India

NEW DELHI/ WASHINGTON: After months of bruising trade tensions, India and the US on Monday announced a bilateral trade deal that will see Washington slash additional tariffs on Indian imports to 18%, from the current 50%, making it more competitive for textiles, leather and seafood exporters.While PM Narendra Modi, in a post on X, which followed US President Donald Trump’s announcement on Truth Social, said he had a wonderful conversation with “dear friend” Trump and thanked him on behalf of 1.4 billion people for the reduced tariff of 18% on Indian goods, he did not mention the trade deal at all in his post on X that followed Trump’s “wonderful” announcement.

PM Modi and Trump

Modi also did not comment on Trump’s claim that in their conversation the PM had agreed to stop buying Russian oil and purchase much more energy from the US, and potentially Venezuela. Trump had said Modi had agreed to stop buying Russian oil and to buy much more from the US — $500 billion of energy, technology and farm products — a step that the President claimed would help end the war in Ukraine.According to the American President, Modi also agreed to bring down tariff and non-tariff barriers against the US to zero. A US embassy spokesperson confirmed that the final tariff now on India is 18%, down from the earlier 50%. This is a better deal for India than countries such Vietnam, Bangladesh, Indonesia, South Korea and China, which face higher tariffs. The Trump-Modi conversation coincided with the visit of EAM S Jaishankar to US for a critical minerals ministerial that will be chaired by Secretary of State Marco Rubio this week.The announcement came six days after India and the EU announced the completion of talks for a comprehensive trade agreement.Trump leadership vitalfor global peace: ModiThe deal had drawn sharp comments from some members of the Trump administration, including attacks on the EU.In his X post, PM said, “When two large economies and the world’s largest democracies work together, it benefits our people and unlocks immense opportunities for mutually beneficial cooperation”. He added that Trump’s leadership was vital for global peace, stability, and prosperity. India fully supports his efforts for peace. Modi said he was looking forward to working closely with Trump to take the partnership to unprecedented heights.Apart from reciprocal tariff, Trump had announced an additional 25% tariff on India for its purchase of Russian oil.Trump said the US had agreed to the trade deal with India out of friendship and respect for Modi, and at the latter’s request. “Our amazing relationship with India will be even stronger going forward. PM Modi and I are two people that GET THINGS DONE, something that cannot be said for mos,” he added.Trump in his social media post also said that it was an honour to speak with Modi whom he described as “one of my greatest friends and, a Powerful and Respected Leader of his Country”.

Ties set to get boost

While the US had acknowledged in past few months that India had cut down its Russian purchase, it had not eliminated the additional tariff.Trump also said, “We spoke about many things, including Trade, and ending the War with Russia and Ukraine. He agreed to stop buying Russian Oil, and to buy much more from the US and, potentially, Venezuela. This will help END THE WAR in Ukraine, which is taking place right now, with thousands of people dying each and every week!”Following the announcement last week of the successful conclusion of FTA negotiations with EU, India had suggested that India and US might be close to finalising the trade agreement they have been discussing since Feb last year.Trump’s disclosure of the trade deal was preceded by two India-related posts a few hours before, one of which featured him and Modi on a magazine cover with the caption “The Mover and the Shaker”. Another post featured New Delhi’s India Gate, which Trump called “India’s beautiful Triumphal Arch” and said, “Ours will be the greatest of them all!” — referring to a similar monument he wants to build in Washington DC.

Business

Union Budget 2026: Five changes in rules that could directly affect you

New Delhi: Union Finance Minister Nirmala Sitharaman delivered presented the Budget 2026 on February 1 in Parliament. At first glance, the announcements seemed limited in impact for the average citizen. Closer analysis, however, reveals several changes that could have consequences across investment, property, digital assets and overseas remittances.

The tax slabs were not changed, but multiple announcements received attention for their long-term effects. One of the changes affects Sovereign Gold Bonds. The government removed the capital gains tax exemption on bonds purchased from secondary markets. Investors will now receive tax benefits only if the bonds were bought directly from the Reserve Bank of India during the primary issuance and held until maturity. Bonds purchased on exchanges and held beyond April 1, 2026, will attract tax on gains.

Another major announcement targets derivatives trading. The government increased the Securities Transaction Tax on futures and options. Futures transactions will now attract a 0.05 percent STT instead of 0.02 percent, while options will see the rate rise to 0.15 percent from 0.10 percent. This change increases the cost of each transaction and directly impacts profits on trading.

The budget also eased property purchase procedures for non-resident Indians (NRIs). Indian buyers acquiring property from NRIs no longer need a separate Tax Deduction and Collection Account Number (TAN) for Tax Deducted at Source (TDS) payments. They can use their PAN number, similar to property purchases from domestic sellers. This simplification reduces paperwork and makes transactions smoother.

Cryptocurrency regulations were tightened. From April 1, 2026, failing to provide accurate crypto transaction information will result in a daily penalty of Rs 200. Providing incorrect data without correcting it can attract fines up to Rs 50,000. This move aims to ensure proper reporting and compliance for digital assets.

Overseas education and medical remittances received relief. The Tax Collected at Source (TCS) on funds sent under the Liberalised Remittance Scheme for education and medical needs exceeding Rs 10 lakh has been reduced from 5 percent to 2 percent. This measure lowers costs for students and patients sending funds abroad.

The TCS is collected by banks or authorised dealers when sending money abroad and is adjusted against the total tax liability during income tax filing. Excess payments are refunded. The Liberalised Remittance Scheme allows Indian residents to send up to $2.5 lakh per year for different purposes, including education, medical treatment, travel, gifts or foreign investment.

These five changes in Union Budget 2026 introduce new rules for gold bonds, derivatives, property purchases from NRIs, cryptocurrencies and foreign remittances. Each announcement has the potential to affect citizens and investors in meaningful ways, highlighting the government’s evolving focus on financial regulation, investment and cross-border transactions.

-

Sports7 days ago

Sports7 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment6 days ago

Entertainment6 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Business7 days ago

Business7 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Sports6 days ago

Sports6 days agoCollege football’s top 100 games of the 2025 season

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Sports6 days ago

Sports6 days agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Politics6 days ago

Politics6 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Tech7 days ago

Tech7 days agoBrighten Your Darkest Time (of Year) With This Smart Home Upgrade